EURUSD

Fundamental Perspective

The EURUSD extended its rally for a fourth straight day on Thursday, nearing the 200-day Simple Moving Average (SMA) at 1.0870 and close to the 1.0900 resistance level. This climb correlates with a softer US Dollar, as the US Dollar Index (DXY) dipped below 104.00 amid a broader decline in US Treasury yields. The Euro found additional support in a modest pullback in 10-year German bund yields after reaching highs near 2.45%.

Market expectations for a 25-basis-point rate cut by the Federal Reserve (Fed) on November 7 have intensified, driven by persistently high PCE inflation data and a strong labor market, ahead of Friday's Nonfarm Payrolls report. The CME FedWatch Tool shows nearly full pricing for this anticipated cut.

Meanwhile, the European Central Bank (ECB) recently cut its Deposit Facility Rate to 3.25%, with officials adopting a cautious approach to further reductions. ECB President Christine Lagarde expects inflation to align with the 2% target by 2025, while Governing Council member Fabio Panetta suggests more easing may be needed. Conversely, board member Isabel Schnabel supports a gradual approach to avoid overshooting targets.

As the Fed and ECB weigh policy, EURUSD's path will likely hinge on broader economic dynamics, with the more robust US economy favoring the Dollar.

Technical Perspective

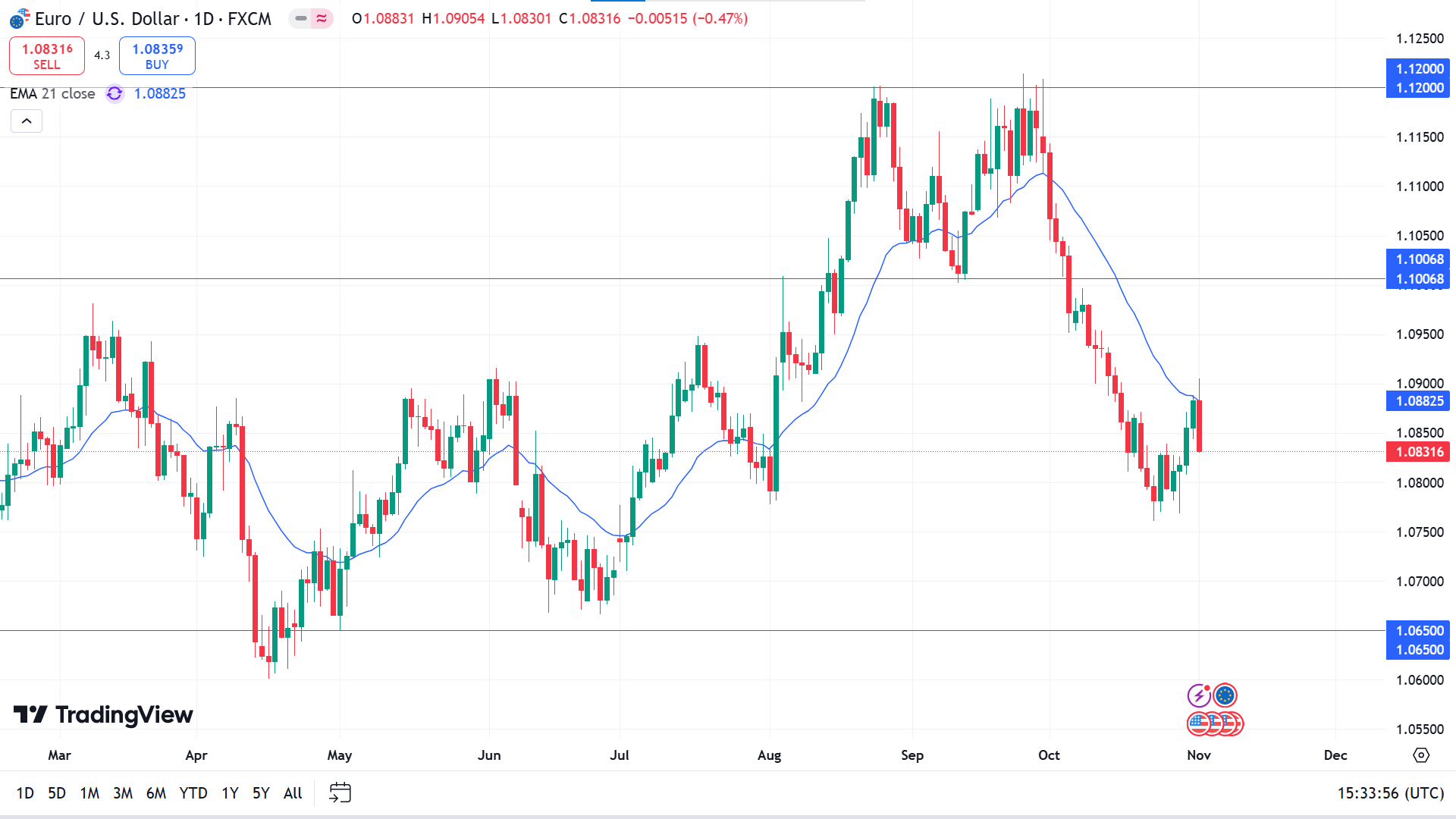

EURUSD posted a green candle after four consecutive losing weeks, reflecting a pause in the current bearish trend.

In the daily chart of EURUSD, an ongoing bearish trend is visible as the recent selling pressure came after sweeping the buy-side liquidity from the 1.1200 level. Moreover, the post-NFP sentiment showed the same sentiment after having a solid reversal from the dynamic 21 EMA line.

According to the current context, a downside continuation is highly possible, where the selling pressure below the 1.0777 level could lower the price towards the 1.0650 level.

On the other hand, the August 2024 low could work as a crucial support as a minor upward correction is visible from that zone. In that case, overcoming the 20 EMA line might find resistance from the 1.1000 area.