- Adobe achieved record revenue in Q2 fiscal 2024, showing a 10% year-over-year growth.

- Adobe's integration of AI, including the Firefly generative AI models, has significantly enhanced its product offerings.

- Adobe stock is projected to increase moderately by the end of 2024, with mixed signals from technical indicators.

- Strong market sentiment, high institutional ownership, and favorable analyst ratings suggest a positive outlook for Adobe stock.

- Adobe faces competition from companies like Corel, DocuSign, and Salesforce, along with risks related to technological innovation and regulatory challenges.

I. Adobe Q2 2024 Performance Analysis

A. Key Segments Performance

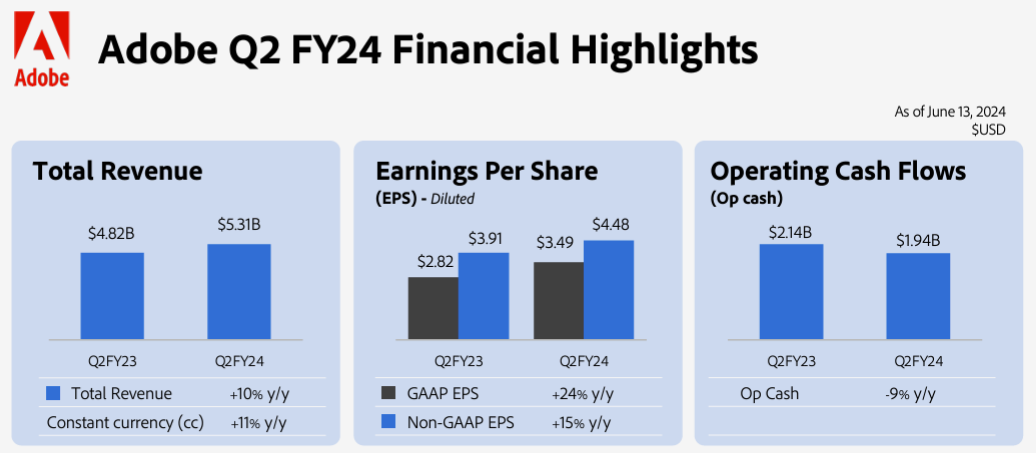

Financial Highlights

Adobe reported record revenue of $5.31 billion for Q2 fiscal 2024, marking a 10% year-over-year growth, or 11% in constant currency terms. GAAP diluted earnings per share (EPS) were $3.49, while non-GAAP EPS stood at $4.48, showing a 15% year-over-year increase. The company's GAAP operating income was $1.89 billion, and its non-GAAP operating income was $2.44 billion. Net income on a GAAP basis was $1.57 billion, with a non-GAAP net income of $2.02 billion. Cash flows from operations totaled $1.94 billion, and Adobe repurchased approximately 4.6 million shares during the quarter.

