I. Recent CVS Health Stock Performance

CVS Stock Got A Downbeat Forecast

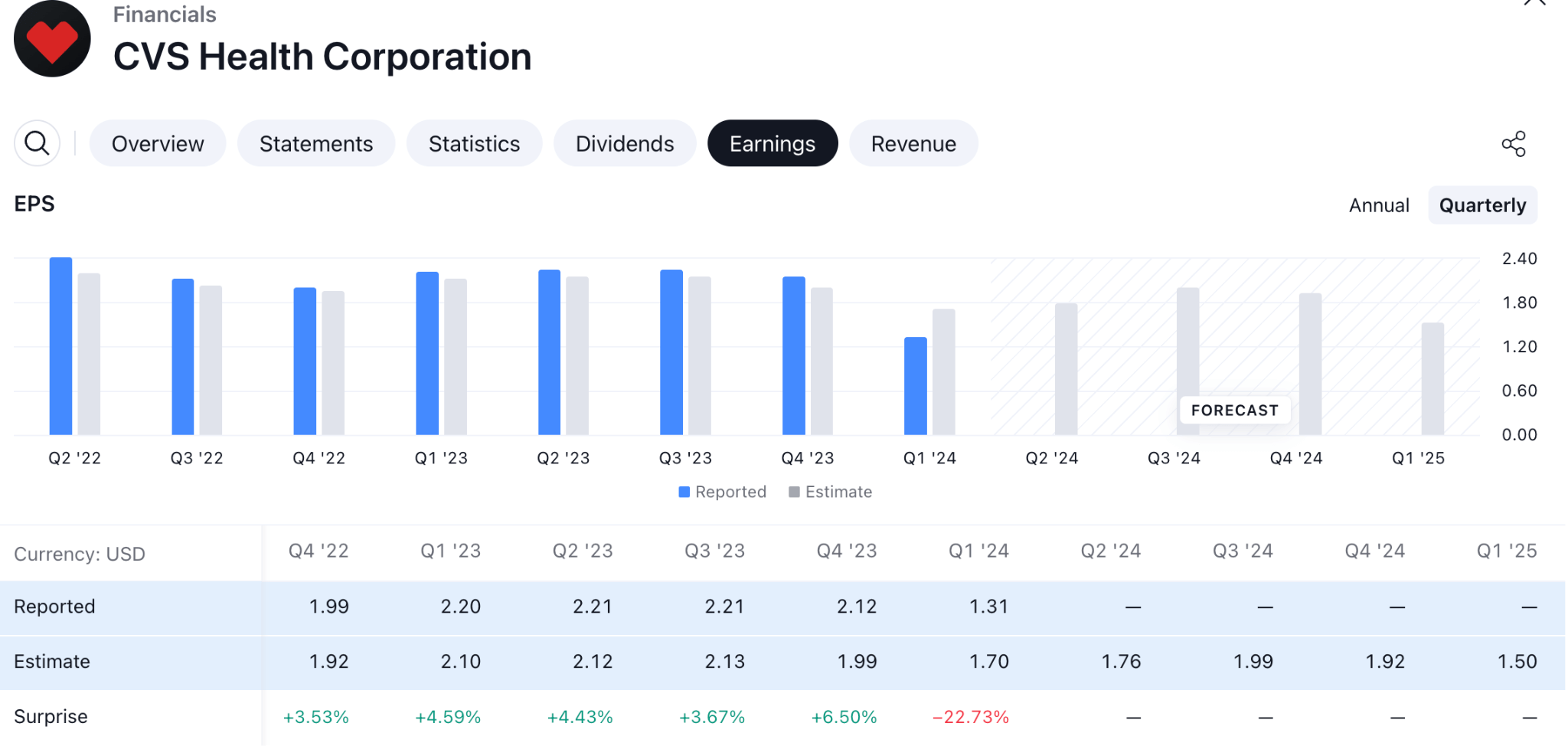

On May 1, CVS Health reported its latest earnings, precipitating a sharp decline in its stock price. The company's adjusted earnings per share (EPS) for the first quarter came in at $1.31, well below the analyst consensus of $1.69. CVS's significant reduction in its annual earnings guidance was more alarming to investors, slashing it from $8.30 per share to $7.00 per share.

