I. Recent Arm Holdings Stock Performance

Arm Stock Price Performance And Changes

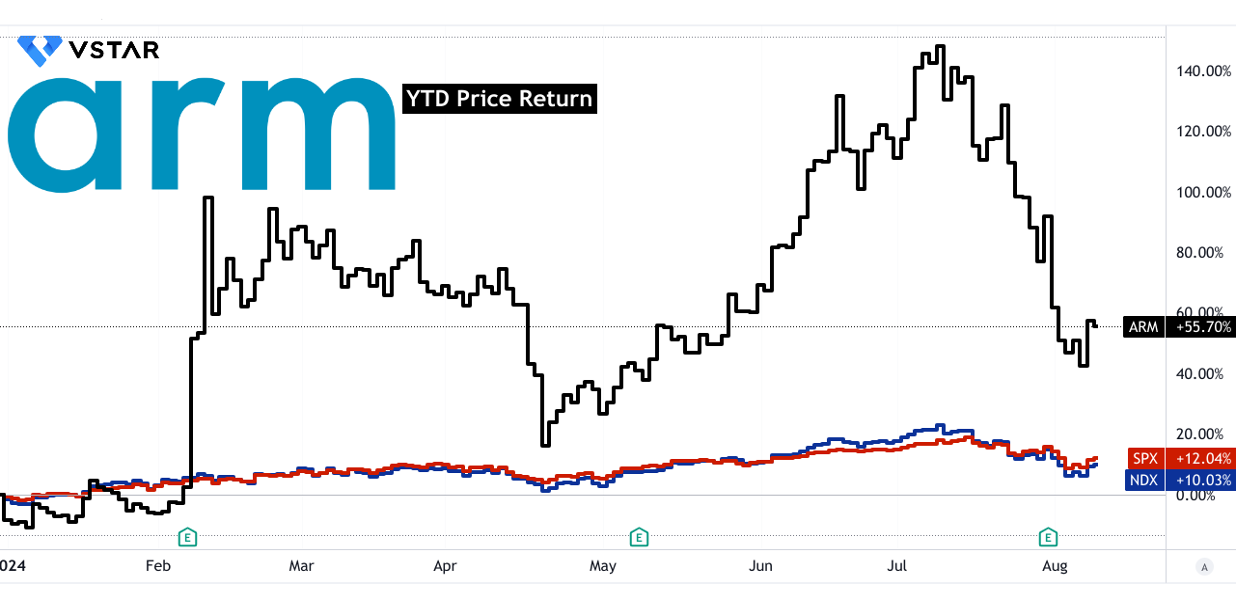

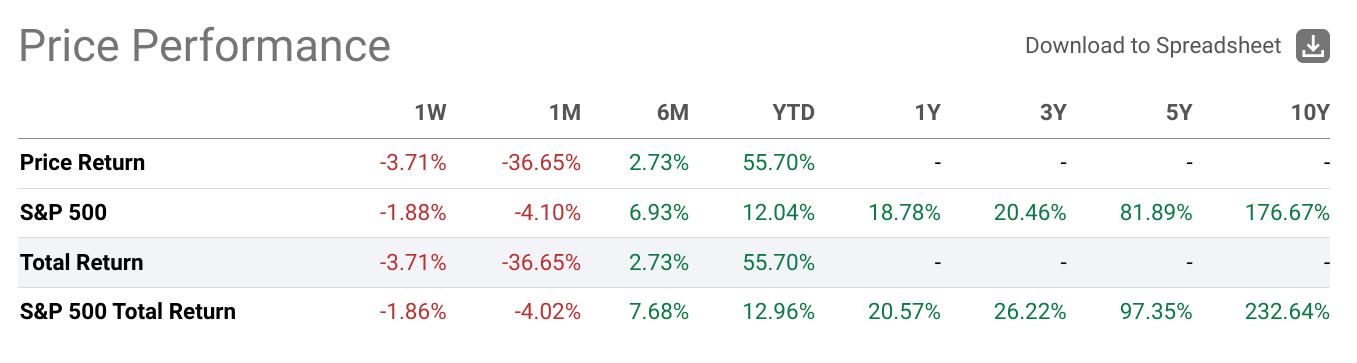

Arm Holdings (NASDAQ:ARM) stock has experienced volatile performance in recent periods. Year-to-date, Arm has seen a robust increase of 55.70%, substantially outperforming the S&P 500's 12.04% gain. This strong performance may be driven by positive investor sentiment around the company's long-term prospects, particularly in AI and other advanced technologies.