Source: Q2 2024 Investor Datasheet

Operational Performance

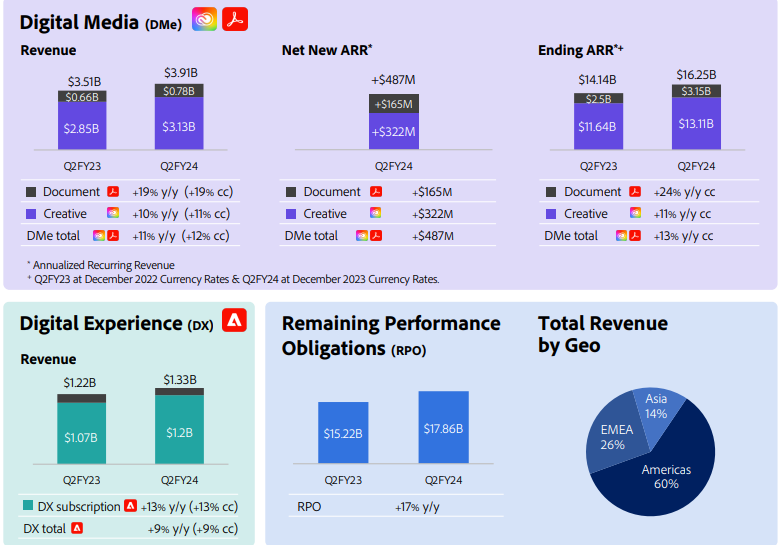

Digital Media Segment: This segment generated $3.91 billion in revenue, an 11% increase year-over-year (12% in constant currency). Within this segment, Creative revenue rose to $3.13 billion, a 10% year-over-year increase (11% in constant currency), and Document Cloud revenue surged by 19% to $782 million. The segment's Annualized Recurring Revenue (ARR) grew to $16.25 billion, with a net new ARR of $487 million.

Digital Experience Segment: This segment reported $1.33 billion in revenue, reflecting a 9% year-over-year growth. Subscription revenue within this segment was $1.20 billion, a 13% increase year-over-year.

Source: Q2 2024 Investor Datasheet

Technological Advancements and Innovations

Adobe's focus on AI and product innovation has been pivotal. The company has integrated AI capabilities across its offerings, such as the Firefly family of creative generative AI models within Creative Cloud tools like Photoshop and Illustrator. Firefly has generated over 9 billion images, underscoring its popularity and utility. In Document Cloud, the Acrobat AI Assistant enhances document productivity by enabling conversational interactions with PDFs, significantly improving workflow efficiency.

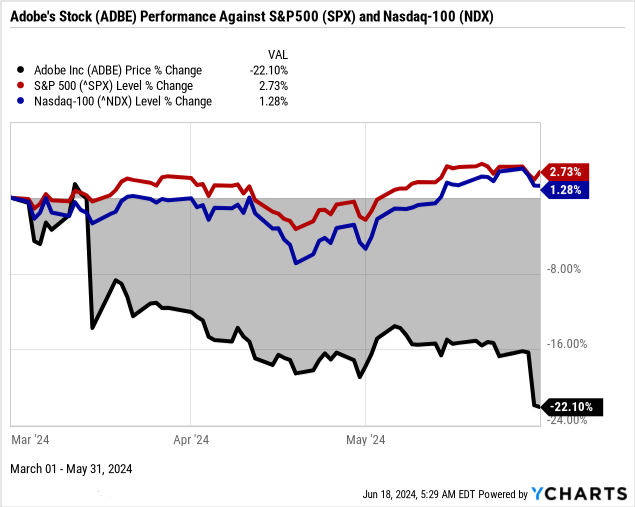

B. ADBE Stock Price Performance

Adobe's (NASDAQ: ADBE) stock performance over the quarter has been notably poor, with a significant decline of 22.1% from its opening price of $561.11 to a closing price of $444.76. This contrasts starkly with the broader market indices, as the S&P 500 saw a modest gain of 2.7% and the NASDAQ 100 increased by 1.3%. Adobe's high of $585.35 and low of $433.97 during the quarter indicate substantial volatility. Despite a market capitalization of $199.25 billion, the steep drop in Adobe's stock suggests underlying issues or market concerns.

Source: Ycharts.com

II. Adobe Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

Adobe's fiscal 2024 outlook highlights robust growth expectations across its key segments: Digital Media and Digital Experience. These segments are poised to capitalize on innovative technologies and strategic expansions to drive future revenues.

