- Tesla reported solid revenue, with key growth drivers being the energy generation and storage business, Cybertruck deliveries, and regulatory credit revenue.

- The company achieved positive net income, despite a decline in operating income due to reduced ASPs, restructuring charges, and increased AI project expenses.

- Tesla made significant investments in AI and FSD technologies, aiming to enhance customer experience and drive demand.

- TSLA stock price increased during Q2 2024, significantly outperforming broader market indices with a positive technical outlook.

I. Tesla Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

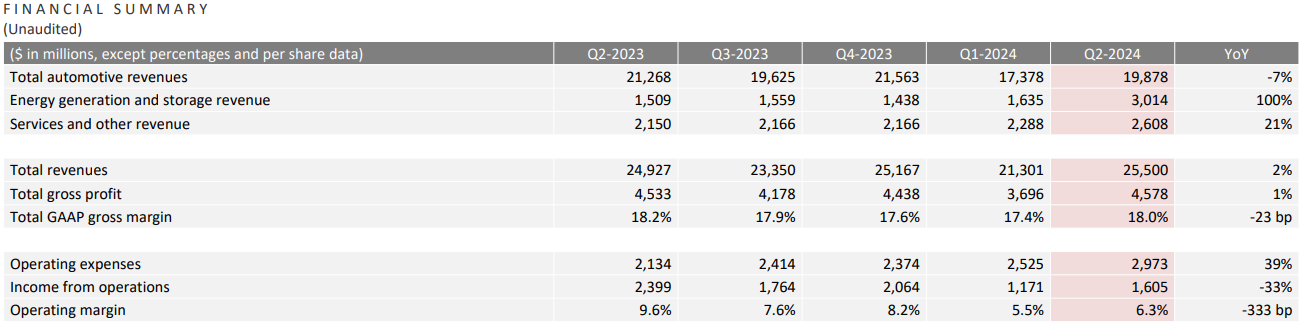

Tesla reported a total revenue of $25.5 billion for Q2 2024, a 2% year-over-year increase. This growth was driven by the energy generation and storage business, Cybertruck deliveries, and higher regulatory credit revenue. The company achieved a GAAP net income of $1.5 billion and a non-GAAP net income of $1.8 billion. Operating income decreased to $1.6 billion, resulting in a 6.3% operating margin (down 3.33% YoY). This decline was attributed to reduced average selling prices (ASP) for S3XY vehicles, restructuring charges, and increased operating expenses due to AI projects.

Source: 2024 Q2 Quarterly Update Deck

At the bottom-line, Q2 net income stands at $1.8 billion (-42% YoY) with an EPS of 52 cents (-43% YoY). This is due to heavy CapEx spending. On the positive side, the bottom-line has improved sequentially. Moreover, operating expenses increased, driven largely by AI project investments. However, Tesla managed to reduce costs per vehicle, including raw material costs and freight duties. Further, Tesla's cash, cash equivalents, and investments grew by $3.9 billion sequentially, reaching $30.7 billion at the end of Q2 2024. Operating cash flow was $3.6 billion, with a free cash flow of $1.3 billion, despite $0.6 billion in AI infrastructure capital expenditures.

Operational Performance

Tesla saw a sequential rebound in vehicle deliveries in Q2, with notable contributions from new Model 3 and Model Y trims. The Cybertruck became the best-selling EV pickup in the U.S. during this quarter. Global EV penetration increased, taking market share (near 4% as of Q2) from internal combustion engine (ICE) vehicles. Tesla's strategic focus on cost reduction and core functionality positions it well for long-term growth in competitive markets like China and Europe. Tesla's AI and FSD (Full Self-Driving) initiatives included offering free trials to boost adoption rates. The expansion of the Supercharging network and opening it to non-Tesla EVs demonstrates Tesla's commitment to increasing EV penetration.

Source: 2024 Q2 Quarterly Update Deck

Technological Advancements and Innovations

Tesla introduced new trims and paint options for the S3XY lineup. The Cybertruck's production ramped significantly, aiming for profitability by the end of the year. Significant investments were made in AI infrastructure, with $0.6 billion allocated in Q2. The development of the Optimus robot and advancements in FSD technology were notable. Tesla produced over 50% more 4680 cells than in Q1, achieving major cost reduction milestones. The first prototype Cybertruck with in-house dry cathode 4680 cells entered vehicle testing validation, marking a significant achievement in cost efficiency.

B. TSLA Stock Price Performance

During Q2 2024, Tesla's (NASDAQ:TSLA) stock price demonstrated strong performance, closing at $197.88, up from an opening price of $176.17, marking a 12.3% increase. The stock reached a high of $203.20 and a low of $138.80 within the quarter. This performance significantly outpaced broader market indices, with the S&P 500 (SPX) returning 3.9% and the NASDAQ-100 (NDX) returning 7.7% in the same period. Tesla's robust financial results, record energy storage deployments, and strategic advancements in AI and vehicle technology contributed to investor confidence, leading to the notable rise in stock price and a market cap of $631 billion.

