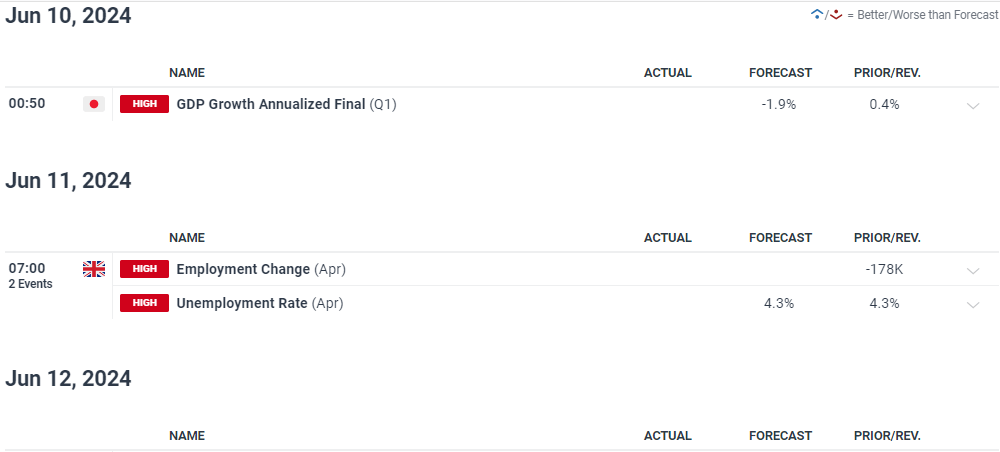

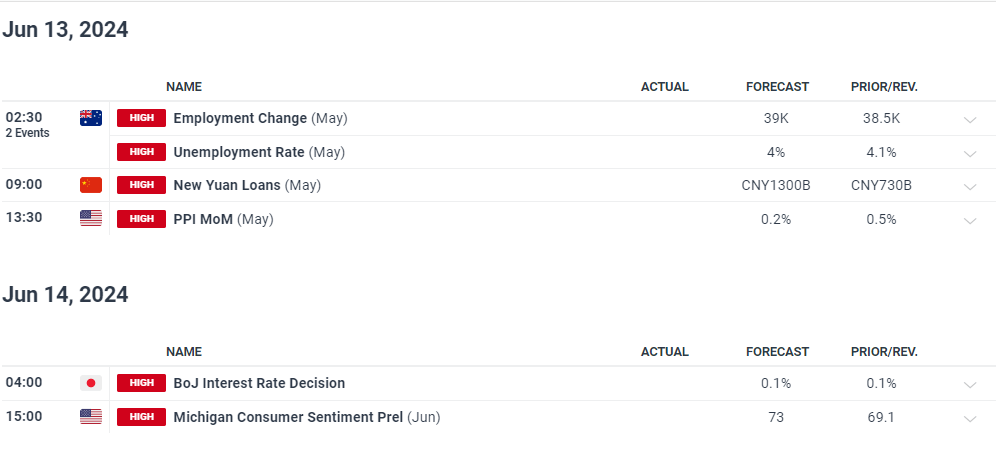

A week full of high-impact economic data and events including UK employment data, US inflation, Australian employment, US PPI, along with the latest monetary policy decisions from the Federal and the Bank of Japan. The Fed will leave all policy levers untouched but the accompanying release of the latest summary of economic projections will likely give the market something to work with. The BoJ will also leave rates unchanged but may signal that they will let bond yields drift higher, the first step towards tightening monetary policy. USD/JPY will be an active pair in the second half of next week.

