- Meta's Q2 2024 Revenue: Meta achieved $39.1 billion in revenue, a 22% increase YoY, with robust financials.

- Operational Highlights: The Family of Apps generated $38.7 billion in revenue, while Reality Labs saw a 28% rise.

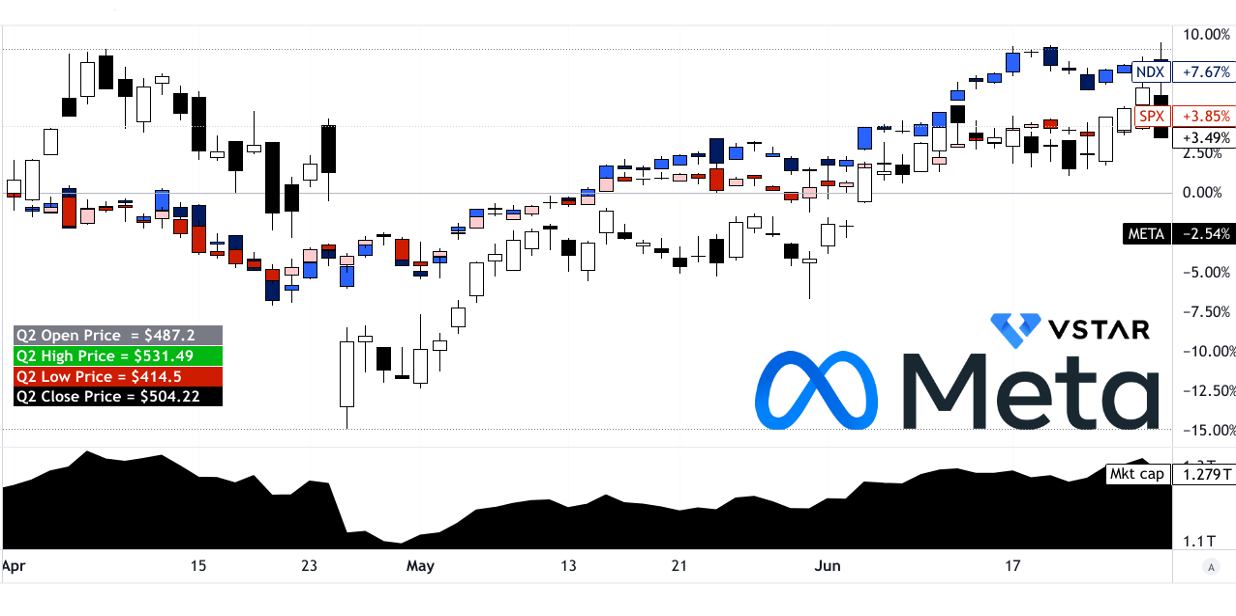

- Stock Performance: META stock rose 3.49% this quarter, underperforming relative to major indices.

- AI and VR Investments: Meta's advancements in AI and Reality Labs position it for future growth.

- Price Targets: Technicals project Meta stock could range between $375 and $640 by year-end.

I. Meta Q2 2024 Performance Analysis

A. Key Segments Performance

Financial Highlights

Meta reported robust financial performance in Q2 2024, with total revenue of $39.1 billion, marking a 22% year-over-year increase. Net income rose to $13.5 billion, reflecting significant profitability. Earnings per share (EPS) stood at $5.16, showcasing strong earnings growth. Operating income reached $14.8 billion, achieving a 38% operating margin. Total expenses increased by 7% to $24.2 billion, driven by higher infrastructure and Reality Labs inventory costs. The balance sheet remained solid with $58.1 billion in cash and marketable securities, while free cash flow was $10.9 billion, highlighting strong cash generation.

Operational Performance

Meta's operational performance was marked by diverse product sales and innovations. The Family of Apps segment, including Facebook, Instagram, and WhatsApp, generated $38.7 billion in revenue, a 22% increase. Reality Labs saw revenue grow by 28% to $353 million, driven by Quest headset sales. Market share analysis showed strong user engagement, with over 3.2 billion daily active users across Meta's apps. Significant advancements included the rollout of a unified video recommendation service and the launch of AI-driven innovations like Meta AI and AI Studio, fostering deeper user engagement and interaction.