This downward revision is primarily attributed to rising medical costs. As the world returns to normalcy post-COVID-19, previously deferred surgeries and medical procedures are resuming, driving up healthcare expenses. Last year, UnitedHealth Group and other insurers noted a similar trend, observing an increase in surgical procedures.

CVS's health insurance division, Aetna, is particularly impacted by this surge in medical activity. CEO Karen Lynch highlighted that the company faces "broad-based utilization pressure in our Medicare Advantage business in a few areas." This increased utilization and rising costs have prompted CVS to lower its earnings forecast, resulting in a sell-off of its stock.

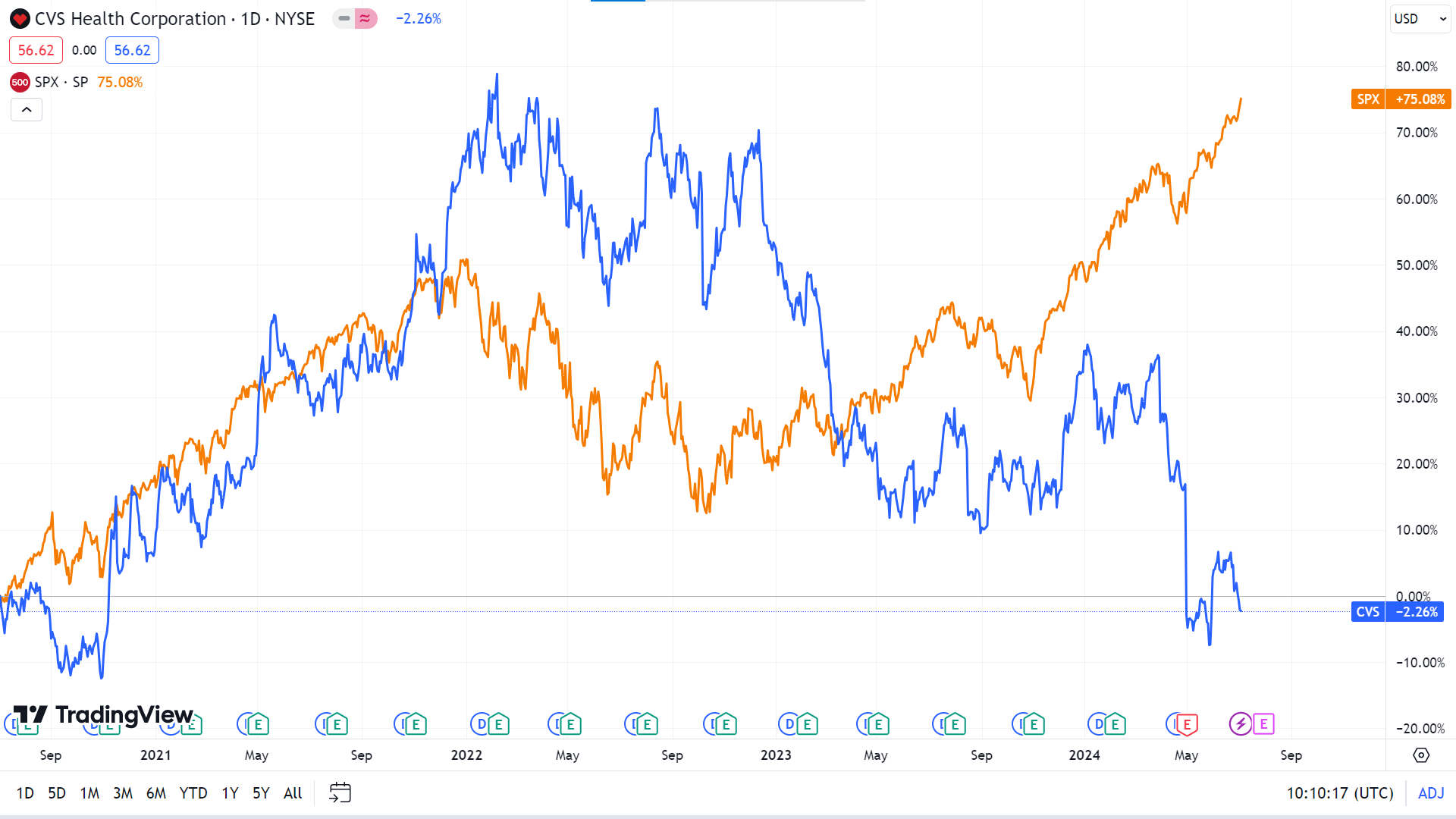

CVS Health Lags S&P 500

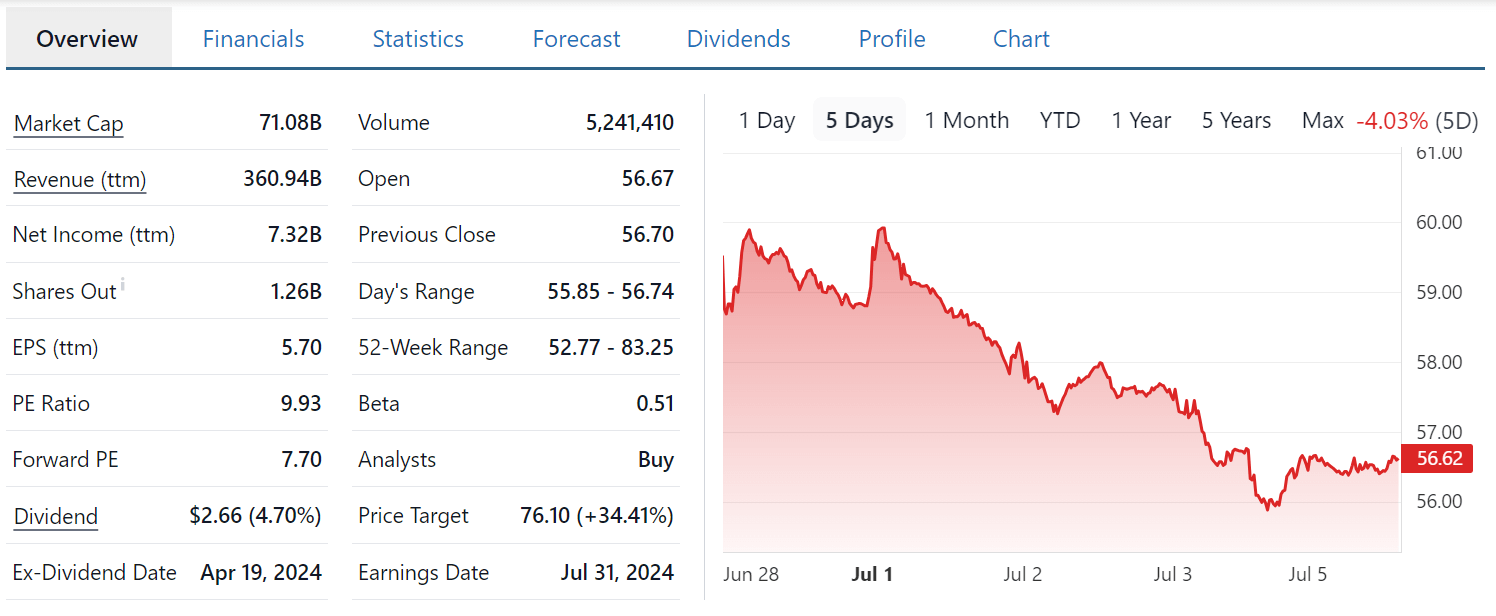

CVS Health stock (NYSE: CVS) currently trades at $58 per share, marking a steep 47% decline from its pre-inflation peak of $110 in February 2022. In contrast, Walgreens stock has fallen by 75% during this period due to declining profitability. In early June 2022, before the Federal Reserve began raising interest rates, CVS stock was at $93. Since then, it has dropped by 37%, while the S&P 500 has risen by 45%.

The underperformance of CVS stock can be attributed to shrinking margins driven by rising medical costs. To return to its pre-inflation high of $110, CVS stock would need to gain 90%, which seems unlikely. Our in-depth analysis of CVS Health's potential upside post-inflation shock explores the company's stock trends during the tumultuous market conditions in 2022. It compares them to its performance during the 2008 recession.

