Yesterday was a day choke full of records. The weakest ISM Manufacturing data since June 2013 drove risk appetite lower, resulting in 10Y Treasury Yields have also falling to lowest levels since Nov 2013. Gold prices rallied the strongest in more than a week. Fear Index VIX has also broken above the 20.0 key level, closing at 21.44 – highest since the Christmas week of 2012. Stocks wise, we already suspected that February will be bearish, but nothing could have prepared us for declines of this magnitude. S&P 500 has the worst start to February since 1933. Dow Jones Industrial Average wasn’t as bad, but nonetheless yesterday marked the 7th triple digit fall in 2014, and also the worst start since 1982. Things were much worse for the higher risk sensitive Nasdaq 100 which clocked in the worst Feb trading day on record. The list of record breaking is longer, but all the records are either stocks (e.g. Singapore stocks hitting 14 month low) or yields ( Japanese 10Y hitting 2 month low) related and hence there isn’t really a need to point out every single one of them. But nonetheless, all these point to one thing – unprecedented risk off sentiment in recent history.

Given all these, it is clear that bearish momentum should be able to continue for a while more. Furthermore, traders are selling longer-dated VIX futures and buying nearer-dated ones, suggesting that they are concern over short-term downsides scenarios. This move shouldn’t be too surprising though, as it has been mentioned previously that traders are at leveraged levels. Hence, it is reasonable that most of them are buying up hedging instruments in order to mitigate their losses. That being said, it is unlikely that they will fully hedge against their current exposure, and even if they want to hedge fully it is possible that they will not be able to have the loose cash to fork out the premiums needed. As such, we can expect more selling to continue as these leveraged traders will need to clear their positions if prices push lower, resulting in a bearish perpetual machine.

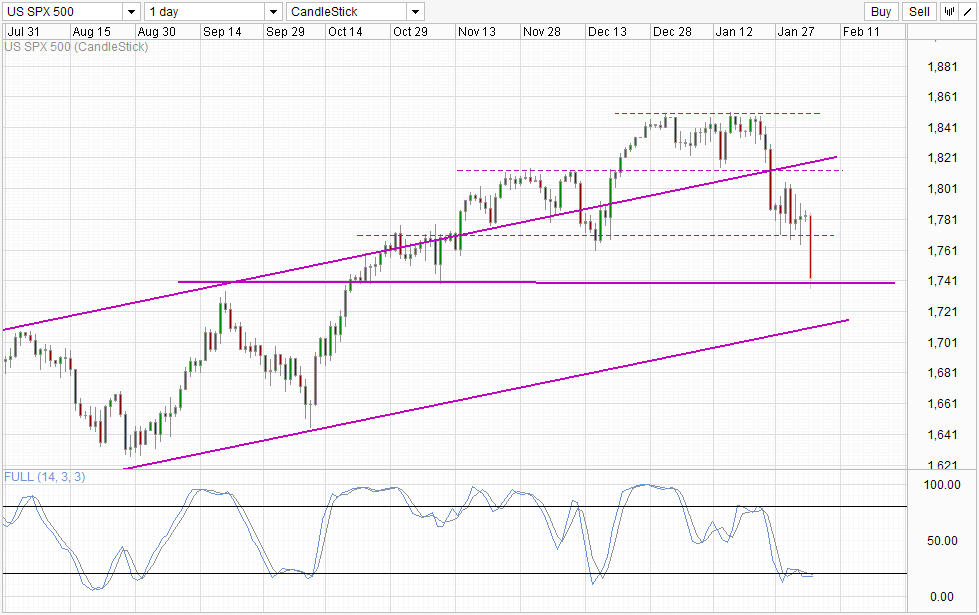

Daily Chart

On the technical front, clearing the 1,770 round figure is a huge testament of the bearish strength. However the more important question is whether the move is already over as prices appears to be holding above the 1,740 support level. Price has since rebounded up slightly despite the continued risk off sentiment during Asian hours, but certainly bearish pressure is still reigning hence a break of the support level cannot be invalidated. That being said, Channel Bottom is less than 25 points below 1,740, and with Stochastic readings already within Oversold region, it will be a difficult task to push beyond Channel Bottom.

Difficult doesn’t mean impossible though, there are talks along the market street that a close below 1,770 will trigger huge short orders. As it is right now, we are already seeing higher short interest with NYSE reporting that total short interest have rose to 13.8 billion shares. That number is bound to increase further should all the algo traders get into this play.

More Links:

GBP/USD – Drops Sharply to Six Week Low Below 1.63

AUD/USD – Rejected Again at Resistance Level of 0.88

EUR/USD – Bounces Well off Support around 1.35