I. Recent Pfizer Stock Performance

Recent PFE stock price performance and changes

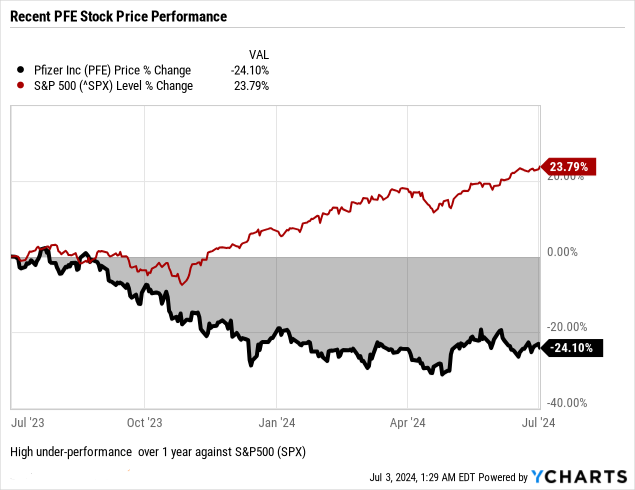

Over the past year, Pfizer experienced a significant decline of -24.1%, far below the S&P 500's 23.8% gain.

Source:Ycharts.com

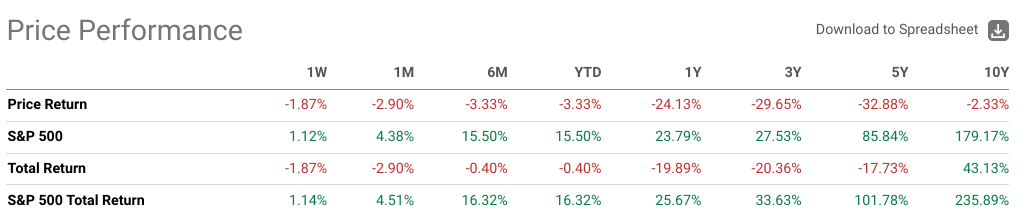

Looking at different holding periods, Pfizer's performance remains weak:

- Over the last six months, Pfizer stock declined by -3.3%, contrasting with the S&P 500's robust 15.5% increase.

- Year-to-date, PFE stock performance mirrors its six-month trend, down by -3.3%, while the S&P 500 rose by 15.5%.

- Over the last month, Pfizer stock has declined by -2.9%, underperforming the S&P 500's gain of 4.4%.

- Looking further back, Pfizer's performance over three years (-29.7%), five years (-32.9%), and ten years (-2.3%) indicates challenges in long-term growth compared to the S&P 500's more substantial gains.

Source:seekingalpha.com

Main influencing factors

Pfizer's recent stock performance in early 2024 reflects a complex interplay of factors influencing its financial health and investor sentiment. Key drivers include both positive and negative influences:

- Revenue Dynamics: Pfizer reported first-quarter revenues of $14.9 billion, a 19% decline year-over-year driven by decreased sales of Comirnaty and Paxlovid, partly offset by 11% operational growth in other products. The decline in COVID-19 vaccine revenues was expected due to reduced global demand and lower U.S. volumes as markets transitioned to commercial sales.

- Earnings Growth: Adjusted diluted EPS for Q1 2024 was $0.82, benefiting from cost management initiatives and a favorable $0.11 impact from Paxlovid revenue adjustments. Despite revenue declines, Pfizer's focus on cost realignment and operational efficiencies bolstered profitability.

- Strategic Initiatives: Pfizer remains committed to its 2024 priorities, including achieving $4 billion in net cost savings and enhancing shareholder value through strategic capital allocation. This includes significant investments in R&D ($2.5 billion) and $2.4 billion in dividends, although no share repurchases were completed in the period.

- Product Portfolio Performance: Non-COVID products like Vyndaqel, Eliquis, and the Prevnar family showed robust operational growth, reflecting Pfizer's diversified portfolio strategy. Oncology products like Ibrance and newer acquisitions from Seagen contributed to revenue diversification.