Source: tradingview.com

Over the past month, Arm stock plummeted by 36.65%, a significant drop compared to the S&P 500's 4.10% decline. This sharp decline likely indicates investor concerns regarding the company's valuation or potential challenges in the semiconductor industry.

However, Arm's six-month performance shows a modest gain of 2.73%, which, while positive, lags behind the S&P 500's 6.93% increase. This suggests that while the company has faced recent setbacks, it has managed to maintain some growth momentum.

Source:seekingalpha.com

Main influencing factors

Arm Holdings (NASDAQ: ARM) has demonstrated impressive performance recently, underscoring its strong market positioning and growth trajectory. In the latest quarter, the company achieved record revenues of $939 million, marking a 39% year-over-year increase. This growth was driven by robust license and royalty revenues, with licenses surging 72% and royalties up 17%. These results reflect continued high demand for Arm's technology, particularly in AI and advanced compute applications.

Key factors influencing Arm's performance include its leadership in AI and compute efficiency. The company's technology, particularly Armv9, has seen widespread adoption, which has significantly boosted royalty revenues. The introduction of advanced products such as Google's Axion Processor and AWS's Graviton4 highlights Arm's pivotal role in the AI and cloud sectors. These developments are contributing to increased demand for Arm's high-performance, power-efficient chips.

Moreover, Arm's success is supported by its expansive ecosystem and strategic investments. The company's focus on compute subsystems and its growing partnerships across mobile, cloud, and automotive sectors are enhancing its market presence. For example, the launch of Arm Ethos-U85 for edge AI and the expansion of CSS offerings are critical in accelerating customer time-to-market and boosting overall revenue per chip. Despite these successes, Arm faces some challenges. The ongoing weakness in IoT and networking markets due to inventory corrections poses a risk. Additionally, the stock's performance might be impacted by potential fluctuations in licensing revenue, which can be variable.

Expert Insights on ARM Stock Forecast for 2024, 2025, 2030 and Beyond

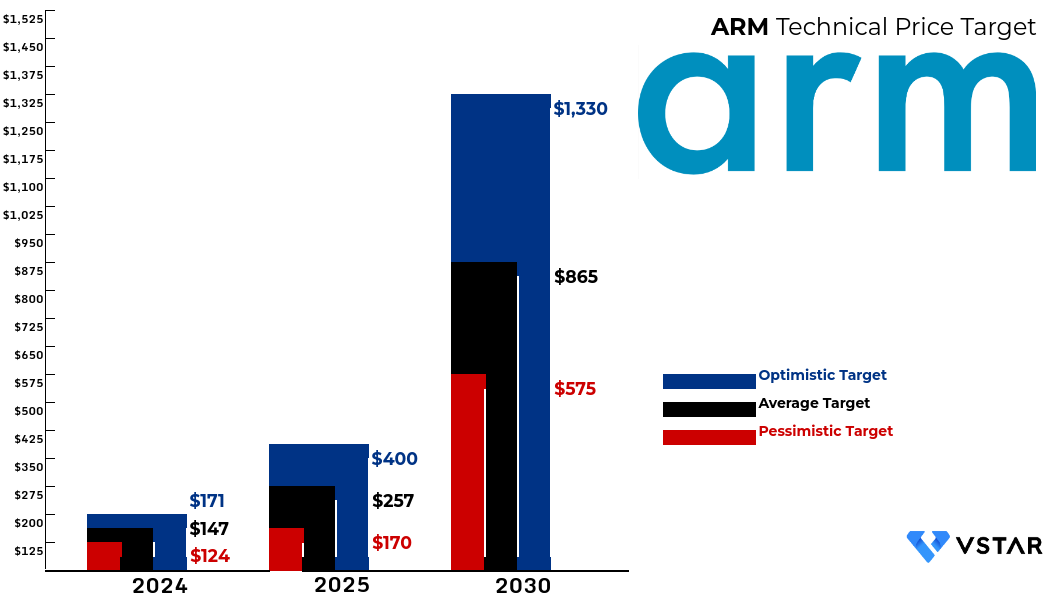

Arm Holdings (NASDAQ: ARM) has shown volatile stock performance, driven by high expectations post-IPO. Expert forecasts for ARM vary significantly, reflecting market uncertainty. For 2024, targets range from $124 to $171. By 2025, predictions extend from $170 to $400, and by 2030, estimates range from $575 to $1,330. These projections underscore the potential for substantial growth but also highlight significant risks tied to market and technological shifts.

