I. Recent ASML Stock Performance

Recent ASML stock price performance and changes

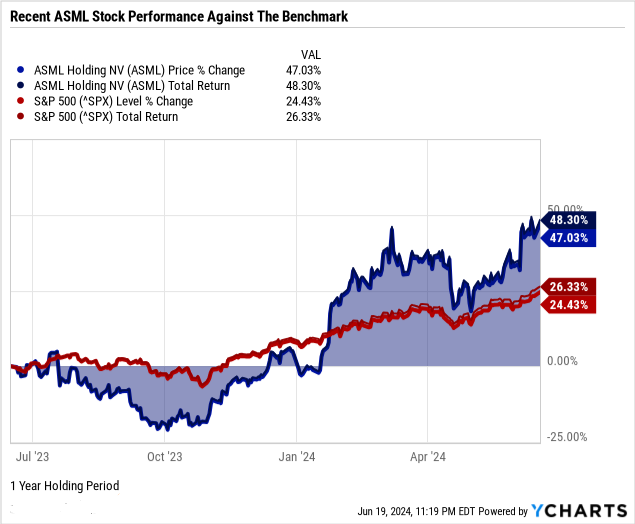

ASML Holding NV (NASDAQ: ASML), a key supplier to the semiconductor industry, has demonstrated remarkable stock performance in recent periods. With a market cap of $415 billion, ASML's stock price has shown significant upward momentum. Over the past 52 weeks, its stock has fluctuated between $564 and $1,077.22, indicating substantial volatility and potential for high returns.

In the last six months, ASML's stock price increased by an impressive 43%, compared to the S&P 500's 15.8%. Year-to-date, the stock has appreciated by 40.2%, nearly tripling the S&P 500's 15% gain. Over the past year, ASML stock has climbed by 47%, versus the S&P 500's 24.4%.

Source: Ycharts.com

Over three and five years, ASML has delivered returns of 58.2% and 445.1%, respectively, vastly outperforming the S&P 500's 31.7% and 88.1%. Over the past ten years, ASML's stock has skyrocketed by 1,038%, compared to the S&P 500's 180%. Including dividends, ASML's total return is 1,150% against S&P500's 238%, underscoring its exceptional long-term performance. ASML's robust performance reflects its critical role in the semiconductor industry and investor confidence in its growth prospects amid increasing demand for advanced lithography equipment.

Recent ASML Stock Performance: Influencing Factors

Several key factors have influenced the recent stock performance of ASML.

Financial Performance:

- Q1 2024 Results: ASML reported total net sales of €5.3 billion and a net income of €1.2 billion. The gross margin was 51%, exceeding the guidance due to favorable product mix and one-off items. These robust results likely bolstered investor confidence, positively impacting the stock.

Technological Advancements:

- EUV and High NA Systems: ASML's shipment of 12 EUV systems, recognizing €1.8 billion in revenue, and advancements in high numerical aperture (High NA) systems underline its technological leadership. These innovations are crucial for semiconductor manufacturing, driving future revenue growth and market share.

Market Dynamics:

- Semiconductor Industry Recovery: The broader semiconductor industry's recovery from the downturn, with improving inventory levels and tool utilization rates, has positively impacted ASML. The expectation of a stronger second half of 2024 aligns with industry trends, suggesting a favorable operating environment.

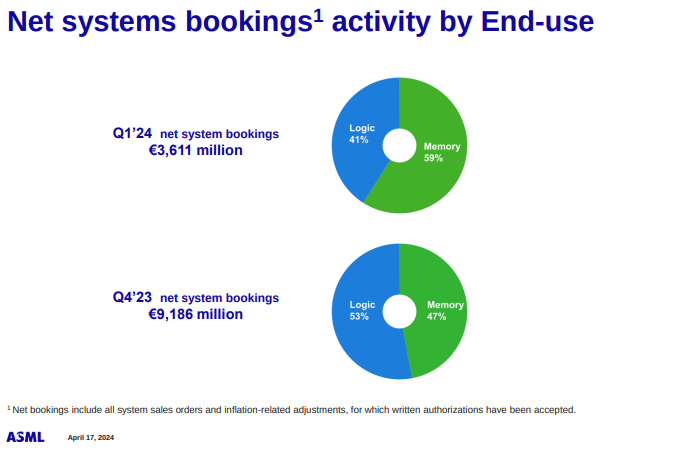

- Demand Drivers: Increasing demand for advanced memory technologies (DRAM, DDR5, HBM) and AI-related applications supports ASML's growth prospects. Memory and logic segments contribute significantly to its revenue, with ongoing transitions to advanced nodes driving future demand.

