- 3M's Q2 2024 showcased operational excellence with $6 billion in sales and a 39% EPS growth, supported by improved operating margins.

- Promising growth through increased industrial automation and safety product demand.

- 3M's P/E ratio indicates slight undervaluation but a premium over historical averages.

- 3M faces competition from Honeywell, General Electric, Johnson & Johnson, Medtronic, Avery Dennison, and BIC, each with strong technological and market positions.

I. 3M Q2 2024 Performance Analysis

A. Key Segments Performance

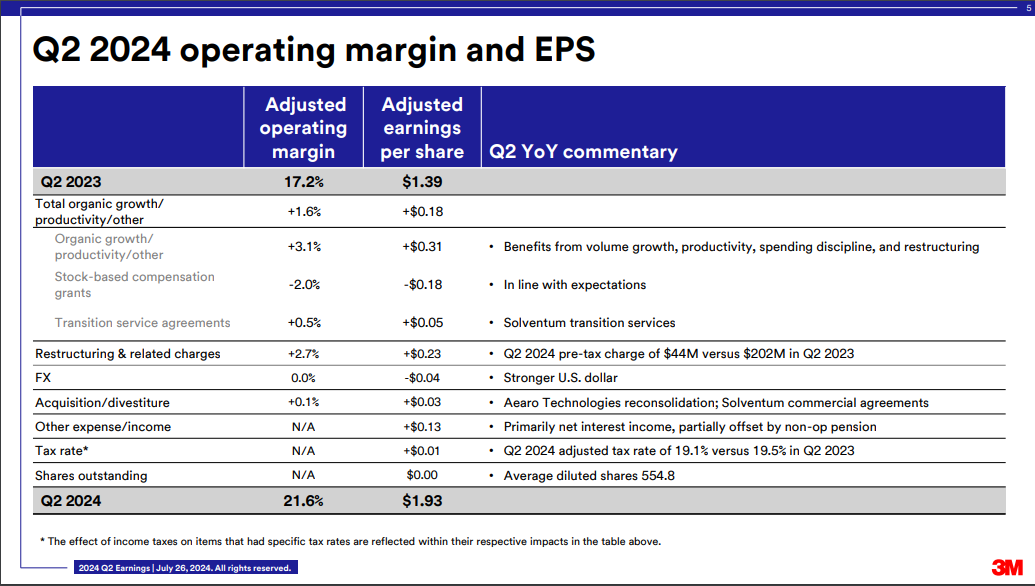

3M's Q2 2024 performance showcases significant operational and financial achievements amidst ongoing strategic shifts. The company experienced robust adjusted results, with sales of $6 billion and an impressive EPS growth of 39% year-over-year. This performance was supported by improved operating margins, which expanded by 4.4% to 21.6%, driven by productivity improvements, restructuring savings, and disciplined spending.

Financial Highlights:

Revenue growth was modest at 1.2% adjusted organic growth, reflecting the mixed industrial market demand and consumer discretionary spending. The net income and EPS figures were particularly strong, with EPS at $1.93, underscoring the company's ability to generate profit despite market challenges. The operating income benefited significantly from ongoing productivity and restructuring actions, showcasing the company's commitment to operational efficiency.

Source: Q2 Presentation

Expenses were controlled well, with restructuring charges amounting to $44 million, lower than anticipated. This control over expenses contributed to strong free cash flow generation, which reached $1.2 billion for the quarter, demonstrating the company's solid cash generation capability.

Operational Performance:

Safety and Industrial segment sales were robust, reaching $2.8 billion, driven by growth in Industrial Adhesives and Tapes, Personal Safety, and Automotive Aftermarket. However, segments like Abrasives and Industrial Specialties saw declines. The Transportation and Electronics segment saw a healthy performance with $1.9 billion in sales, driven by double-digit growth in electronics and gains in the auto OEM business. The Consumer segment experienced a decline in sales, reflecting softness in consumer discretionary spending.

Market share analysis revealed strong positions in key segments, particularly in electronics and automotive, with notable spec wins and platform penetrations. Key partnerships and collaborations, including the spin-off of the healthcare business, played a critical role in aligning 3M's strategic direction.

Technological Advancements and Innovations:

3M maintained a strong focus on technological advancements and innovation. New product launches were aligned with high-growth markets like auto electrification and industrial automation, though the number of new product introductions had declined over the past decade due to strategic shifts. R&D investments remained significant at $1 billion per year, focusing on material science innovation. However, the company acknowledged the need to get more from its current R&D spend by improving new product development velocity and eliminating non-value-added work.

