I. Recent PayPal Stock Performance

PayPal's Movement To Crypto

PayPal's strategic involvement in cryptocurrency has solidified its position as a significant player in the digital currency space. By enabling merchants to accept crypto payments and allowing customers to buy, hold, and sell cryptocurrencies directly from their PayPal accounts, the company simplifies access to digital currencies. The integration extends to Venmo, where users can manage their crypto assets within the app, appealing to a younger, tech-savvy audience.

The innovative Checkout with Crypto feature converts cryptocurrency holdings into fiat currency at the point of sale, ensuring smooth and effortless transactions. Furthermore, PayPal's recent launch of its stablecoin, PayPal USD (PYUSD), on the Solana blockchain exemplifies its commitment to enhancing transaction efficiency. By leveraging Solana's high speed and low fees, PayPal makes digital currencies more accessible and practical for everyday use, driving broader adoption and integration into mainstream finance.

PayPal's Collaboration with Large-Cap Companies

PayPal's strategic initiatives and robust portfolio signal a promising long-term opportunity. For large enterprises, PayPal is enhancing its core branded checkout experiences. Early testing of Fast Lane by PayPal has shown a low-double-digit increase in guest checkout conversions for participating merchants, indicating strong demand. The company plans to make Fast Lane widely available in the United States in the latter half of the year, reflecting its commitment to optimizing the checkout process.

PayPal's collaboration with Apple and Alphabet to integrate the Venmo debit card with Google Pay and Apple Pay is a significant advantage. This feature, anticipated to launch in the coming months, will enhance customer momentum. The growing popularity of PayPal's Tap to Pay on Android and iPhone also highlights the company's commitment to providing seamless and convenient payment solutions for its users. Through these initiatives, PayPal is well-positioned to capitalize on the evolving digital payment landscape and drive sustained growth.

PayPal is also moving towards password-less authentication processes, such as biometrics, and plans to launch a redesigned mobile checkout experience to boost conversion rates. For small and medium-sized businesses (SMBs), the PayPal Complete Payments platform is gaining significant traction. The platform's geographic reach extends to over 34 countries, with new features introduced in Australia, Germany, and the United States. These efforts will strengthen PayPal's relationships with SMBs and reduce customer churn.

