I. Recent Qualcomm Stock Performance

QCOM December-Quarter Comments

According to JPMorgan analyst Samik Chatterjee, investors were expecting a double-digit revenue increase in the December quarter. On flat smartphone progress, Qualcomm, however, projected mid-single-digit expansion for the period, its fiscal Q1, he stated in a client note.

Chatterjee, however, believes that early advice might be conservative.

Nevertheless, he maintained his overweight assessment of Qualcomm stock but lowered his price target from 235 to 230.

Qualcomm's chip operations generated 86% of its total revenue in the June quarter. Qualcomm's remaining sales were derived from its technology licensing division.

73% of its revenue in the chip segment came from handsets, with the Internet of Things coming in second at 17% and the automotive sector at 10%. Device chip sales increased 12% annually to $5.9 billion in the third quarter of the fiscal year. Sales of automotive chips increased by 87% to $811 million. However, sales of IoT chips fell by 8% to $1.4 billion.

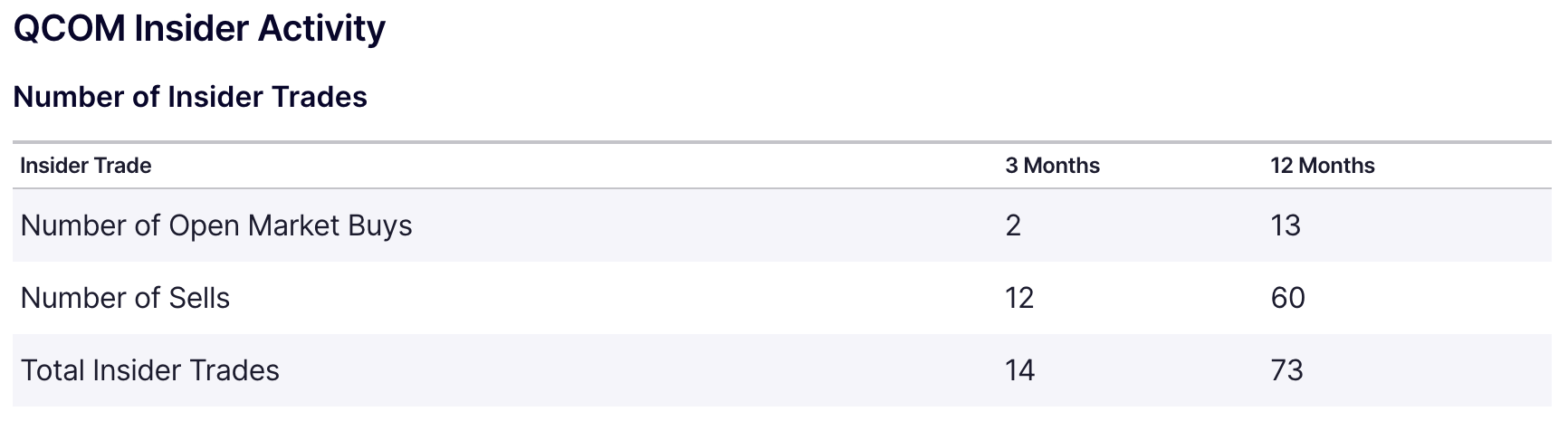

Qualcomm Inc. Insider Trading

Source: nasdaq.com

Qualcomm Inc. (NASDAQ:QCOM) Chief Financial Officer and Chief Operating Officer Akash Palkhiwala sold 3,000 shares of the business on August 8, 2024, for a price of $162.89 per share. The latest SEC filing contained documentation of the transaction. The insider now has 57,437 Qualcomm Inc. shares after this sale.

Qualcomm Inc. is a frontrunner in wireless technology research and development, having developed semiconductors, software, and services. The company's products are used in various wireless gadgets and mobile devices.

The insider has not made any stock purchases in the last year and has sold an aggregate of 22,000 shares. This latest deal is part of a larger pattern at Qualcomm Inc., where over the previous year, there have been 34 insider trading sales and no insider purchases.

On the day of the transaction, Qualcomm Inc.'s shares were valued at $162.89, giving the business a market value of roughly $183.23 billion. The stock's price-earnings ratio is 21.31, less than the industry average of 30.01.

With a price-to-gf-value percentage of 1.15, Qualcomm Inc. is slightly overvalued at $162.89, based on GF Values $141.28 estimate for the stock.

