EURUSD

Fundamental Perspective

The EURUSD pair traded steadily around 1.0700 throughout the week, showing little reaction even after releasing the US Personal Consumption Expenditures (PCE) Price Index. The Federal Reserve's preferred inflation gauge met expectations, with the annual rate dipping to 2.6% in May from 2.7% in April and the monthly reading hitting the forecast of 0.0%. Core annual inflation was 2.6%, while the monthly core PCE Price Index increased by 0.1%. Although these figures initially caused the US Dollar to lose some ground, it quickly regained stability at around 1.0700 against the Euro.

Market sentiment leaned towards caution due to political uncertainties in the Eurozone, notably in France, ahead of upcoming snap elections. The Federal Reserve's hawkish stance contrasted sharply with the more dovish approaches of the European Central Bank (ECB) and the Bank of Canada, both of which have started easing monetary policies. The Fed seems determined to delay interest rate cuts, with recent comments suggesting only one 25 basis points cut this year. Meanwhile, Germany's economic data, including a contraction in the IFO Business Climate Survey and declining consumer confidence, further limited the Euro's appeal.

Across the Atlantic, the US economy showed resilience, with GDP growth for the first quarter slightly exceeding initial estimates at an annualized rate of 1.4% and Durable Goods Orders increasing by 0.1% in May. As markets await significant data releases next week, including Germany and Eurozone inflation figures and various US employment reports, the insights from Fed and ECB leaders at the ECB Forum on Central Banking will be crucial. These developments are poised to offer further direction for the EUR/USD pair, which has remained within familiar levels amidst the ongoing macroeconomic uncertainties.

EURUSD Forecast Technical Perspective

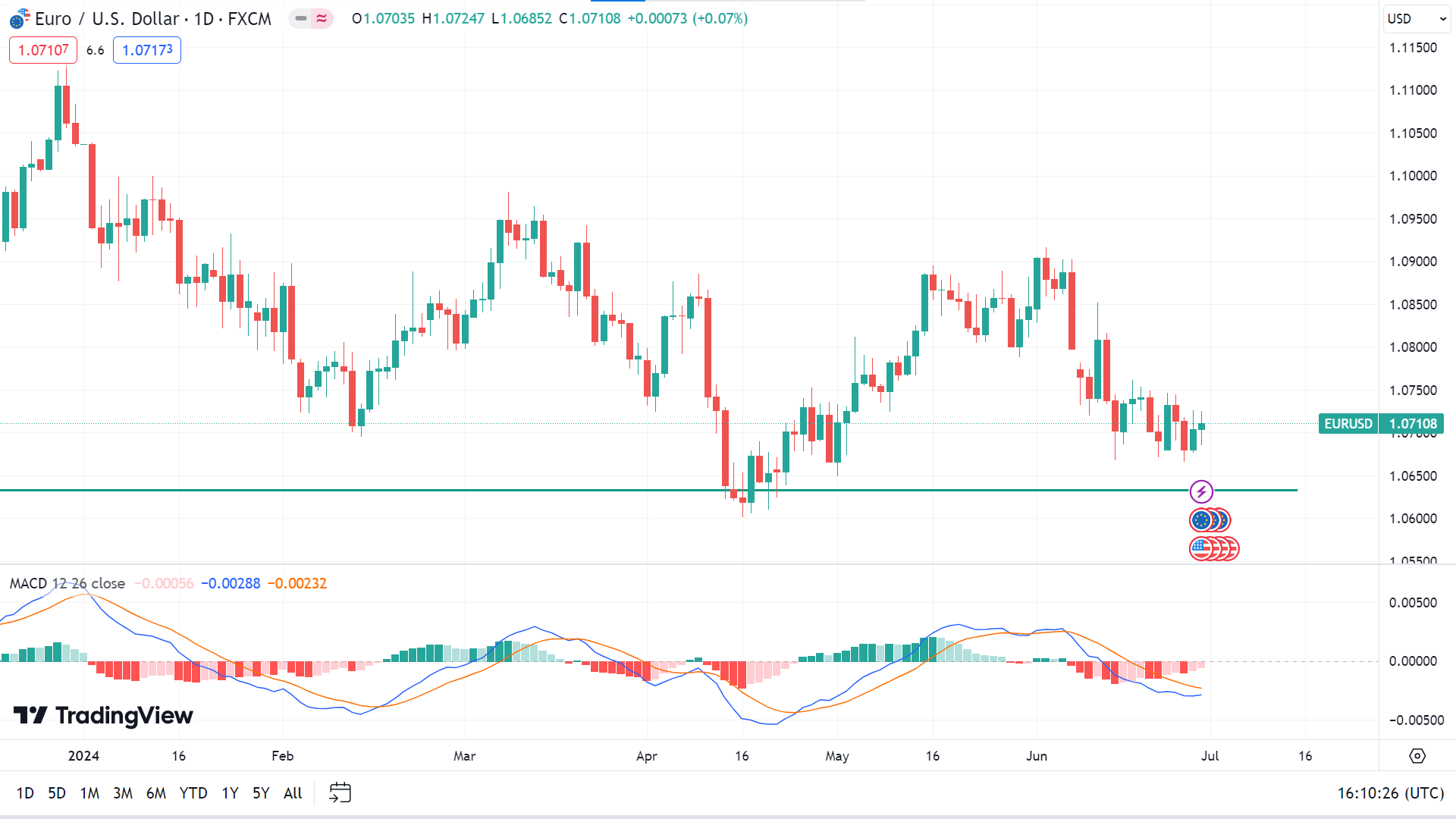

The last weekly candle closed green after three consecutive losing weeks, reflecting bulls may get back at this place, indicating the next candle might be another green one.

On the daily chart, the MACD indicator reading shows the price is still in negative territory and can continue to decline toward the primary support near 1.0625, followed by the next support near 1.0507.

Meanwhile, the red histogram bars are fading at the MACD window, which reflects decreasing sell pressure. A pause can trigger the price to the primary resistance near 1.0807, whereas the next resistance is near 1.0912.