I. Recent Ford Stock Performance

Ford Insider Purchase

According to a recent SEC filing, John Thornton, a Director at Ford Motor Co (NYSE:F), acquired 24,790 company shares on June 6, 2024. This acquisition increases his total ownership to 389,576 shares.

Ford Motor Company, a multinational corporation, is distinguished for its production and distribution of commercial vehicles and automobiles under the Ford brand and prestige vehicles under the Lincoln brand.

Each share was acquired for $12.08, for a total of approximately $299,471.20. This acquisition substantially increased Thornton's stake in the organization.

Insider transactions at Ford Motor Co have been evenly distributed over the past year, with two purchases and two sales. John Thornton has been particularly active, purchasing 24,790 shares.

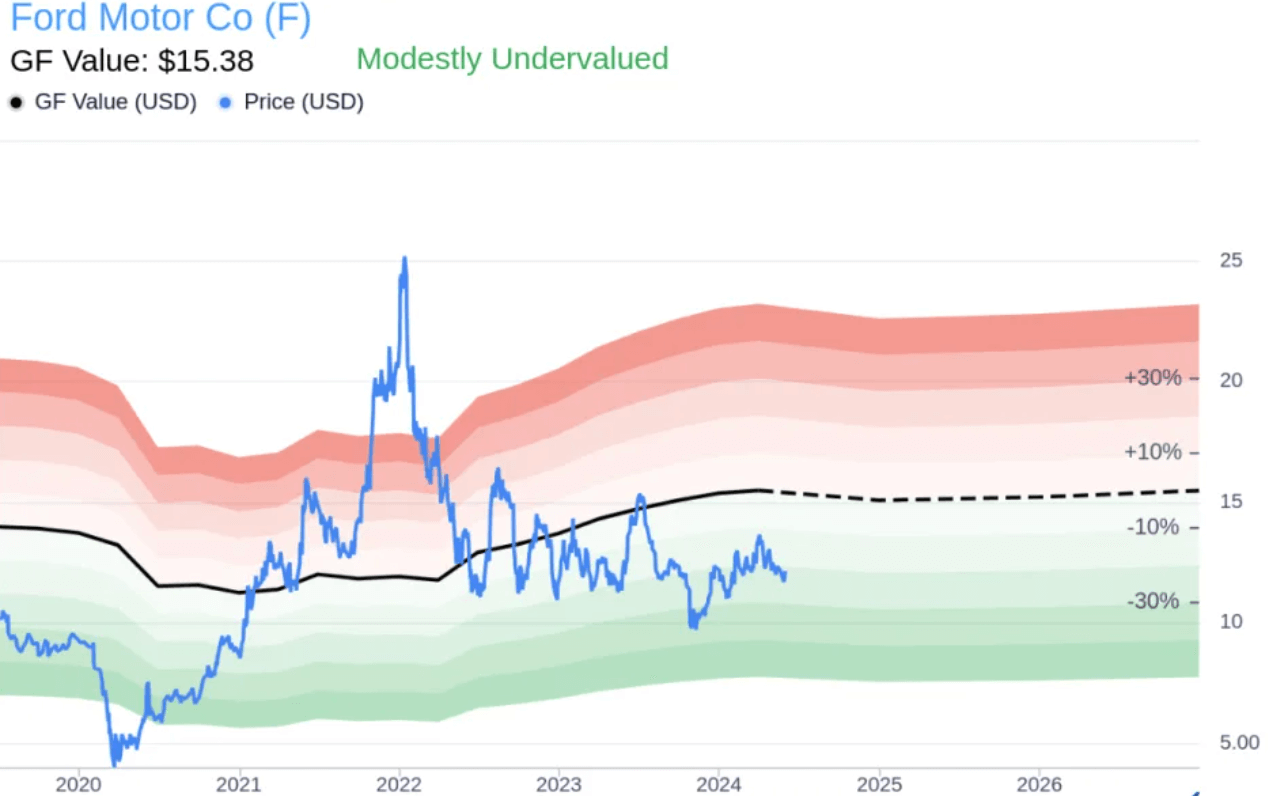

Ford Motor Co. has a price-earnings ratio of 12.53, lower than the industry median of 15.66, and a market cap of $48.51 billion. The price-to-GF-Value ratio of 0.79 suggests that the stock is modestly undervalued, as indicated by the GF Value of $15.38.

The GF Value is calculated by adjusting historical trading multiples for past returns and growth and estimating future business performance.

This insider purchase event may indicate to investors the stock's current price, as the insider's ownership of the company is increasing.

Biden's Fuel Standard Is Good For EV

The Biden administration enhanced vehicle gasoline mileage standards to encourage the adoption of emissions-free electric vehicles in the American automobile industry.

The U.S. Department of Transportation has announced the new standards, which are part of a series of White House regulations intended to motivate car manufacturers to produce more electric vehicles, as the New York Times reported.

The New York Times reported that the Environmental Protection Agency issued stringent new limits on exhaust pollution in April. The goal is to ensure that by 2032, most new passenger cars and light trucks sold in the US are all-electric or hybrids. This represents a substantial increase from the 7.6 percent of vehicles sold last year.

These more stringent measures may impact the stock prices of publicly traded automobile manufacturers developing electric vehicles like Ford.

Expert Insights on Ford Stock Forecast for 2024, 2025, 2030 and Beyond

Ford Stock (F) trades within a tight range since the 2022 bottom, from where a valid breakout is needed before aiming for a stable trend.