Expert Insights on QCOM Stock Forecast for 2024, 2025, 2030 and Beyond

QCOM stock is trading within bullish continuation momentum, and any dip could be a potential bullish signal. Before proceeding further, let's see Expert Insights on QCOM Stock Forecast for 2024, 2025, 2030, and Beyond:

|

Providers |

2024 |

2025 |

2030 & beyond |

|

Coinpriceforecast |

$182 |

$263 |

$532 |

|

Stockscan |

$179.53 |

$231.15 |

$251.78 |

|

Coincodex |

$ 137.43 |

$191.48 |

$324.75 |

|

Stockraven |

n/a |

$173.69 |

$268.34 |

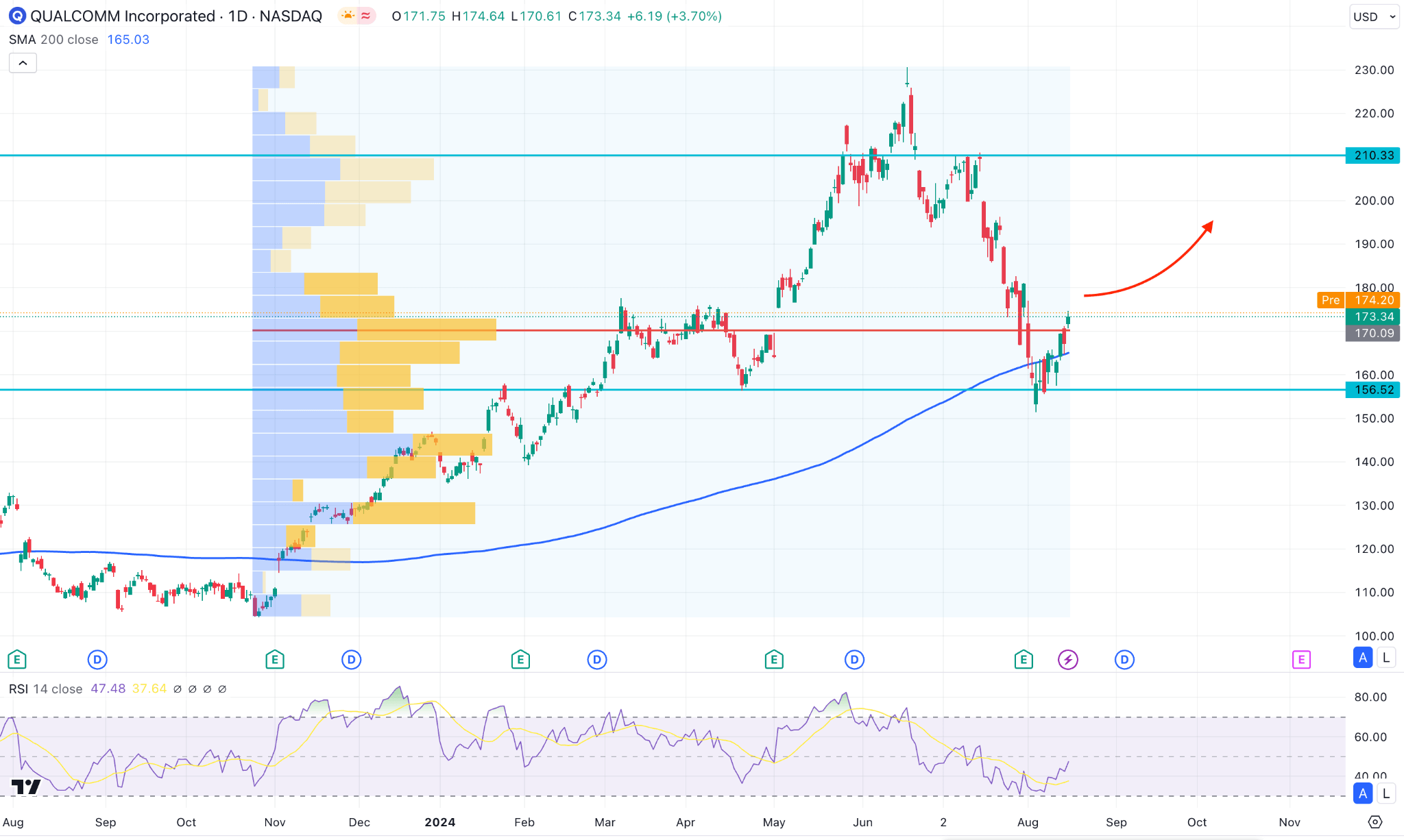

II. QCOM Stock Forecast 2024

Based on the current market outlook, the ongoing buying pressure could offer a decent trend trading opportunity in this stock, leading the price above the 200.00 psychological level by the end of 2024.

In the broader context, the bullish wave initiated from November 2023 came with a valid range breakout, making a decent bullish rally. Later on, we saw a bearish base formation before making another swing high at the 230.00 psychological level.

After forming a top at the 230.00 level, the price went bearish, forming a valid bearish reversal candlestick formation. As a result, the counter-impulsive bearish pressure took the price below the high volume level. In that case, investors should closely monitor how the price reacts at the discounted zone, from where a recent recovery is pending.

Based on the QCOM Stock Forecast 2024, investors should closely monitor how the price trades at the 156.52 static line. The primary intention for this stock is to find a bearish recovery below this line, which could offer a bearish continuation signal. In that case, a daily candle below the 150.00 psychological line could lower the price towards the 110.00 level.

On the other hand, the broader market outlook is still bullish, where a recovery above the high volume line signals a trend reversal. In that case, a valid daily candle above the 182.44 swing high could increase the bullish possibility, aiming for the 210.33 resistance level.