- Marvell's Q2 2024 revenue declined 5% year-on-year but increased 10% sequentially.

- The data center segment, contributing 69% of revenue, grew 92% year-on-year.

- Stock performance declined 15%, underperforming major indices.

- Marvell's valuation ratios suggest significant overvaluation, with a forward P/E of 52.02.

- Despite competition from Broadcom and Intel, analysts are optimistic with 91% rating MRVL as a "Buy."

- Technical analysis remains bullish, suggesting potential upward movement.

I. Marvell Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights:

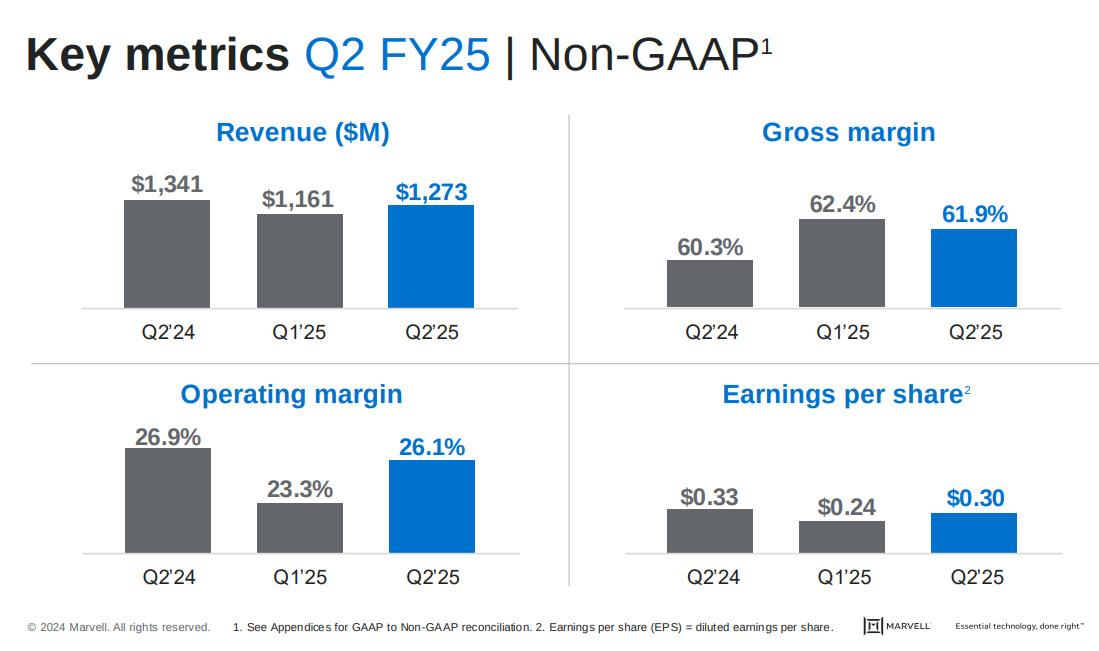

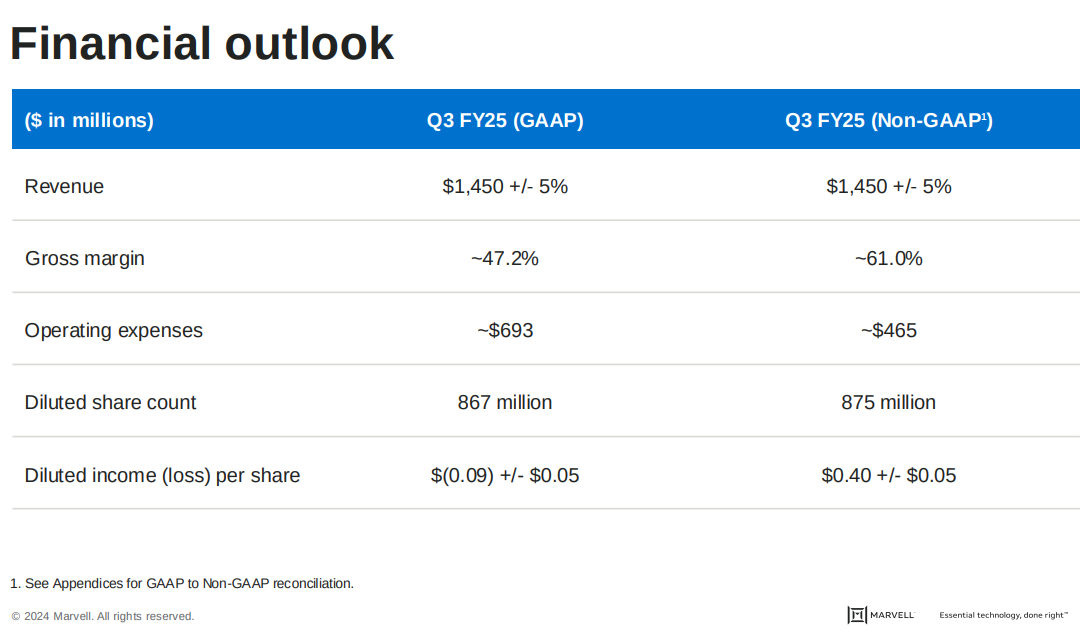

Marvell's Q2 2024 revenue was $1.273 billion, marking a 5% year-on-year decline but a 10% sequential increase. The GAAP gross margin stood at 46.2%, while the non-GAAP gross margin was significantly higher at 61.9%. The company reported a GAAP net loss of $193.3 million, translating to a loss of $0.22 per share. However, non-GAAP net income was $266.2 million, resulting in earnings per share (EPS) of $0.30. Operating expenses on a GAAP basis were $688 million, leading to a negative operating margin of 7.9%, whereas non-GAAP operating expenses were $456 million, yielding a 26.1% operating margin. Cash flow from operations was robust at $306 million, and the company returned $227 million to shareholders through dividends and stock repurchases. Marvell's balance sheet showed total debt at $4.13 billion, with a net debt to EBITDA ratio of 1.84x.

