I. Recent Snowflake Stock Performance

Snowflake Eyed On AI Demand

Snowflake CEO Sridhar Ramaswamy announced that the company would strengthen its partnership with AI chip titan Nvidia. In a CNBC interview, Ramaswamy stated that Snowflake and Nvidia have formed a partnership on numerous projects to date and intend to undertake many more. The partnership between the two companies was extended in April to offer businesses a comprehensive AI platform. This collaboration will incorporate Nvidia's full-stack accelerated platform into Snowflake's Data Cloud, which features a secure AI and trusted data foundation.

Ramaswamy stated that demand for Snowflake's Cortex AI platform and Iceberg databases is already substantial. Additionally, he disclosed that the company would deliberate on artificial intelligence and novel product introductions during its forthcoming Data Cloud Summit conference the following month. Snowflake introduced Snowflake Arctic in April; it is a large language model intended for complex enterprise workloads and can generate responses to inquiries from vast amounts of text data.

Furthermore, Snowflake disclosed its intentions to procure technology assets and recruit 35 personnel from TruEra, an AI observability platform. TruEra software assists developers in monitoring and evaluating applications using large language models and other AI tools.

In general, Snowflake exhibited strong efficacy in its fundamental operations. Despite surpassing initial revenue projections, the revised guidance for the year suggests that anticipated profit margins remain stagnant. Nevertheless, the marginal upswing in anticipated product development from 22% to 24% annually indicates that Snowflake is regaining stability after a difficult quarter.

