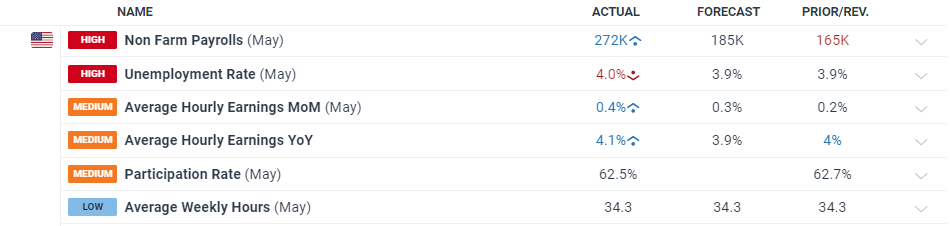

The latest US Jobs Report showed 272k new roles created in May, dwarfing expectations of 185K and April’s 165k (revised lower from 175k). The unemployment rate rose to 4.0%, from 3.9%, while monthly average earnings rose to 0.4% from 0.2% last month.

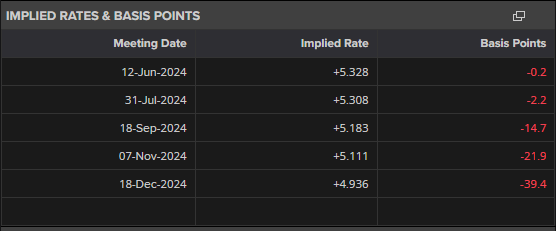

Today’s release contrasts weak ADP and JOLTs jobs data released this week, which has boosted the dollar as US rate cut expectations fade further. The market is implying that the first cut may happen in November although this isn’t fully priced.

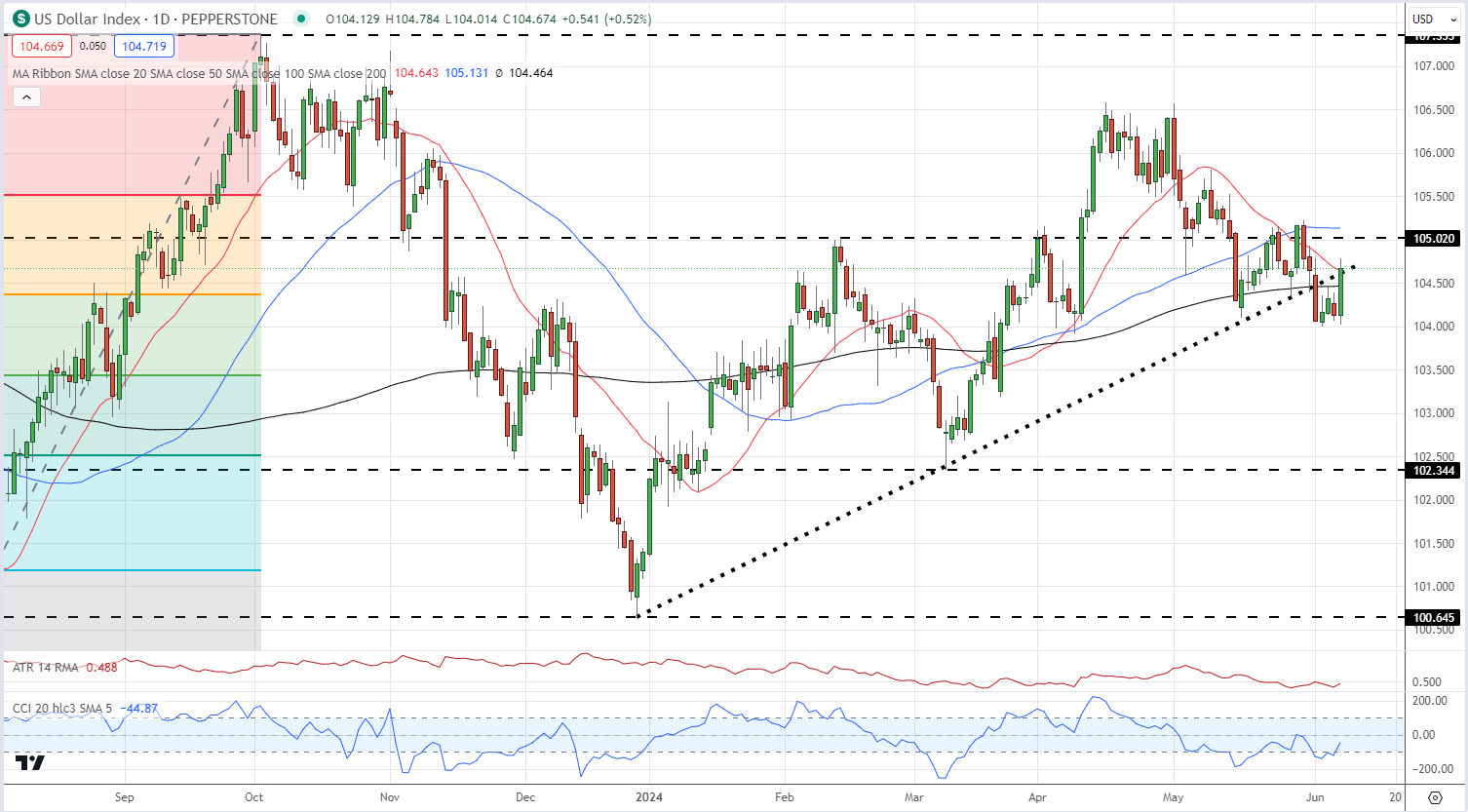

The dollar index has been under pressure this week from the weak ADP and JOLTs data but regained all of this week’s losses after the NFP numbers hit the screens. The dollar index has broken back above the 200-dsma and the 38.2% Fib retracement and is currently testing the multi-month trend support.

US Dollar Index Daily Chart

Gold is now posting a fresh one-month low and gold bulls have endured a difficult day. Earlier today a Bloomberg report noted that China had stopped buying gold, sending the precious metal down $20/oz. in quick order. A confirmed break and open below the $2,315/oz. would bring $2,280/oz. back into play.