- Apple achieved a record $85.8 billion revenue in Q2 2024, up 5% YoY, with an 11% increase in EPS.

- AAPL stock surged 23% this quarter, closing at $210.62, amid a market cap of $3.23 trillion.

- Analysts predict a bullish outlook with a AAPL price target of $270 by year-end, reflecting growth potential.

- Risks include strong competition from Samsung and Microsoft, regulatory challenges, and economic fluctuations.

I. Apple Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights [Q3 Fiscal 2024]

Apple reported a record quarterly revenue of $85.8 billion for Q2 2024, a 5% year-over-year increase. This growth was driven by robust performance in services and higher sales in key regions, despite a 230 basis point negative impact from foreign exchange. The company achieved a net income of $21.4 billion, translating to earnings per share (EPS) of $1.40, marking an 11% year-over-year increase and setting a new June quarter record. Apple's gross margin stood at 46.3%, near the high end of its guidance range. Product gross margin was 35.3%, while services gross margin was significantly higher at 74%.

Source: apple.com

Operating expenses totaled $14.3 billion, a 7% increase year-over-year, reflecting ongoing investments in innovation and market expansion. Apple ended the quarter with $153 billion in cash and marketable securities. Operating cash flow was a robust $28.9 billion. The company returned over $32 billion to shareholders through dividends and stock repurchases.