SNOW Quarterly Earnings Remained Steady

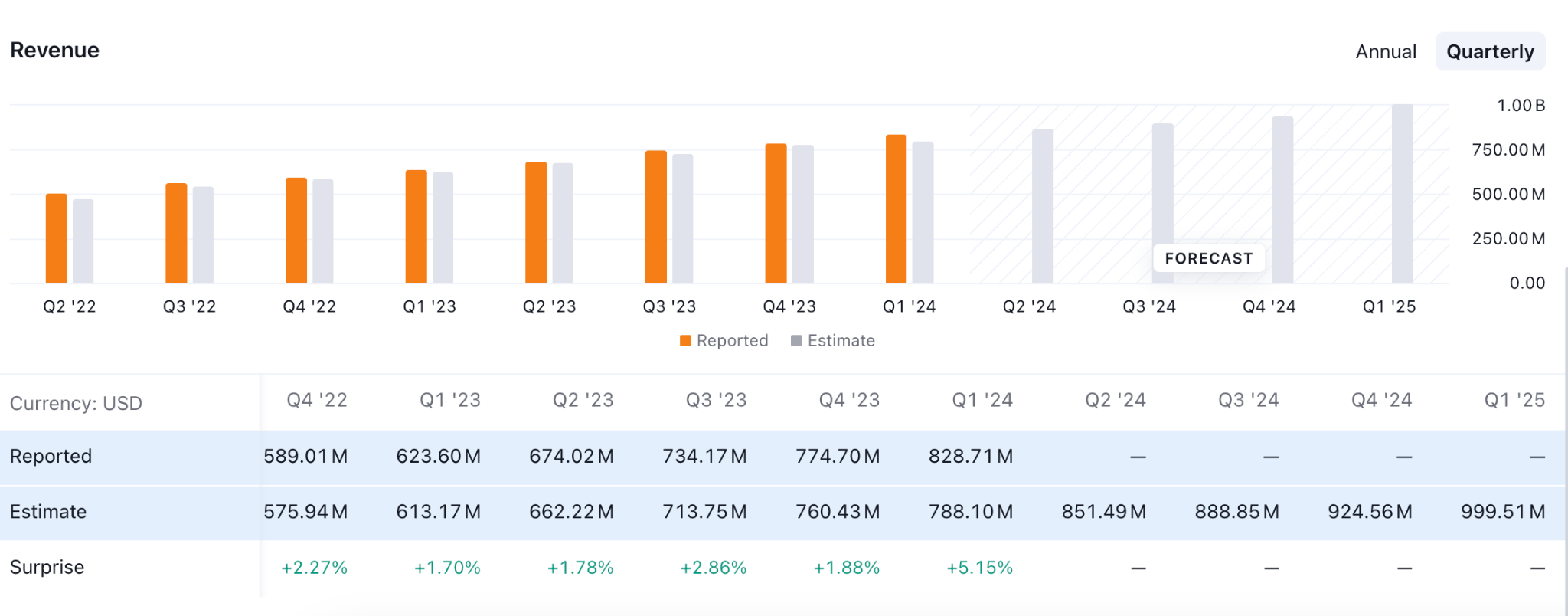

Snowflake reported 33% year-over-year revenue growth to $828.7 million and 34% product revenue growth to $789.6 million for the quarter ending April 30, exceeding Wall Street's expectations. The Snowflake revenue retention rate declined from 151% in the corresponding quarter of the previous year and 131% in January to 128%.

Adjusted earnings per share fell 6% annually to 14 cents, below the analysts' consensus estimate of 15 cents.

Wall Street received Snowflake's revised product revenue guidance for fiscal year 2025. Snowflake has revised its product revenue forecast from $3.25 billion to $3.3 billion for the fiscal year from February 1, 2024, to January 31, 2025. In contrast, the organization altered its operating income forecast for the entire year. Non-GAAP operating margins are now anticipated at 3%, a decrease from the projected 6% and the previous year's 8%.

Product revenue for the second quarter is anticipated to range from $805 million to $810 million, exceeding analysts' average forecast of $785 million.

