I. Recent SoundHound Stock Performance

Recent SOUN stock price performance and changes

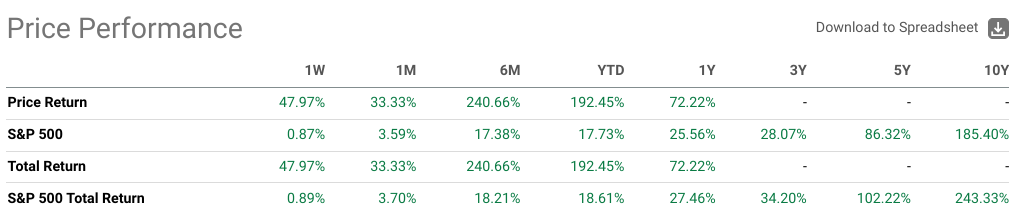

SoundHound AI (NASDAQ: SOUN) has shown robust performance in recent times, reflecting its growth trajectory and the street sentiment. With a market capitalization of approximately $2.04 billion, the stock has experienced significant price movements over various periods:

Source: Ycharts.com

Over the past week, SOUN stock has surged by 47.97%, outperforming the S&P 500's 0.87% return. In the last month and six months, the stock has continued to exhibit strong gains, with returns of 33.33% and 240.66%, respectively, far surpassing broader market indices. Year-to-date, SOUN has seen a substantial rise of 192.5% against S&P500's (SPX) 17.7% and Nasdaq-100's (NDX) 20.8%, indicating solid positive momentum. Over the past year, SOUN has delivered a return of 72.22%, though slightly underperforming the broader market's 25.56% return.

Source: seekingalpha.com

Main Influencing Factors

SoundHound AI has exhibited robust stock performance driven by a series of positive developments and strategic initiatives. Here's a critical analysis of the main influencing factors:

Strong Revenue Growth:

SoundHound reported a remarkable 73% year-over-year increase in first-quarter revenue, reaching $11.6 million. This substantial growth reflects the company's successful expansion and adoption of its AI solutions across various sectors.

Strategic Milestones:

The company celebrated its second anniversary as a public entity, highlighting its resilience and growth amidst challenging economic conditions. SoundHound has significantly increased its revenue while doubling its cash reserves to $225 million, reinforcing its financial stability.

Innovative AI Solutions:

A key factor in SoundHound's performance is its advanced AI customer service solutions. The successful deployment of these solutions in over 10,000 locations, with an additional 100,000 in the pipeline, underscores the demand and effectiveness of their technology.

Breakthroughs in AI Technology:

The introduction of dynamic interaction for drive-thru services, which has garnered positive feedback from major global QSR brands, signifies a technological breakthrough. This innovation not only enhances customer service efficiency but also creates new revenue streams for SoundHound.

Strategic Partnerships and Expansions:

SoundHound's collaborations with prominent brands like Church's Chicken, White Castle, and several EV manufacturers highlight its growing market penetration. Additionally, partnerships with technology leaders like NVIDIA and Arm further bolster its technological capabilities and market reach.

Broadening Product Portfolio:

The expansion of SoundHound's product offerings, such as Smart Answering and SoundHound Employee Assist, has diversified its revenue sources. These products cater to a wide range of businesses, enhancing operational efficiency and customer engagement.