Source: Analyst's compilation

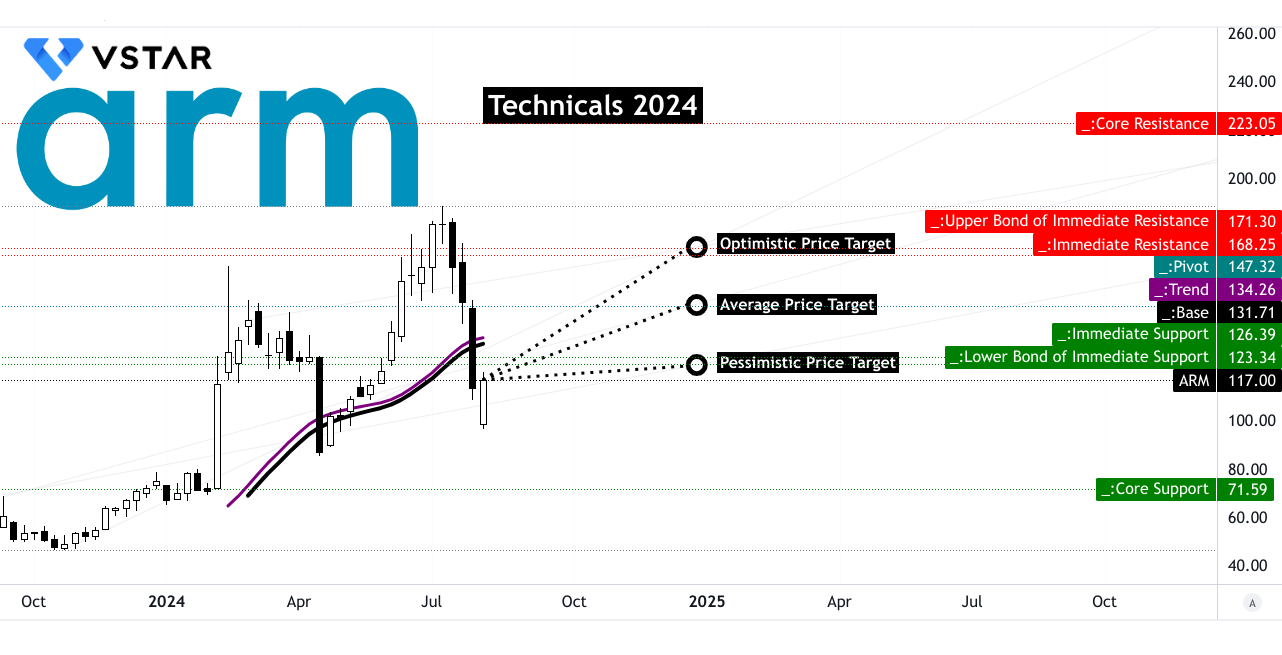

II. ARM Stock Forecast 2024

For 2024, ARM Holdings (NASDAQ: ARM) presents a mixed forecast. The average ARM price target is projected to be $147, reflecting a moderate upward trend. An optimistic scenario suggests a peak price of $171, indicating strong upward momentum. Conversely, a pessimistic outlook sets a low of $124, indicating potential downside risks.

Source:tradingview.com

The stock's current price stands at $117, below the trendline at $134.26 and the baseline at $131.71, which suggests a prevailing downward direction. Resistance levels are key to understanding ARM's potential movement. The primary resistance is identified at $126.39, with a significant pivot point at $147.32. In cases of heightened volatility, the resistance could extend up to $168.25, suggesting substantial potential for upward movement. The core support level is considerably lower at $71.59, providing a strong safety net in extreme scenarios.