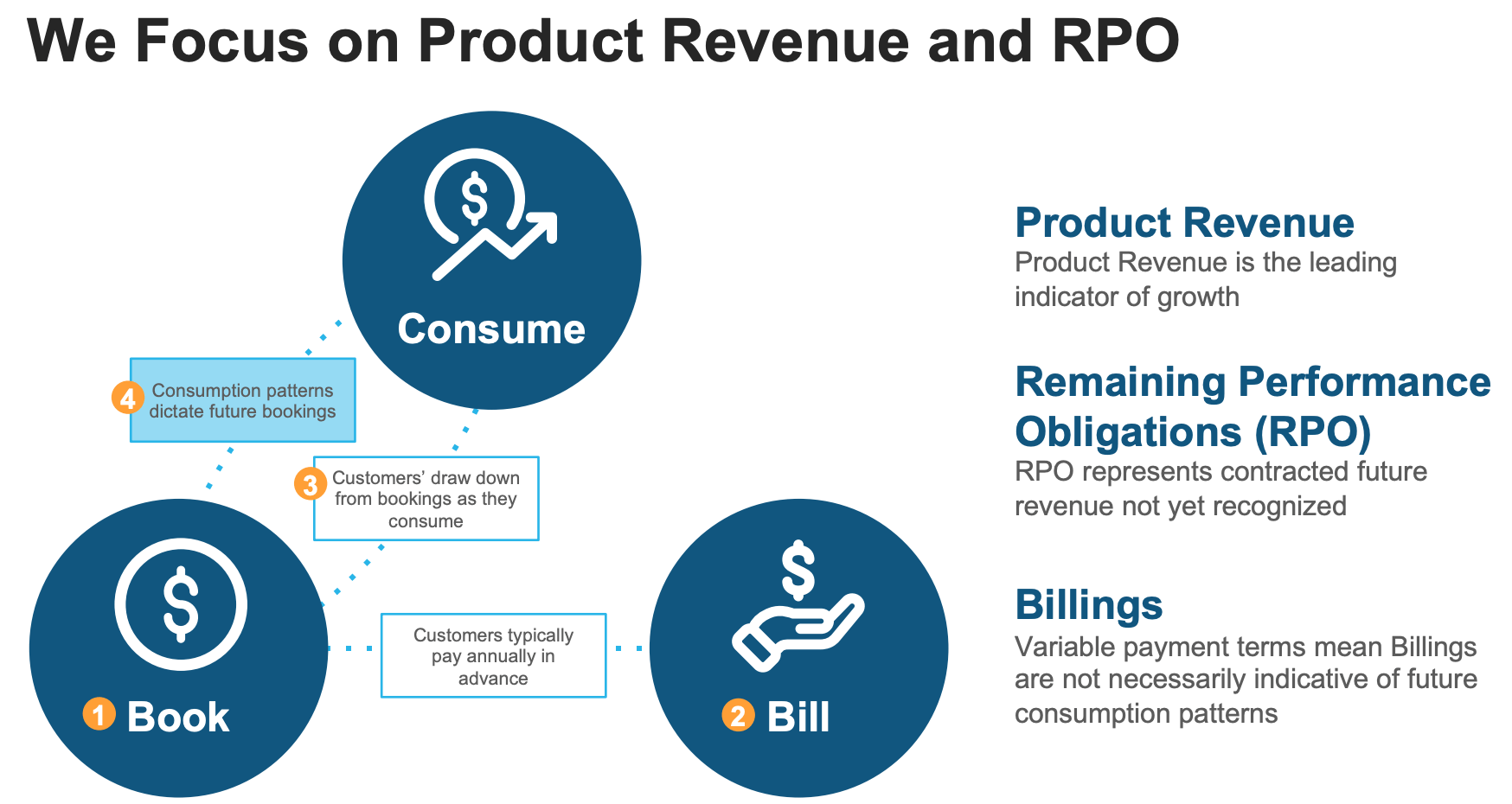

SnowFlake RPO

Snowflake and other subscription software companies include remaining performance obligations (RPO) in their financial statements. Snowflake disclosed an RPO of $5 billion for the latest quarter, indicating a marginal decline from $5.2 billion in the fiscal fourth quarter of 2024, yet a noteworthy year-on-year growth of 46%. This signifies a substantial surge in prospective business in comparison to the corresponding period of the previous year.

The primary insight is that customers, who were previously hesitant to make long-term commitments, are now swiftly increasing Snowflake's RPO, and management observes a resurgence in long-term customer commitment. The news is extraordinarily favorable for investors.

Expert Insights on SNOW Stock Forecast for 2024, 2025, 2030 and Beyond

The recent collaboration and implementation of Artificial Intelligence could be a strong buying factor for SNOW.

Before proceeding further, let's see what analysts think about SNOW Stock Forecast for 2024, 2025, 2030, and Beyond:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$174 |

$228 |

$380 |

|

Coincodex |

$196.19 |

$155.30 |

$151.22 |

|

Stockscan |

$164.13 |

$233.39 |

$22.72 |

II. SNOW Stock Forecast 2024

Snowflake stock (SNOW) remains under pressure as the current price hovers at a record low level. Considering the bullish break of structure, we may expect the SNOW share price to correct higher at the 180.00 level by the end of 2024.

The ongoing bearish pressure is potent in the weekly SNOW price as the current price hovers below the 100-week SMA line. Moreover, the near-term price action suggests a consolidation, from where a potential breakout could signal an impulsive wave.

Looking at technical indicators, the 20-week Exponential Moving Average is the near-term resistance. This average is in line with the 100 SMA line, providing an additional bearish signal.

On the other hand, there is recent buying pressure with a bullish break-of-structure above the 192.76 level. After a new high, the SNOW share price dropped and reached the near-term demand zone. In that case, investors should closely monitor how the price trades at the near-term order block from where a bullish trend trading signal might come after a valid price action.

Based on the SNOW Stock Forecast 2024, an upward pressure with a valid weekly close above the 168.38 high could be a potential bullish opportunity, targeting the 180.00 level.

On the other hand, the rising trendline support acts as a major barrier for sellers, and a sell-side liquidity sweep from the 138.00 to 120.00 zone could be another long signal.