CVS Health Seeks a Trend From Earnings Report

The investment community is keenly awaiting CVS Health's forthcoming earnings report. The company is projected to post an EPS of $1.77, reflecting a 19.91% decline from the same quarter last year, while revenue is expected to rise by 3.03% to $91.62 billion.

For the full year, analysts Estimate forecast earnings of $7.02 per share and revenue of $368.96 billion, indicating a 19.68% drop in earnings and a 3.12% increase in revenue compared to the previous year.

Notably, recent changes in analyst estimates for CVS Health often signal shifting business trends. Thus, upward revisions in these estimates can be seen as a positive sign for the company's future prospects.

Expert Insights on CVS Stock Forecast for 2024, 2025, 2030 and Beyond

CVS stock price has remained in a downtrend since 2022, floating above the support level of 55. Before checking on the details of CVS Stock Forecast for 2024, 2025, 2030, and Beyond, let's see what analysts think about CVS stock:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$63.26 |

$76.63 |

$121.89 |

|

Coincodex |

$ 58.24 |

$ 59.90 |

$ 67.05 |

|

Stockscan |

$76.69 |

$57.30 |

$57.73 |

|

Coindataflow |

$766.86 |

$2063.31 |

$1921.04 |

II. CVS Stock Forecast 2024

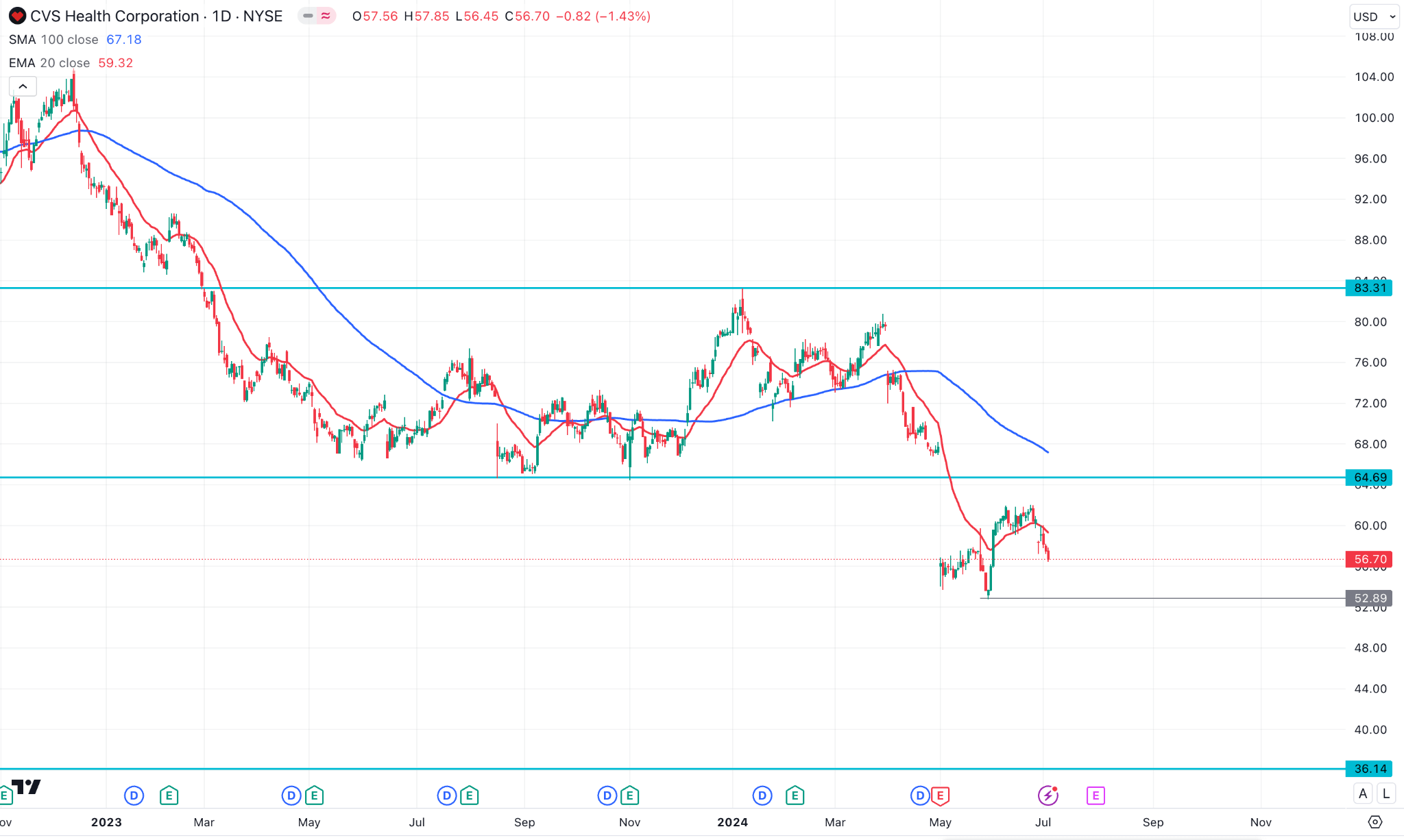

After reaching the low of 52.77 in the last week of May, the price has been sideways in Q1 this year and slipped in Q2. By the end of the current year, the price may hit 64.69 resistance, and a possible breakout may lead the price to 83.31.