- Market Outlook and Guidance: Pfizer reaffirmed its 2024 revenue guidance of $58.5 to $61.5 billion, despite challenges in the COVID product segment. The company revised its adjusted EPS guidance upward to $2.15 to $2.35, demonstrating confidence in operational efficiencies and strategic initiatives.

Expert Insights on Pfizer Stock Forecast for 2024, 2025, 2030 and Beyond

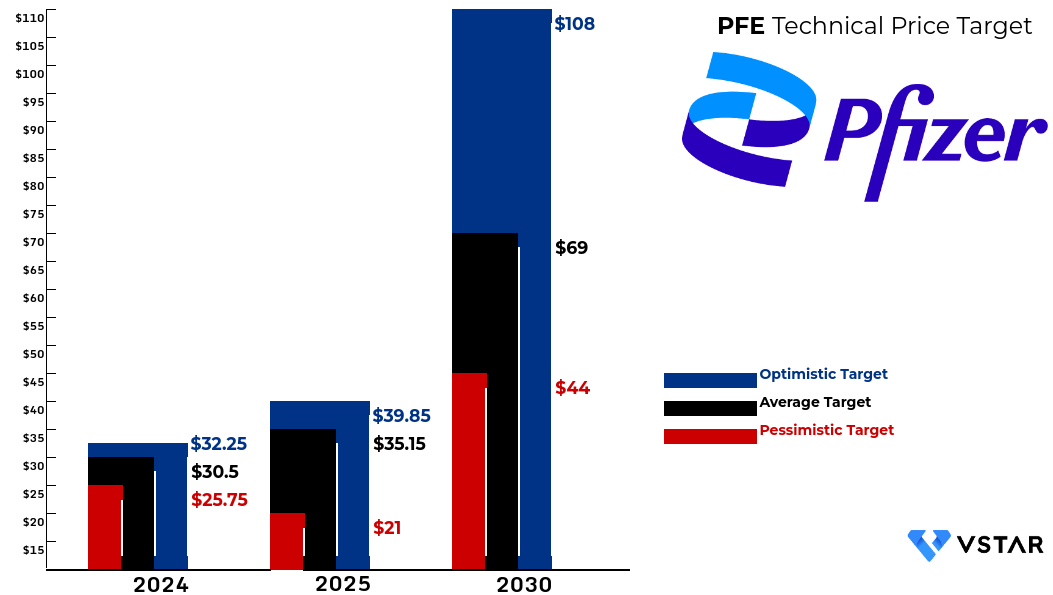

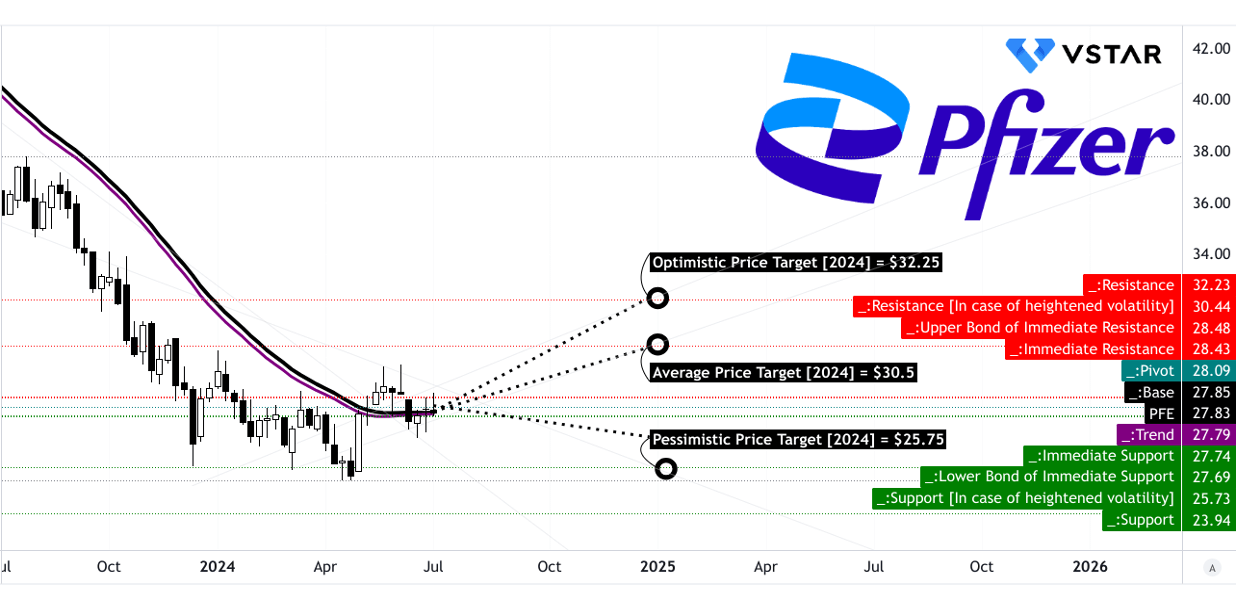

Recent Pfizer stock performance reveals fluctuating trends influenced by market conditions. Expert forecasts for Pfizer (NYSE: PFE) show a range of potential outcomes: by 2024, targets span $25.75 to $32.25, by 2025, $21.00 to $39.85, and by 2030, $44.00 to $108.00. These predictions reflect varying degrees of optimism and pessimism, underscoring the stock's potential volatility and long-term growth possibilities.

Source: Analyst's complication

II. Pfizer Stock Price Forecast 2024

Based on technical analysis and insights, the predicted stock prices for Pfizer (NYSE: PFE) by the end of 2024 are as follows: the average PFE price target is $30.50, the optimistic price target is $32.25, and the pessimistic Pfizer price target is $25.75. These predictions are derived from the momentum of change-in-polarity over the short term, projected over Fibonacci extension and retracement levels.

The current price of Pfizer is $27.83, which is close to the modified exponential moving average trendline of $27.79 and the baseline of $27.85. This indicates a stable sideways movement without significant deviation from the average, suggesting that the stock is currently experiencing limited volatility. The stock's sideways trend suggests limited immediate volatility, with resistance levels identified at $28.48 and pivot at $28.09. In case of heightened volatility, the resistance level is projected at $30.44. The primary support level is at $27.74, with core support at $23.94. In a highly volatile scenario, the support level could drop to $25.73. These levels provide a safety net for the pessimistic PFE stock price target of $25.75.