Expert Insights on SoundHound Stock Prediction for 2024, 2025, 2030 and Beyond

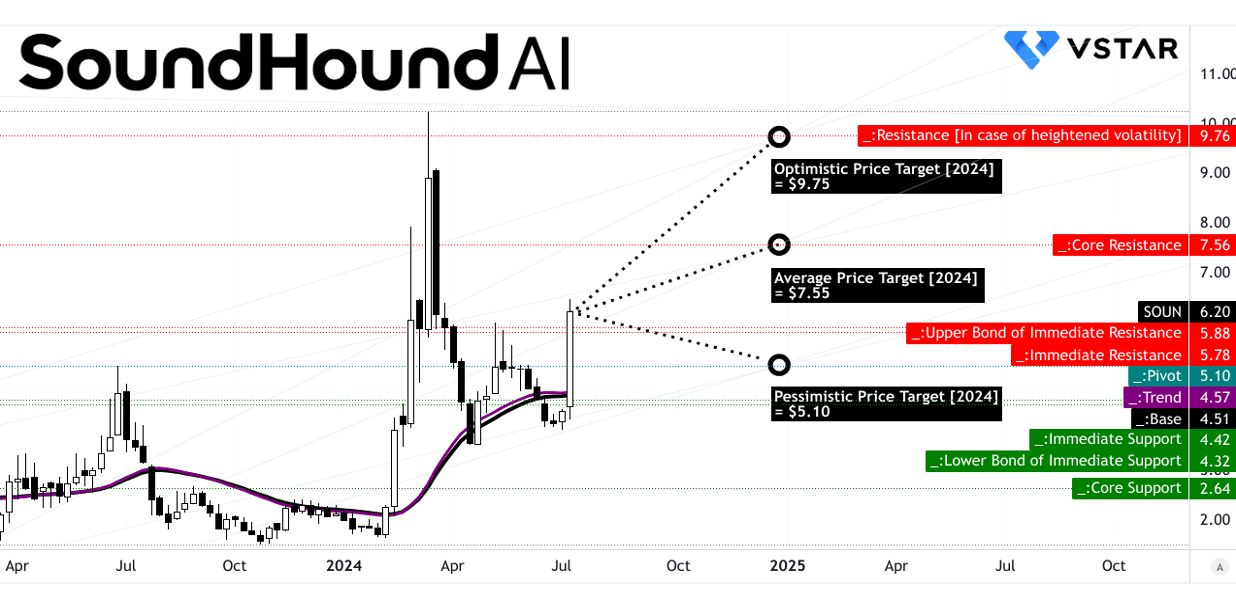

SoundHound AI stock performance has shown volatility, influenced by AI market trends. Expert insights suggest varied projections: Optimistic targets for 2024, 2025, and 2030 are $9.75, $13.35, and $35.00, respectively; average targets are $7.55, $9.75, and $22.15; pessimistic targets are $5.10, $7.55, and $9.25. Long-term growth is anticipated, but risks persist due to competitive and technological uncertainties.

Source: Analyst's compilation

II. SoundHound Stock Prediction 2024

Based on the technical analysis, the projected average SOUN stock price target by the end of 2024 is $7.55. Optimistically, the stock could reach up to $9.75, while a pessimistic scenario sees it falling to $5.10. The stock is currently trading at $6.20, showing an upward direction. These predictions are derived from momentum indicators and Fibonacci extension levels, suggesting potential price movements based on recent trends.

The trendline and baseline, based on modified exponential moving averages, are currently at $4.57 and $4.51, respectively. This indicates a solid support base just below the current price, which aligns with the upward price direction. The primary support level is $5.78, and the pivot point of the current horizontal price channel is $5.10. The core resistance level is pegged at $7.56, suggesting that if the stock breaks through this level, it could surge towards the optimistic target of $9.75.