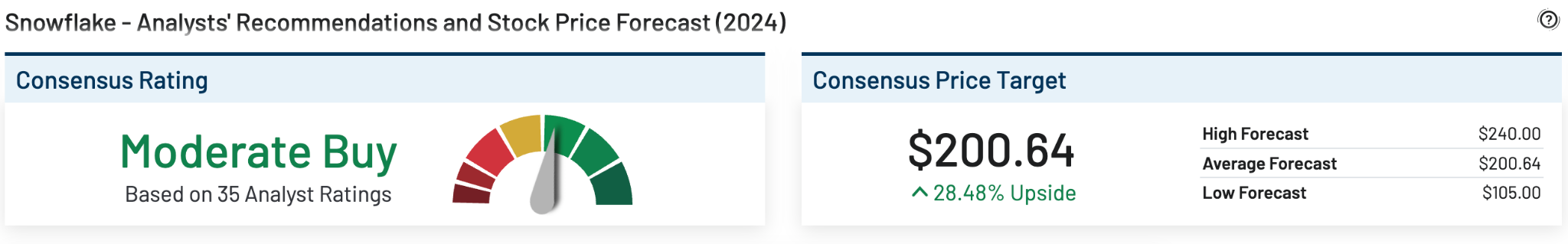

A. Other Snowflake Stock Forecast 2024 Insights: SNOW stock buy or sell?

Source: marketbeat

According to a report from marketbeat, there is a moderate buy signal in SNOW stock, as provided by 35 analysts. However, the highest target of the buying possibility is $240.00 level by the end of 2024, while the lowest forecasted Snowflake price target is $105.00.

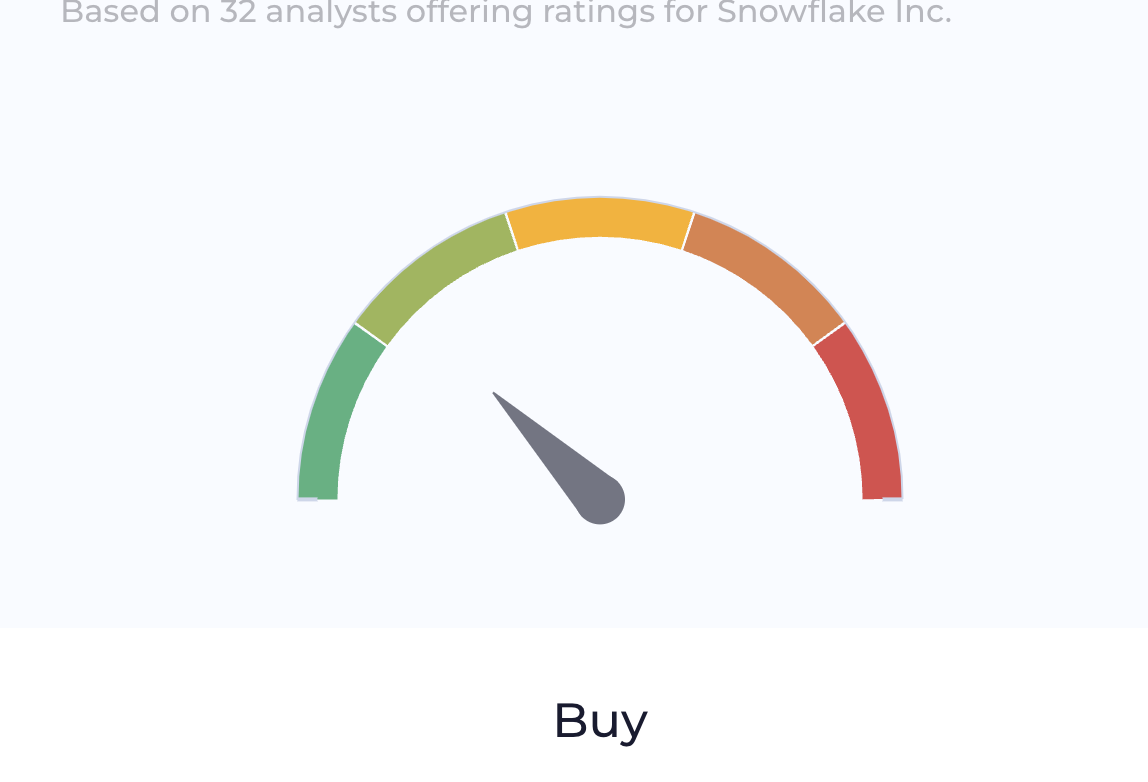

Souce: wallstreetzen

Another report from Wallstreetzen suggests another moderate buy signal, where the highest SNOW price target is $240.00 level. Among forecasts, 13 analysts showed a strong buy signal, while 10 analysts were medium buy with hold signals by 10 analysts.

Also, a specified analysts projection is also available in the Wallstreetzen as shown below:

B. Key Factors to Watch for SNOW Stock Prediction 2024

Snowflake EPS Forecast

In the EPS forecast, SNOW showed a moderate buy signal as the upcoming reports are expected to remain flat compared to Q1 2024.

