- Carnival Corporation reported record Q2 2024 financial performance with $5.8 billion in revenue and a significant increase in net income.

- Strategic partnerships and the rollout of SpaceX's Starlink enhanced Carnival's operational success and guest experience.

- Carnival's growth potential is strong in North American and European markets, luxury segments, and new demographics.

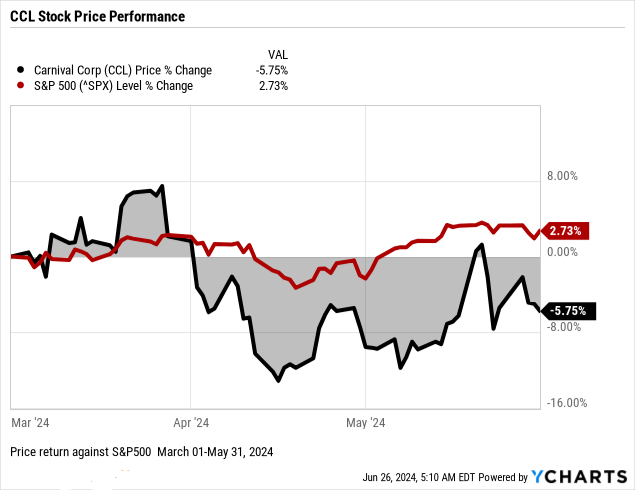

- Technical analysis suggests an average end-of-2024 price target for Carnival (CCL) stock of $23.80, reflecting potential for substantial gains.

I. Carnival Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights:

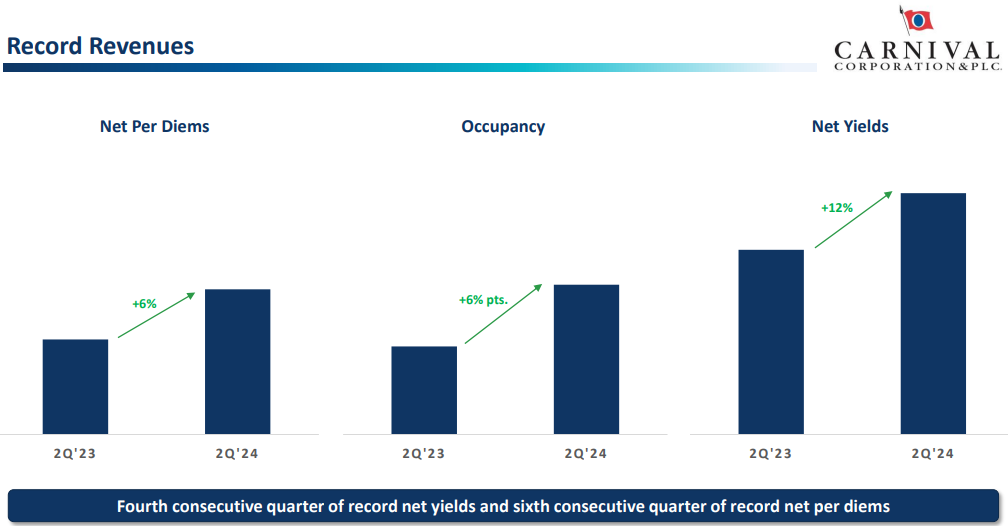

Carnival Corporation (NYSE) reported record financial performance for Q2 2024, showcasing significant growth across various financial metrics. The company achieved record revenues of $5.8 billion, reflecting strong demand and higher ticket prices. Net income saw an impressive increase to $92 million, up nearly $500 million from the previous year, with adjusted net income reaching $134 million, exceeding the March guidance by $170 million. EPS was reported at $0.07, with adjusted EPS at $0.11.

Source: Q2 2024 Earnings Presentation

Operating income reached a record $560 million, a fivefold increase from 2023, while adjusted EBITDA rose over 75% to $1.2 billion. Gross margin yields increased by nearly 50%, and net yields in constant currency exceeded 2023 levels by over 12%. Carnival's balance sheet showed robust health, with customer deposits hitting an all-time high of $8.3 billion, surpassing the previous record by $1.1 billion. Cash flow from operations was $2.0 billion, and adjusted free cash flow was $1.3 billion, reflecting strong operational execution.

Operational Performance:

Carnival reported increased passenger cruise days and higher onboard spending, contributing to the overall revenue growth. Market share remained strong across key regions, with particularly notable performance in the European and North American markets. Strategic portfolio optimization included the decision to sunset the P&O Cruises (Australia) brand, folding its operations into Carnival Cruise Line, which is expected to enhance operational efficiencies and strengthen performance in the South Pacific.

Technological Advancements and Innovations:

The installation of SpaceX's Starlink transformed the onboard connectivity experience, providing high-speed WiFi comparable to land-based services. This upgrade not only enhanced the guest experience but also improved crew communication and operational systems.