Source: tradingview.com

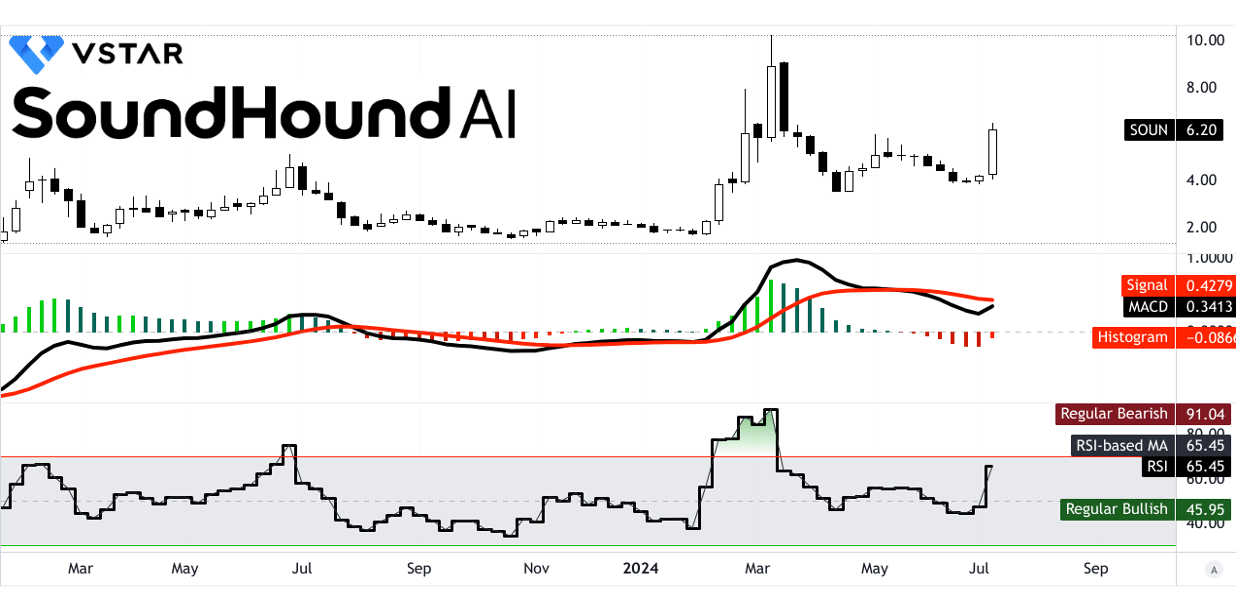

The Relative Strength Index (RSI) stands at 65.45, indicating a bullish sentiment as it trends upwards. Regular bullish levels are noted at 45.95, while bearish levels are much higher at 91.04, signaling more room for upward movement before reaching overbought conditions. Bullish divergence in the RSI further supports a positive price trend.

The Moving Average Convergence/Divergence (MACD) indicator shows a bearish trend with the MACD line at 0.3413 and the signal line at 0.4279. However, the decreasing strength of this bearish trend suggests a potential reversal, contributing to the positive outlook for SoundHound AI stock price in 2024.