Source: tradingview.com

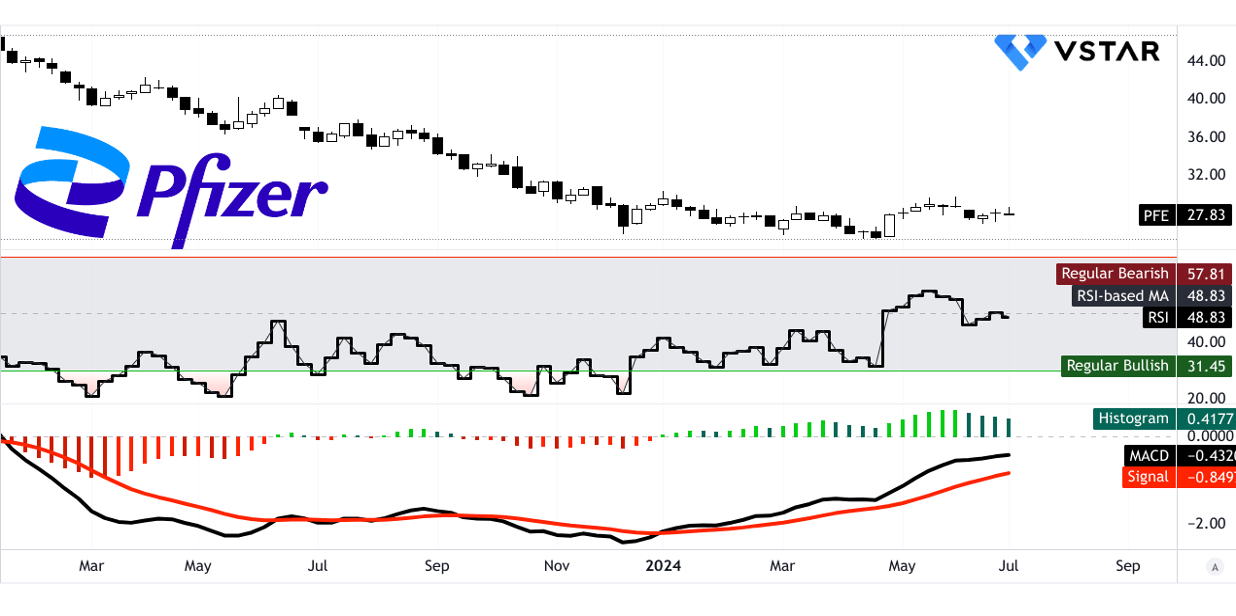

The Relative Strength Index (RSI) value of 48.83 indicates a neutral stance with no clear bullish or bearish divergence. The RSI line trend is sideways, aligning with the overall stock trend. Additionally, the Moving Average Convergence/Divergence (MACD) analysis shows the MACD line at -0.432 and the signal line at -0.849, with a histogram value of 0.4177, indicating a decreasing bullish trend. The weakening bullish momentum aligns with a conservative price movement projection, supporting the average PFE price target of $30.50.

Source: tradingview.com

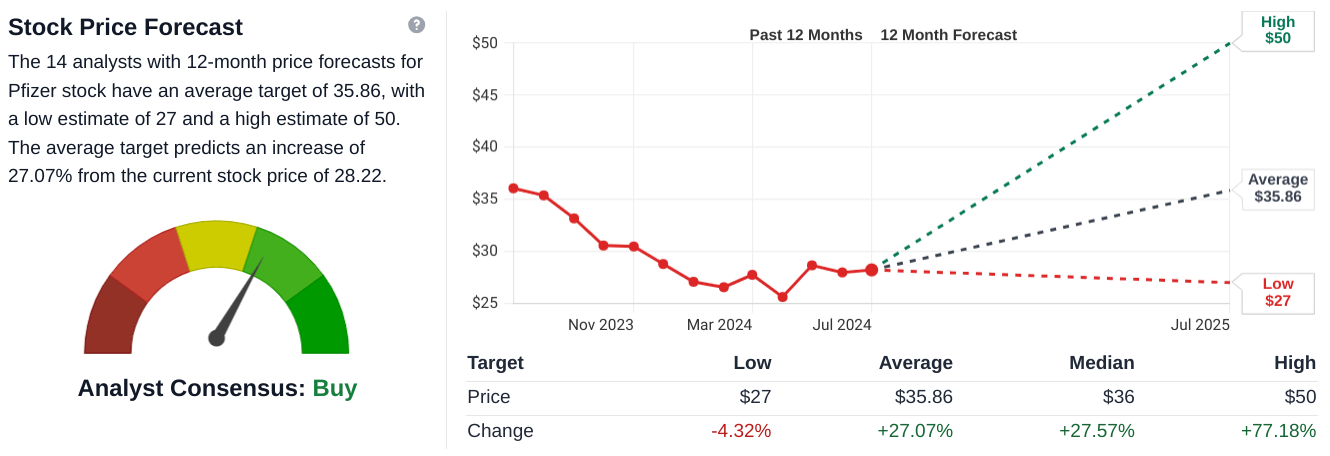

The forecasted stock price for Pfizer in 2024 varies among different sources, reflecting a range of analyst perspectives and methodologies. According to stockanalysis.com, the consensus among 14 analysts suggests an average target price of $35.86, indicating a potential 27.07% increase from the current price of $28.22. This optimistic outlook is supported by a high estimate of $50 and a low estimate of $27, showcasing a wide spectrum of expectations.

Similarly, tipranks.com reports a slightly lower average PFE target price of $33.50, derived from 15 Wall Street analysts. Here, the forecasts range from a low of $27 to a high of $53, emphasizing considerable divergence in expert opinions. This diversity in forecasts could stem from varying methodologies, including fundamental analysis, market sentiment, and technical indicators.

