- Nio's Q2 2024 revenue increased substantially to RMB17.45 billion, driven mainly by vehicle sales.

- Despite a large net loss, Nio's gross profit and margin saw dramatic improvements.

- Nio delivered a record 57,373 vehicles, capturing over 40% of China's premium BEV market.

- The stock price showed volatility with a closing price trailing its quarterly high by over 30%.

- Growth opportunities are evident in the expanding EV market and international presence, though competitive pressures and supply chain risks remain significant.

I. Nio Q2 2024 Performance Analysis

A. Key Segments Performance

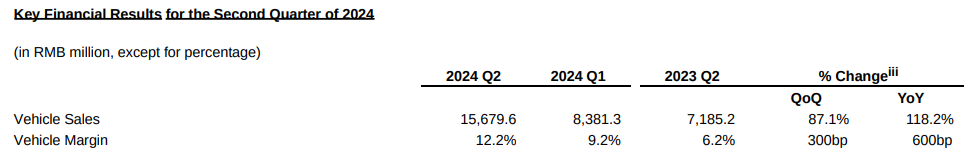

Financial Highlights: In Q2 2024, Nio's total revenue surged to RMB17.45 billion (US$2.40 billion), a 98.9% year-over-year increase and a 76.1% rise from Q1 2024. Vehicle sales, the largest contributor, amounted to RMB15.68 billion (US$2.16 billion), an increase of 118.2% year-over-year. Despite strong revenue growth, Nio reported a net loss of RMB5.05 billion (US$694.4 million), although this loss decreased by 16.7% year-over-year. Gross profit rose to RMB1.69 billion (US$232.4 million), a staggering 1,841% jump from Q2 2023, improving gross margins to 9.7% from 1.0% the prior year. Earnings per share (EPS) remained negative at RMB2.50 (US$0.34) per share, but adjusted EPS improved from Q1. Cash reserves stood at RMB41.6 billion (US$5.7 billion), ensuring liquidity for future expansion.

Source: ir.nio.com

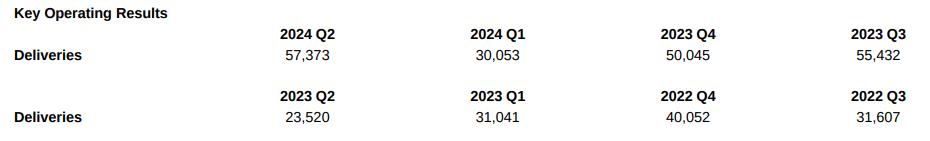

Operational Performance: Nio delivered 57,373 vehicles in Q2 2024, a record-breaking 143.9% year-over-year increase. This includes 32,562 premium electric SUVs and 24,811 sedans. Nio secured over 40% market share in China's BEV market segment priced above RMB300,000. The company introduced key technological advancements, including its proprietary intelligent driving chip and SkyOS, an in-house vehicle operating system. Nio also announced the launch of its mass-market ONVO brand, debuting the L60 model, and marking a push into a broader customer base. Nio's expanding infrastructure includes over 2,561 battery swap stations and 23,000 chargers globally, bolstering its market presence and user experience.

Source: ir.nio.com

B. NIO Stock Price Performance

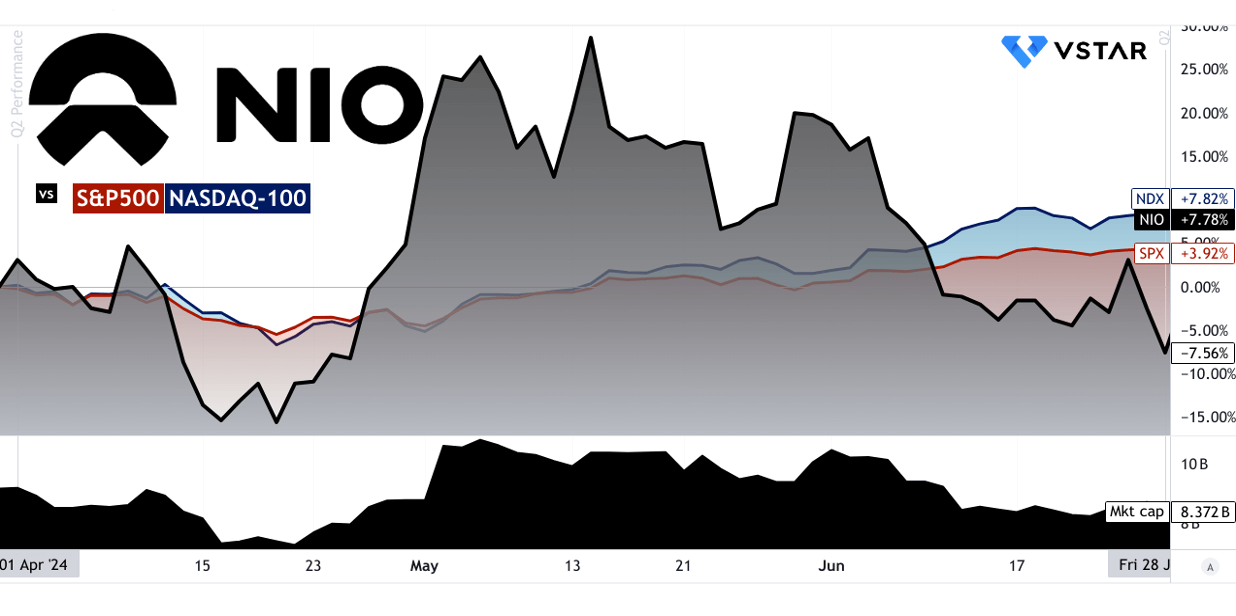

NIO's market cap is $8.372 billion, with an opening price of $4.63 and closing at $4.16. The stock peaked at $6.05 and hit a low of $3.61 during the quarter. It saw a negative 7.78% price return, underperforming against NASDAQ's 7.82% return and the S&P 500's 3.92%. During Q2, its closing price still trailed the quarter's high by 31.35%.