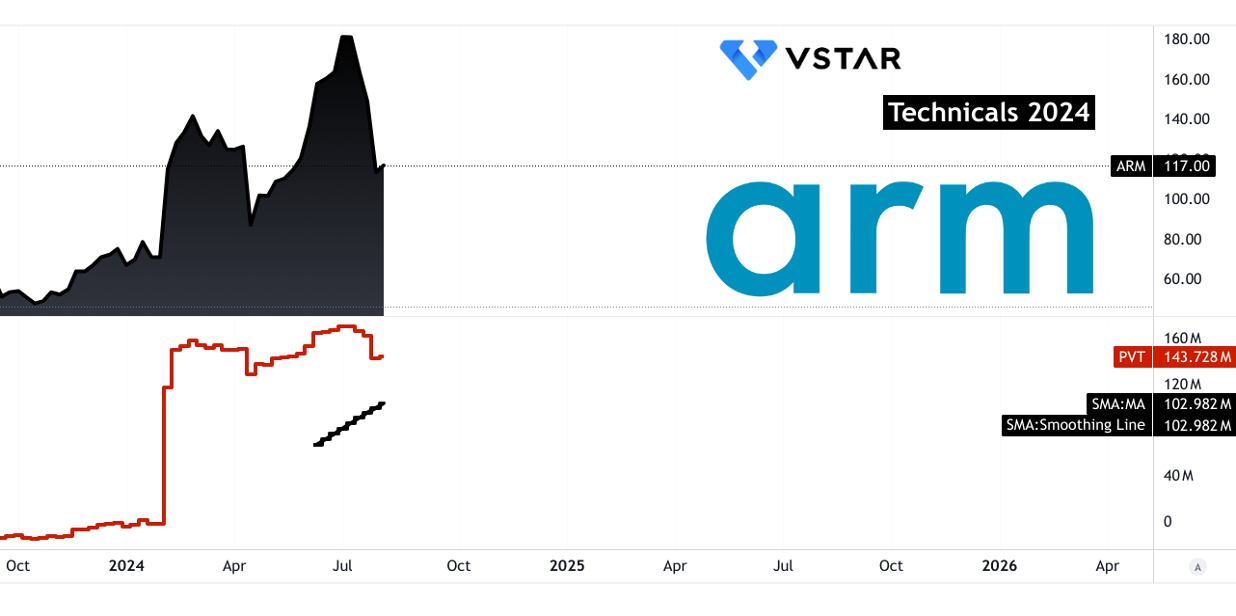

However, the price volume trend (PVT) reveals a bullish sentiment with the PVT line at 143.728 million, above its moving average of 102.982 million.

