I. Recent American Airlines Stock Performance

American Airlines Management Projection

On July 25, American Airlines AAL announced its second-quarter earnings and revised its full-year financial estimate. The fair value estimate has dropped from $13.10 to $12.00 per share.

Because global distribution systems and travel management companies are still utilizing outdated digital protocols to miss out on the many complex offers that airlines make, the company's aggressive efforts in late 2023 to modernize how it sells and distributes its tickets digitally disrupted the distribution process. The company has thus lost its edge in the profitable business travel sector.

In June, American announced the departure of its chief commercial officer and reverted strategies meant to encourage the use of digital ticketing systems, such as deducting mileage rewards from travelers using antiquated systems. We estimate that the company's distribution will take until the following year to revert to its prior levels. The commercial error happened at a bad time: in early 2024, US airline capacity exceeded demand, which prompted aggressive ticket discounts that further undermined profitability.

Direct Booking Strategy Bites Back: American Airlines Profits Crash

Following a sharp drop in profits, American Airlines is currently dealing with the consequences of its current direct booking plan. The airline's goal of eliminating middlemen and encouraging direct booking through its systems hasn't worked out.

To cut expenses and improve ties with customers, the airline preferred direct reservations over those made through independent travel agencies. But this tactic has backfired miserably, resulting in a 46% decline in earnings. Reduced insight and fewer bookings due to the decreased dependence on travel agencies have negatively impacted the final result.

The repercussions of this strategy have been felt by the travel industry, especially by travel agents. Customers frequently depend on travel agents to help them access the intricacy of flight options and offers, so it is not surprising that numerous agents have noted a decrease in reservations for American Airlines flights. As a result of the decline in bookings, the airline and its affiliates have been impacted.

The financial outcomes for American Airlines' period present a clear picture. As the company attempts to handle the consequences of the strategy, revenue has decreased, and operating expenditures have gone up. Due to the notable decline in profits, analysts and investors in the industry are becoming increasingly concerned about the viability of the direct reservation method.