B. MMM Stock Price Performance

3M (NYSE: MMM) demonstrated notable stock price performance recently. The market cap stands at $56.548 billion. The stock opened at $91.05 and closed at $102.19, with quarterly highs and lows of $106.04 and $88.23, respectively. This translates to a 12.24% price return. Comparatively, this significantly outperformed major indices, with the S&P 500 (SPX) delivering a 3.85% price return and the NASDAQ-100 (NDX) showing a 7.67% price return. The robust performance of MMM indicates strong investor confidence and resilience, despite broader market fluctuations.

Source: tradingview.com

II. MMM Stock Forecast: Outlook & Growth Opportunities

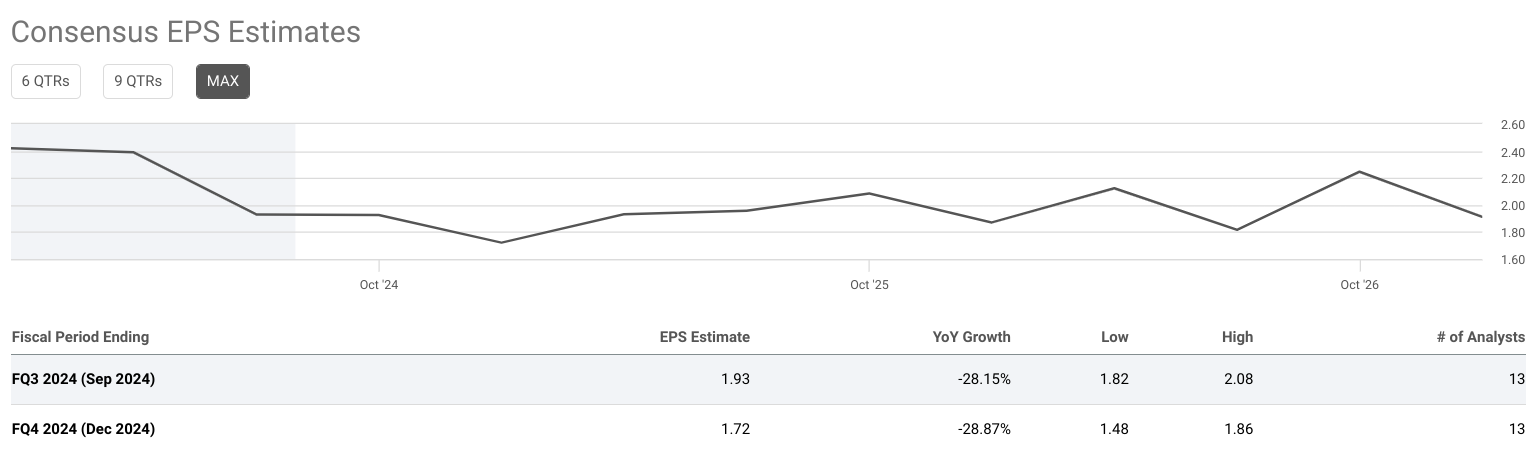

3M (NYSE: MMM) faces a challenging outlook, with consensus EPS estimates for FQ3 2024 and FQ4 2024 showing a decline of around 28% year-over-year, and revenue estimates reflecting a similar downward trend. Despite these hurdles, 3M is focused on driving growth through its core segments and strategic initiatives. Here's a critical look at its growth opportunities:

Source:seekingalpha.com

Segments with Growth Potential

Safety and Industrial: This segment remains crucial, contributing significantly to 3M's revenue. Growth potential lies in industrial adhesives, personal safety products, and automotive aftermarket solutions. The post-pandemic industrial rebound and increasing demand for safety products in workplaces can drive growth. Moreover, the segment benefits from secular trends like increased industrial automation and infrastructure development.

Transportation and Electronics: This segment has shown resilience with organic growth driven by electronics and automotive OEM businesses. The rise in consumer electronics and electric vehicles (EVs) presents substantial opportunities. 3M's innovative solutions in semiconductor manufacturing and advanced materials position it well to capture market share as these industries expand.

Health Care: Following the spin-off of its healthcare business, 3M focuses on core areas like medical solutions and oral care. The aging global population and increasing healthcare expenditure provide a favorable environment for growth in this segment. However, it must continue to innovate and adapt to changing market dynamics to maintain its competitive edge.

