I. Recent Boeing Stock Performance

Recent BA stock price performance and changes

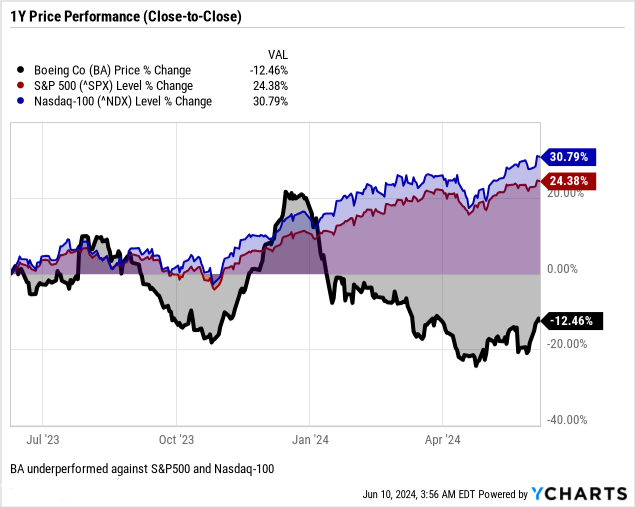

Boeing's stock performance has been underwhelming compared to broader market indices. With a market cap of $116.79B, Boeing's 52-week high and low prices stand at $159.70 and $267.54, respectively. Over the past year, Boeing experienced a meager 13% price return (close-to-close), significantly trailing behind the S&P 500's 31% return and Nasdaq-100's 24% return.

Several factors contribute to this subdued performance. Boeing faced persistent challenges, including the prolonged grounding of its 737 MAX aircraft due to safety concerns, global travel restrictions amid the pandemic, and supply chain disruptions. These issues have eroded investor confidence, leading to sluggish stock growth. Additionally, heightened competition in the aerospace industry, particularly from emerging market players, poses long-term threats to Boeing's market share and profitability.

