- Oracle's Q2 2024 financials demonstrate strong growth, primarily driven by cloud services.

- Stock performance reflects resilience, with a 3% increase and positive sentiment, outperforming major indices.

- Growth opportunities lie in OCI, Autonomous Database, SaaS, and IaaS segments, supported by expansions, partnerships, and R&D investments.

- Oracle stock forecast indicates a potential upward momentum to $140, supported by technical and fundamental analyses.

- Market sentiment favors 'Buy,' backed by institutional ownership, though competition and capital expenditure risks present challenges to Oracle's growth trajectory.

I. Oracle Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

Oracle's Q4 fiscal 2024 financial results demonstrate a robust performance across several metrics. The company reported a total revenue of $14.3 billion for the quarter, marking a 3% year-over-year increase in USD and 4% in constant currency. Cloud revenue, comprising Infrastructure as a Service (IaaS) and Software as a Service (SaaS), was a significant driver, growing by 20% to $5.3 billion. Notably, IaaS revenue surged by 42%, while SaaS revenue increased by 10%. Q4 EPS were $1.11 GAAP and $1.63 non-GAAP.

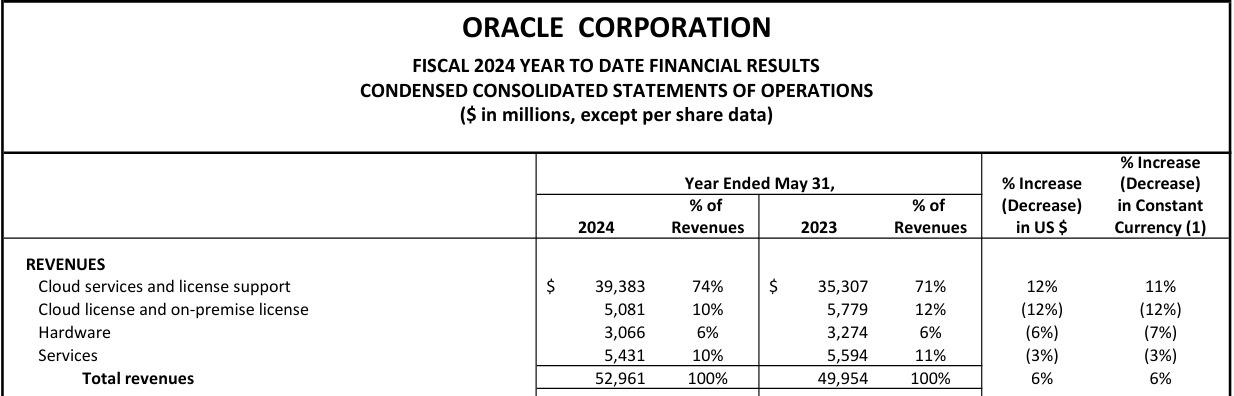

Fiscal year 2024 saw Oracle's total revenue reach $53 billion, a 6% increase from the previous year. The cloud services and license support revenues grew by 12% to $39.4 billion, while cloud license and on-premise license revenues fell by 12% to $5.1 billion. The GAAP operating margin for the year was 29%, and non-GAAP was 44%. Operating cash flow was a healthy $18.7 billion, up 9%, and free cash flow increased by 39% to $11.8 billion.

Source: Q4 2024_Form8K

Operational Performance

Oracle's operational performance was marked by significant advancements and strategic initiatives. The product sales breakdown highlighted the strength in cloud offerings, with IaaS and SaaS revenues being the standout performers. Fusion Cloud ERP and NetSuite Cloud ERP revenues both saw substantial increases, up 14% and 19% respectively, indicating strong market acceptance and growth in these segments.

Furthermore, the company's remaining performance obligations (RPO) surged by 44% YoY to $98 billion, reflecting strong demand for Oracle Cloud services. Approximately 39% of total RPO is expected to be recognized as revenue over the next 12 months, highlighting sustained momentum in bookings and customer adoption.

Technological Advancements and Innovations

Oracle's focus on technological advancements and innovations is evident from its significant investments in research and development (R&D). The company has been actively launching new products and enhancing existing ones to stay ahead in the competitive cloud market. Noteworthy is the development of the Oracle Cloud Infrastructure (OCI) and its increased adoption for AI and large language model training. The partnership with OpenAI, for instance, underscores OCI's capabilities in handling demanding AI workloads efficiently.