In the daily chart of CVS, the broader market outlook is bearish, as the downward pressure is visible since the beginning of 2023. Moreover, a buy-side liquidity sweep is seen in January 2024, which suggests a confluence of bearish factors. Overall, the ongoing bearish pressure needs to form a bottom before validating the trend reversal.

In the main price chart, the EMA 21 line crossed below the SMA 100 line when the price declined in May, declaring significant bearish pressure on the asset price. So, the price may reach the nearest support of 52.89, followed by the next support of 48.36.

Meanwhile, the price may exceed the EMA 20 line, indicating a primary sign of upcoming buying pressure. Concurrent bullish pressure will also trigger the price above the SMA 100 line. In that case, buying pressure with a stable momentum above the 64.69 event level might influence bulls to extend the market moment.

Based on the CVS Stock Forecast 2024, the significant bullish pressure can trigger the price toward the nearest resistance of 64.69, while a breakout of that level may lead the price toward the next resistance of 83.31 by the end of 2024.

A. Other CVS Stock Price Prediction 2024 Insights

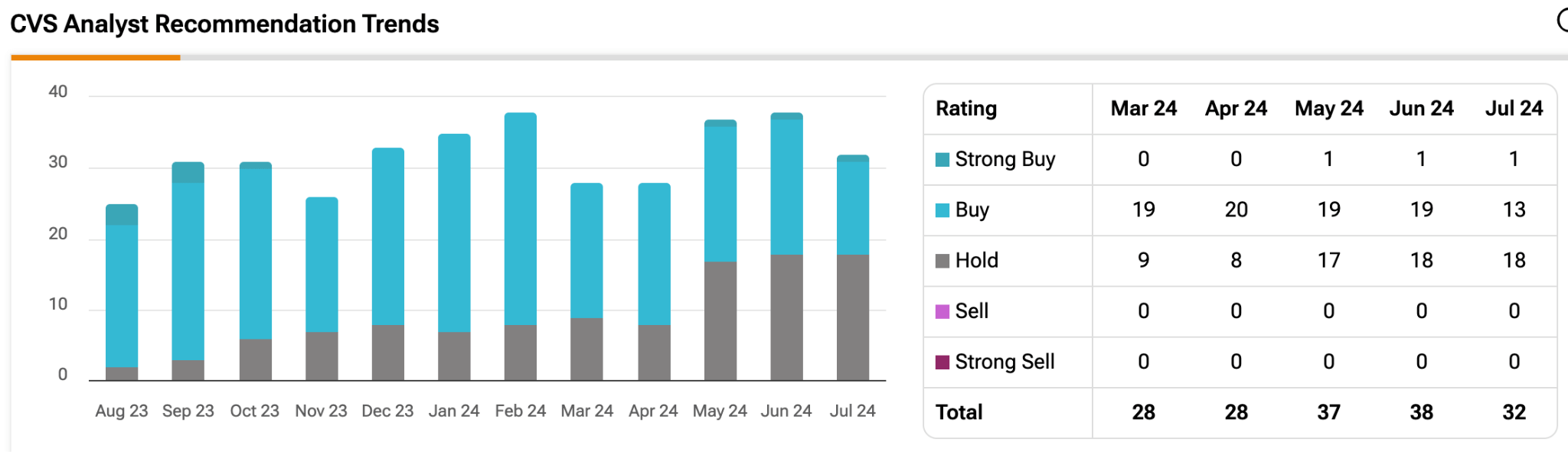

According to a recent report from Tiprank, most analysts are long in this stock. According to the projection from 32 analysts, 13 analysts are long in July 2024, as opposed to holding 18 analysts. Overall, Analyst average CVS price target in the past 3 months is $67.11.