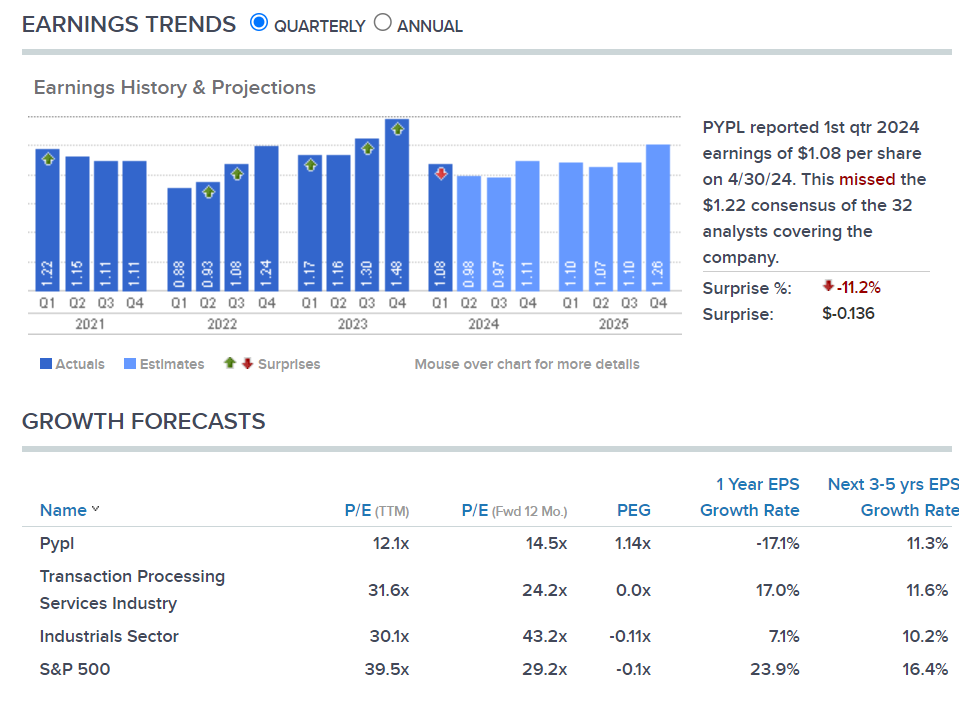

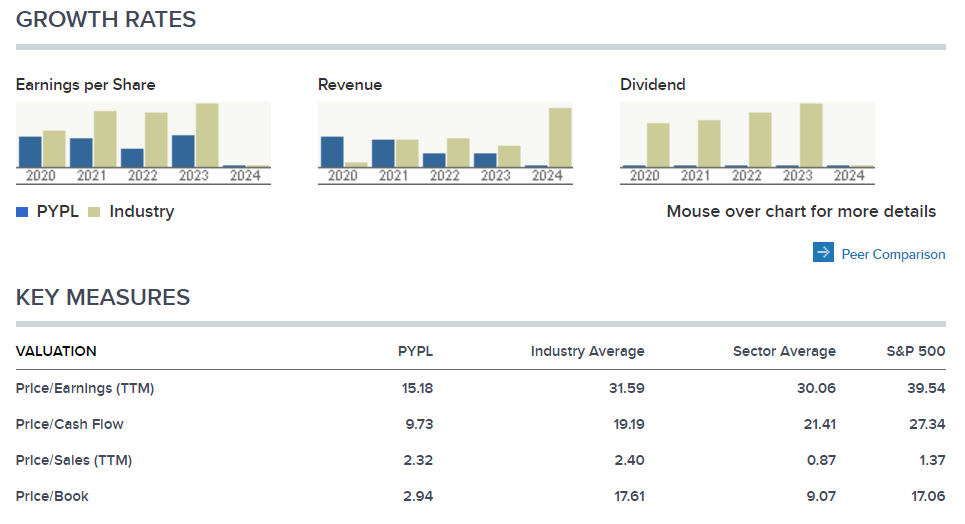

Key Financial Metrics Beat

In Q1, PayPal's total payment volume from merchant customers soared 14% to $403.9 billion, surpassing analysts' expectations of $393.64 billion. Active accounts increased by 1 million to 427 million, marking the first sequential growth since late 2022. "PayPal's Q1 featured a bigger beat than anticipated on key metrics," remarked Bank of America analyst Jason Kupferberg, highlighting a 4% growth in transaction profit revenue against expectations of zero growth.

Furthermore, PayPal repurchased $1.5 billion of its shares in Q1, with plans for at least $5 billion in buybacks throughout 2024. The year's guidance includes Q1 restructuring charges of $175 million and an estimated $90 million from $70 million in Q2.

Last year, PayPal appointed Jamie Miller, formerly CFO at consultancy EY, as its new chief financial officer. This leadership change aligns with PayPal's evolution from an online checkout site to a comprehensive mobile shopping and person-to-person payments platform.

Amid intensifying competition with Apple, Block (formerly Square), and other fintech firms, PayPal's strong performance and strategic initiatives highlight its resilience and growth potential in the digital payments sector.

Expert Insights on PayPal Stock Forecast for 2024, 2025, 2030 and Beyond

Paypal stock price rapidly fell from Q3 2021 to Q2 2022. Since then, the price has been moving sideways, making a low near $50. Before checking on details on the Paypal stock price Forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about PYPL stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$66.72 |