Source: Ycharts.com

Main Influencing Factors

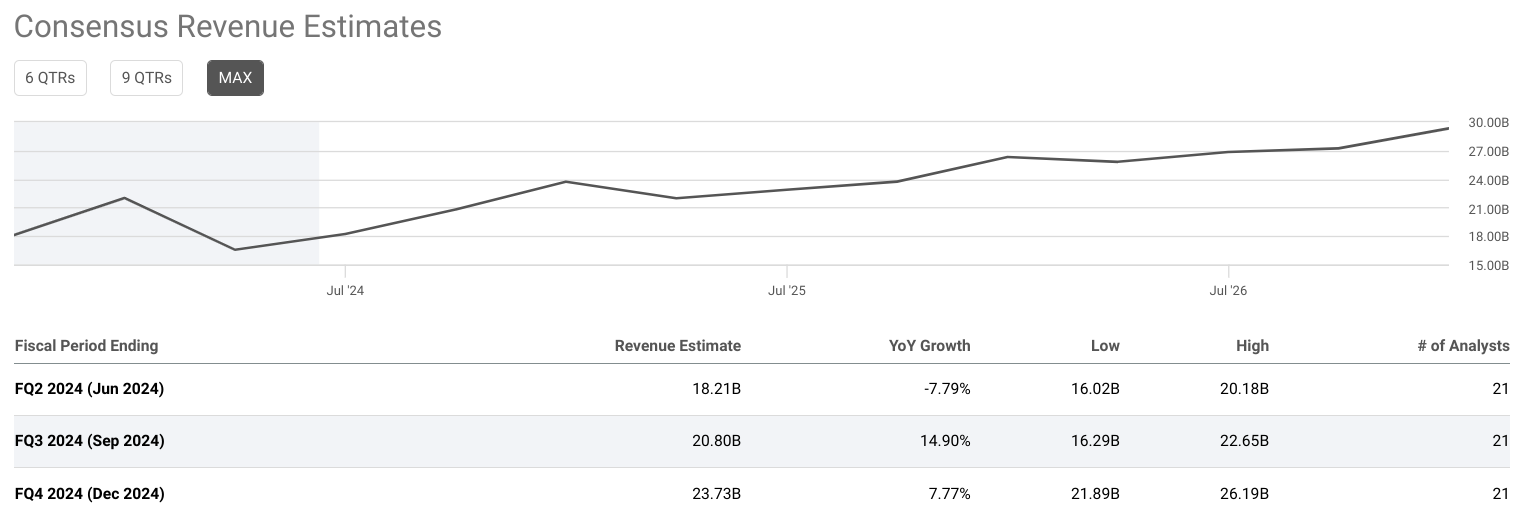

Boeing's recent stock performance has been significantly influenced by a range of internal and external factors. A primary internal factor is the company's strategic decision to slow down 737 production. This measure was taken to enhance quality and safety management systems, which although essential for long-term stability, has negatively impacted short-term revenues and delivery volumes. Specifically, Boeing's Q1 2024 results show an 8% decline in revenue compared to the previous year, primarily due to lower 737 deliveries and considerations related to the 737-9 grounding.

Financial performance also reflects substantial operational challenges, such as the $3.9 billion free cash flow usage and a core loss per share of ($1.13). Despite these setbacks, Boeing's backlog grew to $529 billion, indicating strong future demand. Notably, the commercial airplanes segment reported significant net orders, suggesting optimism for recovery once production issues are resolved.

Source: Q1 2024 Earnings Presentation

External factors also play a crucial role. Regulatory scrutiny and the need to comply with FAA standards have forced Boeing to implement comprehensive action plans, further slowing production. Additionally, global supply chain disruptions have compounded these challenges, affecting the availability of critical components and materials. Boeing's defense, space, and security segments provided some financial stability, with a modest increase in operating margins due to higher volume and improved performance. However, losses on certain fixed-price development programs partially offset these gains.

Expert Insights on Boeing Stock Forecast for 2024, 2025, 2030 and Beyond

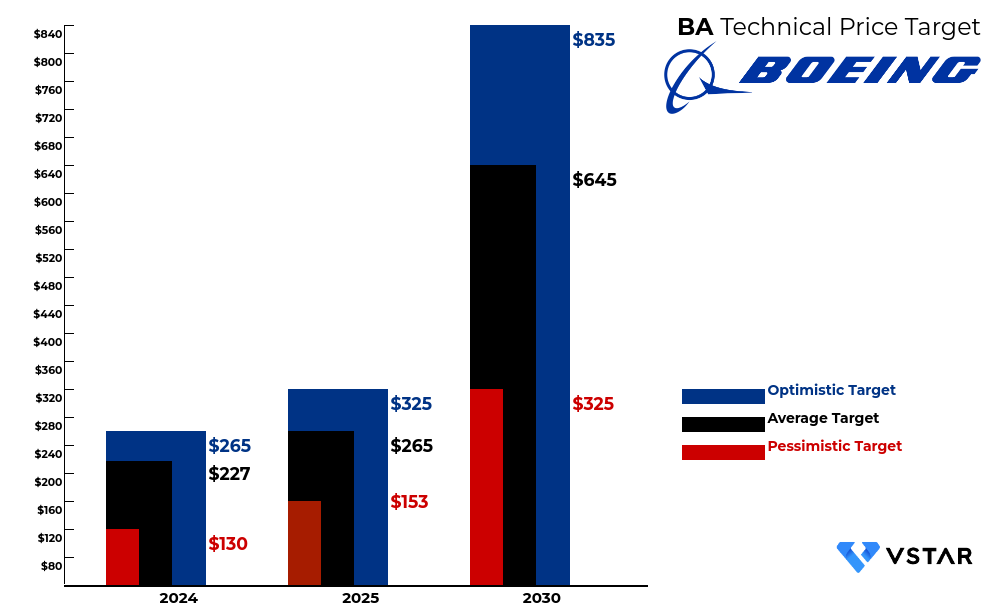

The recent performance of Boeing stock has been subject to scrutiny amidst varying expert forecasts for its trajectory into the future. The provided data presents a range of projections spanning 2024, 2025, and 2030, indicating a spectrum of optimism, moderation, and caution.

In 2024, the optimistic target stands at $265, reflecting bullish sentiments, while the average target of $227 represents a more conservative outlook. The pessimistic target of $130 signals apprehension or potential downside risks. Moving into 2025, the forecast continues this trend, with projections ranging from $153 to $325, showcasing the diverse perspectives on Boeing's future performance.

