- UnitedHealth Group reported Q2 2024 revenues growth despite cyberattack impacts, with solid operating earnings.

- UNH showed robust stock performance, with a 10.8% return in Q2, outpacing the S&P 500, driven by strong financial health and strategic initiatives.

- Technical indicators show bullish momentum with an average price target of $615, while fundamental metrics like P/E ratio and EV/Sales suggest relative undervaluation and strong sales performance.

- Faces competition from major players like Anthem and regulatory risks, including potential policy changes impacting healthcare sector dynamics.

I. UnitedHealth Group Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

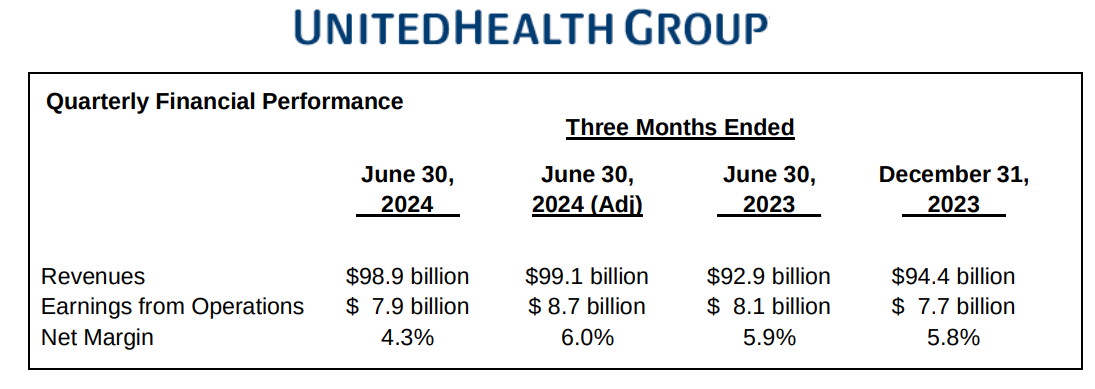

- Revenue Growth: UnitedHealth Group reported revenues of $98.9 billion in Q2 2024, an increase of nearly $6 billion year-over-year. Optum and UnitedHealthcare were the primary contributors to this growth.

Source: UNH-Q2-2024-Release

- Net Income and Earnings Per Share (EPS): Net income was robust. Adjusted EPS stood at $6.80 per share, accounting for $0.28 in business disruption impacts but excluding South American and direct response costs.

- Profit Margins: Operating earnings from operations were $7.9 billion, including $1.1 billion in unfavorable impacts from a cyberattack. Adjusted earnings from operations were $8.7 billion.

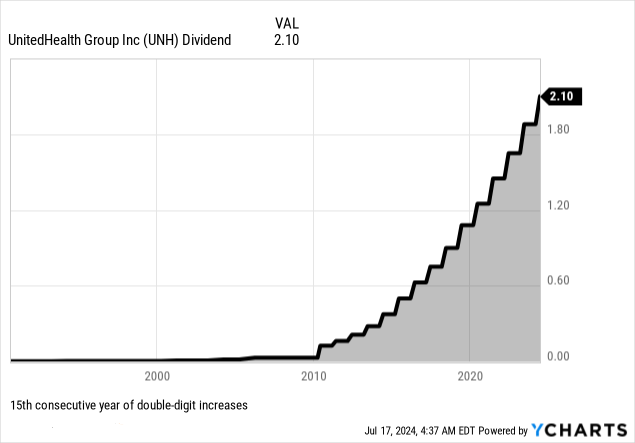

- Balance Sheet and Cash Flow: Cash flows from operations were $6.7 billion, or 1.5 times net income. The company increased its annual dividend rate by 12%, marking the 15th consecutive year of double-digit increases.

Source:Ycharts.com

Operational Performance

- Product Sales Breakdown: UnitedHealthcare's commercial domestic offerings grew by 2.3 million consumers year-to-date, reaching a total of 29.6 million. The number of seniors and people with complex needs served grew to 9.4 million, while state-based community offerings served 7.4 million people.

- Operating Cost: The operating cost ratio was 13.3%, down from 14.9% in 2023, indicating improved cost efficiency.

- Expenses: The medical care ratio was 85.1%, impacted by accommodations for care providers and South American actions.

Technological Advancements and Innovations

- New Product Launches: UnitedHealth Group continued to bring practical innovation to market through new products and services. Surest, for example, differentiated itself and saw substantial growth.