In another report from Simplywall.st, the consensus CVS price target has decreased by 15% to $74.93, as analysts have plainly linked the stock's performance to lower-than-anticipated earnings. Analyzing the range of analyst estimates can offer valuable information regarding the extent to which outlier opinions deviate from the average. The most optimistic analyst assigns a value of $101 per share to CVS Health, while the most pessimistic analyst positions it at $60.00.

B. Key Factors to Watch for CVS Stock Forecast 2024

CVS Earnings Forecast 2024

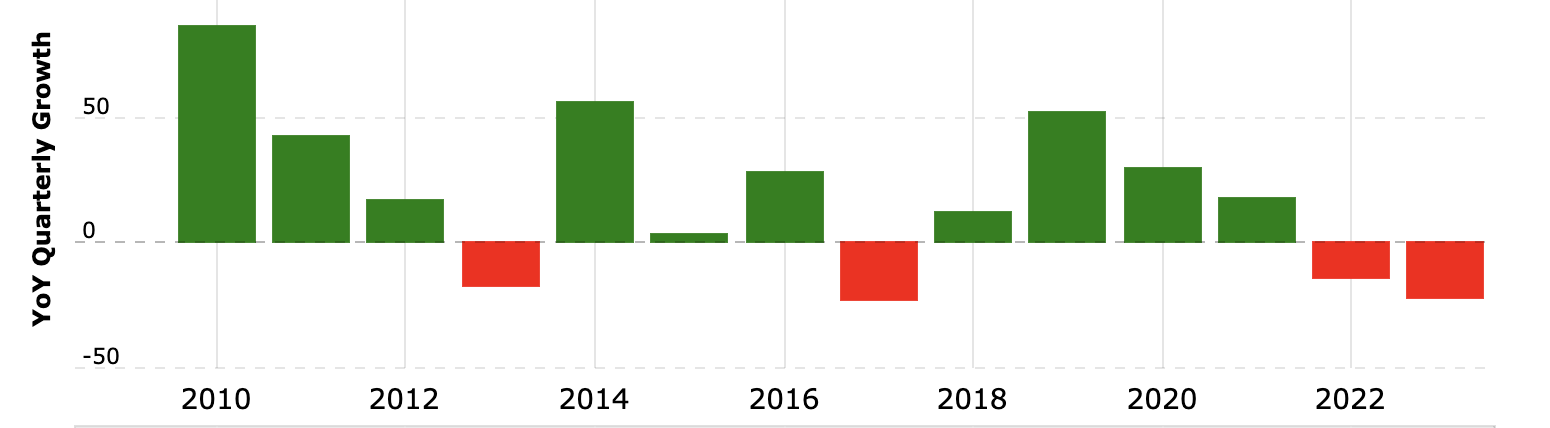

In the current forecast, CVS has maintained positive earnings per share until a 22.72% decline was seen in Q1 2024. For the coming quarter, investors should find a rebound in earnings reports, ensuring that the company is not falling apart.

For Q2 2024, the forecasted earnings per share is $1.76, which might be extended to $1.92 in Q4 2024. If the company produces an upbeat result, we may expect the stock price to increase.