Source: Source: Q2 2024 Earnings Presentation

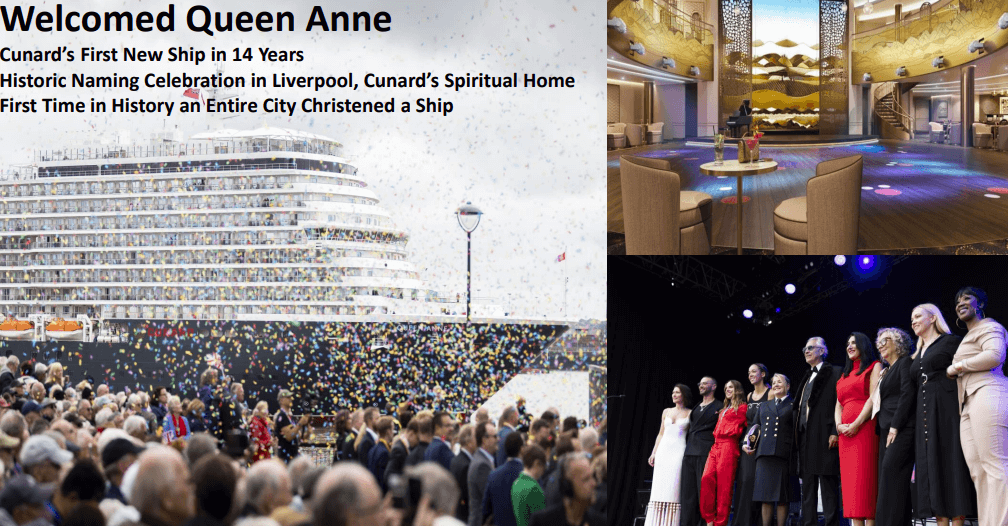

The launch of new products, such as the Queen Anne by Cunard, further highlighted Carnival's focus on innovation. The Queen Anne, Cunard's first new ship in 14 years, received record-breaking bookings following its launch, demonstrating strong market reception.

B. CCL Stock Price Performance

Carnival's Q2 2024 performance highlights a notable stock price decline, contrasting with broader market trends. The stock opened at $15.90 and closed at $15.08, marking a 5.8% decrease. Within the quarter, it experienced a high of $17.68 and a low of $13.80, indicating significant volatility. This performance is starkly different from the S&P 500, which saw a 2.7% price return, underscoring Carnival's underperformance relative to the market. The company's market capitalization stands at $20 billion, reflecting its substantial size.

Source:Ycharts.com

II. CCL Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

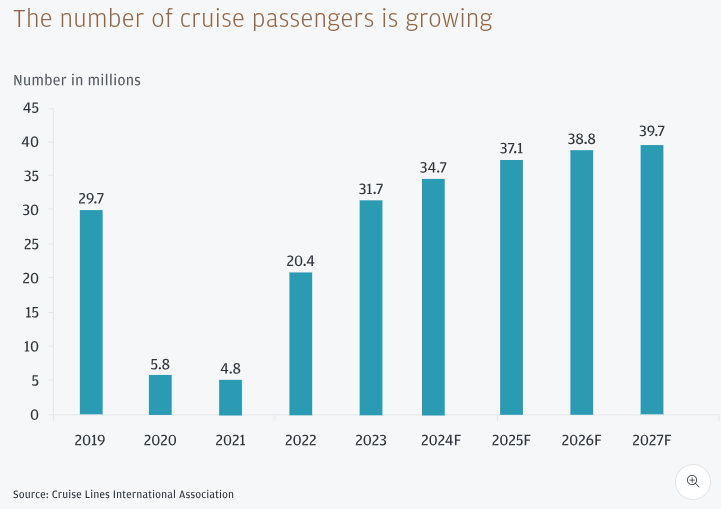

North American and European Markets: Carnival's North American and European segments have shown remarkable yield improvements. In Q2 2024, European brands experienced over 20% yield improvement, while North America saw a healthy 7% rise. These regions are crucial for Carnival's revenue growth due to their strong demand and high occupancy rates. Overall, cruise passengers count is expected to expand constantly.

Source: jpmorgan.com

Luxury and Premium Segments: Carnival's luxury and premium brands, such as Cunard and Seabourn, continue to attract high-end travelers. The successful launch of Cunard's Queen Anne and its associated high booking rates demonstrate the strength of this segment. The premium segment offers higher margins and enhanced revenue per passenger, which is vital for profitability.

B. Expansions and Strategic Initiatives

Mergers and Acquisitions: Carnival's strategic mergers and acquisitions have been instrumental in expanding its fleet and market presence. For instance, the acquisition of ships from Costa Cruises and the integration of P&O Australia's vessels into Carnival Cruise Line highlight the company's focus on optimizing its fleet and enhancing operational efficiency.

Research and Development Investments: Carnival's commitment to innovation is evident through its investments in research and development. The introduction of new, technologically advanced ships like the Sun Princess, which boasts unique features and experiences, showcases Carnival's dedication to enhancing passenger experience.

Partnerships and Collaborations: Strategic partnerships and collaborations play a pivotal role in Carnival's growth strategy. For example, the collaboration with Tesla for the development of energy-efficient technologies underscores Carnival's focus on sustainability.

Destination Development: Carnival's investment in developing exclusive destinations, such as Celebration Key, is a significant growth driver. These destinations provide unique experiences that attract more passengers and increase revenue through higher ticket prices and onboard spending. Celebration Key is set to support growth from 2025, with 18 ships expected to call there by 2026, enhancing Carnival's competitive edge.