Source: tradingview.com

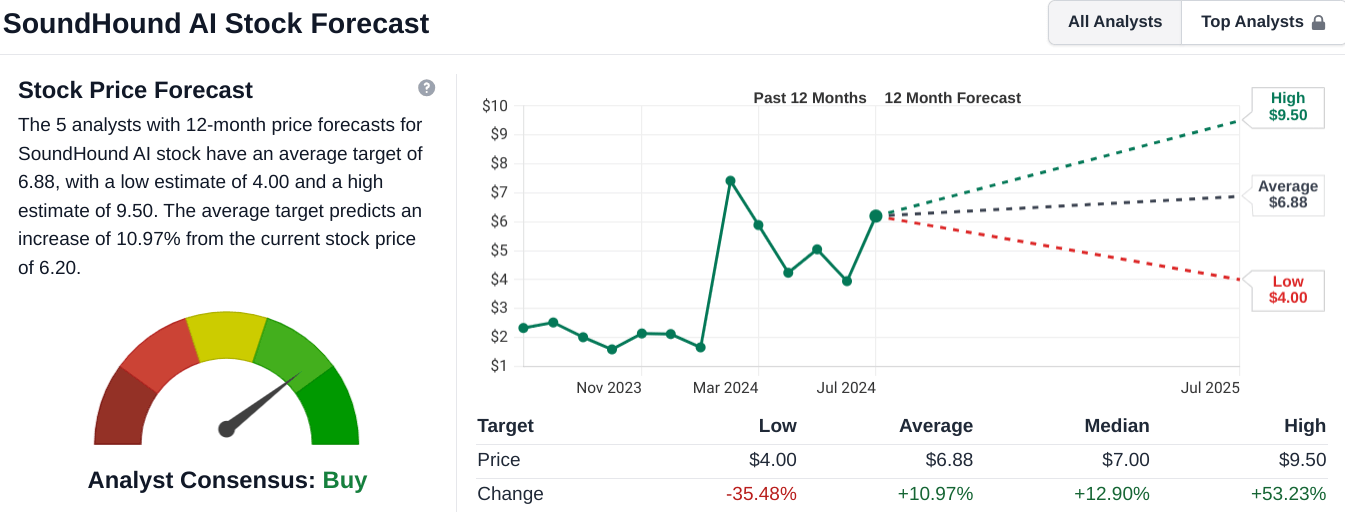

SoundHound AI (NASDAQ: SOUN) exhibits optimistic price forecasts for 2024. According to various analysts, the average SOUN target price hovers around $7.00, reflecting a notable potential upside from current levels.

StockAnalysis and TipRanks: For Sound AI stock price prediction 2024, both platforms indicate similar bullish sentiments. StockAnalysis.com shows a 12-month average target of $6.88, while TipRanks offers a slightly higher average of $7.50. This represents a potential increase of approximately 11% and 21% from the current price of $6.20, respectively. Their high estimates reach up to $9.50, suggesting significant upside if positive conditions prevail.

Source: stockanalysis.com

Zacks: Zacks provides the most bullish outlook for Sound Hound stock forecast 2024, with an average price target of $7.17 and a high estimate of $9.50. This translates to an impressive 33.52% potential increase from a lower starting price of $5.37, indicating room for substantial gains.

MarketBeat: Analysts from HC Wainwright and Wedbush reiterate positive ratings for SOUN stock prediction 2024 with price targets of $7.00 and $9.00, further reinforcing the general sentiment of growth.

A. Other SOUN Stock Forecast 2024 Insights

SoundHound AI (NASDAQ: SOUN) has shown potential for significant growth in 2024, driven by advancements in its voice AI technology and strategic partnerships. Analysts project varying levels of price increases, reflecting both optimism and caution regarding the company's future performance.

HC Wainwright & Co. On May 13, 2024, HC Wainwright & Co. analyst Scott Buck reiterated a "Buy" rating for SoundHound AI, setting a price target of $7. This target represents an 11.47% upside potential, indicating a moderate level of confidence in the company's ability to grow. Buck's assessment reflects a belief in SoundHound's strategic direction and technological advancements, suggesting steady but cautious optimism regarding its market performance.

Wedbush In contrast, Wedbush analyst Daniel Ives offered a more bullish outlook on May 10, 2024. Ives reiterated an "Outperform" rating with a SOUN price target of $9, suggesting a substantial 43.32% upside. This optimistic projection underscores a strong belief in SoundHound's market potential and growth trajectory. Ives's assessment points to the company's robust capabilities in voice AI technology and strategic positioning within the industry.

Analysts like Scott Buck from HC Wainwright & Co. and Daniel Ives from Wedbush are optimistic about SoundHound's market potential. Buck's target of $7 represents a moderate upside of 11.47%, while Ives is more bullish with a target of $9, suggesting a substantial 43.32% increase. Both analysts reaffirm their positive outlooks, indicating confidence in SoundHound's continued growth and market relevance. This collective sentiment from respected institutions underscores the company's robust prospects in the AI industry.