Source:tradingview.com

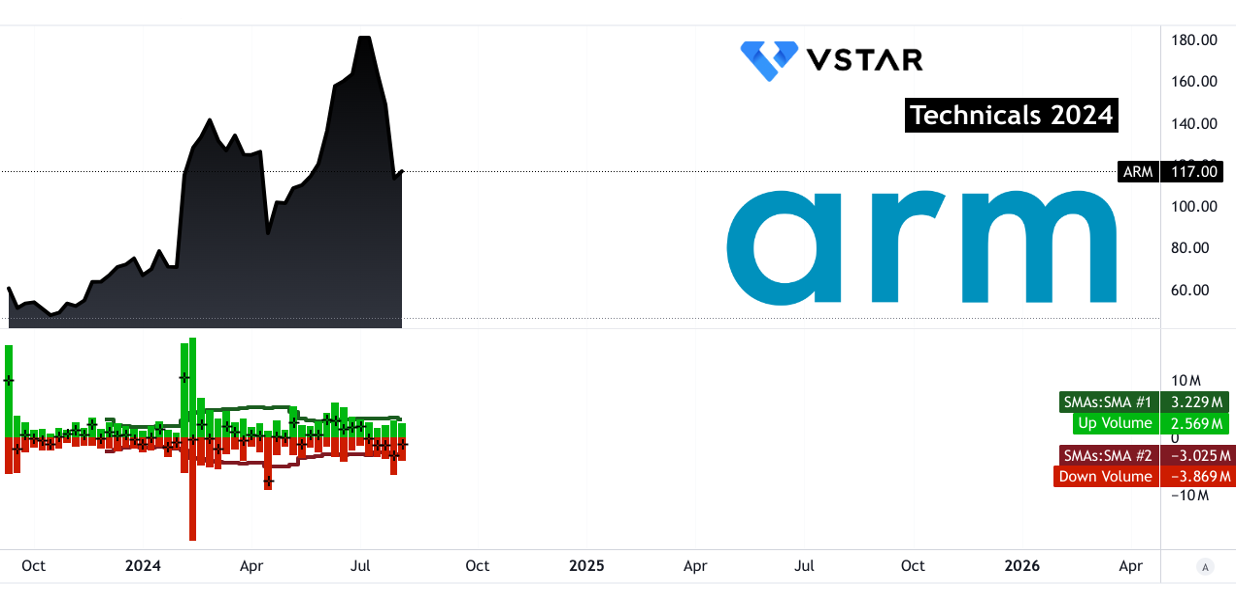

This bullish momentum is contradicted by the up volume average of 3.229 million is below the down volume average of -3.869 million, highlighting stronger selling pressure.

Source:tradingview.com

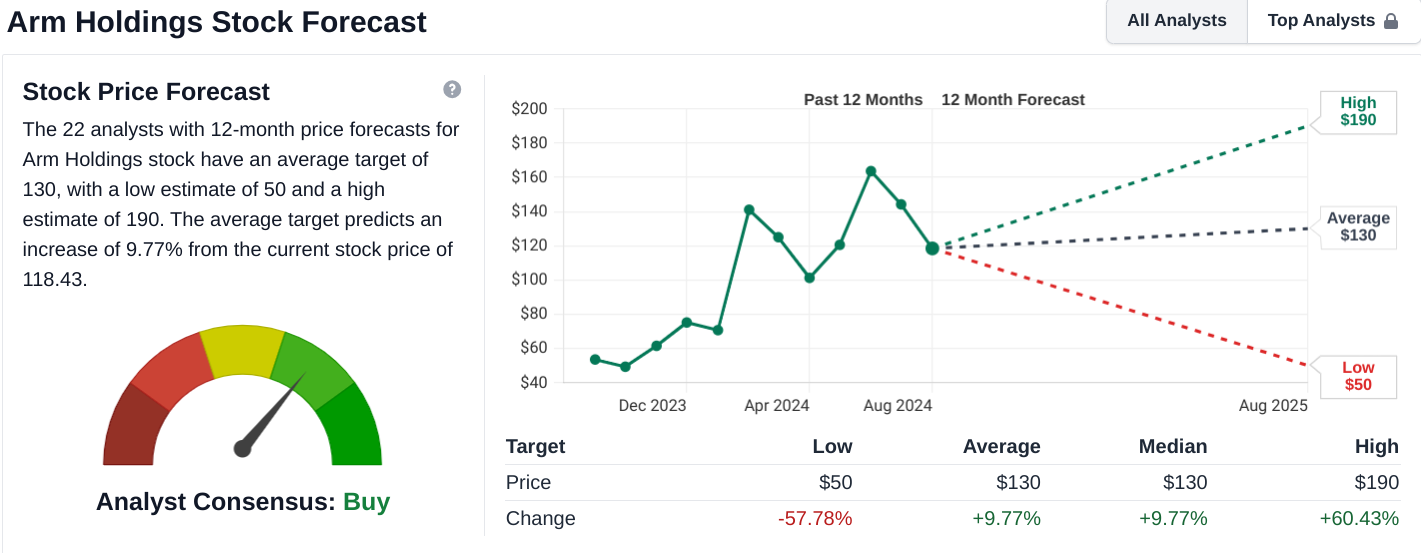

As of mid-2024, Arm Holdings (NASDAQ: ARM) stock forecasts present a mixed yet optimistic outlook. According to TipRanks, 19 Wall Street analysts have set an average 12-month price target of $139.31, suggesting a potential increase of 17.63% from the current price of $118.43. The forecasts range from a high of $180.00 to a low of $82.00, indicating considerable variability in expectations.

StockAnalysis.com provides a slightly lower average target of $130, which translates to a 9.77% potential increase from the current price. This forecast also spans a broad range, from $50 to $190, reflecting differing views on Arm's future performance.