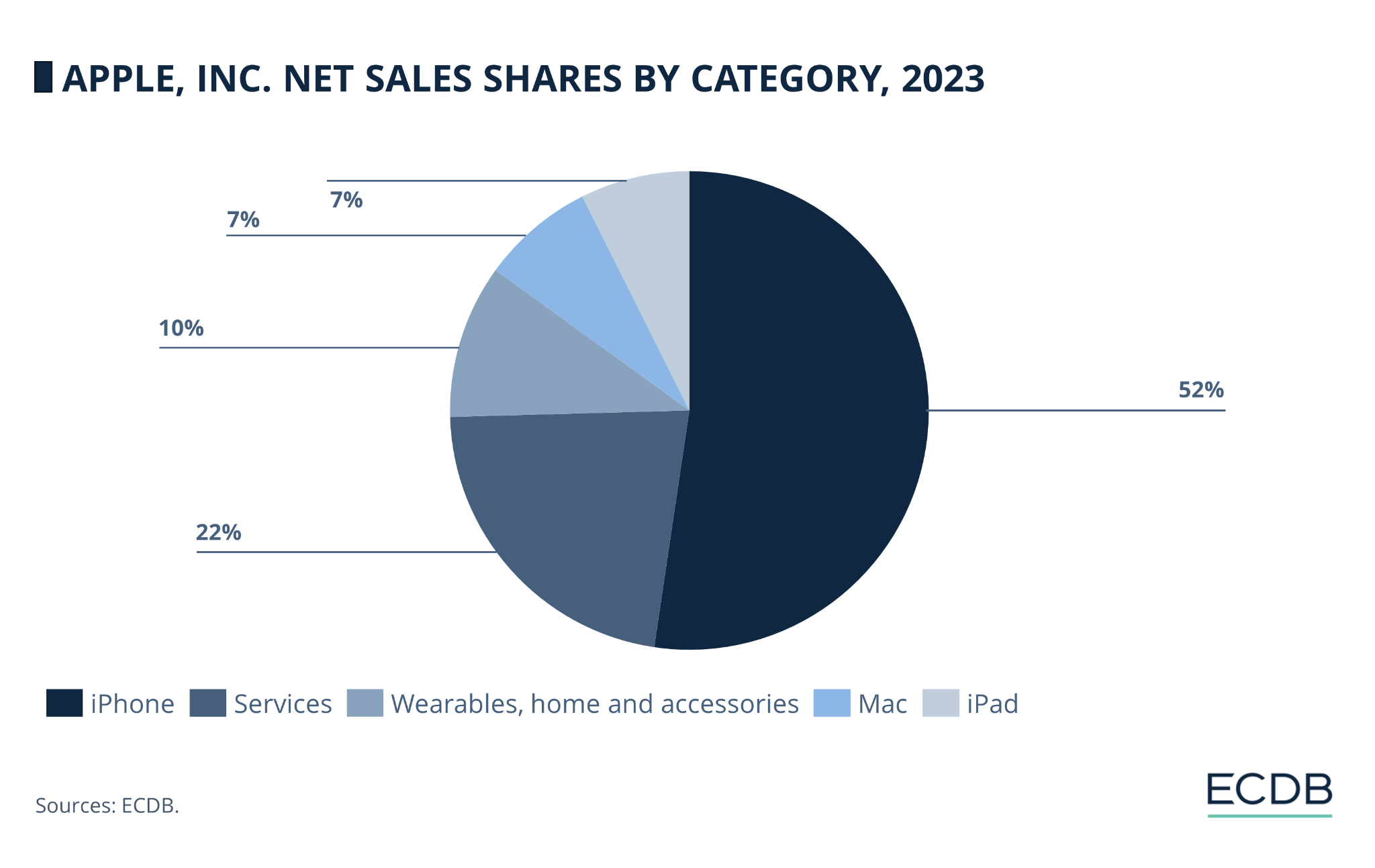

Operational Performance

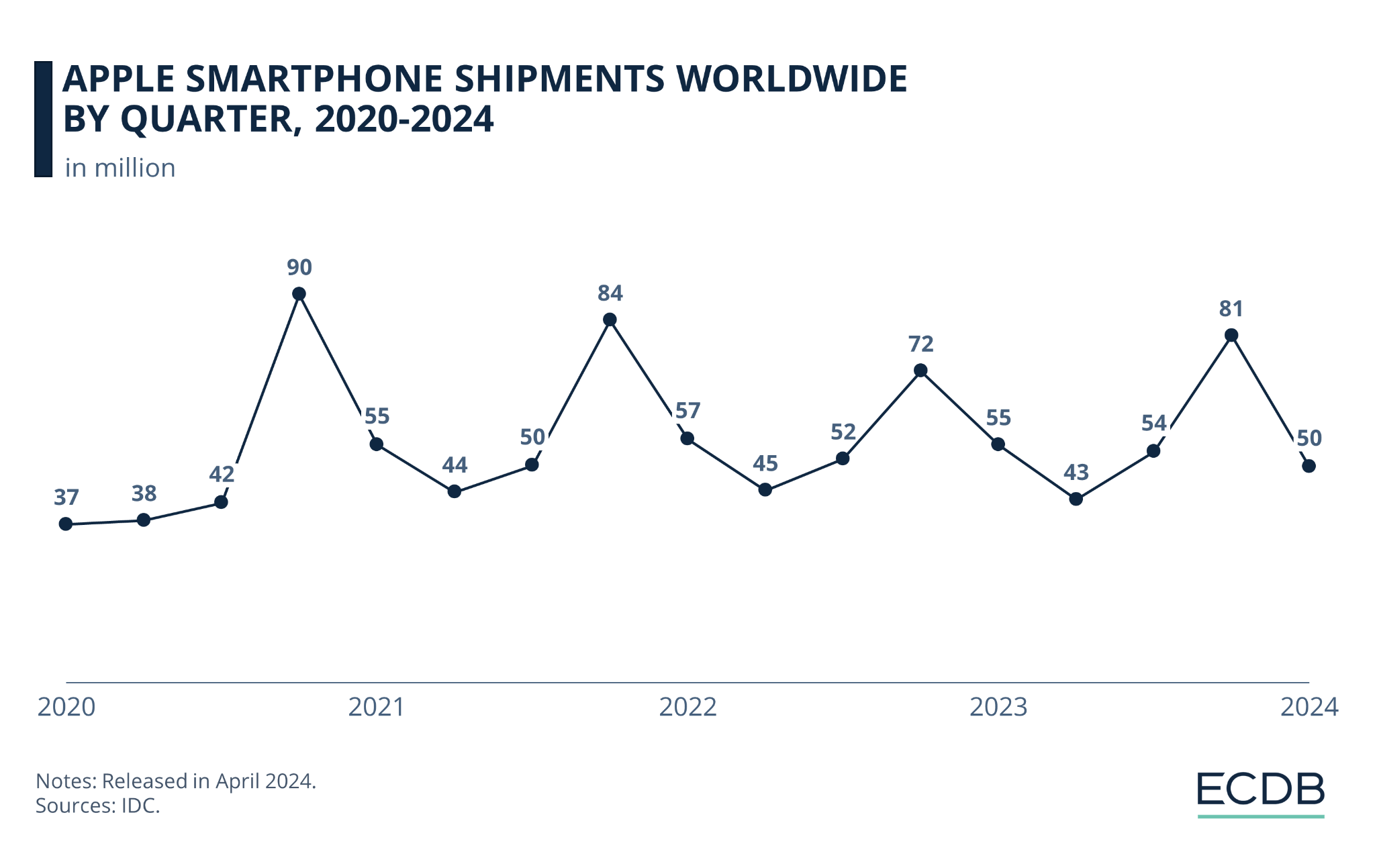

- iPhone: Revenue was $39.3 billion, a 1% year-over-year decline but stable on a constant currency basis. The iPhone 15 lineup received high praise for its battery life, camera quality, and performance.

Source: static.ecommercedb.com

- Mac: Generated $7 billion in revenue, up 2% year-over-year. The M3-powered MacBook Air contributed significantly, especially in emerging markets.

- iPad: Revenue reached $7.2 billion, a substantial 24% increase year-over-year, driven by the new iPad Pro and iPad Air models.

- Wearables, Home, and Accessories: Revenue was $8.1 billion, down 2% year-over-year. Apple Watch continued to attract new customers, pushing the installed base to a new high.

- Services: Achieved an all-time revenue record of $24.2 billion, up 14% year-over-year. This was driven by strong growth in advertising, cloud, and payment services.

Market Share Analysis:

- Geographical Performance: Apple set quarterly revenue records in over two dozen countries, including Canada, Mexico, France, Germany, the UK, India, Indonesia, the Philippines, and Thailand.

- Product Popularity: iPhone remained the top-selling smartphone in key markets like the US, urban China, the UK, Germany, Australia, and Japan.

New Product or Technological Advancements and Innovations:

- Apple Intelligence: Introduced at the Worldwide Developers Conference, this AI-driven platform enhances user interaction with generative AI models integrated into iPhone, iPad, and Mac. It includes tools for writing, image creation, and notification management, all with a focus on privacy.

- Apple Vision Pro: Expanded to more countries, offering users advanced spatial computing experiences. Vision Pro is gaining traction in both consumer and enterprise markets, with over 2,500 native spatial apps available.

- iOS 18 and New Features: The iOS 18 update brought significant enhancements, including a redesign of the Photos app, satellite messaging, and new AI capabilities through Apple Intelligence.

- MacBook Air and M3 Chip: The new M3-powered MacBook Air has been well-received, especially among students and professionals.

