The Australian Dollar was a little lower on Monday but remains close to its 2024 peak thanks to some solid and enduring monetary policy support.

While most major central banks are either already cutting rates, or within sight of doing so, persistently high inflation has meant that the Reserve Bank of Australia will likely be among the very last to join that party.

Indeed, it’s not thought impossible that Australian rates could rise again this year following the release of May’s inflation numbers. They showed a surprise climb for consumer prices back above the 4% level- a six-month high.

However, even if rates merely stay on hold at current levels into year-end. that will leave Australian yields and the Australian Dollar looking attractive.

Monday’s economic data were sparse but interesting, with home loans and investment lending for homes both revealed to have fallen in May. Tuesday will bring the monthly snapshot of consumer confidence from Australian banking major Westpac. The last look, for June, found Aussies still gloomy but a little less so than they were. More of the same will underline the RBA’s problem. Sullen consumers hardly suggest an economy crying out for the higher borrowing costs strong inflation could force on them.

After that focus will cross the Pacific to the United States where Federal Reserve Chair Jerome Powell is due on Capitol Hill for his regular Congressional testimony.

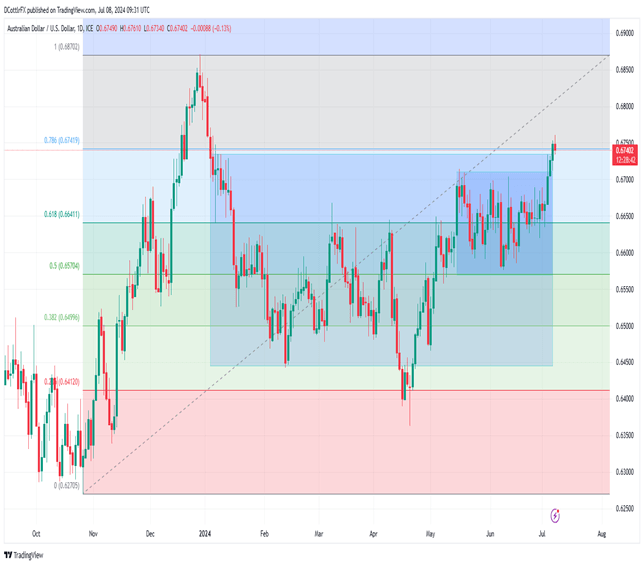

Australian Dollar Technical Analysis