![]()

Source: benzinga.com

B. Key Factors to Watch for SoundHound AI Stock Forecast 2024

SoundHound Stock Forecast 2024 - Bullish Factors

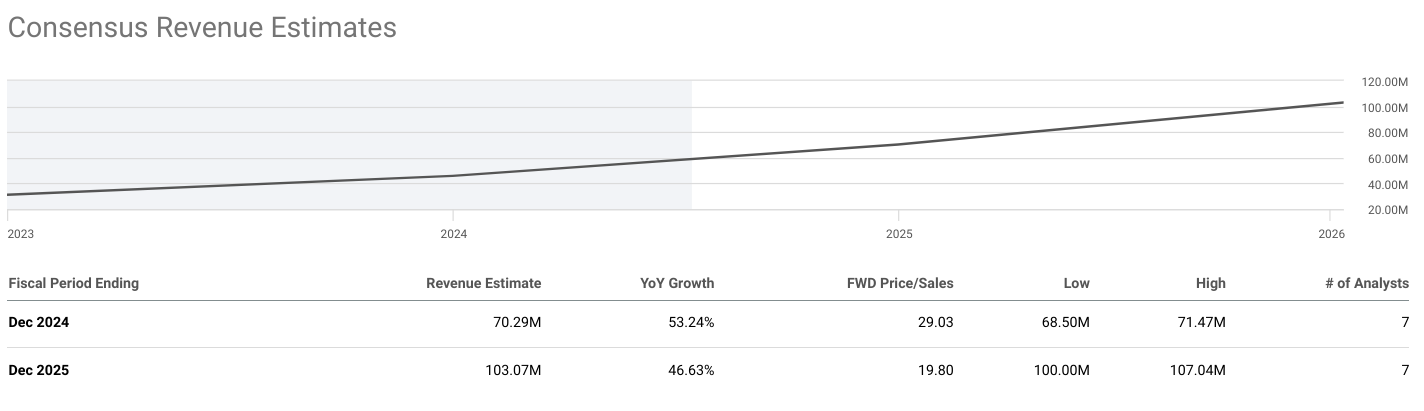

Financial Performance and Forecast: SoundHound AI's recent financials show a significant growth trajectory. In Q1 2024, revenue increased by 73% year-over-year, reaching $11.6 million. The company's revenue forecast for the next quarters shows robust growth, with Q2, Q3, and Q4 2024 projected revenues of $13.09M, $19.96M, and $25.86M, respectively. This indicates a year-over-year growth of approximately 50% for each quarter. Despite negative EPS estimates for 2024, the losses are decreasing, indicating an improving financial position. For instance, the EPS for Q4 2024 is estimated at -$0.05, improving from -$0.09 in Q2 2024.

Source:seekingalpha.com

Strong Revenue Growth: The consistent revenue growth, with projections showing a near doubling from Q2 to Q4 2024, is a bullish indicator. This growth is driven by expanding AI solutions in various sectors, particularly the restaurant industry.

Technological Advancements: SoundHound's innovative AI solutions, such as dynamic interaction and Smart Ordering, have been well-received. The company's ability to integrate with major brands like Church's Chicken and expand services with existing customers like Jersey Mike's highlights its technological edge and market acceptance.

Strategic Partnerships: The collaboration with NVIDIA and the integration of ChatGPT into vehicles with Stellantis showcase SoundHound's ability to innovate and partner with industry leaders. These partnerships are expected to drive further growth and market penetration.

SOUN Stock Price Prediction 2024 - Bearish Factors

Persistent Losses: Despite the improving financial position, SoundHound AI is still operating at a loss. The EPS estimates for 2024 are negative, with Q4 projected at -$0.05. Continued losses may concern investors, especially if the company fails to turn profitable soon.

Revenue Revision Trends: The revenue estimates have seen downward revisions over recent months. For instance, the Q2 2024 revenue estimate was revised down by 2.47% in the past month. This trend may indicate potential challenges in achieving the projected growth.

Competitive Landscape: The AI industry is highly competitive, with major tech companies continually innovating. SoundHound AI must maintain its technological edge and expand its market share amidst fierce competition from larger, well-funded competitors.