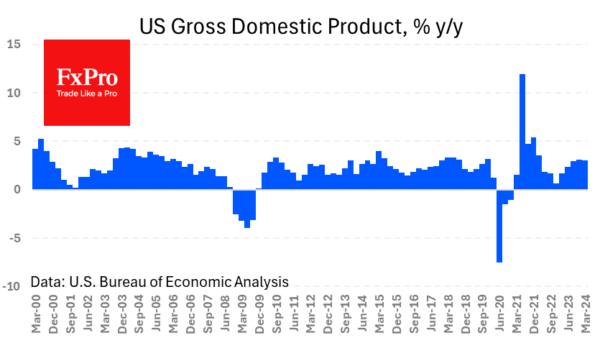

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast. Disappointment increased given that exceeding forecasts has become the norm. GDP growth for the same quarter a year earlier fell to 3.0% from 3.1%.

In contrast, the price index showed a 3.1% increase from 1.6% previously. Thus, the U.S. economy simultaneously faced increased inflationary pressures and slowing growth. This has caused even more concerns among those who fear stagflation.

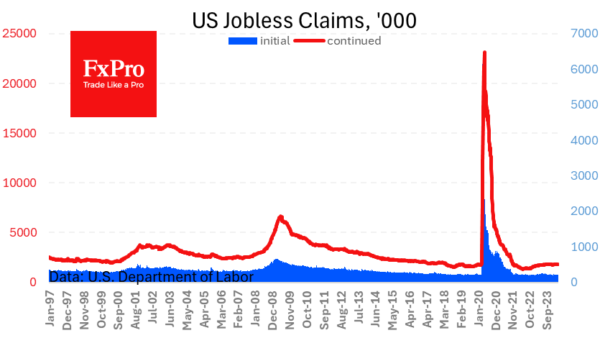

At the same time, a new batch of very positive weekly unemployment data was released. Initial jobless claims fell to 207K, the lowest since February. The number of repeat claims fell to 1781K – the lowest in three months. It is worth noting that these are very low figures by historical standards. The tense situation in the labour market will create domestic inflationary pressures even if commodity prices start to decline.