On the other hand, coinpriceforecast.com provides a more conservative outlook, projecting a modest increase to $29.18 by the year-end, reflecting a 3% rise from the current price.

Source:stockanalysis.com

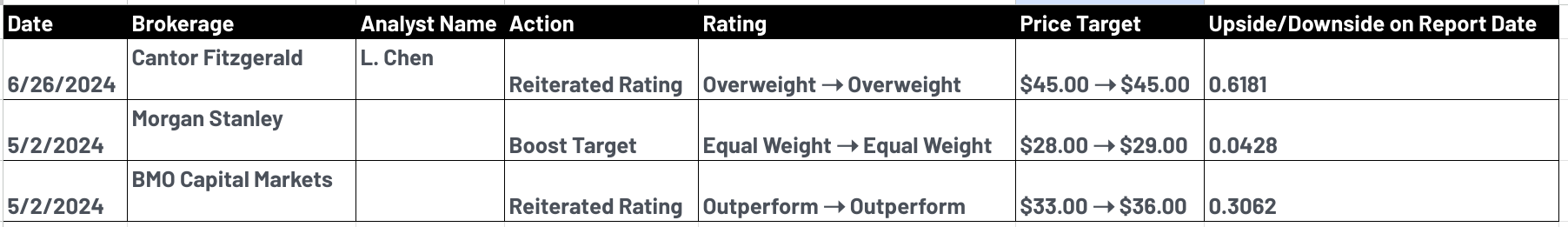

A. Other Pfizer Stock Forecast 2024 Insights

For 2024, analysts from various financial institutions offered differing perspectives on Pfizer's (NYSE: PFE) stock outlook. Cantor Fitzgerald's L. Chen reiterated an "Overweight" rating with a price target of $45.00, suggesting a slight upside potential. This indicates their confidence in Pfizer's future performance relative to the market.

Moreover, Morgan Stanley adjusted their price target from $28.00 to $29.00 while maintaining an "Equal Weight" rating. This modest increase reflects a neutral stance on Pfizer's expected performance compared to its peers. Meanwhile, BMO Capital Markets reiterated an "Outperform" rating and raised their price target from $33.00 to $36.00. This indicates a more optimistic outlook, suggesting they believe Pfizer will outperform market expectations.

Source:marketbeat.com

B. Key Factors to Watch for PFE Stock Forecast 2024

PFE Forecast 2024 - Bullish Factors

Pfizer (NYSE: PFE) demonstrates several positive indicators that could support a bullish outlook for 2024. Firstly, the company has raised its adjusted diluted EPS guidance to $2.15 to $2.35, reflecting confidence in its cost realignment program and strong underlying business performance. This upward revision suggests improved profitability expectations, which could bolster investor confidence.

Source:seekingalpha.com

Strategically, Pfizer's focus on oncology leadership is yielding results, with a 19% operational growth in oncology revenues driven by acquisitions and strong commercial execution. The expansion into biologics and breakthrough therapies, such as Tivdak for cervical cancer and gene therapies like Beqvez for hemophilia B, underscores Pfizer's innovation pipeline strength and potential for revenue diversification.

Financially, Pfizer's gross margin improved significantly by 530 basis points to 79.6% in Q1 2024, driven by favorable sales mix and effective cost management strategies. This margin enhancement, alongside disciplined expense control despite integrating Seagen's operations, indicates operational efficiency and potential for margin expansion.

Pfizer Stock Price Forecast 2024 - Bearish Factors

Despite these strengths, Pfizer faces notable challenges that could temper its stock performance in 2024. The company's revenue projections, while robust, heavily depend on the seasonal demand and regulatory landscapes for COVID-19 vaccines like Comirnaty. Approximately 90% of Comirnaty sales are expected in the second half of the year, introducing significant revenue concentration risk.

Furthermore, Pfizer's operational revenues outside of COVID products declined by 19% in Q1 2024 compared to the previous year, highlighting ongoing challenges in non-COVID segments. Lower demand for established drugs like Ibrance in certain markets adds to these concerns, reflecting competitive pressures and market dynamics.