Consumer: This segment faces headwinds due to reduced consumer discretionary spending. However, growth can be driven by leveraging strong brand recognition and expanding product lines in home improvement and safety products. Effective marketing strategies and enhancing e-commerce capabilities can help mitigate some of the adverse impacts.

Expansions and Strategic Initiatives

Research and Development (R&D) Investments: 3M's commitment to innovation is evident in its annual R&D expenditure of around $1 billion. However, there's a need to enhance the effectiveness of these investments. By improving the new product development process, reducing bottlenecks, and increasing the efficiency of engineers, 3M aims to rejuvenate its product pipeline and drive organic growth.

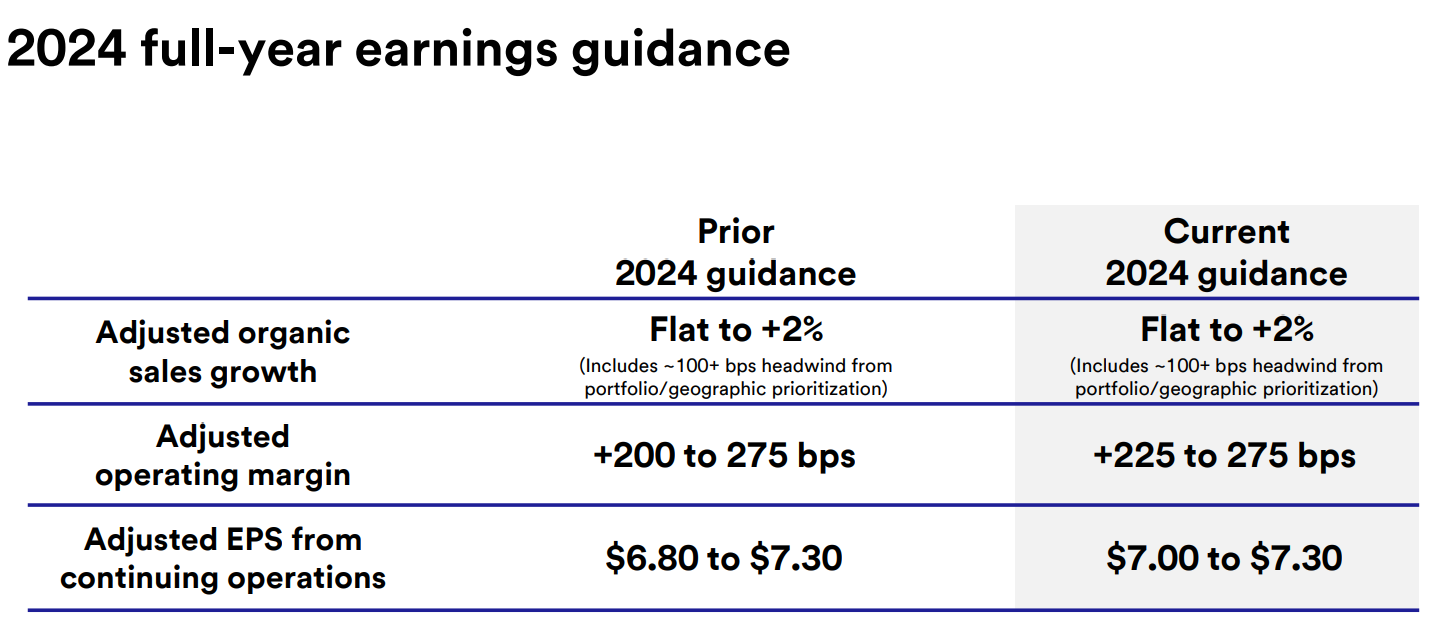

Source: Q2 Presentation

Partnerships and Collaborations: Strategic partnerships play a crucial role in 3M's growth strategy. Collaborations with key players in emerging markets like EVs, industrial automation, and climate tech can help 3M leverage its expertise in material science and expand its market presence. These partnerships also enable access to new technologies and customer bases, fostering innovation and growth.

Operational Edge: 3M is focused on enhancing its operational performance by optimizing its manufacturing and supply chain processes. Initiatives to reduce complexity, drive lean manufacturing, and improve supply chain efficiency are underway. These efforts aim to lower costs, increase productivity, and improve service levels, thereby enhancing overall operational performance.