- AT&T's Q2 2024 performance showed a slight decline in revenue and net income, while operating income fell due to increased expenses.

- Mobility services and fiber broadband grew, with significant gains in subscriber numbers and broadband revenue.

- The T stock price saw an over 11% price increase, outperforming major indices.

- Growth opportunities lie in 5G and fiber expansion, though challenges include high debt and intense competition.

I. AT&T Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

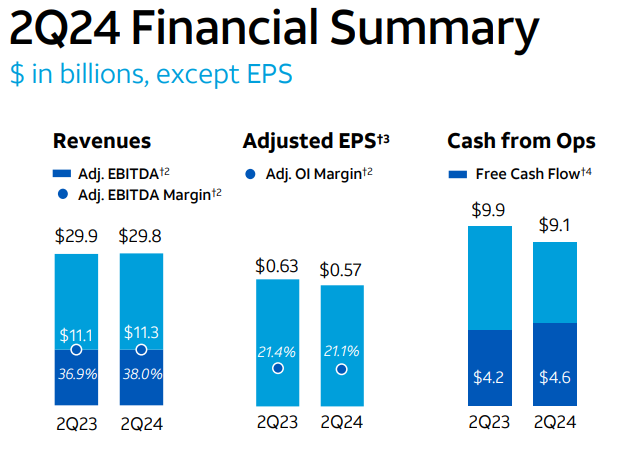

AT&T's revenues for Q2 2024 were $29.8 billion, a slight decrease from $29.9 billion in Q2 2023. This decline was primarily due to lower Business Wireline service revenues and Mobility equipment revenues. The net income was $3.9 billion, compared to a higher figure in the previous year. Adjusted EBITDA was $11.3 billion. The diluted EPS was $0.49, with an adjusted EPS of $0.57, a decrease from the previous year's $0.63.

Operating income was $5.8 billion, down from $6.4 billion in Q2 2023. Adjusted operating income was $6.3 billion. The operating income saw a decline due to higher operating expenses. Operating expenses increased to $24.0 billion from $23.5 billion, driven by network modernization efforts and higher depreciation costs. Cash from operating activities was $9.1 billion, down $0.8 billion year-over-year. Capital expenditures were $4.4 billion, with a total capital investment of $4.9 billion. Free cash flow was $4.6 billion, up $0.4 billion from the previous year.