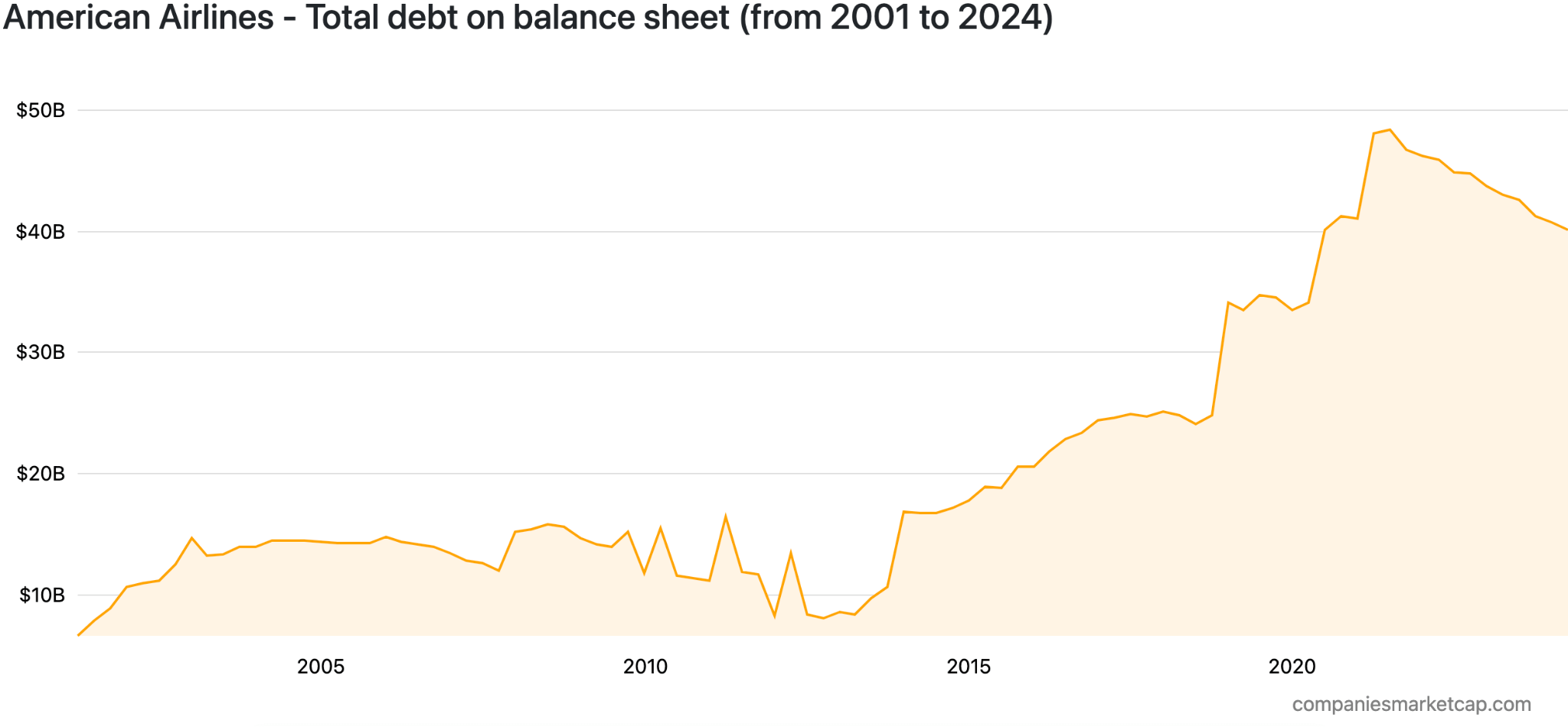

American Airlines Debt Burden: A Threat or Not

Source: companiesmarketcap.com

Operating-wise, American Airlines is heavily indebted, and its short-term liabilities are greater than its liquid assets. Analysts anticipate the company will profit this year despite these obstacles; it has turned a profit over the past 12 months. Additionally, InvestingPro Tips points out that despite being a major participant in the passenger airline sector, American Airlines does not distribute dividends to shareholders, which could impact investment choices.

For anyone considering investing in American Airlines, it's crucial to remember that the company's stock is trading close to its 52-week low and that its price has dropped dramatically over the previous three months. Although the current price offers a more affordable entry point, analysts' caution is also reflected.

Expert Insights on AAL Stock Forecast for 2024, 2025, 2030 and Beyond

AAL stock price is trading at a record low, signaling a long-term buying opportunity from the discounted price. Before proceeding further, let's see Expert Insights on AAL Stock Forecast for 2024, 2025, 2030, and Beyond:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$14.41 |