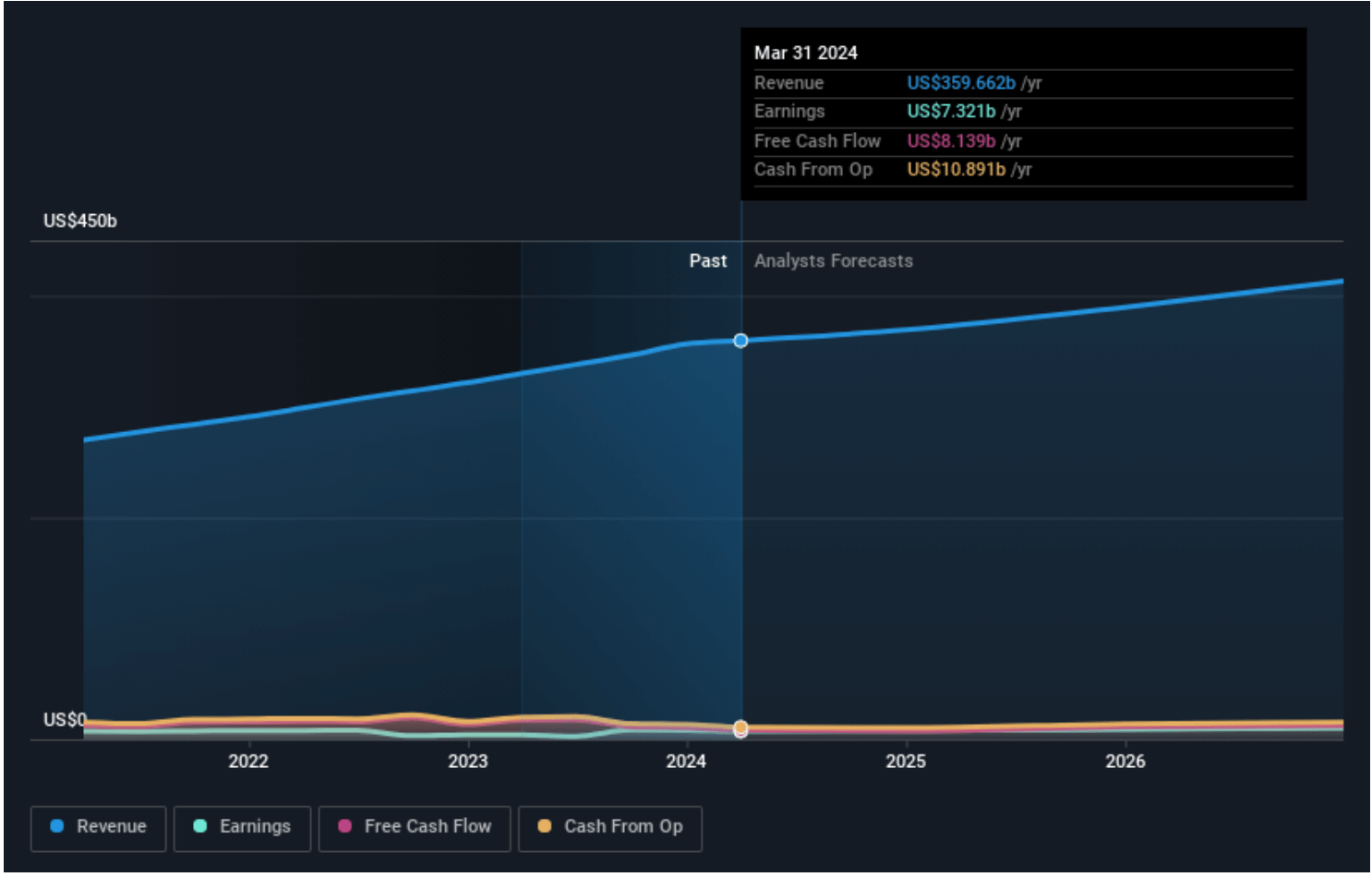

CVS Health Cash Flow Position

In the cash flow position, CVS failed to show an optimistic cash flow position in recent years, where 2023's cash flow showed a 22% decrease. However, the downbeat cash flow position since 2019 could be an alarming sign for this stock. Currently, a positive cash and cash equivalent position could signal long-term business stability, creating a bullish opportunity.