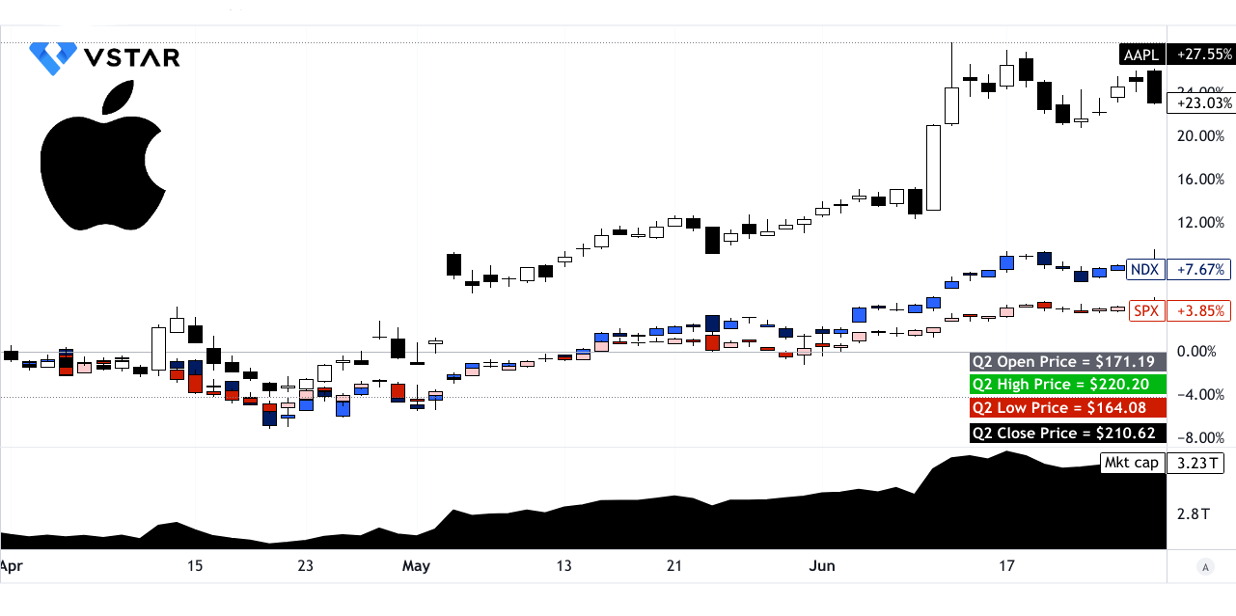

B. AAPL Stock Price Performance

Apple stock (NASDAQ: AAPL) exhibited robust performance with a 23.03% price increase, opening at $171.19 and closing at $210.62. Throughout the quarter, it traded between highs of $220.20 and lows of $164.08. This growth propelled Apple's market capitalization to $3.23 trillion, underscoring its dominance in the tech sector. In contrast, broader market indices like the S&P 500 (SPX) and NASDAQ (NDX) reported more modest price returns of 3.85% and 7.67%, respectively.