Source: Marvell_Q2_FY25_financial_business_results

Operational Performance:

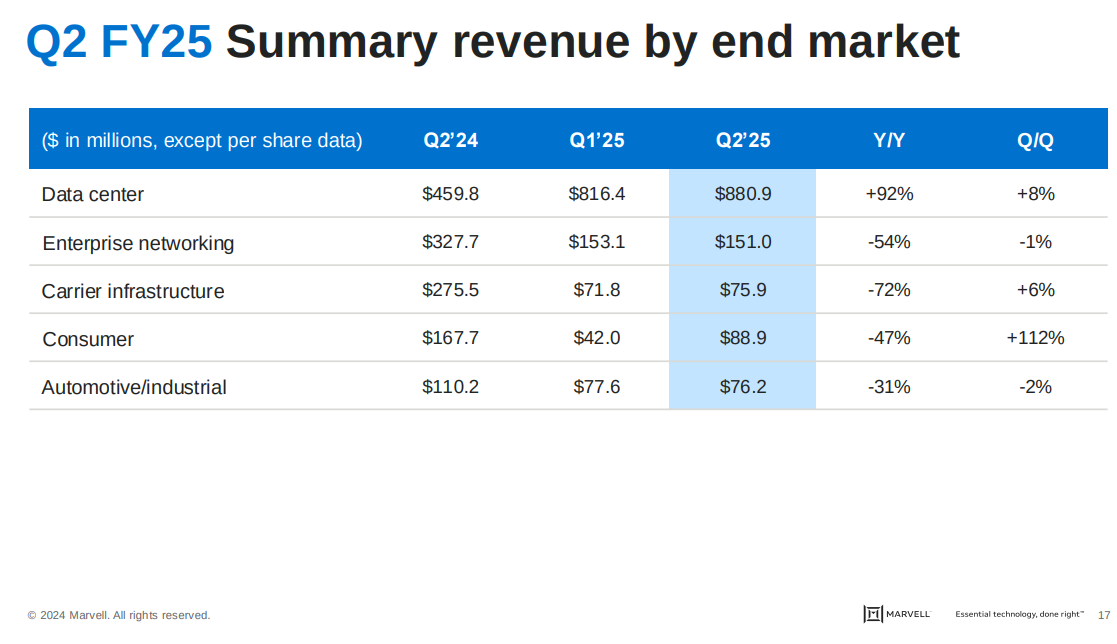

Marvell's data center segment, which contributed 69% of total revenue, was a standout performer, with revenue growing 92% year-over-year to $881 million. This growth was driven by strong demand for electro-optics products and the ramp-up of custom AI silicon. In enterprise networking, revenue was flat at $151 million, but growth is expected to resume in the next quarter. The carrier segment remained stable at $76 million, with future growth anticipated from new 5nm-based OCTEON 10 DPUs. The consumer segment saw a sharp rebound, with revenue doubling sequentially to $89 million, driven by recovery in the gaming sector. However, the automotive and industrial segment faced challenges, with revenue declining 31% year-over-year to $76 million, reflecting broader market inventory corrections. Despite these challenges, Marvell is optimistic about a recovery in these segments in the coming quarters. The company continues to innovate, with new product launches like the 200 gig per lane 1.6 terabit DSPs, positioning it strongly for future growth.