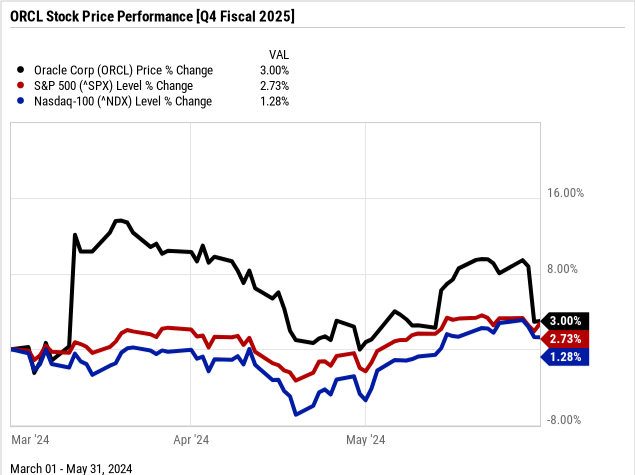

B. ORCL Stock Price Performance

Oracle's (NYSE:ORCL) stock price performance witnessed a 3% increase in the quarter, reflecting resilience amidst market dynamics. Its market capitalization stands at $322 billion. The opening and closing prices of $111.68 and $117.19 respectively signify investor confidence and positive sentiment towards the company. Throughout the quarter, Oracle experienced highs and lows at $132.77 and $110.37, showcasing fluctuations. Comparatively, Oracle outperformed major indices; the S&P 500 and NASDAQ recorded price returns of 2.7% and 1.3%, respectively. This outperformance may be attributed to Oracle's strategic positioning within the technology sector.

Source: Ycharts.com

II. Oracle Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

- Cloud Infrastructure (OCI): Oracle Cloud Infrastructure (OCI) has emerged as a significant growth driver. The demand for OCI, particularly for training large language models and deep learning AI workloads, has surged. This growth is evidenced by Oracle's record sales and contracts, including a $12 billion AI-related contract. OCI's advantages in speed and cost-effectiveness make it a preferred choice for high-profile clients like NVIDIA, Microsoft, Google, and OpenAI.

- Autonomous Database: Oracle's Autonomous Database continues to be a pivotal segment with considerable growth potential. This technology automates routine database management tasks, enhancing performance, security, and efficiency. With an annualized revenue of $2 billion, the Autonomous Database segment is poised for further expansion as more on-premise databases migrate to the cloud.

- Cloud Applications (SaaS): Oracle's strategic cloud applications, particularly its Fusion and NetSuite suites, are integral to its growth strategy. The company's Fusion applications, which facilitate business process reengineering, are witnessing increased adoption. A notable example includes a $600 million contract with a large enterprise tech company aimed at operational transformation. SaaS revenues, excluding Cerner, grew by 13% to $10.4 billion, underscoring the robust demand for these solutions.

- Infrastructure as a Service (IaaS): The IaaS segment saw a remarkable 42% revenue growth, driven by OCI Gen2 infrastructure cloud services. As Oracle continues to expand its cloud regions and enhance capacity, the IaaS segment is expected to maintain its strong growth trajectory.

B. Expansions and Strategic Initiatives

- Mergers and Acquisitions: The acquisition of Cerner, a leading healthcare technology company, highlights Oracle's commitment to expanding its footprint in the healthcare sector. Although Oracle will no longer break out Cerner's results, the acquisition is expected to contribute to modest growth in revenue and operating margins.

- Partnerships and Collaborations: Strategic partnerships are central to Oracle's growth strategy. The multi-cloud partnership with Google, which integrates OCI with Google Cloud's network, exemplifies this approach. This collaboration allows customers to access Oracle Database Services on Google Cloud, offering a flexible and integrated cloud solution. Additionally, Oracle's partnership with Microsoft for Azure Oracle Interconnect demonstrates its commitment to providing multi-cloud solutions.

- Expansion of Cloud Regions: Oracle's aggressive expansion of its cloud infrastructure is a key growth driver. The company has 76 customer-facing cloud regions live, with plans for an additional 19 public cloud regions, 15 dedicated regions, and multiple national security and EU sovereign regions. This expansion is critical to meeting the growing demand for cloud services and enhancing global accessibility.