Source: 2Q24_ATT_Earnings

Operational Performance

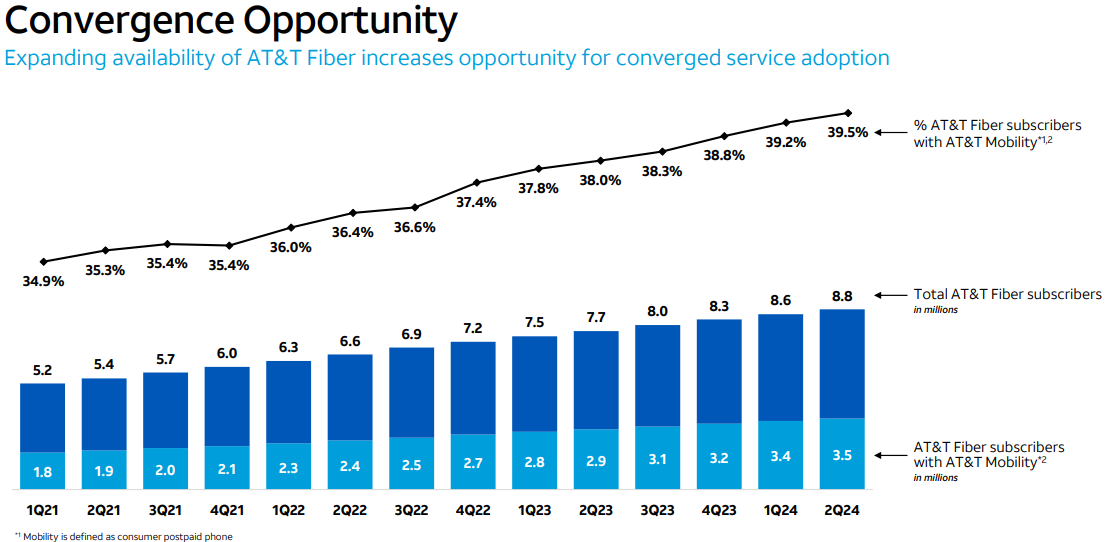

Mobility service revenues grew by 3.4% to $16.3 billion. AT&T Fiber added 239,000 net subscribers, marking the 18th consecutive quarter with over 200,000 net adds. Consumer broadband revenues increased by 7% to $2.7 billion. AT&T continues to lead in converged connectivity, with nearly 40% of AT&T Fiber households also opting for AT&T wireless services. Postpaid phone net adds totaled 419,000, with an industry-leading postpaid phone churn rate of 0.70%. AT&T continues to expand its fiber network through partnerships, such as the Gigapower joint venture and capital-light arrangements with other commercial fiber network providers.

Source: 2Q24_ATT_Earnings

Technological Advancements and Innovations

AT&T Internet Air is gaining traction, with nearly 350,000 total consumer subscribers, including 139,000 added in Q2 2024. Significant investments in 5G and fiber infrastructure continue, with ongoing network modernization efforts including Open RAN technology. AT&T Fiber now passes 27.8 million consumer and business locations, with a target to exceed 30 million by the end of 2025. The company has made substantial progress in integrating 5G and fiber services, leading to improved customer penetration and market share in areas where both services are offered.

B. T Stock Price Performance

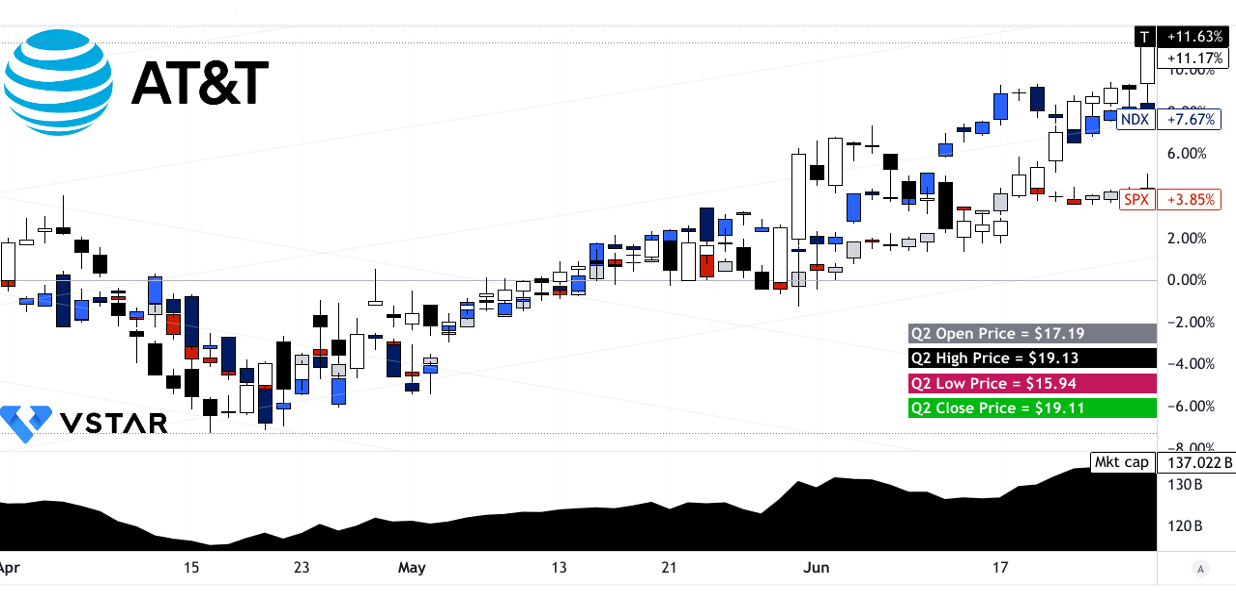

AT&T stock price showed a notable 11.17% increase over the quarter, moving from $17.19 to $19.11, with highs and lows at $19.13 and $15.94, respectively. This performance outstripped major indices, with the S&P 500's price return at 3.85% and the NASDAQ's at 7.67%. Despite its substantial market cap of $137.022 billion, AT&T's stock demonstrated relative strength, outperforming broader market benchmarks.

