The British Pound is little changed as traders open their books for the week with little macro news around to start a move. The situation in the Middle East remains unpredictable and very volatile, while the proposed Israel move into Gaza is seemingly still on hold. Market sentiment is risk-averse at the open and likely to stay that way ahead of a week packed full of potentially volatile releases and events. The delayed UK unemployment will be released tomorrow morning (07:00 UK) before the latest S&P Global PMIs hit the screens at 09:30 GMT.

For all market-moving economic data and events, see the DailyFX Calendar

Another rating agency, Moody’s, was in the news recently after it upgraded the UK’s long-term outlook to stable from negative and reaffirmed the UK’s Aaa3 rating. Moody’s placed a negative outlook on the UK after ex-PM Liz Truss’s disastrous mini-budget last year. The next UK Budget will be on November 22nd.

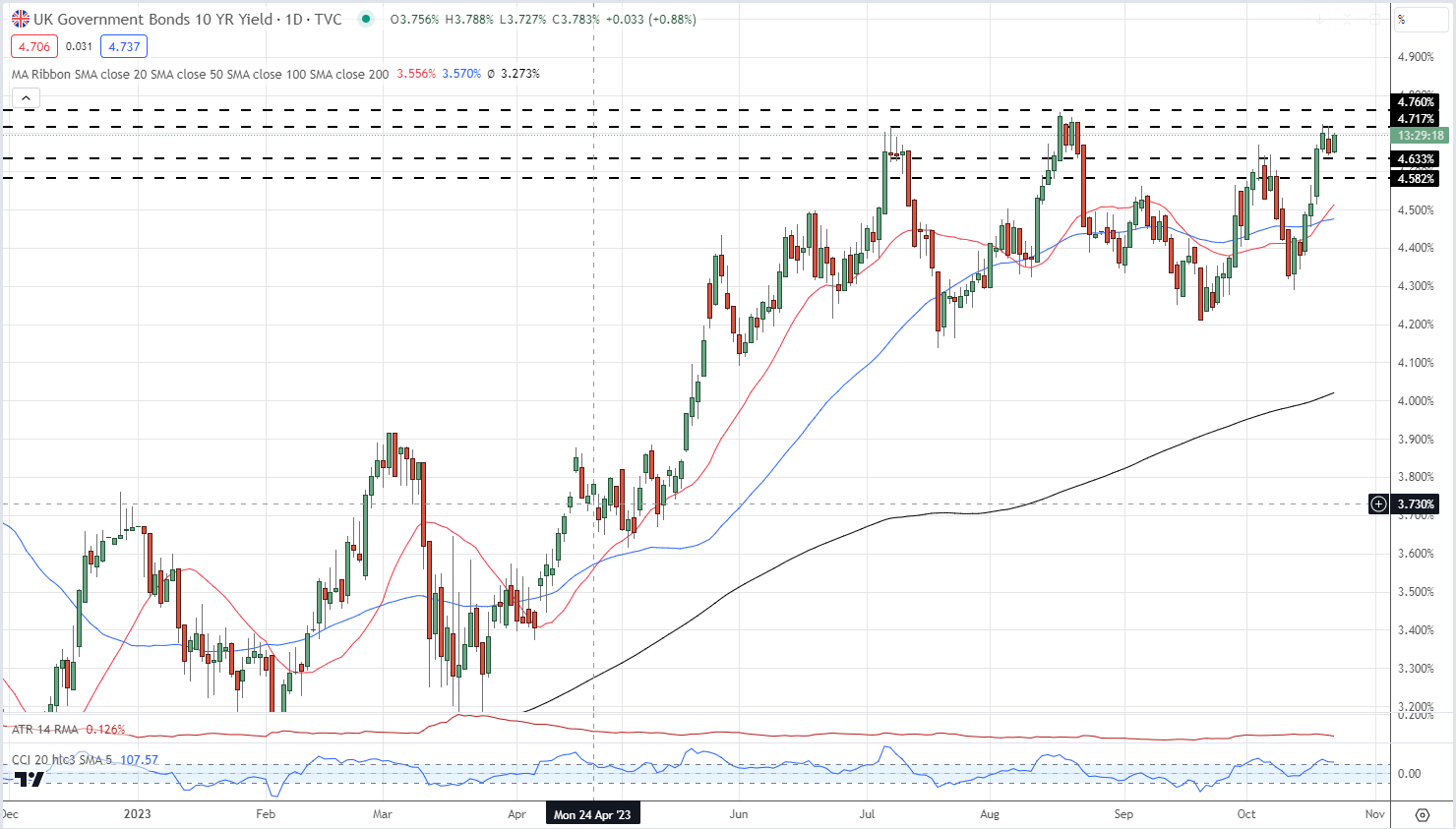

UK government bond yields remain elevated ahead of next week’s BoE meeting with the 10-year benchmark eyeing a fresh re-test of levels last seen in August 2008. The daily chart shows a triple top formation for UK 10-year yields, a pattern that normally suggests that the market is set to turn lower.

UK 10-Year Gilt Yields

Cable remains stuck in a short-term range between 1.2089 (78.6% Fibonacci retracement) and a prior horizontal high of around 1.2303. The chart remains negative with a death cross formed last week, while the 20-day simple moving average continues to guide the pair lower.

Learn How to Trade GBP/USD