Source:tradingview.com

II. NIO Stock Prediction: Outlook & Growth Opportunities

A. Segments with Growth Potential

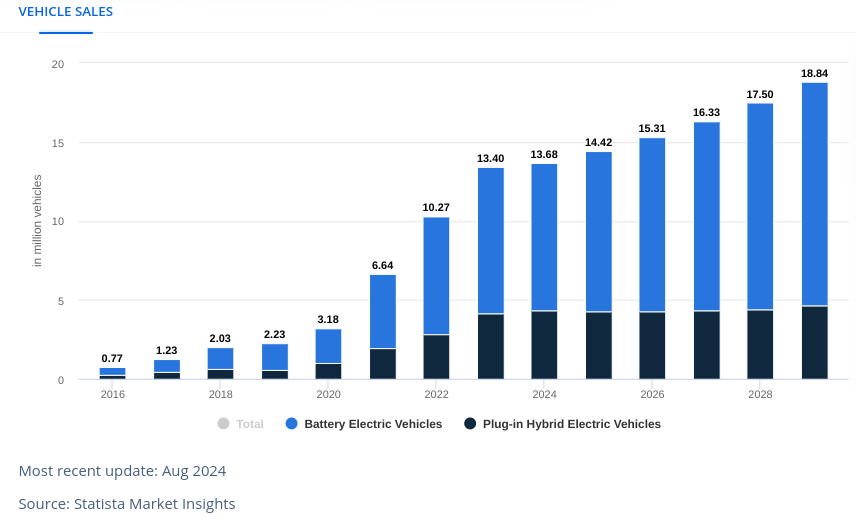

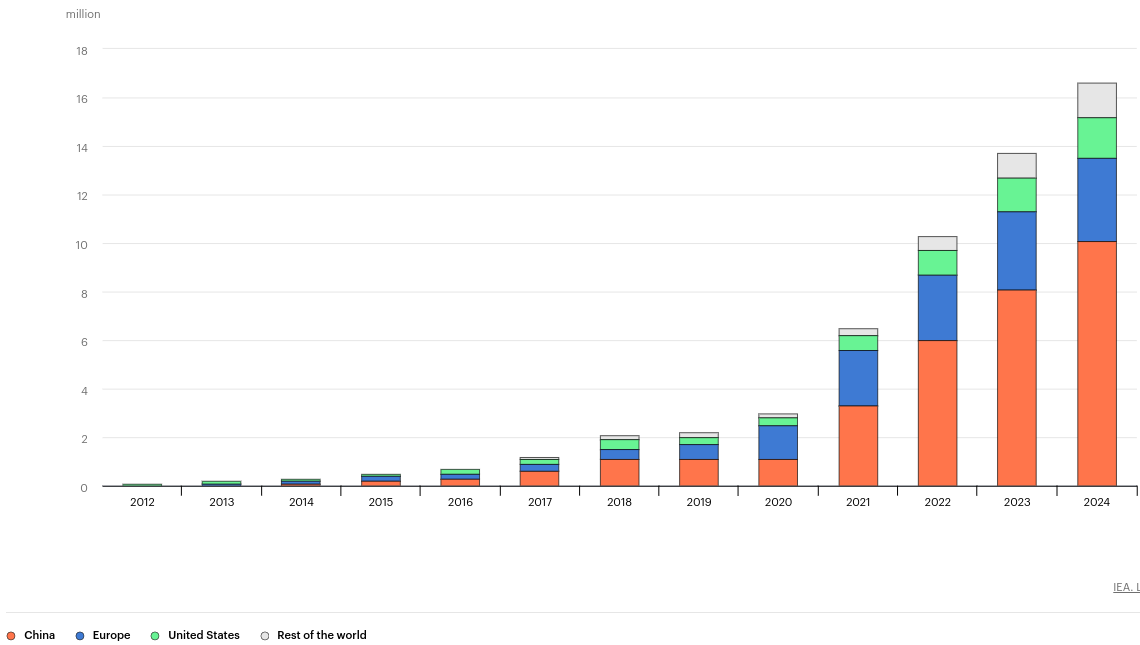

NIO operates in the rapidly growing electric vehicle (EV) market, where revenue is projected to reach $786.2 billion globally by 2024. China will dominate this market, contributing $376.4 billion. The EV market is expected to grow at a 6.63% CAGR (2024-2029), positioning NIO well in this expanding landscape. A key segment for NIO is the premium EV sector in China, where it held a 40% market share in Q2 2024 among battery electric vehicles (BEVs) priced above RMB 300,000. Additionally, with sales surpassing 57,373 units in Q2 2024, NIO's delivery growth rate of 143.9% signals strong future demand. Another area of growth is its burgeoning international presence, with recent market entry in the UAE and planned expansions to other global markets in 2024.

Source: statista.com

[Electric car sales, 2012-2024]

Source:iea.org

B. Expansions and Strategic Initiatives

Research and Development (R&D): NIO's cumulative R&D investment continues to grow, evidenced by the recent unveiling of the SkyOS operating system and the Shenji NX9031 chip for autonomous driving. These innovations will likely bolster NIO's technological edge in the smart EV space.

Partnerships and Collaborations: NIO is expanding its Power Up Partner Plan, with over 2,561 power swap stations deployed globally. This effort, combined with collaborations on infrastructure projects, aims to enhance EV charging accessibility and attract new customers. Additionally, NIO's collaboration with various international markets, like the UAE, underscores its focus on becoming a global player.

Source: nio.com