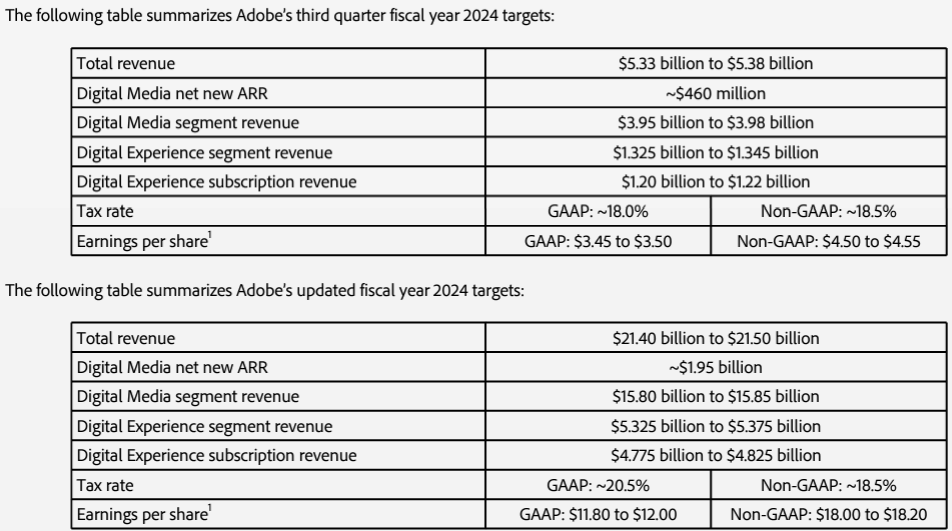

Source: Q2 2024 Earnings

Digital Media Segment:

Creative Cloud: Expected revenue of $3.95 billion to $3.98 billion for Q3 fiscal 2024, with continued growth driven by new AI features like Firefly. Net new ARR target approximately $460 million, reflecting sustained customer acquisition and retention. Adobe's Creative Cloud suite, including flagship applications like Photoshop, Illustrator, and Premiere, is continually enhanced with new features powered by generative AI (e.g., Firefly models). The expansion of Adobe Express, which simplifies design for communicators using AI, is also driving significant user growth. The integration of AI tools like Generative Fill and Text to Vector in these applications is anticipated to attract more users and drive higher subscription rates.

Document Cloud: Projected revenue growth to $1.20 billion to $1.22 billion for Q3 fiscal 2024, fueled by Acrobat AI Assistant's adoption. Achieved $782 million in Q2 fiscal 2024, marking a 19% year-over-year increase. The PDF format continues to be a global standard for documents. Innovations like Acrobat AI Assistant, which leverages AI for tasks such as document summarization and data extraction, significantly enhance productivity. The broad adoption of Acrobat across different platforms (desktop, web, mobile) and its integration into business workflows contribute to steady growth.

Digital Experience Segment:

Adobe Experience Platform (AEP): Revenue target of $1.325 billion to $1.345 billion for Q3 fiscal 2024, with subscription revenue reaching $1.20 billion to $1.22 billion. AEP innovations driving 60% year-over-year growth in subscription revenue in Q2 fiscal 2024. The Adobe Experience Platform (AEP) celebrated its fifth anniversary and continues to grow, with new AI-powered features like AEP AI Assistant enhancing marketing productivity. Adobe's technological achievements include the launch of Adobe Express as an AI-first application and the integration of AI capabilities in various products, facilitating greater user engagement and operational efficiency.

B. Expansions and Strategic Initiatives

Adobe's growth strategy for fiscal 2024 includes significant investments in AI, strategic acquisitions, and partnerships to expand market reach and enhance product offerings.

Mergers and Acquisitions:

Adobe has a history of strategic acquisitions to bolster its product portfolio and market position. Acquisitions like Magento for e-commerce capabilities and Workfront for project management have expanded Adobe's reach into new markets and enhanced its existing offerings.

Research and Development Investments:

Adobe's commitment to R&D is evident in its continuous roll-out of innovative features across its product suite. Significant investments are directed towards AI and machine learning, as demonstrated by the development of the Firefly family of creative generative AI models and the Acrobat AI Assistant.

Partnerships and Collaborations:

Strategic partnerships enhance Adobe's ecosystem and expand its market reach. Collaborations with major tech companies, such as Microsoft for integrating Adobe Sign into Office 365, boost Adobe's visibility and adoption. Other key partnerships with major companies such as AstraZeneca, Chevron, and FedEx have bolstered Adobe's market share and operational effectiveness.

Geographic Expansion:

Adobe is focused on expanding its presence in emerging markets. The growth of Creative Cloud and Document Cloud subscriptions in regions like Asia-Pacific and Latin America presents significant revenue opportunities. Localization of products and targeted marketing campaigns are key strategies in these regions.