Technological Advancements

AI was a significant focus for Meta. Advances in AI improved content recommendations on Facebook and Instagram, driving user engagement. The full-screen video player and unified video recommendation service enhanced user experience by integrating Reels and other video formats. Meta's AI innovations also impacted advertising. The Meta Lattice ad ranking system improved ad performance, and AI-driven tools like Advantage+ Shopping campaigns provided advertisers with enhanced return on ad spend. AI-generated creative content further streamlined advertising processes. Meta's investment in AI extended to its metaverse initiatives. The release of Llama 3.1, an open-source AI model, positioned Meta at the forefront of AI development. AI-powered products like Meta AI and AI Studio facilitated new user experiences and business opportunities, supporting Meta's long-term vision for AI and the metaverse.

B. META Stock Price Performance

Meta stock (NASDAQ: META) experienced a 3.49% price return this quarter, with its stock opening at $487.20 and closing at $504.22. The quarterly trading range was $414.50 to $531.49, indicating significant volatility. Despite a positive return, Meta's performance lagged behind major indices; the S&P 500 gained 3.85%, while the NASDAQ surged 7.67%. The market capitalization stands at $1.279 trillion, underscoring its substantial market presence. The underperformance relative to the NASDAQ suggests that Meta's stock was less favorable compared to the broader technology sector.

Source: tradingview.com

II. Meta Stock Price Prediction: Outlook & Growth Opportunities

Meta (NASDAQ: META) Looking forward, Meta anticipates third-quarter revenue between $38.5 billion to $41 billion, reflecting continued momentum in user growth and advertising effectiveness. The ongoing investments in AI, AR/VR, and strategic expansions position Meta for sustained growth and market leadership in the digital ecosystem.

A. Segments with Growth Potential

Family of Apps: Meta's Family of Apps continues to be a cornerstone of its revenue growth, with over 3.2 billion daily users globally. The strong growth in user engagement, particularly in the US and globally, underscores the potential for continued expansion. WhatsApp and Threads are standout performers, with significant user bases that contribute to Meta's overall ecosystem strength.

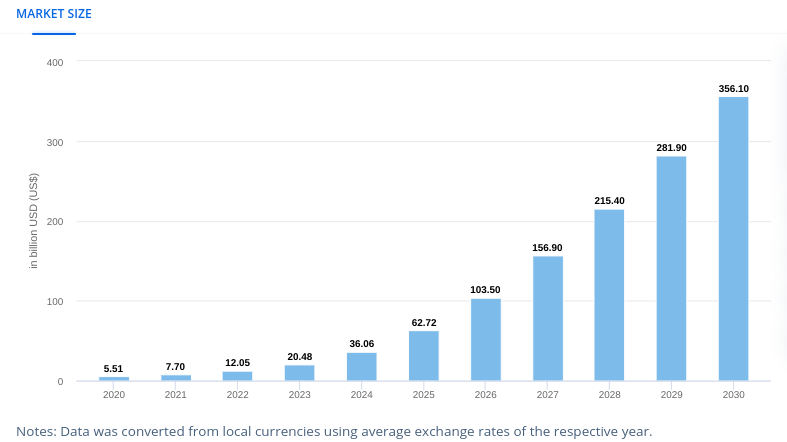

Generative AI: AI technologies are pivotal for Meta's future growth. The deployment of AI across its platforms enhances user experience through improved content recommendations and personalized advertising. This technology not only drives engagement but also boosts monetization efficiency, as evidenced by ongoing improvements in ad performance and relevance. The market (Generative AI) may hit $36 billion in 2024 with an annual growth rate (2024-2030) of 46.47%. Meta's topline will surely benefit from this trend.

[Gen AI market size]

Source: statista.com

Reality Labs: Meta's investment in Reality Labs, highlighted by the success of Quest 3 and Ray-Ban Meta Glasses, underscores its commitment to augmented reality (AR) and virtual reality (VR) technologies. These products are not only popular among consumers but also represent a strategic push into new, immersive computing platforms.

B. Expansions and Strategic Initiatives

Mergers and Acquisitions: Meta's strategic acquisitions, such as those enhancing AI capabilities or expanding its product portfolio (like Oculus), are pivotal. These acquisitions bolster its technological edge and market position, driving long-term growth prospects.

Research and Development (R&D): Continued R&D investments are crucial for Meta's innovation pipeline. Advances in AI, particularly with the development of Llama 3.1 and future models, underscore its leadership in open-source AI technologies. These investments are critical for maintaining competitive advantage and driving future revenue streams.

Partnerships and Collaborations: Collaborations with industry leaders, such as EssilorLuxottica for Meta Glasses, amplify Meta's reach and innovation capacity. Strategic partnerships enable Meta to leverage expertise and resources beyond its core competencies, accelerating product development and market penetration.