- US CPI for May unchanged at 0% MoM, below estimates of 0.1%, with annual increase at 3.3%.

- 10-year Treasury bond yield drops 14 basis points to 4.266%, lowest since April.

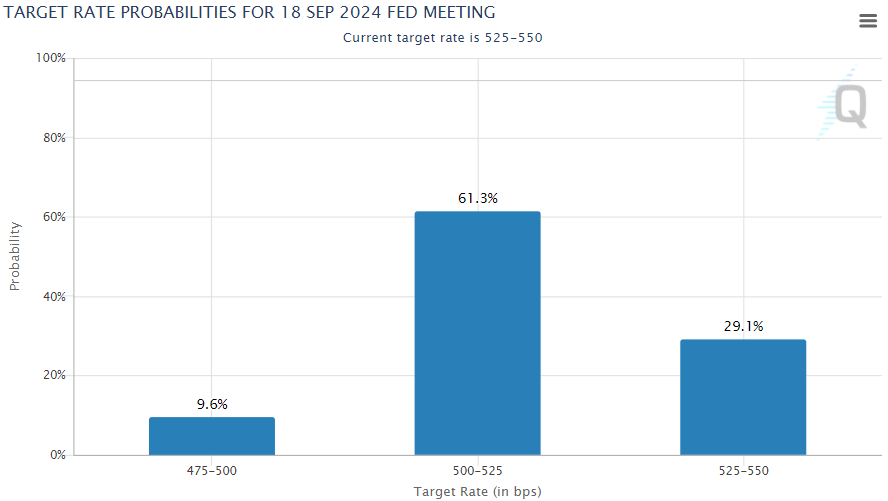

- Gold hits weekly high of $2,341; traders anticipate potential 25 bps rate cut by September with 61.3% odds.

US Treasury yields collapsed on Wednesday after a colder-than-expected May US Consumer Price Index (CPI) report increased speculation about the Federal Reserve's rate cuts in 2024. Despite that, caution is warranted, as the Federal Open Market Committee (FOMC) will reveal its monetary policy decision at around 18:00 GMT.

Colder-than-expected inflation report drives speculation of rate cuts ahead of FOMC policy decision

The US Bureau of Labor Statistics (BLS) revealed that the CPI was unchanged at 0% MoM, below estimates of 0.1% and April’s 0.3% increase. In the twelve months to May, it rose by 3.3%, below April’s and the 3.4% consensus.

Underlying inflation figures decreased from 0.3% to 0.2% MoM, while on an annual basis, hit 3.4%, lower than expectations of 3.5% and April’s 3.6%.

The US 10-year Treasury bond yield plummeted 14 basis points to 4.266%, its lowest level since April, after beginning the session at 4.426%. This pushed Gold prices toward a weekly high of $2,341 before stabilizing at around $2,324.

Data from the Chicago Board of Trade (CBOT) shows that traders expect 39 basis points (bps) of easing, according to December’s 2024 fed funds rate futures contract. In the meantime, the CME FedWatch Tool shows odds for a 25 bps rate cut in September jumped from 46.8% a day ago to 61.3%.

US inflation data came ahead of the Federal Reserve’s monetary policy decision. The Fed is expected to keep rates unchanged while updating its economic projections. Traders would be looking for hints about the future interest rate path.