Source: Presentation Investor Relations Q1 2024

Strategic Initiatives:

- Dividend and Share Buyback: The announcement of a 5.2% increase in the total dividend for 2023 and a share buyback program worth €400 million demonstrate ASML's commitment to returning value to shareholders. These initiatives likely enhance investor sentiment and support stock performance.

Macroeconomic Factors:

- Geopolitical and Economic Conditions: ASML's performance is also influenced by global economic trends, including semiconductor supply chain dynamics and geopolitical factors affecting tech supply and demand. While uncertainties remain, ASML's strong backlog and strategic investments position it well for future growth.

Expert Insights on ASML Stock Forecast for 2024, 2025, 2030 and Beyond

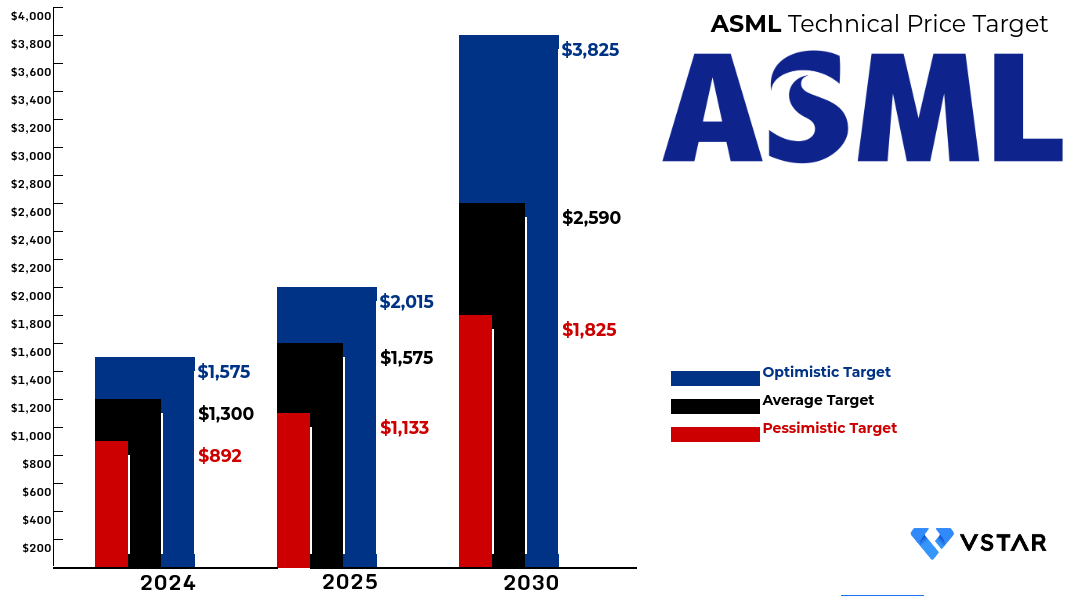

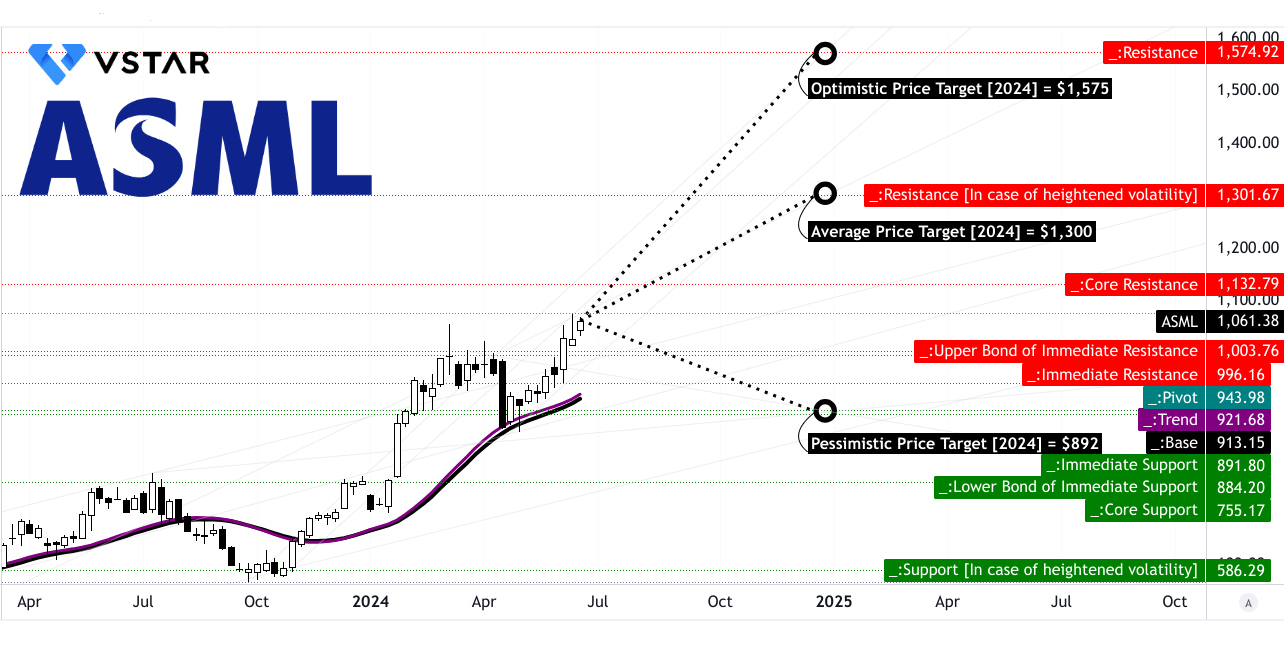

Technical insights on ASML stock forecast indicate a range of potential outcomes. For 2024, projections span from a pessimistic $892.00 to an optimistic $1,575.00, reflecting uncertainties in the semiconductor market and macroeconomic conditions. By 2025, forecasts suggest a more optimistic range, with the stock potentially reaching $2,015.00 or dipping to $1,133.00 in less favorable scenarios. Long-term projections for 2030 show a broader spread, from $1,825.00 to $3,825.00, highlighting both the company's growth potential and the inherent risks in the rapidly evolving tech sector.

Source: Analyst's compilation

II. ASML Stock Forecast 2024

Based on the technical analysis, by the end of 2024, the average ASML stock price target is $1,300.00, driven by the momentum observed in short-term price movements and projected through Fibonacci extension levels. In an optimistic scenario, the price could reach $1,575.00, reflecting a strong upward price momentum of the current swing. However, in a pessimistic scenario, the price might drop to $892.00 if downward momentum takes over, as projected by Fibonacci retracement levels.

The current stock price is $1,061.38, and the technical indicators suggest a robust upward trend. ASML stock price is currently trending upward, with the trendline at $921.68 and the baseline at $913.15, both derived from a modified exponential moving average.

Support and Resistance Levels: The primary support level is identified at $1,003.76, with a core support at $755.17. In case of heightened volatility, support is pegged at $884.20. Resistance levels are significant at $1,132.79 (core resistance) and $1,301.67 (in case of heightened volatility). The pivot of the current horizontal price channel is at $943.98, suggesting a strong foundation for upward movement if the price breaks above these resistance levels.

