The Bank of Japan's most recent summary of market opinions, released earlier today, has highlighted a growing consensus among bond market participants: the need to curtail the central bank's bond-purchasing program. While the BoJ currently acquires bonds worth about 6 trillion yen each month, market experts are proposing a significant reduction, recommending monthly purchases be downsized to between 2 and 4 trillion yen instead. A reduced bond-buying program would allow Japan interest rates to move higher, aiding the central bank as it looks to start the process of tightening monetary policy.

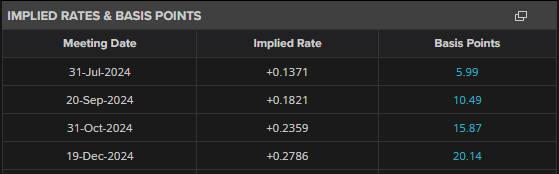

According to the latest money market forecasts, there is around a 60% chance that the BoJ will raise interest rates by 10 basis points at the July 31st meeting. If the BoJ stands pat, then interest rates are fully expected to be hiked at the September 20th meeting with a second rate increase seen on December 19th.

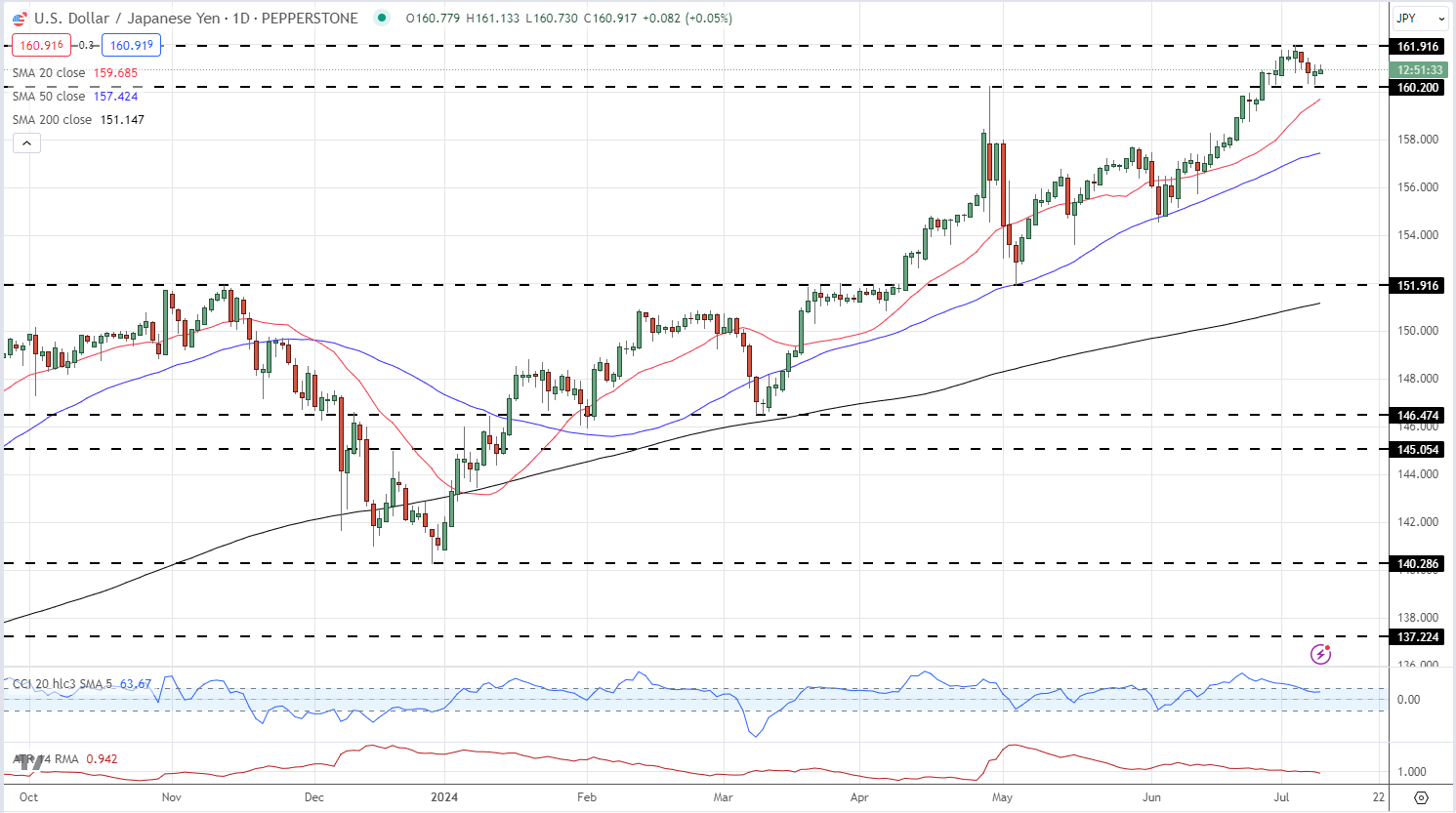

USD/JPY is currently treading water just below multi-decade-high levels. While the Japanese Yen remains weak, recent USD/JPY price action has also been driven by the US dollar. The dollar index, DXY, continues to print a pattern of higher lows since the end of last year and press higher, although the recent failure to print a new higher high may temper further upside. Fed chair Jerome Powell is set to testify before Congress today and tomorrow, and lawmakers are likely to quiz Powell on the central bank’s current policy of keeping rates at elevated levels.

USD/JPY remains capped at just below 162.00 with short-term support seen at 160.20. USD/JPY volatility remains low but traders should remain alert to any official intervention by Japanese authorities if USD/JPY breaks higher.

USD/JPY Daily Price Chart