The most substantial disparity emerges in the 2030 forecast, where the optimistic target reaches $835, suggesting significant growth potential over the decade, while the pessimistic target remains notably lower at $325, underscoring lingering uncertainties or challenges.

Source: Analyst's Compilation

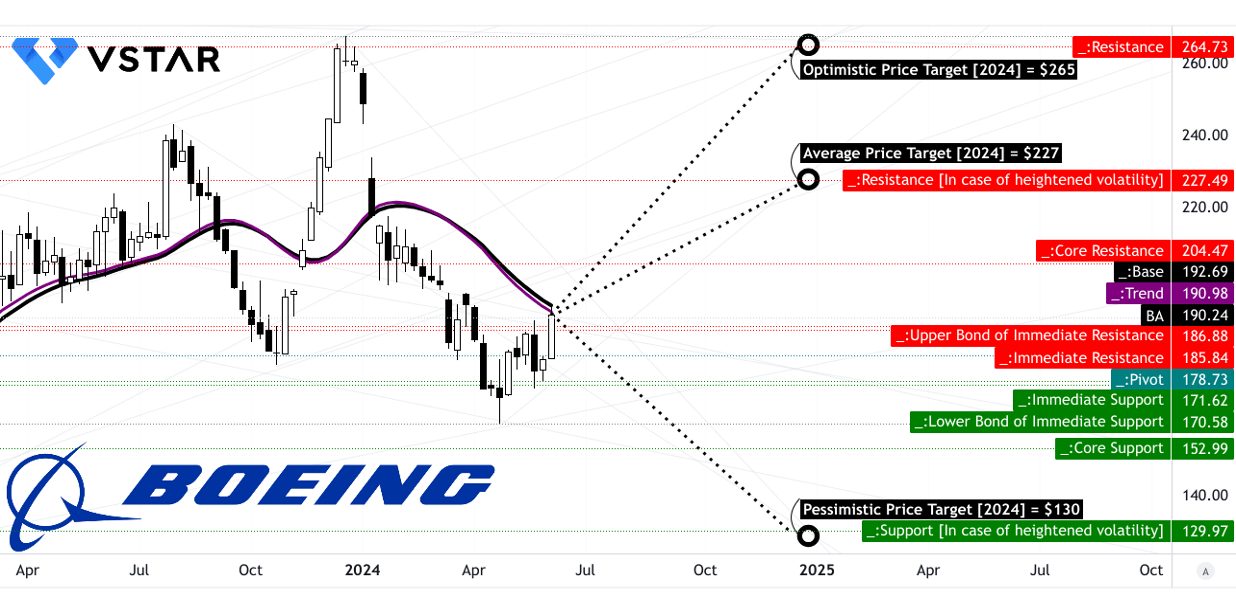

II. Boeing Stock Forecast 2024

Boeing's (NYSE: BA) average price target by the end of 2024 is projected to be $227.00. This forecast is based on the momentum of change-in-polarity over the short-term, extrapolated over Fibonacci extension levels. Additionally, an optimistic Boeing price target of $265.00 is proposed, considering the upward price momentum of the current swing over the short-term and its projection over Fibonacci extension levels. Conversely, a pessimistic BA stock price target of $130.00 is outlined, reflecting the downward price momentum of the current swing over the short-term, projected over Fibonacci retracement levels.