- Research and Development Investments: The company invested in modernization of legacy technology and new emerging technologies, including AI, which is expected to generate significant efficiencies over the next several years.

- Technological Achievements: The company's AI portfolio, consisting of hundreds of practical use cases, aims to improve consumer experience, enhance provider find and price care capabilities, and improve clinical back-office execution.

B. UNH Stock Price Performance

UnitedHealth (NYSE: UNH) has demonstrated robust stock performance with a 10.8% price return (open-to-close) over Q2. Opening at $459.60 and closing at $509.26, it saw highs of $528.16 and lows of $436.38. This performance outpaced the broader market as indicated by the S&P 500's (SPX) 4.9% price return during the same period. UnitedHealth's substantial market capitalization of $469 billion underscores its stability and influence in the healthcare sector, contributing to investor confidence. The company's strong financial health, strategic initiatives in healthcare services, and likely benefits from sector-specific tailwinds such as healthcare reform and aging demographics have likely bolstered its stock performance. Investors may view UnitedHealth as a defensive play with growth potential, given its resilience and ability to navigate regulatory changes and market dynamics effectively.

Source:tradingview.com

II. UNH Stock Forecast: Outlook & Growth Opportunities

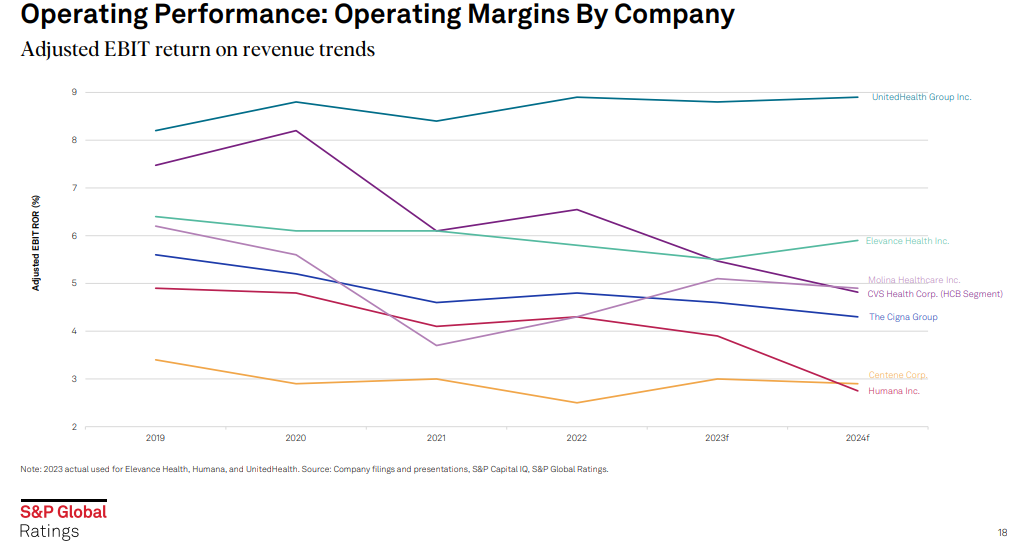

S&PGlobal forecasted UnitedHealth Group (UNH) revenue growth of approximately 8% for 2024, stable margins (Operating Margins around 9%) and efficient management of Medical Loss Ratios (around 84%) underline its resilience in the healthcare insurance sector.

Source: spglobal.com

A. Segments with growth potential

UnitedHealth Group operates through two primary segments: UnitedHealthcare (UHC) and Optum. Within UnitedHealthcare, growth opportunities are evident in its domestic commercial membership, which expanded by 2.3 million in the first half of the year. This growth reflects robust demand for its managed care, pharmacy services, and Medicare Advantage plans, all of which cater to a wide array of customers including large employers, unions, states, and seniors. The Medicare Advantage segment is particularly promising, offering cost-effective solutions and additional benefits like dental, vision, and hearing services, not covered under traditional Medicare fee-for-service plans. This appeals to seniors seeking comprehensive healthcare options and is expected to drive continued growth.

Optum, the healthcare services arm, shows significant potential with revenues growing by 13% to $27 billion, driven by its expanding footprint in value-based care models. Optum aims to reach 5 million patients under value-based care by year-end, emphasizing improved health outcomes and patient engagement. Additionally, OptumRx, which saw revenues grow by 13% to over $32 billion, continues to attract customers with its cost-effective pharmacy services and clinical expertise, ensuring strong momentum going forward.