- Broadcom's Q3 fiscal 2024 performance showcases significant revenue and profit growth, driven by infrastructure software and semiconductor segments, despite a net GAAP loss.

- AVGO stock showed notable gains, significantly outperforming the S&P 500 and NASDAQ, despite market volatility.

- Broadcom's growth is anchored in its AI-focused semiconductor solutions and infrastructure software, particularly VMware's integration.

- Technical and fundamental analyses suggest potential stock price growth, although challenges like competition and geopolitical risks remain.

I. Broadcom Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights [Q3 Fiscal 2024]: Broadcom's Q3 2024 financials demonstrate substantial growth, driven by key segments. Consolidated net revenue reached $13.1 billion, a robust 47% increase from the previous year. Operating profit surged by 44% to $7.9 billion, with an operating margin of 61%. Gross margins for the quarter stood at 77.4%, bolstered by high-margin contributions from infrastructure software. However, the company's net income revealed a GAAP loss of $1.9 billion, influenced by integration and restructuring costs related to VMware. Non-GAAP net income was significantly higher at $6.1 billion, reflecting the operational strength excluding one-time charges. Earnings per share (EPS) showed a loss of $0.40 on a GAAP basis, but non-GAAP diluted EPS was $1.24. Free cash flow for the quarter was strong at $4.8 billion, representing 37% of revenue, indicating healthy cash generation despite substantial capital expenditures of $172 million. Broadcom's balance sheet showed $10 billion in cash against $72.3 billion in gross debt, with ongoing efforts to replace high-cost debt with more favorable fixed-rate instruments.

Source: Q3 fiscal 2024 Financial Results

Operational Performance: Broadcom's operational performance highlights continued momentum in its core segments. The infrastructure software segment, which now includes VMware, saw revenues of $5.8 billion—up 200% year-over-year. This growth was driven by VMware's $3.8 billion contribution and a strong uptake of VMware Cloud Foundation (VCF), which represented 80% of VMware's bookings for the quarter. In the semiconductor segment, networking revenue reached $4 billion, a 43% increase from the previous year, largely due to heightened demand for AI-specific networking solutions. Ethernet switching and optical components also experienced significant growth. Notably, non-AI semiconductor revenues stabilized, showing a 17% sequential increase despite a 41% decline year-on-year. The wireless segment grew marginally by 1% year-on-year to $1.7 billion, while broadband faced a 49% decline, reflecting persistent weakness in telco spending. Industrial resales showed a 31% drop, but a modest recovery is anticipated in Q4.

B. AVGO Stock Price Performance

In Q3 Fiscal 2024, Broadcom (AVGO) exhibited notable stock price performance, with its market capitalization reaching $670 billion. The stock opened at $128.62 and closed at $143.82, reflecting a substantial increase of 11.8%. AVGO's high point during the quarter was $185.16, while its low dipped to $130.25, showing significant intra-quarter volatility. This 11.8% price increase sharply outperformed key indices: the S&P 500, which gained only 3.2%, and the NASDAQ, which rose by 1.9%.

Source: tradingview.com

II. AVGO Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Broadcom Inc. (AVGO) exhibits significant growth potential across several segments. The most promising is its AI-focused semiconductor solutions, which have shown extraordinary growth. For example, custom AI accelerators in networking grew 3.5 times year-on-year in Q3 2024. This sector alone has driven a substantial increase in total semiconductor revenue, projected to reach $12 billion for fiscal year 2024. The rapid expansion is attributed to strong demand from hyperscalers for advanced AI infrastructure, underscoring the segment's pivotal role in Broadcom's future growth. Gartner forecasted AI Chips revenue to hit 33% YoY growth in 2024.

