EURUSD

Fundamental Perspective

The U.S. election results point to a significant economic shift as Donald Trump returns to the presidency with Republican control of the Senate and potentially the House. His platform—focused on tax cuts, deregulation, and protectionist trade policies—promises to impact both the U.S. and global economies.

Anticipated fiscal expansion and tariffs have stirred inflation concerns, leading investors to expect a shift in the Federal Reserve's strategy. Markets foresee fewer rate cuts or even hikes to curb inflation if it rises, which has already boosted bond yields and strengthened the dollar, causing the EUR/USD to dip as low as 1.0681.

In Europe, already grappling with economic stagnation, Trump's trade stance poses additional challenges. European Central Bank officials are concerned that U.S. policies could hamper the EU's recovery, especially in vulnerable economies like Germany and France. This concern adds weight to upcoming European inflation and GDP data, watched closely by investors gauging the Eurozone's resilience.

This week, the U.S. and German inflation releases will be pivotal, likely influencing central bank decisions and shaping market responses as global economic uncertainty grows. Markets brace for a new phase as Trump's policies begin to take effect.

Technical Perspective

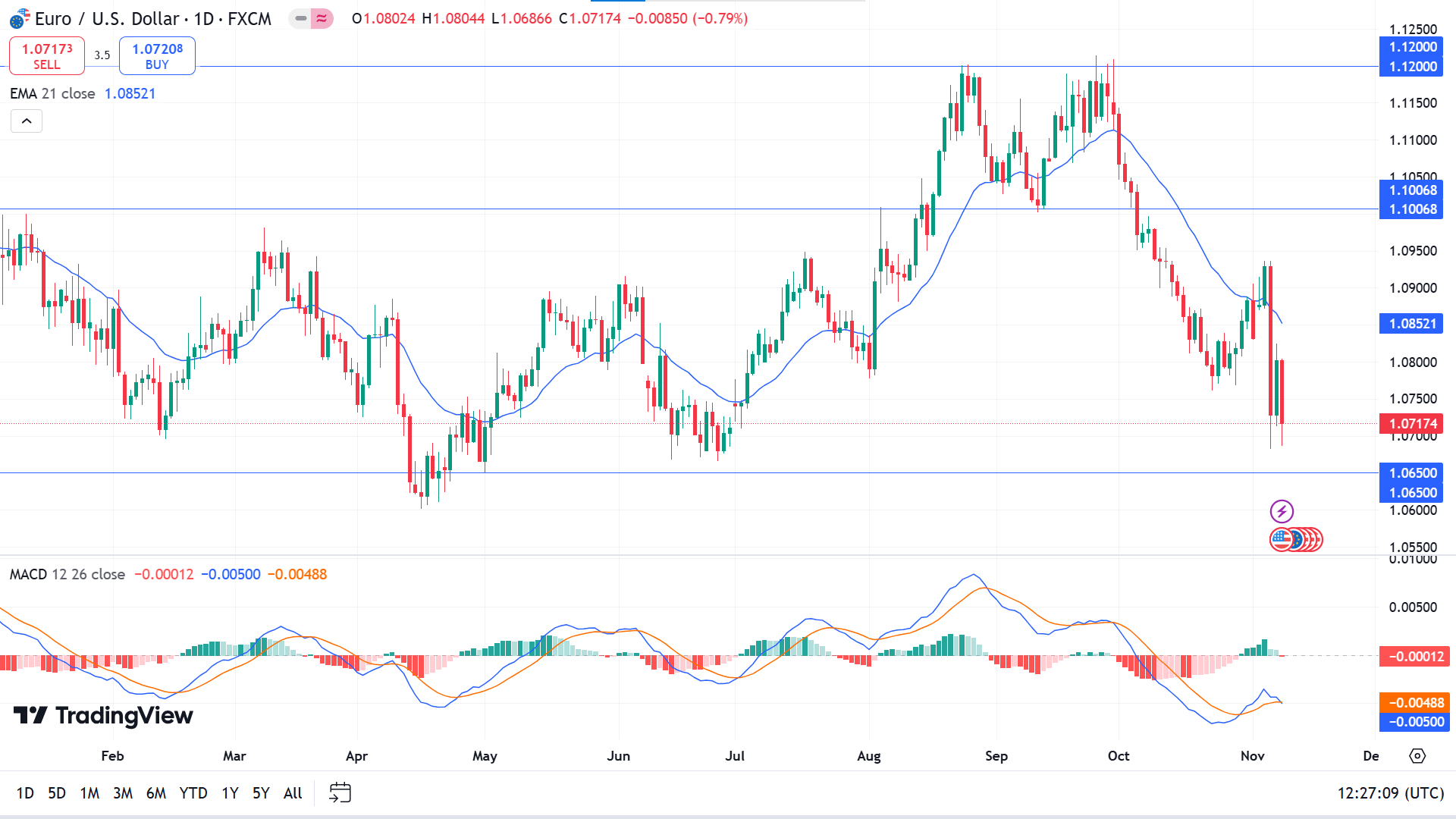

The EURUSD pair continues to decline after a pause as the weekly chart shows after creating a valid double-top pattern.

The pair erases the slight gain from the previous week and continues to decline as it started from 1.1200. The MACD indicator window confirms the bearish pressure as the dynamic signal lines create a fresh bearish crossover and reach below the midline of the indicator window. While the price also remains below the EMA 21 line, confirming the recent bearish pressure.

The current market context suggests that the price may continue to decline and find support from the 1.0650 level before bouncing back to the upside.

On the other hand, a bullish recovery is possible at the 1.0650 level, from where the price may bounce back toward the resistance near the 1.1000 level.