Source: tradingview.com

II. T Stock Forecast: Outlook & Growth Opportunities

A. Segments with Growth Potential

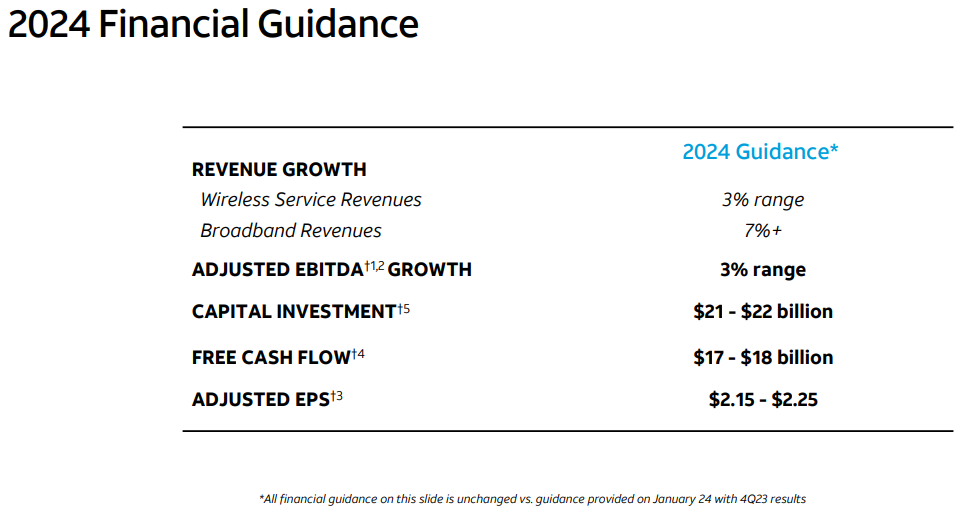

AT&T's 2024 growth trajectory is largely driven by its strategic focus on expanding its 5G and fiber networks. For 2024, the top-line growth in Wireless and Broadband will be 3% and 7% annually.

Source: 2Q24_ATT_Earnings

Key segments with significant growth potential include:

Mobility: AT&T continues to enhance its wireless services, delivering 419,000 postpaid phone net adds in Q2 2024, surpassing last year's pace. The Mobility segment's EBITDA growth of 5.3% reflects robust service revenue growth and efficiency in operational costs. With the rollout of new devices and features, the company expects increased subscriber activity in the latter half of the year, reinforcing its market position.

Fiber Broadband: The Consumer Wireline segment's fiber business is a standout performer, adding 239,000 fiber subscribers in Q2 2024. AT&T's fiber footprint now covers nearly 28 million locations, targeting 30 million by the end of 2025. The focus on fiber expansion is underscored by a 7% growth in broadband revenues and 18% increase in fiber revenue, driven by higher ARPU of $69. This growth is bolstered by the early success of AT&T Internet Air, a fixed wireless service that has quickly gained traction.

Business Solutions: Although traditional voice services are declining, AT&T's Business Wireline segment is leveraging its 5G and fiber infrastructure to offer innovative solutions like FirstNet and AT&T Internet Air for business. This segment aims to capitalize on emerging markets and technology advancements, providing services such as Dynamic Defense, which enhances network security.

Source: factmr.com

B. Expansions and Strategic Initiatives

AT&T's growth strategy is anchored in several key expansions and initiatives:

Mergers and Acquisitions: The company's strategy includes scaling its Gigapower joint venture and forming capital-light partnerships with other fiber providers. These moves are designed to enhance fiber availability and accelerate the deployment of converged services across broader geographies. This approach not only extends AT&T's fiber reach but also reinforces its 5G and fiber convergence model.

Research and Development Investments: AT&T's commitment to innovation is evident in its substantial R&D investments, focusing on enhancing 5G technology and expanding fiber networks. The company's investment-led strategy has positioned it as the largest capital investor in U.S. connectivity infrastructure since 2019. This R&D push is critical in maintaining technological leadership and ensuring the scalability of its services.

Debt Reduction and Financial Flexibility: AT&T is also enhancing its financial health by reducing net debt, with a target of achieving a net-debt-to-EBITDA ratio of 2.5 times by mid-2025. This deleveraging effort, combined with robust free cash flow generation, strengthens AT&T's capacity to invest in growth while delivering shareholder value. The company's free cash flow guidance for 2024 is set between $17 billion to $18 billion, reinforcing its financial stability and growth prospects.