EURUSD

Fundamental Perspective

The EURUSD pair failed to surpass the 1.1200 mark, descending into a corrective phase that saw it close the week just above the 1.1053 low. Initially under pressure, the US Dollar rebounded midweek as market sentiment soured, driven by stronger-than-expected economic data. The US economy reported a 3% annualized GDP growth for the second quarter, exceeding the 2.8% forecast, while unemployment claims were slightly lower than anticipated. The Personal Consumption Expenditures (PCE) Price Index also held steady, further solidifying confidence in the US economic outlook.

However, despite the encouraging data, speculation about the Federal Reserve's upcoming interest rate decision remains unresolved. Market participants are uncertain whether the Fed will opt for a 25—or 50 basis point cut in September, though a rate cut is largely anticipated.

In the Eurozone, inflation data bolstered expectations of a European Central Bank (ECB) rate cut. Germany's Consumer Price Index (CPI) increased by 1.9% year-on-year, below predictions, while the broader Eurozone Harmonized Index of Consumer Prices (HICP) aligned with forecasts, supporting the ECB's cautious monetary stance ahead of its September meeting.

Technical Perspective

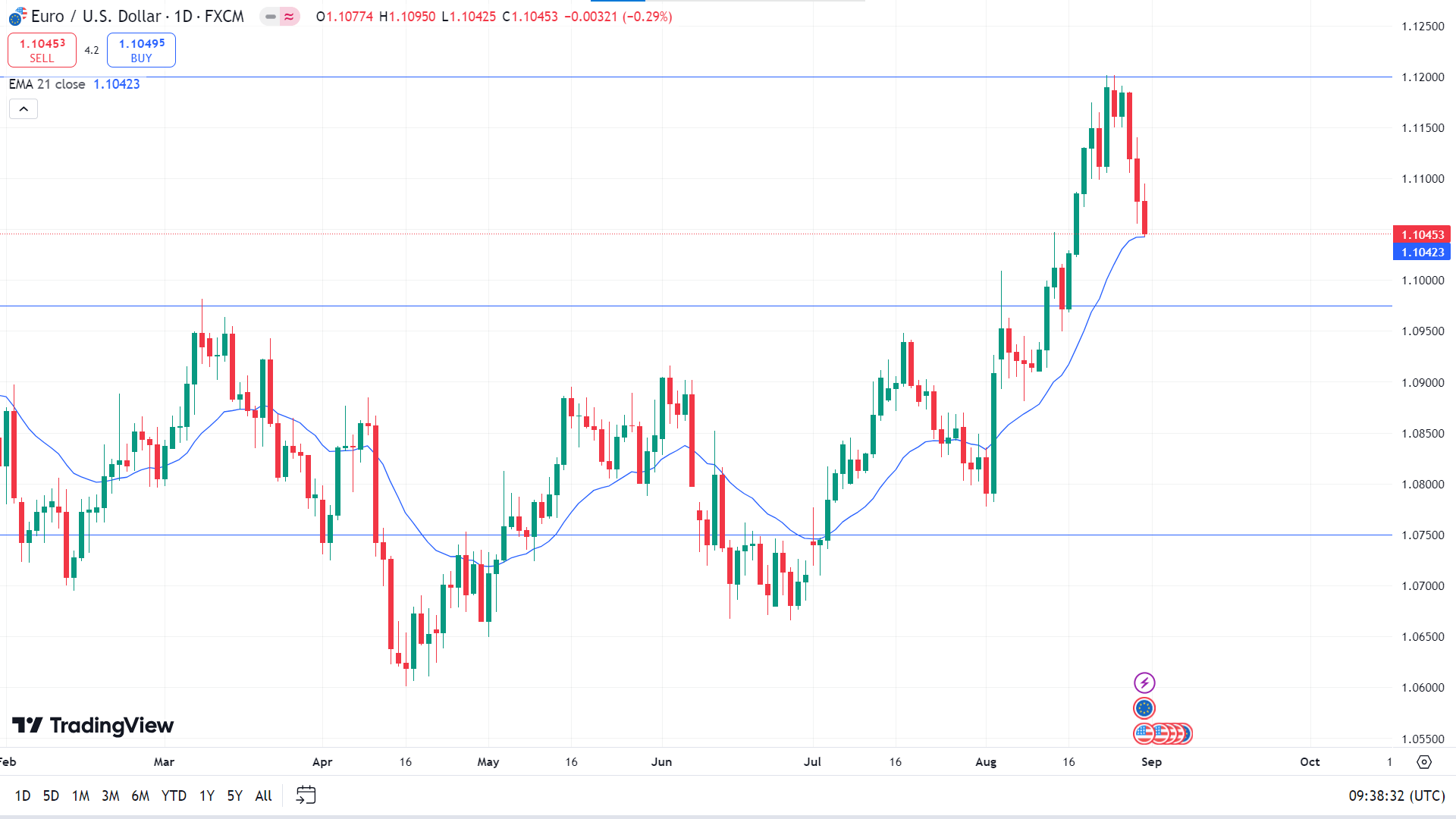

The last weekly candle closed as a solid red candle after reaching near a critical resistance level, indicating a bearish continuation.

On the daily chart, the price reaches the EMA 21 line, reflecting the recent bearish pressure. If the bearish pressure sustains and the price keeps declining below the EMA 21 line, it can reach the nearest support near 1.0975, followed by the next support near 1.0750.

Meanwhile, if the price bounces back from the EMA 21 line due to significant bullish pressure, it may hit the nearest resistance of 1.1200, and a breakout may trigger the price to reach the next resistance near 1.1470.