$16.81 |

$37.34 |

|

Stockscan |

$11.61 |

$4.35 |

$24.95 |

|

Coincodex |

$12.22 |

$ 10.28 |

$ 10.97 |

|

3rates |

$5.08 |

$8.35 |

n/a |

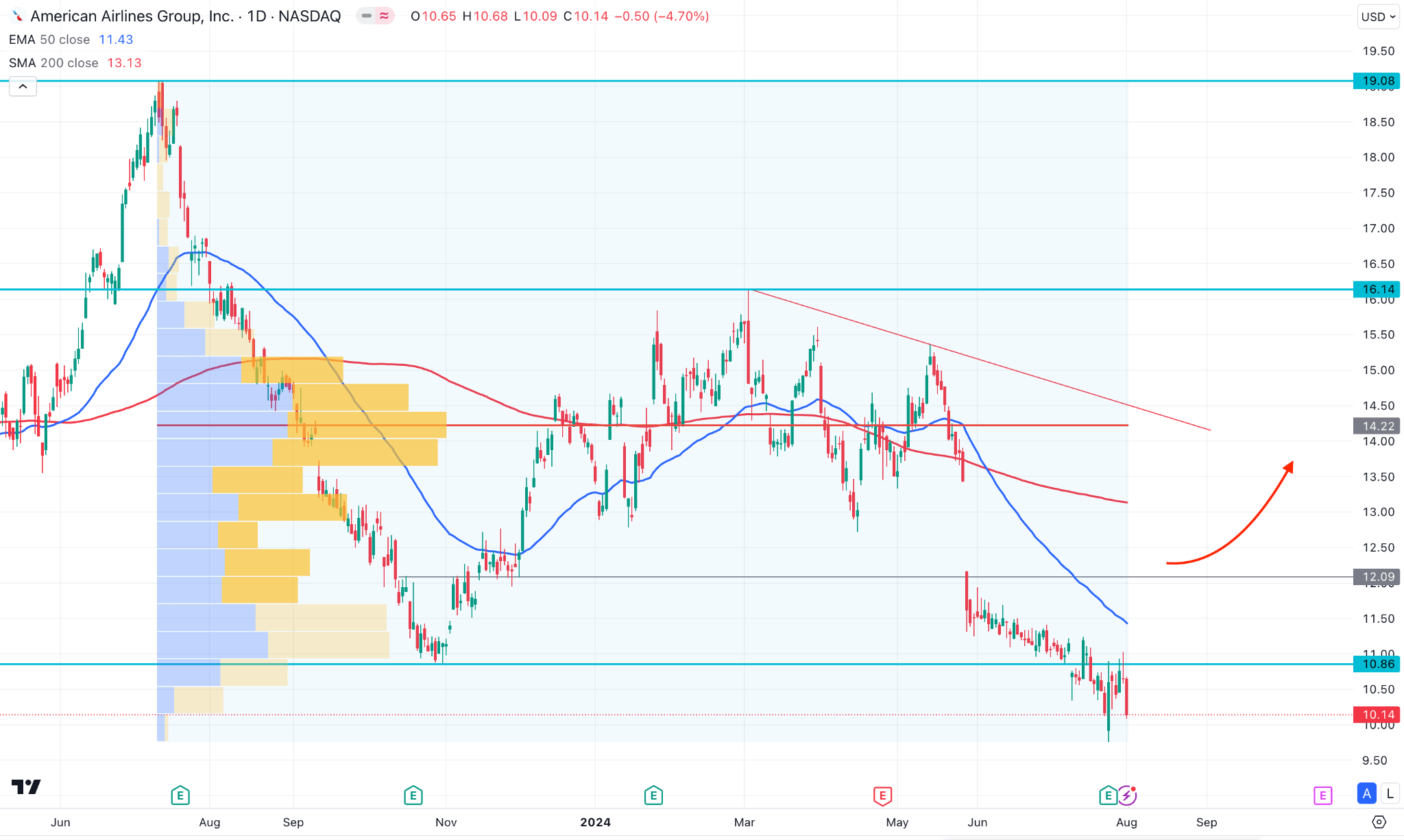

II. AAL Stock Forecast 2024

American Airlines Stock (AAL) is trading at a record level, from where a valid recovery could initiate a bullish signal. A stable market above the 12.03 level might initiate an upside pressure towards the 14.22 resistance level by the end of 2024.

In the daily chart of AAL, the most recent price is trading at the multi-year low, concerning the fundamental growth and a risk of insolvency. On the other hand, the recent price from the discounted zone could be a high probable long opportunity as a value investment.

The selling pressure from June 2023 created support at the 10.86 level before approaching higher to the 16.14 level, from where the most existing downside pressure has come. As the current price is trading below the existing 10.86 low, we may consider the market pressure as bearish. In this context, finding a bullish trend might need a solid price action with fundamental support.

In the main chart, the 200-day Simple Moving Average is 29% above the current price, whereas the 50-day EMA is acting as an immediate resistance. Moreover, the volume shows a bullish possibility as no significant activity was seen since below the 14.00 level.

Based on the AAL Stock Forecast 2024, a valid bullish reversal with a daily candle above the 12.09 level might activate the bullish possibility, aiming for the 200-day SMA line. However, the ongoing market trend is still bearish, and a stable market above the 200-day SMA could increase the possibility of grabbing buy-side orders from the 16.14 swing high.