$79.87 |

$130.81 |

|

Tradersunion |

$52.67 |

$89.29 |

$186.62 |

|

Stockscan |

$66.42 |

$176.87 |

$20.92 |

|

Coincodex |

$86.34 |

$70.83 |

$142.78 |

II. PayPal Stock Forecast 2024

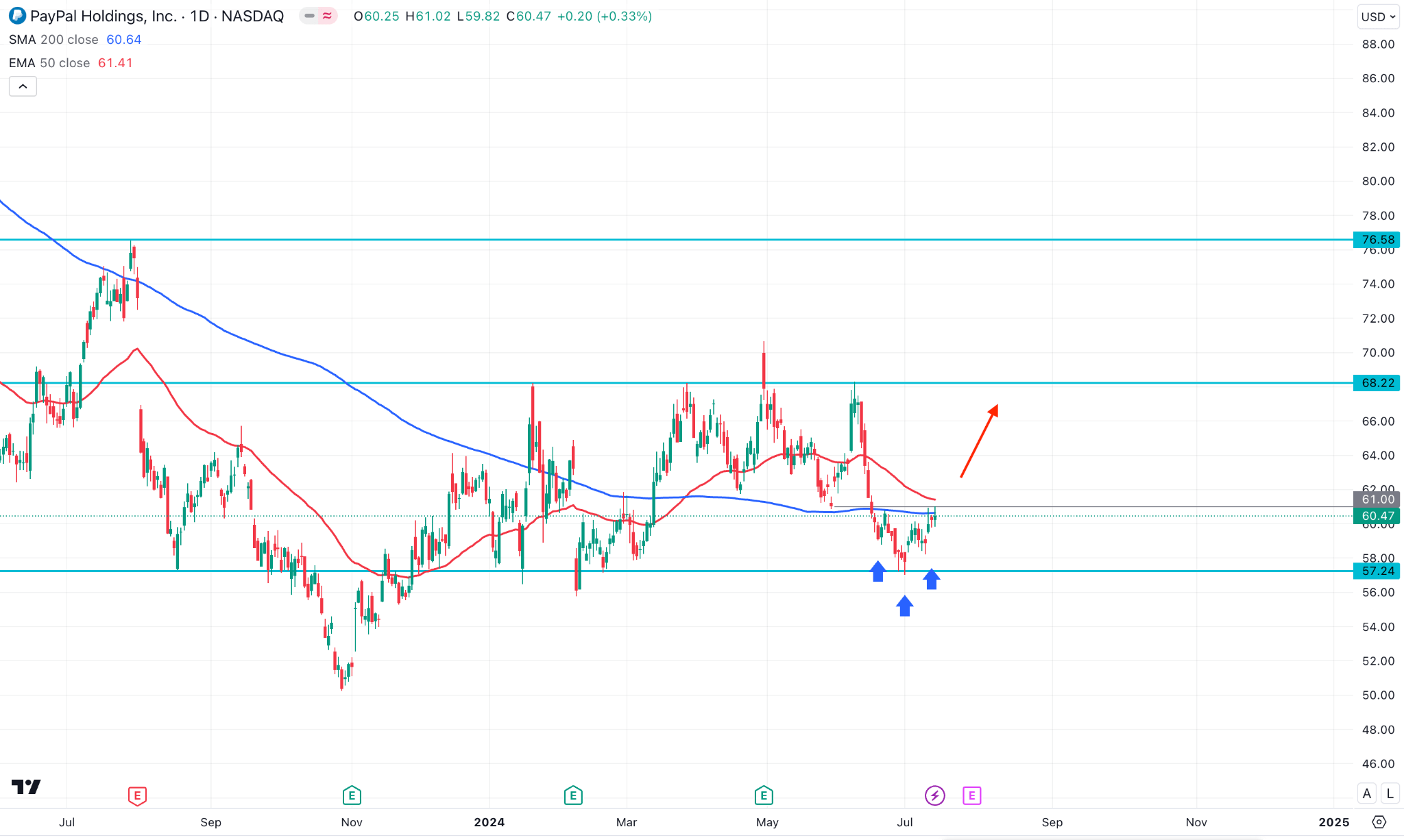

The price for PayPal Stock is 61.00 at the time of writing. It has been consolidating between 57.24 and 68.22 since November 2023. A breakout above 68.22 can trigger the price toward 76.58 by the end of this year.

On the daily chart, 57.24 shows an acceptable support level, and bullish pressure is validated as the price moves above the SMA 200 line. Moreover, the EMA 50 line crosses above the SMA 200, which is the“golden cross”that confirms the price may enter a long-term bullish trend and head toward the nearest resistance of 68.22. Any breakout can trigger the price toward the next resistance near 76.58.

Meanwhile, The price is still below the EMA 50 line, a valid head and shoulders pattern is visible near the resistance, and the price is still below the neckline, declaring seller activities that may continue and the price decline toward the primary support near $7.24, followed by the next support near 52.96.

Let's see the further aspect of PayPal Stock Price Forecast 2024 from the following indicators:

- Average Directional Index (ADX): The ADX indicator value is below 20, declaring a weaker current trend. Hence, the price can decline further, following a weak bullish trend and a bit of soaring sell pressure, to the support level of 57.24, followed by the next support near 52.96.

- MACD: The MACD indicator window shows fresh bullish pressure through signal lines edging upside and green histogram bars above the middle line, reflecting the possibility that the price may hit the nearest resistance of 68.22.

- The Relative Strength Index (RSI): The RSI indicator window supports bullish pressure as the dynamic signal line is above the midline, heading upside. Any breakout of the current resistance may trigger the price to the next possible resistance, which is near 76.58.