Source:stockanalysis.com

Investing.com offers an average target of $135.42, implying a 14.35% upside. Analysts on this platform generally have a positive outlook, with forecasts ranging from a low of $66.00 to a high of $200.00.

A. Other Arm Stock Price Forecast 2024 Insights

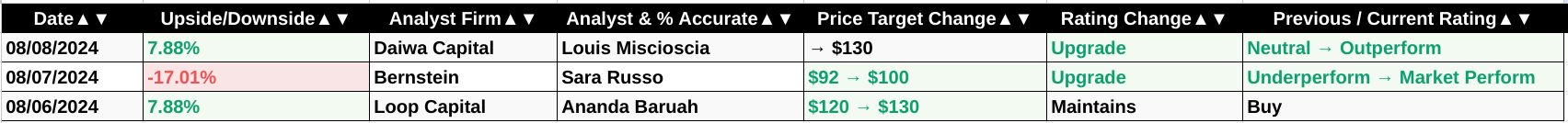

In 2024, ARM Holdings (NASDAQ: ARM) faces varying forecasts from prominent analysts.

- Daiwa Capital: On August 8, 2024, analyst Louis Miscioscia upgraded ARM from Neutral to Outperform with a price target of $130. This represents a 7.88% upside from its then-current price.

- Bernstein: Analyst Sara Russo revised ARM's target upwards from $92 to $100 on August 7, 2024. Despite the increase, Bernstein maintained its rating of Market Perform, indicating a -17.01% potential downside.

- Loop Capital: Ananda Baruah kept a Buy rating on ARM while raising the price target from $120 to $130 on August 6, 2024, reflecting a 7.88% upside potential.

Source: Benzinga.com

These data points highlight a mixed outlook for ARM in 2024. While Daiwa Capital and Loop Capital show optimism with upgraded ratings and higher price targets, Bernstein's cautious stance reflects concerns about potential downside despite its increased target. This divergence suggests uncertainty in ARM's stock performance, influenced by market conditions and company-specific factors.

B. Key Factors to Watch for Arm Stock Forecast 2024

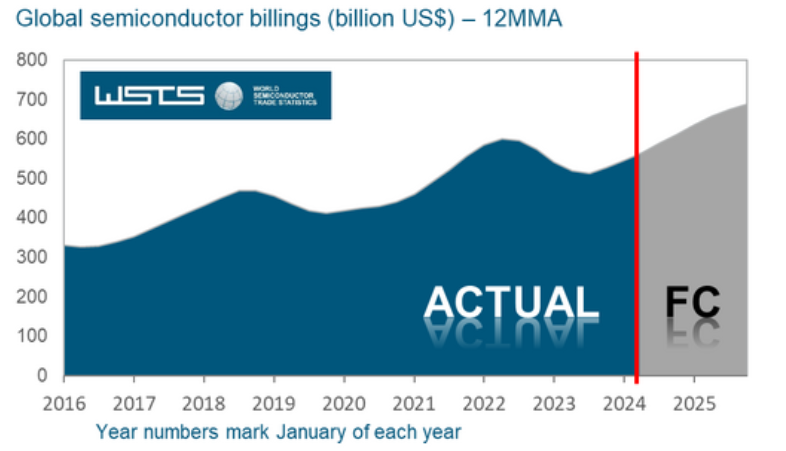

Arm Holdings (NASDAQ: ARM) has shown resilience and growth potential, reflecting broader industry trends. The global semiconductor market, which is expected to grow by 16% in 2024, significantly influences Arm's outlook. According to the Semiconductor Industry Association (SIA), global semiconductor sales reached $46.4 billion in April 2024, up 15.8% year-over-year and 1.1% month-to-month, marking the first month-to-month increase of the year. This positive momentum is expected to continue, with the World Semiconductor Trade Statistics (WSTS) forecasting a record annual sales total of $611 billion for 2024.

Source: wsts.org

Arm's recent developments align with this optimistic forecast. The company benefits from robust growth in the semiconductor sector, particularly in logic and memory integrated circuits. The Americas and Asia Pacific regions, which are projected to experience significant growth, are key markets for Arm. This regional expansion is expected to enhance Arm's market share and revenue.