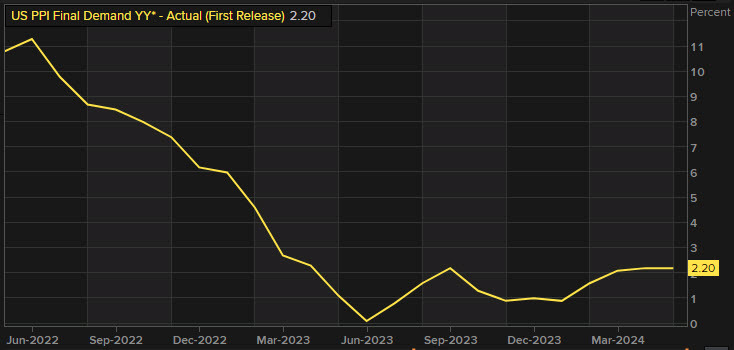

- Prior was +2.2% y/y

- PPI final demand -0.2% vs +0.1% expected

- Prior was +0.5%

- PPI ex food/energy +2.3% vs +2.4% y/y expected

- PPI ex food/energy 0.0% vs +0.3% m/m expected

- Prior ex food/energy +0.5%

The May decrease in final demand prices can be attributed to a 0.8% decline in the index for final demand goods, which was the largest decline since October. Energy fell 4.8% as gasoline prices fell 7.1%. Prices for final demand services were unchanged.

Fed funds futures are back to fully pricing in two cuts this year.