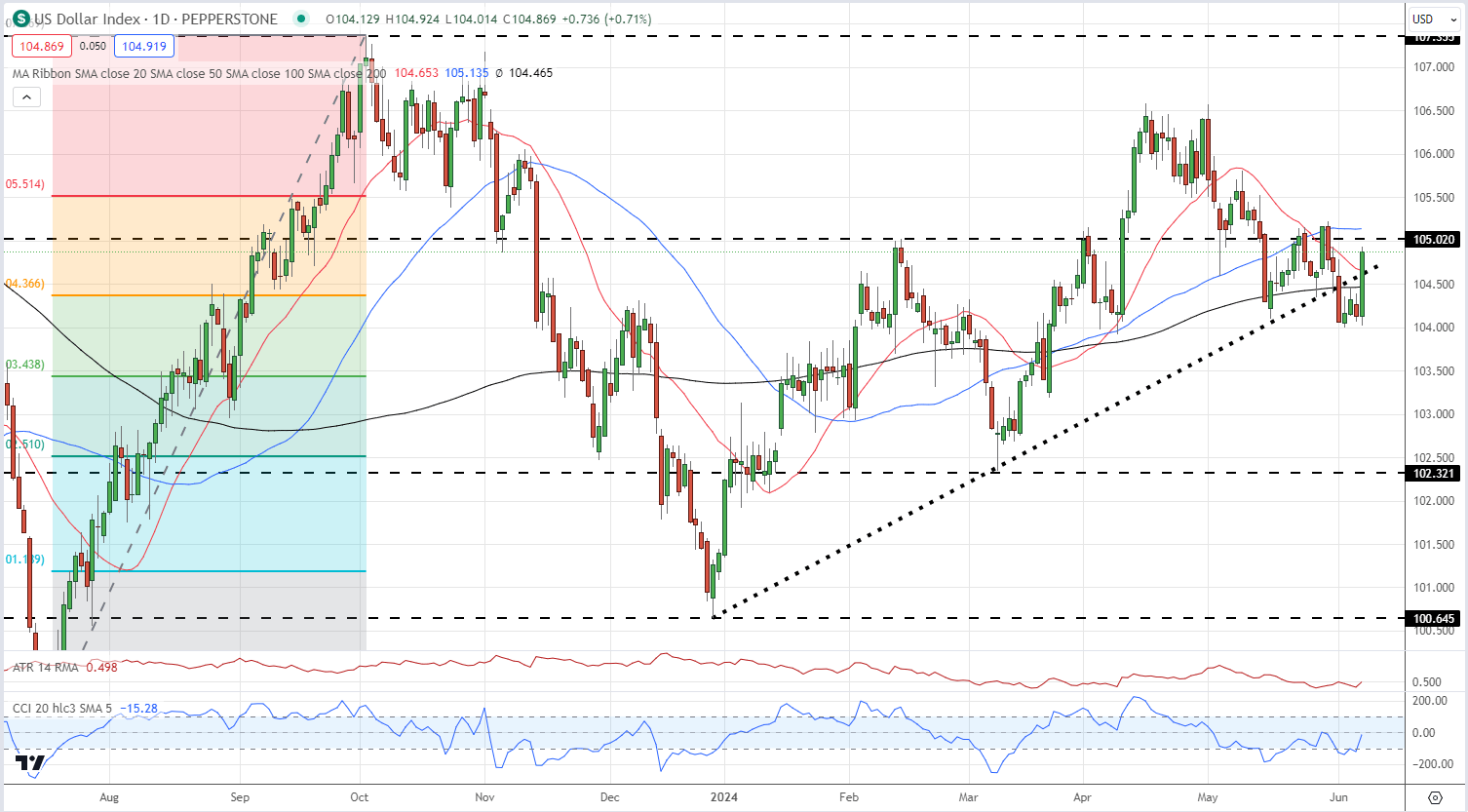

The US dollar pulled back all of this week’s losses on Friday after the release of the latest US Jobs Report (NFPs). This stronger-than-forecast release sent the US dollar back towards 105.00, wiping out all of this week’s losses, and next week’s FOMC meeting will drive action over the next few weeks. The US dollar index remains in a downtrend but a move above 105.21 would break a recent series of higher lows and take the index back above the last of the three simple moving averages.