As per the latest report, the forecasted EPS was $0.18, while the actual report came at $0.14. The forecasted EPS for Q2 and Q4 of 2024 are expected to come at $0.16, where any upbeat result could be a potential long signal for Snowflake stock.

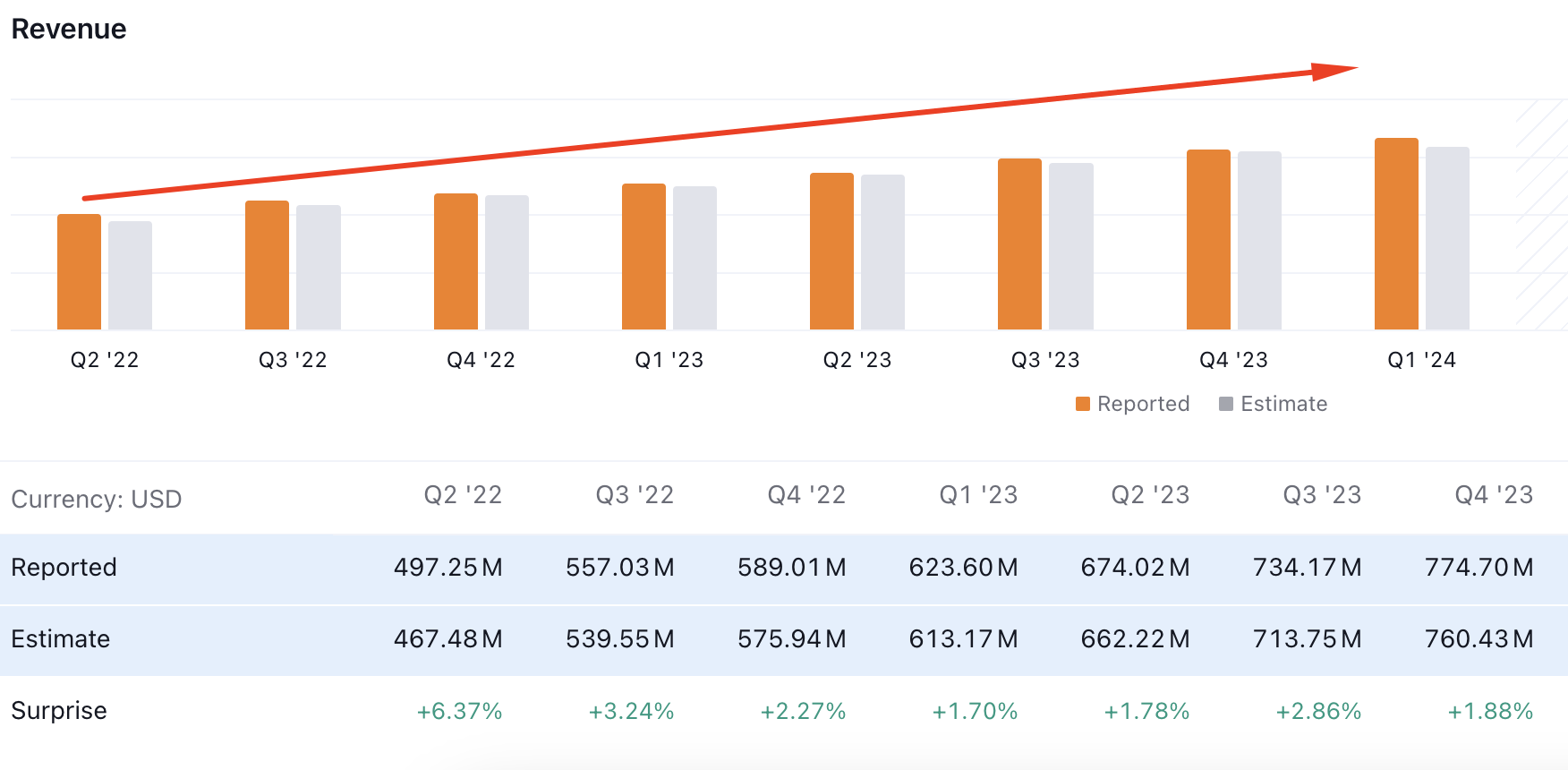

Snowflake Revenue Forecast

Despite the flat EPS forecast, SNOW is expected to maintain the growth in revenue. As per the latest report, the revenue maintained the growth, while the latest report showed a 5.15% growth, which is higher than the last 5 quarters.