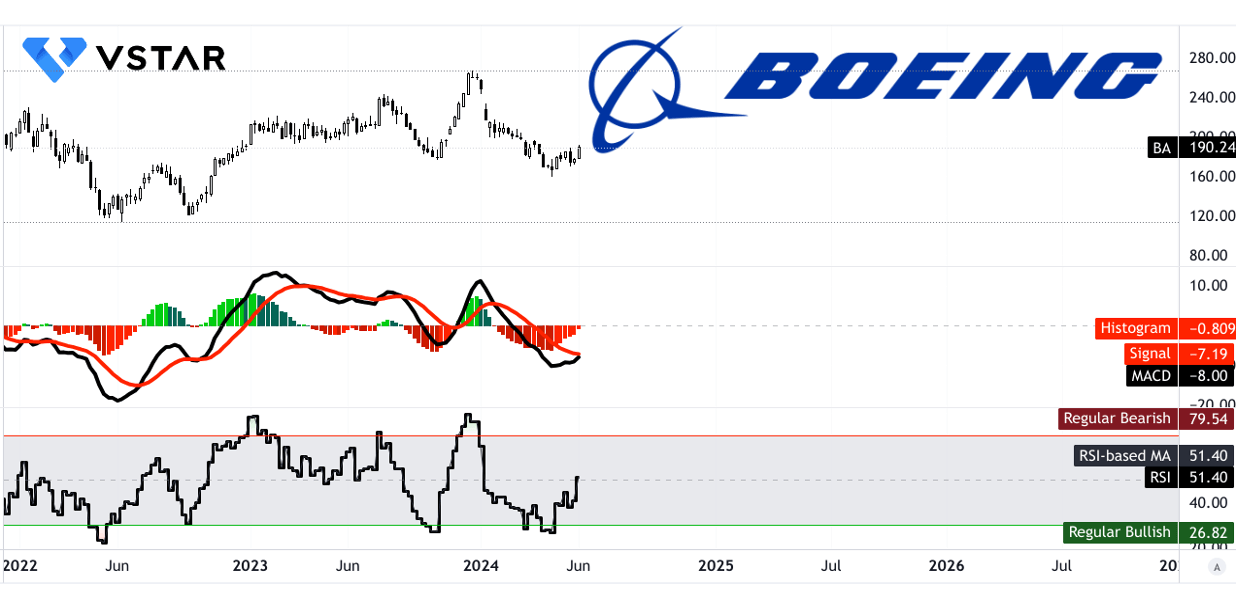

BA stock is currently priced at $190.24 with a modified exponential moving average trendline of $190.98 and a baseline of $192.69. The direction of the stock price is noted as upward, suggesting positive momentum. In terms of support and resistance levels, primary support is estimated at $186.88, with a pivot of the current horizontal price channel at $178.73. Core resistance is identified at $204.47, with potential heightened volatility resistance at $227.49. Core support and support in case of heightened volatility are calculated at $152.99 and $129.97, respectively.

Source: tradingview.com

The Relative Strength Index (RSI) stands at 51.4, indicating a neutral stance with an upward trend. Moving Average Convergence/Divergence (MACD) indicators suggest a bearish trend with decreasing strength, as the MACD line (-8) falls below the signal line (-7.19), with a negative MACD histogram (-0.809).

Source: tradingview.com

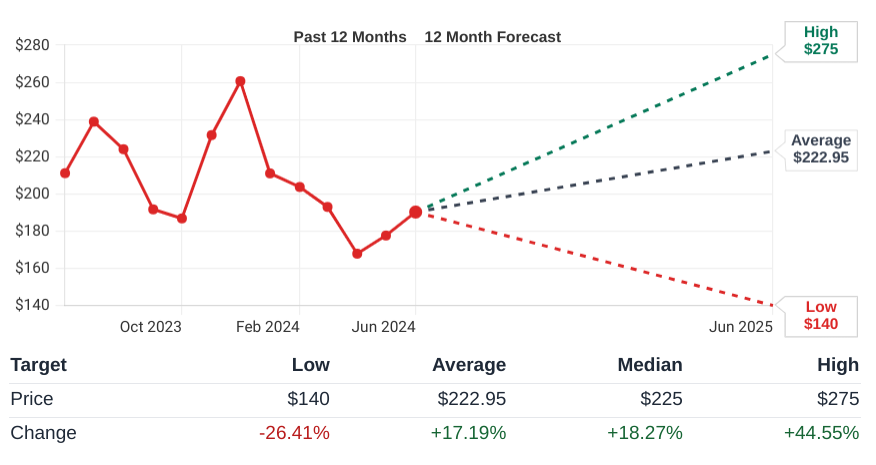

The Boeing stock forecast for 2024 indicates a generally positive outlook with some variations in predicted targets. According to TipRanks, the average BA price target is $215.43, with estimates ranging from a low of $140 to a high of $270. This average suggests a 13.24% increase from the current price of $190.24. Similarly, StockAnalysis provides an average target of $222.95, with a high of $275 and a low of $140, indicating a 17.19% potential increase. CoinPriceForecast predicts the stock will reach $200 by mid-2024 and $214 by year-end, representing a 12% increase from the current price.

