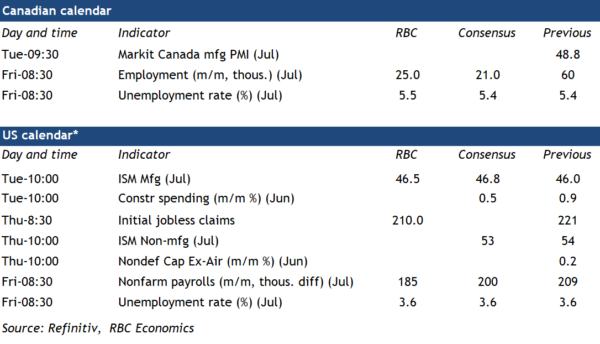

Fresh labour market data for Canada and the U.S. lands next week. And both Bank of Canada Governor Tiff Macklem and U.S. Fed Chair Jerome Powell will be on the lookout for signs that higher interest rates are cooling things down.

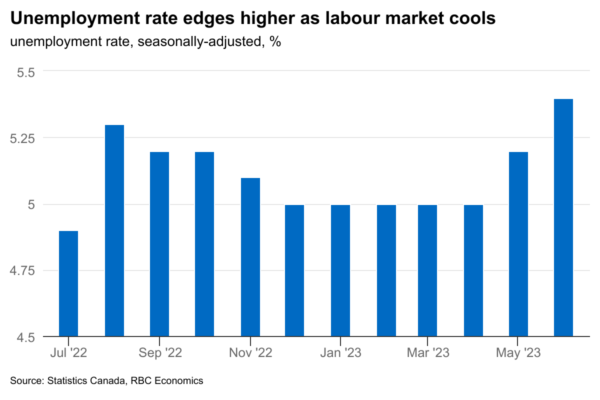

In Canada, we expect a 25,000 uptick in new jobs in July following a stronger increase of 60,000 jobs last month. Still, surging population growth means that won’t be enough to absorb all new labour market entrants. The unemployment rate edged up 0.2 percentage points in each of May and June and we look for another tick higher in July. Total job postings have also been trending lower. And slower wage growth in recent months has been consistent with signs that the surge of excess demand for workers in the economy has weakened.

The jobs report is among a slew of indicators to come in advance of the BoC’s next interest rate decision on September 6th (including one more monthly inflation reading.) The key question is whether interest rates (overnight rate now at 5% after another hike this month) are sufficiently restrictive to tame inflation. GDP has remained firmer than expected but has also been boosted by strong population growth. Per-capita GDP growth rates have been substantially softer. And higher unemployment rates would help to reassure the BoC that the balance of labour demand and supply is returning. We see softening job markets keeping the BoC on the sidelines with no additional interest rate increases this year. Still, central banks in Canada and abroad won’t hesitate to hike interest rates further if needed to put inflation back in target range.

Week ahead data watch

The next U.S. jobs report will come out on Friday. We expect the unemployment rate to hold steady at 3.6%, and non-farm payroll employment to rise (+185,000) in July, slightly lower than the +228,000 in the prior month. Labour markets remain firm, but we look for unemployment to drift higher during the second half of the year.