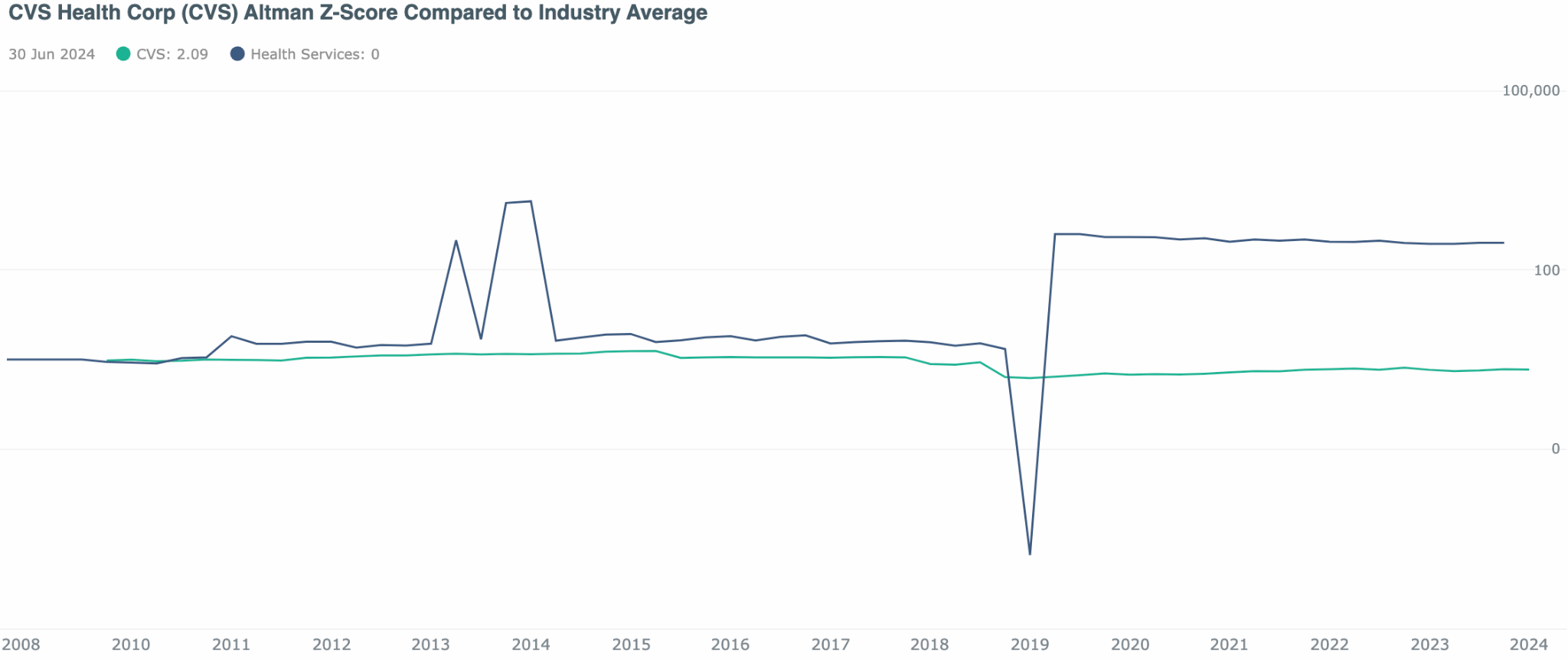

CVS Health: Altman Z Score Analysis

Source: discoverci

As per the latest data, CVS Health Corp's Altman Z-score has decreased from 2.96 to 2.09 since December 31, 2009. The company's quarterly Altman Z-score ranged from 1.51 to 4.28. From 2009 to 2024, the average quarterly Altman Z-score was 2.82.

As per the latest reading, the score is below the industry average, indicating a potential insolvency risk.

CVS Stock Forecast 2024 - Bullish Factors

CVS provides key opportunities to invest depending on some key strengths, such as:

- The current dividend payout ratio is sustainable at 46.75%, and it is expected to drop to 34.28% next year, suggesting potential for continued or increased dividend payments.

- CVS Heals is expanding primary care and telehealth services to enhance customer engagement and loyalty, driving long-term growth.

- CVS's revenue projection is upbeat. According to current data, revenue is expected to increase to $372.45 billion in 2024 and $390.91 billion in 2025.

CVS Stock Price Prediction 2024 - Bearish Factors

CVS has some challenging factors to overcome, such as:

- Due to rising medical costs, CVS has revised its EPS estimate for 2024 from $8.50 to at least $8.30, signaling potential financial strain and reduced profitability expectations (Morpher).

- The company is under multiple investigations for potential securities law violations, contributing to market uncertainty and potential legal costs.