EURUSD

Fundamental Perspective

EURUSD has sustained its gains for the third consecutive week, reaching the 1.0900 level for the first time since early June. This upward momentum has been primarily fueled by a weakened Dollar, with the US Dollar Index (DXY) hitting five-week lows around 104.00.

Investors now anticipate that the Federal Reserve will cut interest rates twice this year, a shift from the previously expected single reduction. This expectation change follows lower-than-forecast June CPI figures and a cooling labor market, intensifying rate-cut speculation.

Meanwhile, the European Central Bank has maintained a primarily silent stance. Dutch central bank Chief Klaas Knot suggested that while no rate cuts are expected this month, the September meeting could be open to such a move. ECB Governing Council member Fabio Panetta indicated that gradual rate reductions could continue without disrupting the current decline in inflation.

Despite the recent strength of the EUR, driven by weakness in the dollar, the underlying robustness of the US economy suggests this trend may be temporary. The US is likely heading toward a soft landing, and the Dollar's current weakness may soon give way to a rebound, especially with the potential political shifts on the horizon.

EURUSD Forecast Technical Perspective

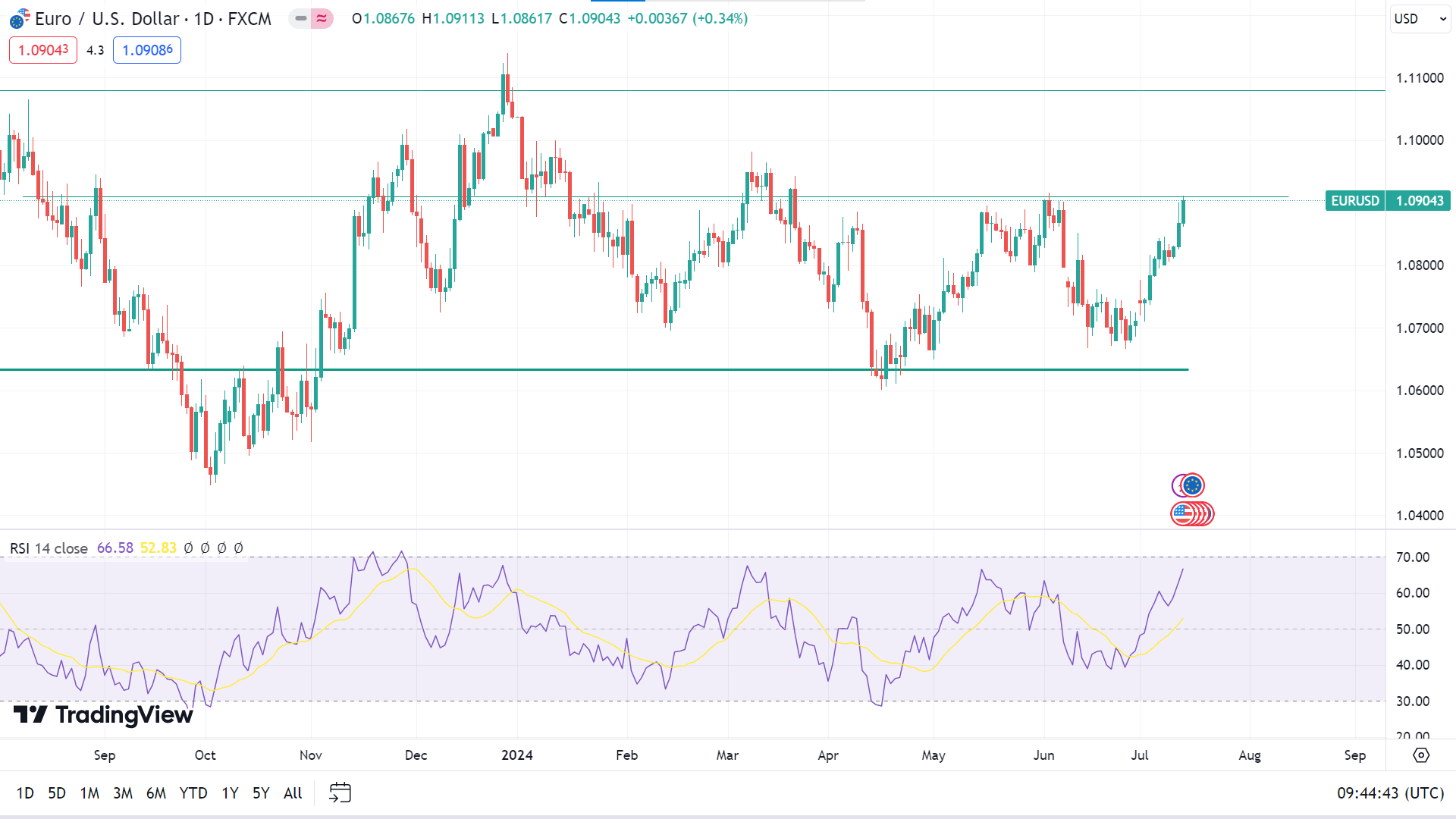

The last weekly candle closed as solid green, posting three consecutive gaining weeks, leaving optimism that the upcoming candle might be another green one.

The price is moving upward on the daily chart, as the RSI indicator window shows the signal line sloping upward just below the upper level, reflecting bullish pressure. The price is floating below a previous resistance of 1.0918; a breakout may trigger the price toward the nearest resistance of 1.1014, followed by the next resistance of 1.1264.

Meanwhile, any pause in the current uptrend might turn the price toward the primary support of 1.0820, followed by the next support near 1.0698.