Source: tradingview.com

II. Apple Stock Predictions: Outlook & Growth Opportunities

A. Segments with growth potential

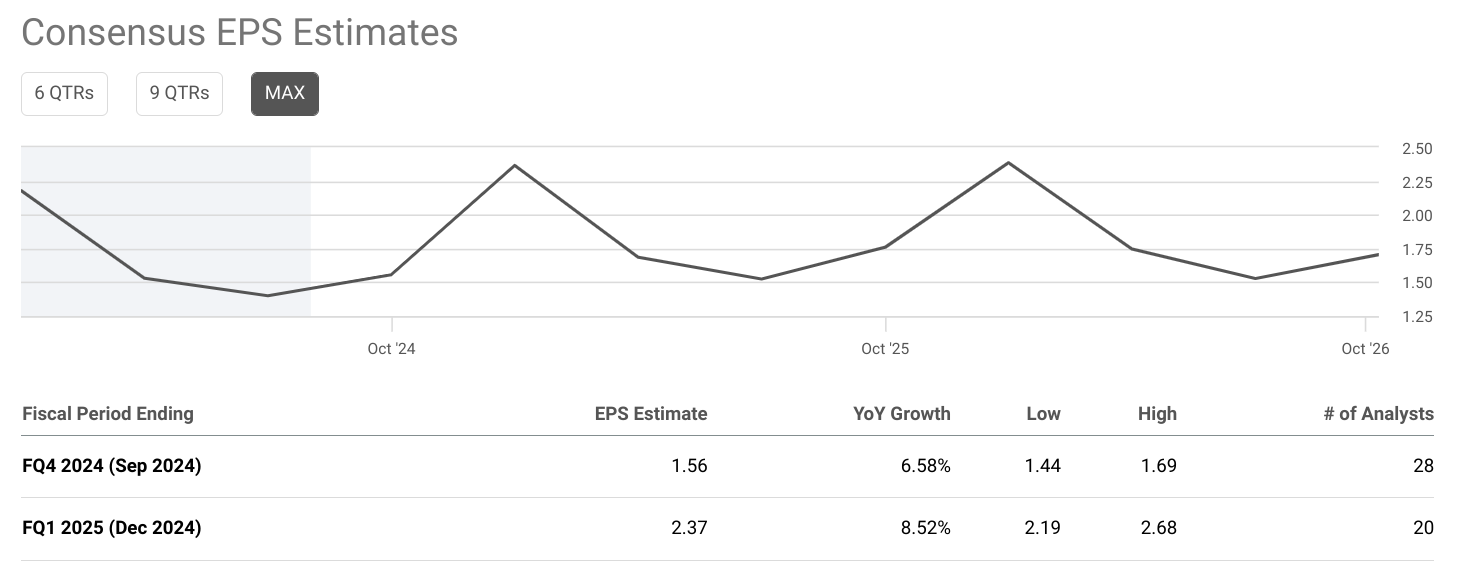

Apple's financial outlook remains strong, driven by its diversified product portfolio and expanding services segment. For fiscal Q4 2024, the consensus EPS estimate is $1.56, reflecting a year-over-year growth of 6.58%. Revenue is expected to reach $93.30 billion, a 4.25% increase. Looking ahead to fiscal Q1 2025, EPS is estimated at $2.37 with an 8.52% growth, and revenue is projected to be $126.88 billion, up 6.11%.

Source: seekingalpha.com

Apple (NASDAQ: AAPL) continues to demonstrate robust growth potential across several key segments:

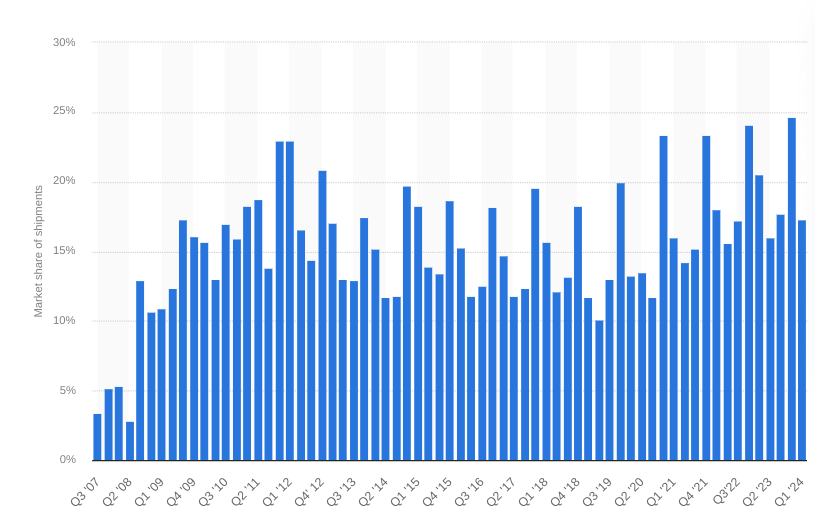

- iPhone: Despite a slight year-over-year decline, iPhone revenue remains strong, with an all-time high active installed base. New models and feature enhancements in the iPhone 15 lineup, combined with high customer satisfaction rates, underpin sustained demand.

[iPhone unit shipments as share of global smartphone shipments]

Source: statista.com

- Mac: Mac revenue grew by 2% year-over-year, driven by the popularity of the M3-powered MacBook Air. The introduction of more powerful models and back-to-school demand are expected to sustain this growth. The Mac installed base also hit a new high, suggesting continued market penetration.

- iPad: iPad revenue surged by 24% year-over-year, reflecting strong demand for the new iPad Pro and iPad Air. These devices, powered by Apple's advanced silicon chips, offer enhanced performance and AI capabilities, appealing to both educational and professional markets.

- Wearables, Home, and Accessories: Although revenue in this segment saw a slight dip, it remains a significant contributor. The Apple Watch continues to attract new users, with advanced health features like irregular heart rhythm notifications and crash detection driving adoption.

- Services: This segment achieved an all-time revenue record of $24.2 billion, up 14% year-over-year. Growth in services is propelled by the increasing installed base of active devices, new content on Apple TV+, and enhanced features across Apple's ecosystem. The introduction of Apple Intelligence and expanded service offerings like Tap to Pay on iPhone are expected to further drive growth.

Source: static.ecommercedb.com

B. Expansions and strategic initiatives

Research and Development Investments: Apple's significant investments in R&D are driving innovation across its product lineup. The development of the M-series chips, advancements in AI and machine learning, and the introduction of Apple Intelligence exemplify how R&D investments are translating into competitive advantages and new growth opportunities.

Partnerships and Collaborations: Collaborations with enterprise customers, such as American Express and Boston Children's Hospital, are expanding the use of Apple products in professional settings. Partnerships in content creation, like those for Apple TV+, are enriching the services ecosystem, attracting more subscribers, and increasing revenue.