If the company maintains the growth in the coming quarters, we may expect SNOW stock price to grow higher.

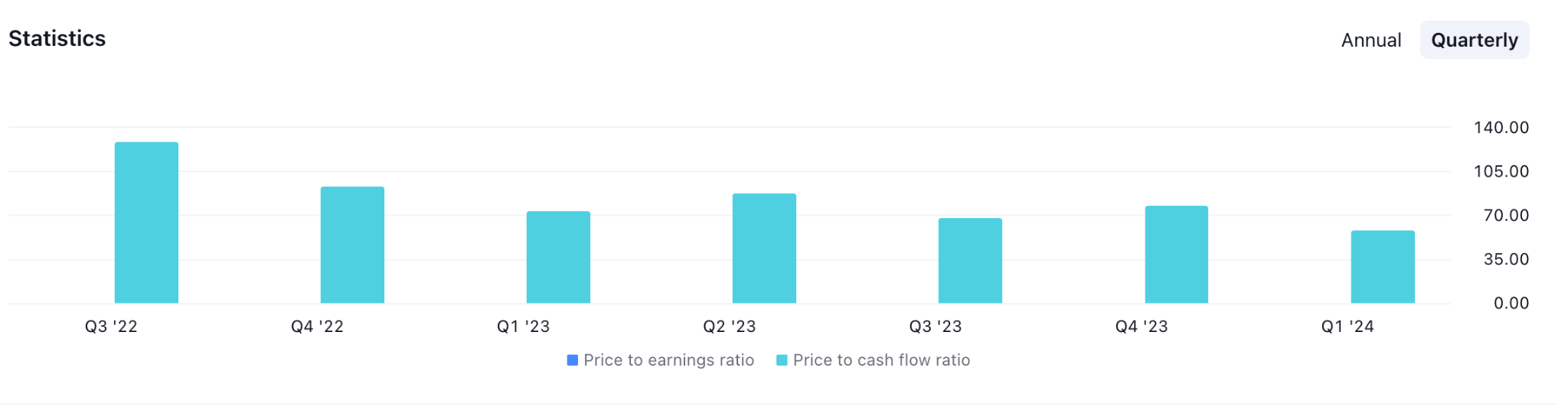

Snowflake Price To Cash Flow Ratio

The P/CF ratio suggests potential investment valuation, which could be a crucial indicator for determining a stock price. As per the current reading, SNOW maintained a stable P/CF ratio, and a surge above the 70.00 level could be a long signal.

SNOW Stock Price Prediction 2024 - Bullish Factors

The first bullish factor for Snowflake stock is the recent revenue report, where upbeat results indicate a potential business activity. However, when considering a buy, the ideal revenue growth is 20% or above, which has not been met yet. In that case, the upcoming earnings report should be monitored to find a suitable buying position.

Other bullish factors are as mentioned:

- Snowflake's growing list of high-profile customers, including Fortune 500 companies, highlights its robust market position and potential for continued revenue increases.

- Strategic acquisitions and partnerships with cloud providers like AWS, Microsoft Azure, and Google Cloud can further enhance Snowflake's offerings and market reach.

- With substantial cash reserves, Snowflake's strong balance sheet allows for continued investment in R&D, marketing, and strategic acquisitions. This financial strength supports long-term growth initiatives.

Snowflake Stock Prediction 2024 - Bearish Factors

- Snowflake is currently being valued excessively in comparison to its revenue and earnings. If the market deems it overvalued, negative pressure may be exerted on Snowflake stock, particularly if growth rates decelerate or the prevailing market sentiment shifts toward risk aversion.

- Prominent cloud service providers, including Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, each providing data warehousing solutions, present formidable competition for Snowflake. These Snowflake competitors' considerable resources and customer bases may impede the expansion of Snowflake market share.

- The potential emergence of novel technologically advanced competitors may cause Snowflake to face market disruption and gradually lose its competitive edge.