Source: stockanalysis.com

A. Other BA Stock Forecast 2024 Insights

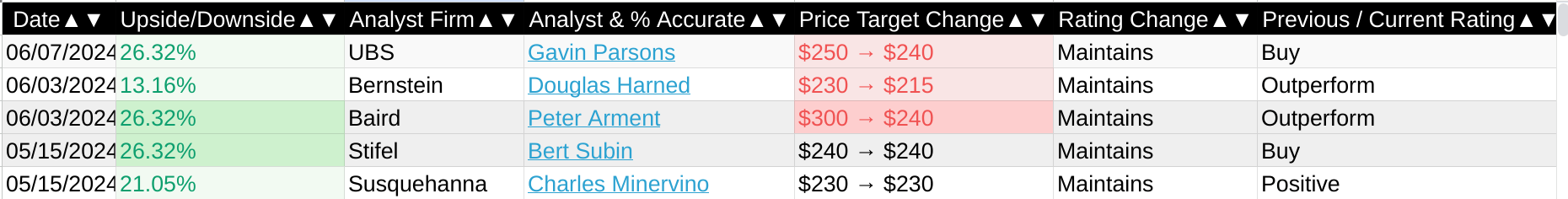

The stock forecast for Boeing (NYSE: BA) in 2024 suggests a mixed outlook among analysts. Analysts from major institutions have provided varied price targets and ratings for Boeing's stock. These are essential to understand the expectations for Boeing's market performance:

- UBS: Analyst Gavin Parsons maintains a 'Buy' rating with a revised BA price target of $240, suggesting a 26.32% upside.

- Bernstein: Douglas Harned has an 'Outperform' rating, adjusting the target from $230 to $215, indicating a 13.16% upside.

- Baird: Peter Arment also keeps an 'Outperform' rating, lowering the target from $300 to $240, with a 26.32% upside.

- Stifel: Bert Subin maintains a 'Buy' rating with a consistent Boeing price target of $240, reflecting a 26.32% upside.

- Susquehanna: Charles Minervino keeps a 'Positive' rating with a BA price target of $230, indicating a 21.05% upside.

Overall, analysts exhibit a cautiously optimistic view on Boeing, with price targets mostly in the range of $215 to $240, and a couple of higher outliers. This indicates confidence in Boeing's potential for recovery and growth, albeit with some reservations likely tied to the company's recent challenges and market conditions.

Source: Benzinga.com

B. Key Factors to Watch for Boeing Stock Predictions 2024

Boeing Stock Forecast 2024 - Bullish Factors

Quality Improvement Initiatives: Boeing's proactive measures to address quality control issues, including collecting employee feedback and engaging in a comprehensive quality action plan, indicate a commitment to enhancing product standards. These initiatives can foster investor confidence in the company's long-term sustainability and market competitiveness.

Strong Demand Across Portfolio: Despite short-term challenges, Boeing emphasizes robust demand across its portfolio. The company's ability to secure significant orders, such as those from American Airlines and Ethiopian Airlines, underscores market confidence in Boeing's products, potentially bolstering investor optimism.

Positive Defense Segment Performance: Boeing's Defense & Space segment witnessed notable order bookings and revenue growth. With a backlog of $61 billion and solid demand, particularly highlighted in the FY 2025 presidential budget, the defense sector's stability could contribute positively to overall financial performance.

Boeing Stock Forecast 2024 - Bearish Factors

Production Challenges: Boeing's admission of deliberately slowing production, particularly in the commercial airplane segment, to address quality and safety concerns may impact short-term financial performance. Lower delivery volumes, as evidenced by reduced 737 deliveries, could lead to revenue declines and margin compression, potentially dampening investor sentiment.

Source: seekingalpha.com

Cash Flow Concerns: Despite expectations of improved cash flow in the latter part of 2024, Boeing anticipates another sizable use of cash in the second quarter. Continuous monitoring of liquidity levels suggests ongoing financial pressures, raising apprehensions about the company's ability to meet its debt obligations and maintain an investment-grade rating, which could unsettle investors.

Uncertainty Surrounding Strategic Deals: Negotiations with Spirit AeroSystems present uncertainties regarding terms, financing, and divestment strategies. The complexity of such deals, coupled with ongoing factory stabilization efforts, may prolong decision-making processes, creating investor unease regarding Boeing's strategic direction and potential implications on financial performance.