Before proceeding to the in-depth F stock forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about Ford stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$12.54 |

$15.69 |

$30.10 |

|

Coincodex |

$14.64 |

$13.00 |

$16.57 |

|

Stockscan |

$11.03 |

$10.28 |

$9.6612 |

|

Tradersunion |

$15.88 |

$18.72 |

$42.6 |

Il. Ford Stock Forecast 2024

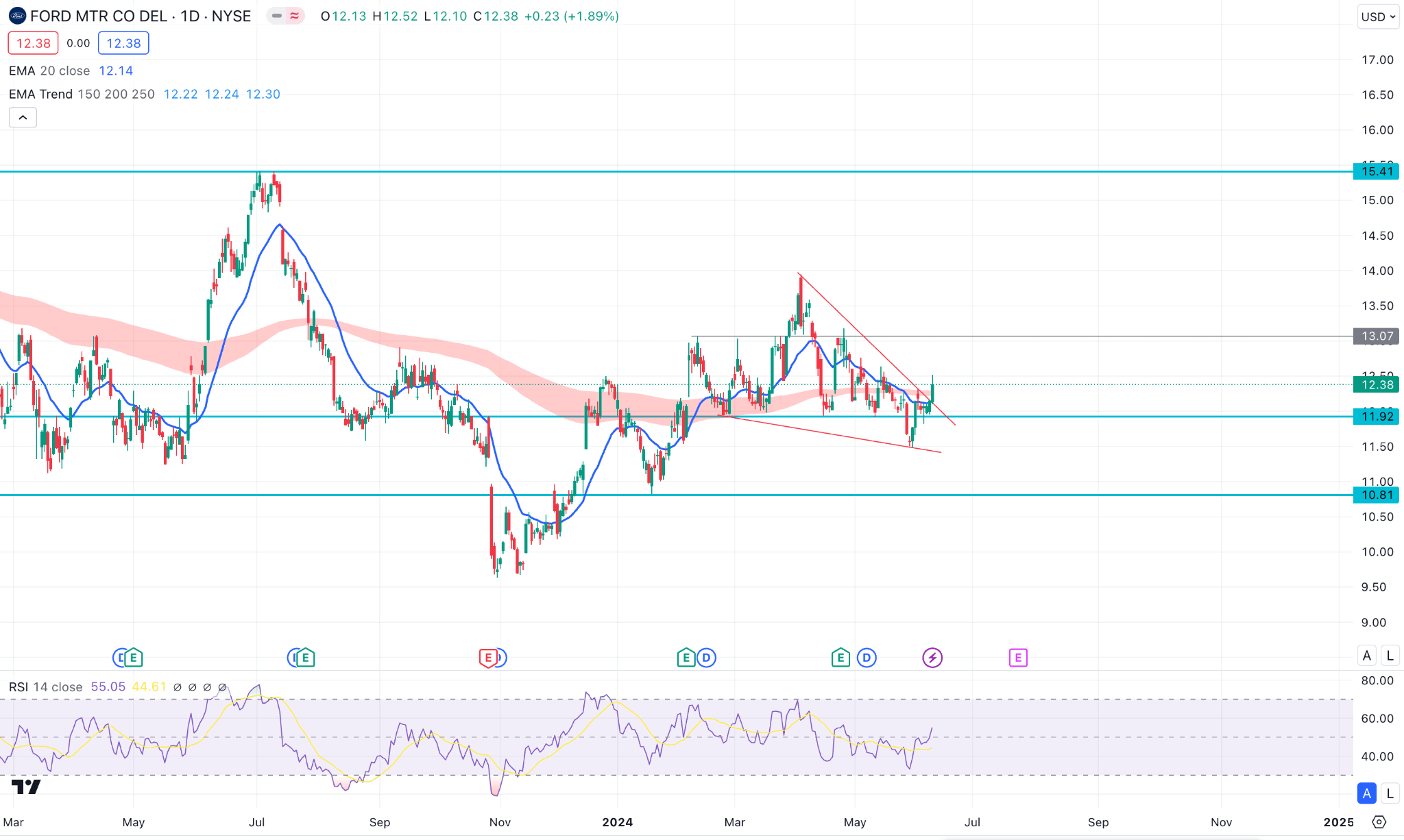

Ford stock (F) has remained sideways recently, creating a potential bullish opportunity from the falling wedge breakout. Considering the ongoing bottom formation, the stock is more likely to reach the 15.41 level by the end of 2024.

In the daily chart, Ford Stock (F) reached a crucial peak at the 15.41 level in 2023, from which a decent recovery came with a 37% discount towards the 9.65 level. Later on, the bottom is validated by making multiple swing highs above the 12.38 level, creating a potential opportunity in the long-term perspective.

Looking at technical indicators, the Moving Average wave consists of MA from 150 to 250, suggesting a minor bullish signal. The most recent price showed a bullish V-shape recovery above the MA wave, while the broader trend is sideways. Moreover, the 20-day Exponential Moving Average is closer to the current price, while the most recent daily candle showed a potential bullish reversal.

In the secondary window, the 14-day Relative Strength Index (RSI) shows the same outlook. The current level hovers above the 50.00 neutral line with a bullish slope.

Based on the Ford Stock Forecast 2024, the ongoing buying pressure is potent, which might take the price towards the 15.00 psychological line. However, a failure to hold the momentum above the 11.92 static line could be a challenging factor for bulls, which might extend the loss toward the 9.50 low.