Source: Marvell_Q2_FY25_financial_business_results

B. MRVL Stock Price Performance

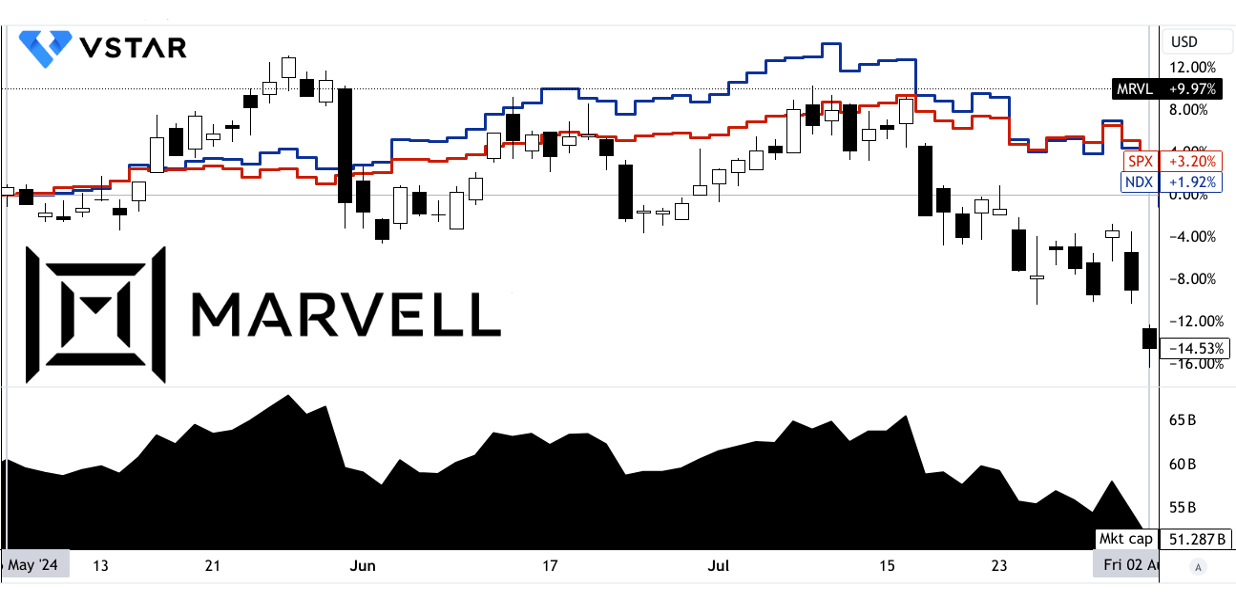

Marvell Technology (MRVL) saw a significant decline in stock price performance, dropping by 15% from $69.33 to $59.25, underperforming compared to the S&P 500 and NASDAQ, which gained 3% and 2%, respectively. The stock hit a high of $78.44 and a low of $57.98 during the quarter, reflecting heightened volatility. This decline suggests investor concerns or broader sector pressures, starkly contrasting with the positive market sentiment driving the major indices. Despite its $51.29 billion market cap, MRVL's negative price return indicates possible challenges in maintaining Street confidence.

[Marvell Q2 Fiscal 2025 Performance]

Source: tradingview.com

II. MRVL Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Marvell's growth prospects are strongly anchored in its data center and AI segments. For Q2 FY25, the data center end market contributed $881 million, reflecting a 92% year-over-year increase. This robust performance is primarily due to rising demand for electro-optics and custom silicon. Marvell's data center revenue is set to benefit from new products like 800G PAM4 and 200G DSPs, which align with the 27% CAGR forecast for the interconnect market. The company's entry into AI-driven custom silicon and PCIe Gen6 technology further positions it to capitalize on the burgeoning data center infrastructure market, which is poised for accelerated growth.

Conversely, Marvell is focusing on rebounding its enterprise networking and carrier infrastructure segments. Both segments experienced a slowdown but are expected to grow sequentially by mid-single digits in Q3 FY25, driven by new product launches like the 5nm OCTEON 10 DPUs. Additionally, Marvell anticipates that its consumer market revenue will stabilize around $300 million annually, primarily due to steady demand for custom SSD controllers used in gaming consoles.