US Dollar Jumps After NFPs Thump Expectations, Gold Hits a One-Month Low

US Dollar Index Daily Chart

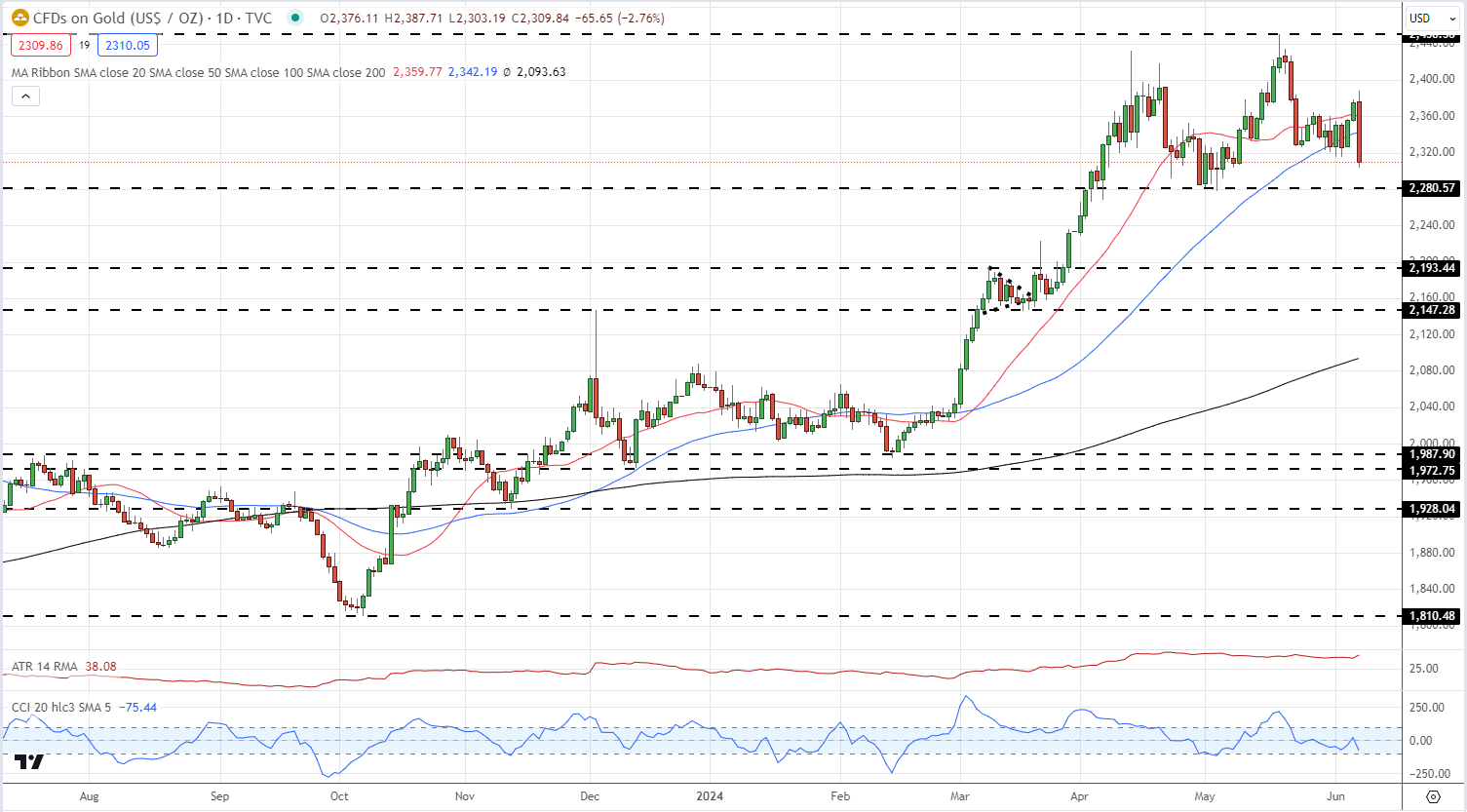

Early Friday gold dropped $20/oz. in a few minutes after a Bloomberg report said that China had stopped buying the precious metal. China has been a big buyer of gold over the last few months and the report caused a buyer’s strike. The precious metal fell further after the release of the US Jobs Report as US Treasury yields spiked higher. Gold currently trades around $2,310/oz. and is closing in on an important level of support at $2,280/oz. This level needs to be held to bring buyers back to market.

Gold Daily Price Chart