EURUSD

Fundamental Perspective

The EURUSD pair continues to struggle near 1.0360, hovering close to the one-month low reached on Thursday. As buyers remain on the sidelines, the pair is set to post its lowest weekly close since November 2022.

The euro's weakness is driven by the divergent monetary policy outlooks between the European Central Bank (ECB) and the Federal Reserve (Fed). The ECB recently cut interest rates for the fourth time this year, signaling potential further easing in 2025. In contrast, the Fed hinted at a slower pace of rate cuts in 2025, reinforcing the downside bias for EUR/USD.

Geopolitical risks, alongside uncertainty surrounding US President-elect Donald Trump's tariff proposals and a looming government shutdown, have supported the US Dollar. These factors and the Fed's hawkish stance have propelled the USD to a two-year high, deepening the negative outlook for the EUR/USD pair.

Attention now turns to the US Personal Consumption Expenditure (PCE) Price Index, the Fed's preferred inflation metric, due later in the day. While the data could influence short-term USD movements, the broader fundamentals remain tilted in favor of USD strength, suggesting any reaction to softer data may be limited.

Technical Perspective

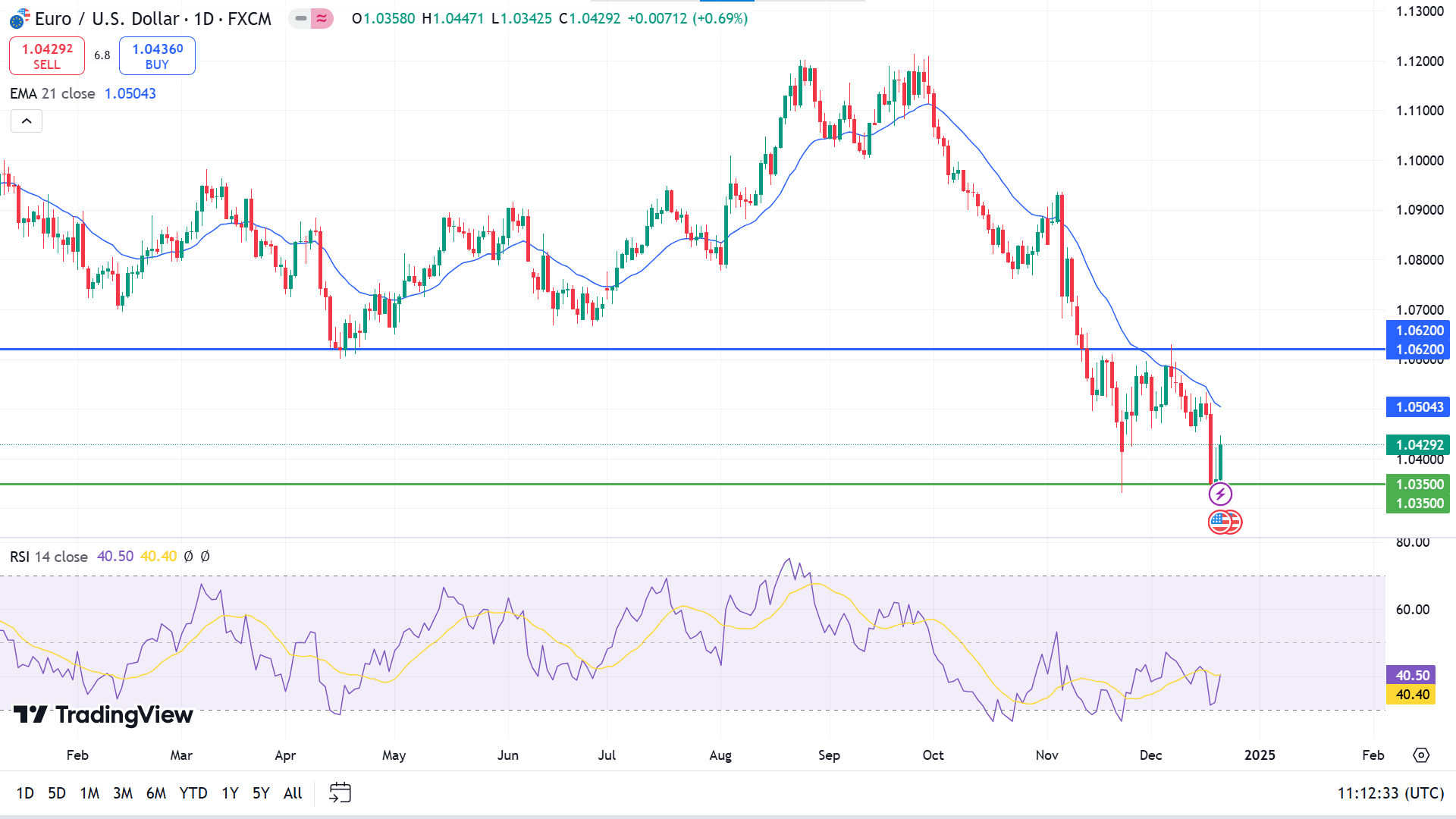

EURUSD's current two red candles on the weekly chart create support near the yearly low, showing that the downtrend still has the possibility of reaching beyond the support level.

The price is moving below the EMA 21 line on the daily chart, reflecting the bearish pressure at the asset price on the daily chart. The RSI indicator scenario is different as the dynamic signal line edging upside after reaching the lower line of the indicator window shows slight buying interest.

As per the current context, buyers may observe near 1.0350 as it looks like adequate support to hold, which can trigger the price toward the resistance near 1.0620 or beyond.

Meanwhile, the bullish signal might be invalid if the price dives below 1.0350, sparking selling interests. Sellers may seek to open short positions primarily near 1.0620 as it is an acceptable distribution level.