Source: tradingview.com

II. Tesla Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

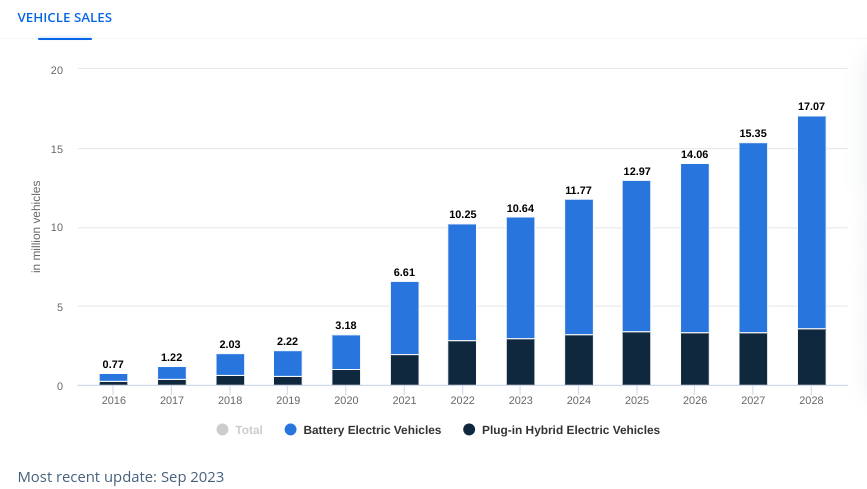

Electric Vehicles (EVs): Tesla remains a leader in the EV market, with significant growth potential as global adoption of electric vehicles increases. The company's focus on affordability, seen with plans to deliver a more affordable model in the first half of next year, positions it well to capture a larger market share. Despite short-term challenges from competitors discounting their EVs, Tesla's long-term prospects are strong due to its efficiency and scale economies. As per statista.com, in 2024, the revenue in the EV market may hit $623 billion. The pace may continue to have an annual growth rate of 9.82% (2024-2028).

[EV Market-wide Vehicle Sales]

Source: statista.com

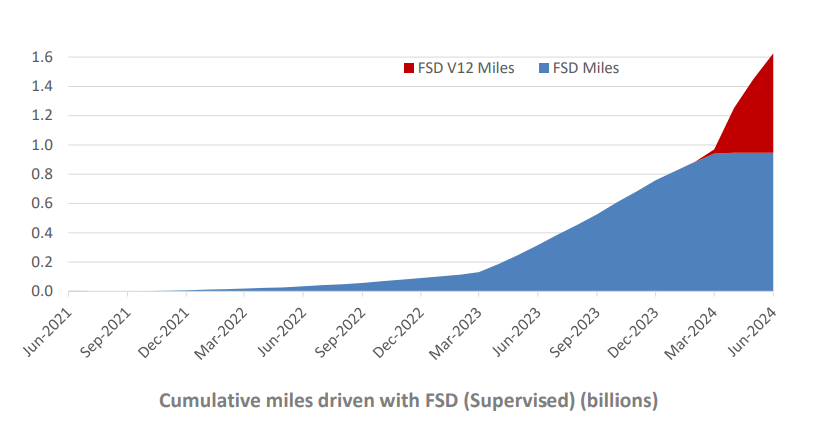

Autonomous Driving: Tesla's advancements in Full Self-Driving (FSD) technology present substantial growth opportunities. With the rollout of version 12.5, which merges highway and city stacks, Tesla aims to enhance customer experience and drive demand. The transition to unsupervised full self-driving will unlock massive potential, making Tesla's fleet a giant autonomous network.

Energy Storage and Generation: Tesla's energy business is rapidly growing, with energy storage deployments reaching record levels in Q2 2024. The expansion of Megapack production, especially with the new factory in China, aims to meet rising demand. Tesla's energy products, including Powerwall, have a strong backlog and the potential to significantly contribute to revenue and profits.

AI and Robotics: Tesla's investments in AI training and inference are critical for future growth. The development of Optimus, an autonomous humanoid robot, is progressing with plans for limited production starting next year. This innovation could revolutionize labor in Tesla's factories and eventually be offered to external customers by 2026, creating a new revenue stream.

Source: 2024 Q2 Quarterly Update Deck

Battery Technology: Tesla's focus on battery advancements, particularly with the 4680 cells, aims to reduce costs and enhance performance. This technology is crucial for Tesla's new vehicle models, including the Cybertruck, and supports the company's goal of making EVs more affordable and efficient.

B. Expansions and strategic initiatives

Mergers and Acquisitions: While Tesla has not announced specific M&A plans, it continues to explore opportunities to enhance its technology and manufacturing capabilities. Strategic acquisitions could further strengthen its position in the EV and energy markets.

Research and Development Investments: Tesla's significant R&D investments are evident in its advancements in FSD, battery technology, and AI. The development of a large AI training cluster in Giga Texas highlights the company's commitment to leading in autonomous technology and AI applications.

Source: 2024 Q2 Quarterly Update Deck

Partnerships and Collaborations: Tesla's collaboration with other OEMs, particularly in opening its Supercharging network to non-Tesla EVs, aims to increase EV adoption and utilization of its infrastructure. Partnerships in battery production and energy projects also enhance Tesla's capabilities and market reach.

Global Expansion: Tesla continues to expand its production capacity globally. The completion of the South expansion of Giga Texas and increased production at Gigafactory Shanghai and Berlin-Brandenburg enable Tesla to meet growing demand across different regions. This global footprint is crucial for Tesla's strategy to localize production and reduce costs.

Product Innovations: Tesla's roadmap includes introducing new models, such as a more affordable EV and the Cybertruck, which are expected to drive volume growth. The focus on high-range EVs and expanding the supercharging network addresses key customer concerns and supports market penetration.