EURUSD

Fundamental Perspective

Recent movements in the EURUSD exchange rate highlight a complex interplay of economic data, geopolitical tensions, and market sentiment. The USD has maintained its strength, driven by safe-haven demand amid geopolitical concerns, notably Russia's remarks on nuclear doctrine and arms supply. US economic indicators present a mixed picture, with weak retail sales and building permits offset by stronger industrial production and capacity utilization. This mixed economic outlook has been further influenced by initial jobless claims and the Philadelphia Fed Manufacturing Survey falling below expectations.

Federal Reserve officials have adopted a hawkish tone, emphasizing concerns about inflation and tempering expectations for interest rate cuts. This stance has provided additional support to the USD, even as market participants await clearer signals on the direction of monetary policy. The anticipation of the US PCE Price Index and other key economic data points adds to the cautious market sentiment.

Economic data in the Eurozone has been equally ambivalent. While inflation figures have aligned with expectations, the German ZEW survey and the EU Composite PMI reveal underlying economic challenges. The HCOB PMIs further indicate stagnation in business activity, particularly within the manufacturing sector, signaling ongoing struggles in the region's economic recovery.

Critical data releases such as US Durable Goods Orders, Consumer Confidence, the Q1 GDP final estimate, the German IFO Business Climate index, the GfK Consumer Confidence Survey, and Retail Sales will be closely scrutinized. Significant deviations from expectations, especially in inflation metrics or Fed commentary, could provoke further volatility in the EUR/USD exchange rate.

EURUSD Forecast Technical Perspective

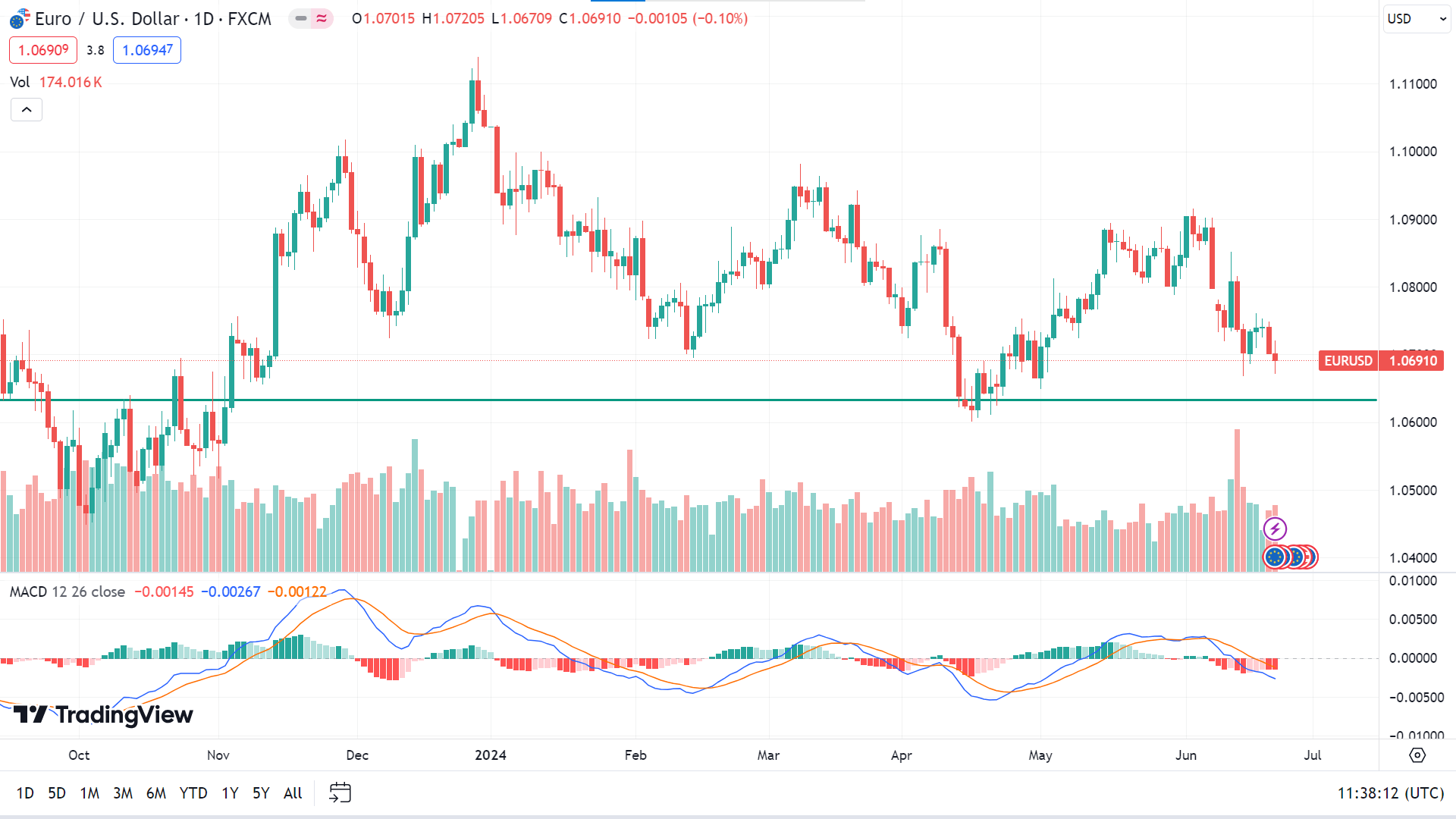

The last weekly candle closed as a hammer with a long upper wick and a small lower wick. The currency pair posted three consecutive losing weeks, leaving optimism that the next candle can be another red one.

On the daily chart, the price continues to decline; looking at the MACD indicator reading, it remains in negative territory. The price may head toward the nearest support of $1.0601, followed by the next support near $1.0500.

On the positive side, any pause in the current trend may cause a price surge toward the primary resistance of $1.0811, followed by the next near $1.0916.