Source: tradingview.com

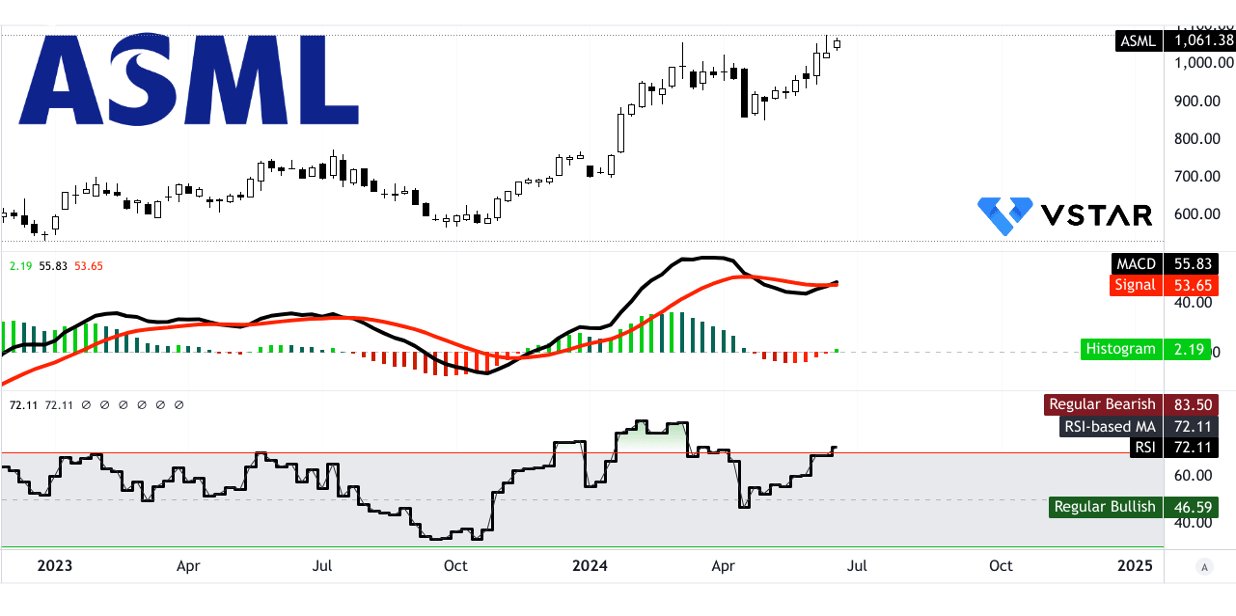

Relative Strength Index (RSI): The RSI is at 72.11, which is in the overbought territory but not at extreme levels. This indicates strong buying momentum, though the stock is nearing a potential overbought condition, warranting close monitoring for any signs of reversal.

Moving Average Convergence/Divergence (MACD): The MACD line at 55.83 and the signal line at 53.65, with a histogram reading of 2.19, all point to a bullish trend. The increasing strength of the trend is evident from the MACD indicator, reinforcing the forecast of a potential rise in the stock price.

Source: tradingview.com

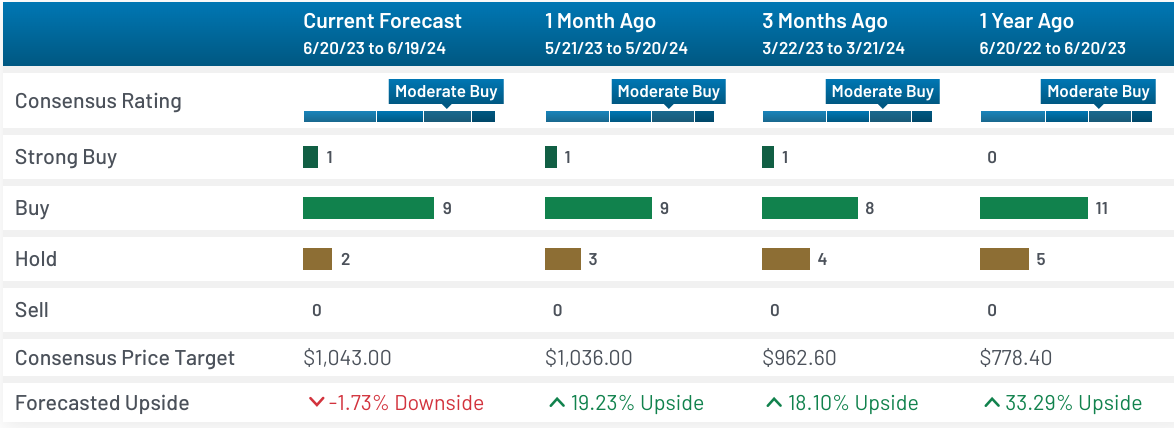

The ASML stock forecast in 2024 presents varying perspectives from different sources, reflecting both optimism and caution among analysts. According to tipranks.com, the average ASML price target is $1,102.25, suggesting a modest 3.85% increase from the current price of $1,061.38. This indicates a relatively conservative outlook with a narrow potential upside. Similarly, as per stockanalysis.com, the average ASML price target is $1,043, suggesting a slight -1.73% drop from the current price of $1,061.38.