Source: Marvell_Q2_FY25_financial_business_results

B. Expansions and Strategic Initiatives

Marvell's strategic initiatives include several key expansions:

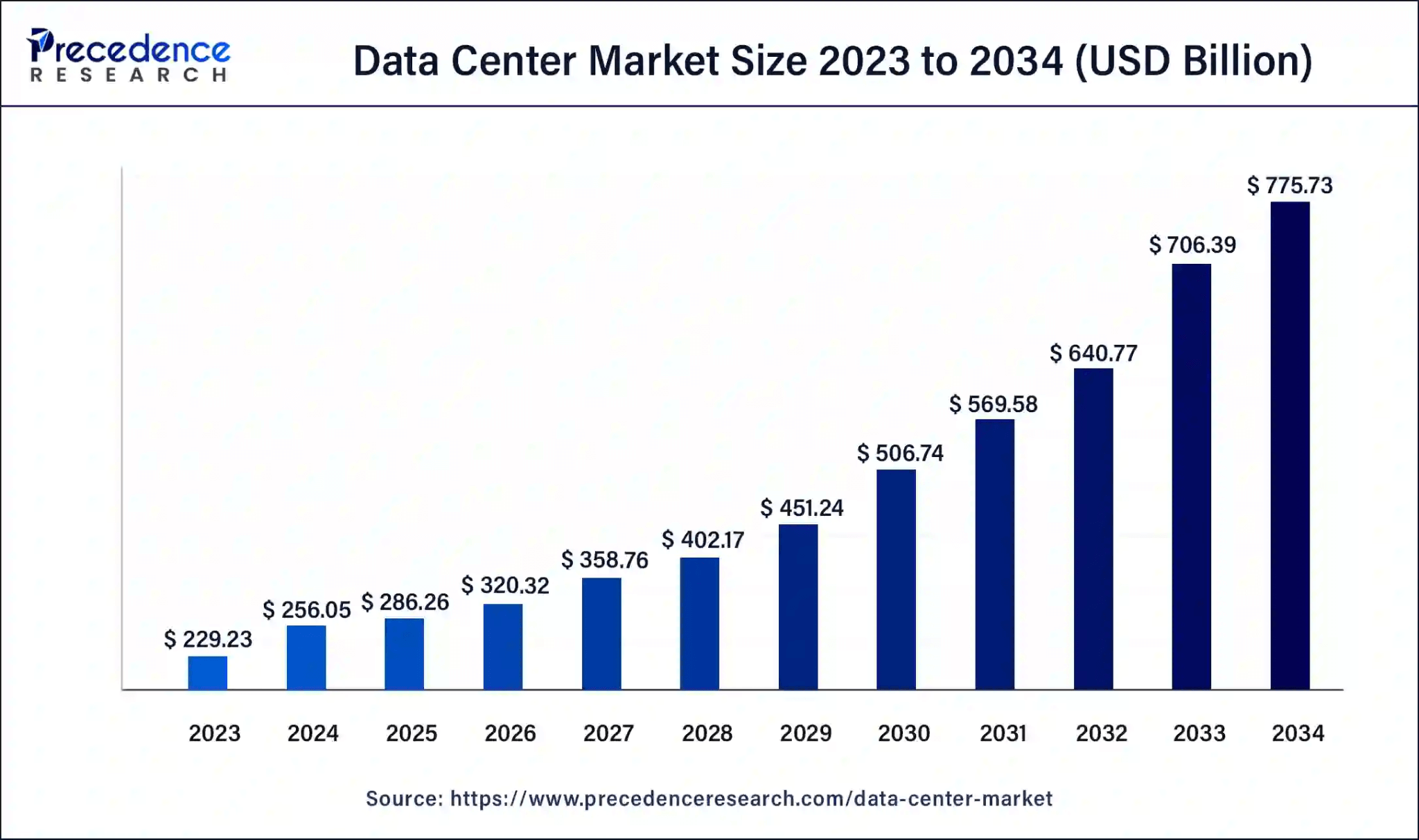

- Research and Development Investments: Marvell is heavily investing in R&D, with substantial resources allocated towards developing new products in AI, PCIe Gen6 technology, and electro-optics. This investment supports the introduction of advanced products such as 200G AEC DSPs and next-gen optical DSPs. The global data center market revenue may hit $256 billion in 2024 and may reach over $775 billion by 2034 based on a CAGR of 11.72%. This trend may benefit Marvell's top-line decisively.

Source: precedenceresearch.com

- Partnerships and Collaborations: Marvell has strengthened its position through strategic partnerships, including a notable collaboration with Microsoft for integrating Marvell's FIPS 140 Level-3 compliant security modules into Azure Key Vault. This partnership enhances Marvell's visibility in cloud security and reinforces its commitment to secure, high-performance solutions.