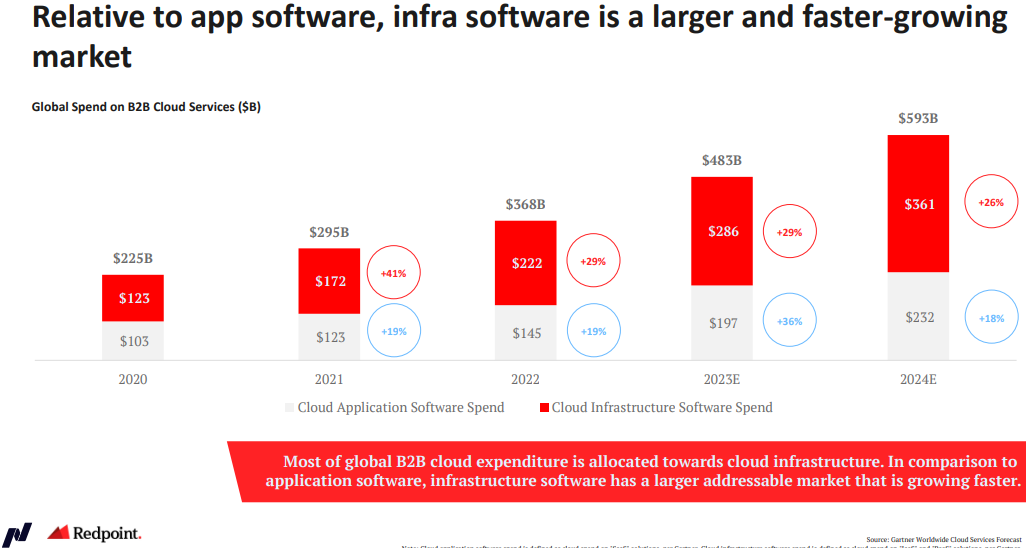

The infrastructure software segment also represents a critical growth area, largely due to the integration of VMware. VMware's contribution has resulted in a massive revenue increase for this segment. This growth reflects Broadcom's successful transition of VMware into a key component of its product lineup, with VMware Cloud Foundation (VCF) seeing a 32% increase in annualized booking value to $2.5 billion. The robust performance in infrastructure software is indicative of the segment's continued expansion and its strategic importance in Broadcom's portfolio. The infrastructure software market revenue may hit $361 billion with 26% YoY growth.

Source: indexes.nasdaqomx.com

B. Expansions and Strategic Initiatives

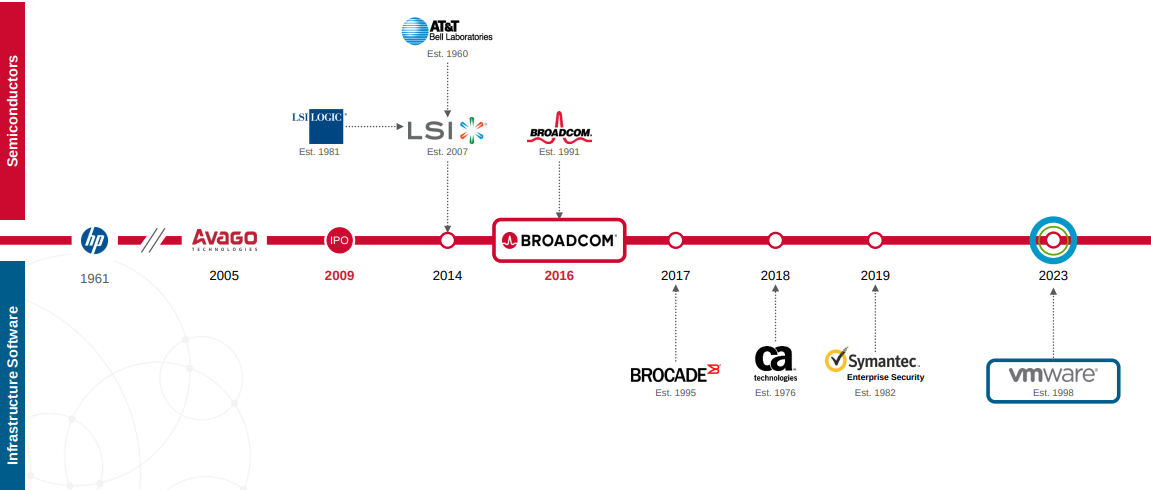

Broadcom's strategic expansion efforts include mergers and acquisitions, research and development investments, and partnerships. The acquisition of VMware has been a cornerstone of Broadcom's strategy, enhancing its software capabilities and driving revenue growth. The successful integration of VMware, including cost reductions and revenue synergies, has positioned Broadcom to exceed its adjusted EBITDA targets for the acquisition within the projected timeline.

Source: Broadcom Inc. Q3'24 Company Overview

Research and development (R&D) remains a focal point for Broadcom, with $1.5 billion allocated in Q3 2024, a notable increase that supports continued innovation in semiconductor and AI technologies. This investment is crucial for maintaining competitive advantages and developing cutting-edge solutions in an evolving tech landscape.

Partnerships, particularly with hyperscalers and leading technology firms, have been instrumental in Broadcom's growth. These collaborations facilitate the deployment of advanced networking and AI solutions, thereby driving demand and expanding market reach.