Source: stockanalysis.com

In contrast, coinpriceforecast.com provides a more bullish long-term projection, predicting ASML to potentially reach $1,200 by the end of 2024, implying an 18% increase from mid-year 2024 levels. This outlook is notably more optimistic, driven by expectations of sustained growth and market conditions favoring the company.

Marketbeat.com aggregates various analyst opinions, showing a consensus rating of "Moderate Buy" with price targets ranging from $778.40 (reflecting a bullish 33.29% upside potential from a year ago) to $1,043.00. This range highlights the divergence in analyst sentiment, with some expecting substantial growth and others more conservative in their estimates.

Source: marketbeat.com

A. Other ASML Stock Forecast 2024 Insights

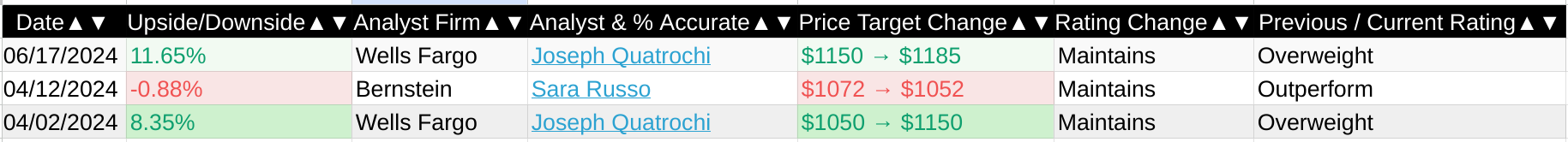

Several financial institutions have provided their insights and projections for ASML's stock performance in 2024. Wells Fargo, through analyst Joseph Quatrochi, has maintained an "Overweight" rating on ASML, suggesting a positive outlook on the stock. Quatrochi's price target for ASML has seen an upward revision twice this year: from $1050 to $1150 in early April, and further to $1185 in mid-June, reflecting an 11.65% upside. These revisions indicate strong confidence in ASML's growth potential and market position.

In contrast, Bernstein's analyst Sara Russo has also maintained a positive "Outperform" rating on ASML but has slightly adjusted the price target downward. In April, Russo revised the ASML stock price target from $1072 to $1052, indicating a modest downside of -0.88%. This adjustment may reflect a more cautious approach, possibly considering the external challenges that could impact the semiconductor industry and ASML's performance.

Source: benzinga.com

B. Key Factors to Watch for ASML Stock Prediction 2024

ASML Forecast 2024 - Bullish Factors

Outlook: The company's guidance for Q2 2024 anticipates net sales between €5.7 billion and €6.2 billion with a gross margin of 50-51%. Maintaining its 2024 outlook similar to 2023 signals stability and confidence in its market position, reassuring investors amidst industry volatility.

Industry Recovery: The semiconductor industry is expected to recover in the latter half of 2024, driven by increased demand for advanced technologies. ASML is well-positioned to capitalize on this recovery, supported by its technological innovations and customer demand for advanced lithography tools.

ASML Stock Price Forecast 2024 - Bearish Factors

Economic Uncertainty: Global macroeconomic conditions, including inflationary pressures and potential economic slowdowns, could impact ASML's financial performance. Reduced capital expenditures by semiconductor manufacturers due to economic uncertainty could affect ASML's order inflow and revenue.

Supply Chain Challenges: Ongoing supply chain disruptions pose risks to ASML's production and delivery timelines. Delays in component availability or logistical challenges could hinder the company's ability to meet its delivery schedules, impacting revenue and profitability.