- TMTG's Q2 2024 showed strong cash reserves but significant losses due to legal and IT costs.

- The new Truth+ platform could drive growth, yet stock performance dropped sharply, reflecting market concerns.

- TMTG's high valuation ratios suggest potential overvaluation, raising caution over technical outlook.

- Competitive pressures and niche reliance pose risks to TMTG's future growth.

I. Trump Media & Technology Group Q2 2024 Performance Analysis

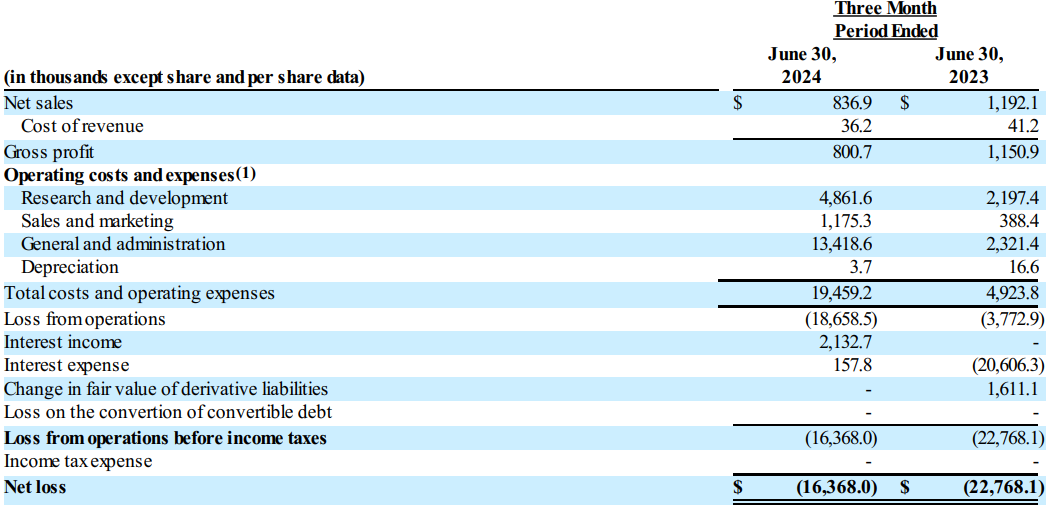

Financial Highlights:

In Q2 2024, Trump Media & Technology Group (TMTG) reported $837K in revenue, with a significant portion derived from interest income totaling $2.3 million. The company, however, faced a GAAP net loss of $16.4 million, largely driven by $8.3 million in legal expenses related to the merger with Digital World Acquisition Corp. and $3.1 million in IT consulting and software licensing costs. TMTG maintained a strong balance sheet with $344 million in cash and no debt. Despite the operating loss, the company's substantial cash reserves provide a solid financial foundation for future growth, particularly in expanding its streaming platform, Truth+.

Source: SEC Form 10-Q

Operational Performance:

During Q2 2024, TMTG focused on launching and expanding its TV streaming platform, Truth+. The rollout began on the Web, followed by Android and iOS devices. The platform leverages TMTG's custom-built content delivery network (CDN), which is designed to be uncancellable by Big Tech. This infrastructure development marks a significant technological advancement, giving TMTG full control over its streaming service. Additionally, TMTG began beta testing new features, such as an interactive 14-day electronic guide, network DVR, and video on demand. These innovations are expected to enhance user experience and increase market share in the conservative media landscape.

Source: SEC.gov

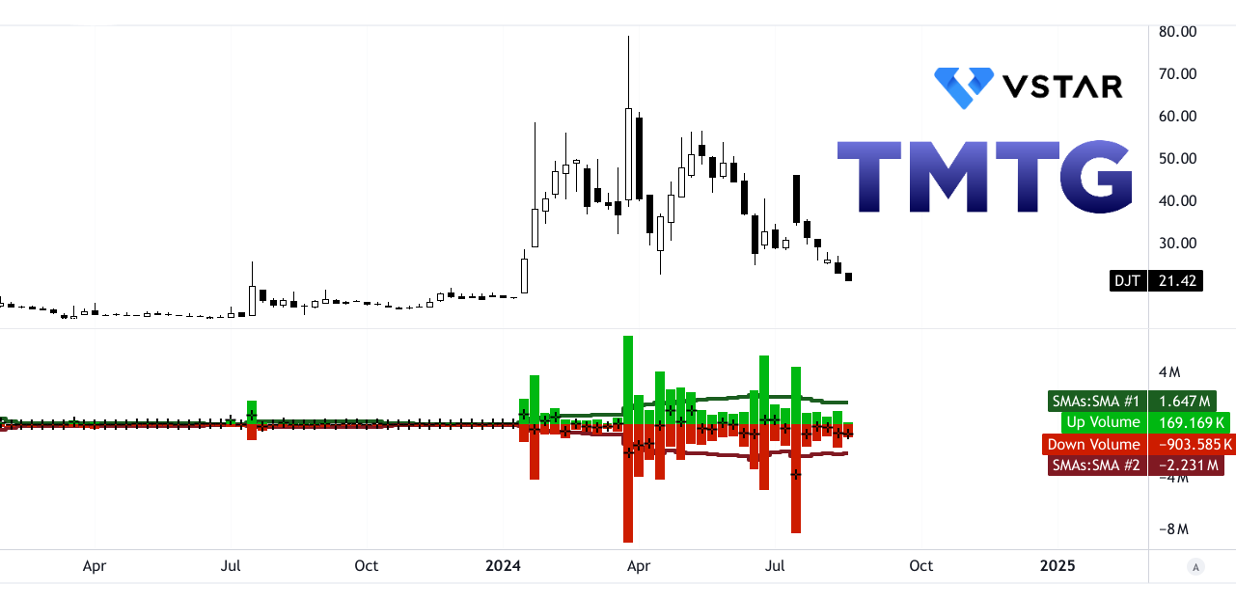

DJT Stock Price Performance

Trump Media & Technology (NASDAQ: DJT) saw a significant decline in stock price performance, with a 45.26% drop, contrasting sharply with the S&P 500's 3.85% and NASDAQ's 7.67% gains. The company's market cap stands at $6.22 billion, but its stock fell from $59.83 to $32.75 during the quarter, with a high of $61 and a low of $22.55. This poor performance indicates market concerns, possibly due to challenges in monetization, regulatory scrutiny, or investor sentiment, especially when compared to broader market indices that have shown positive returns.

Source: tradingview.com

II. DJT Stock Forecast 2024: Outlook & Growth Opportunities

A. Segments with Growth Potential:

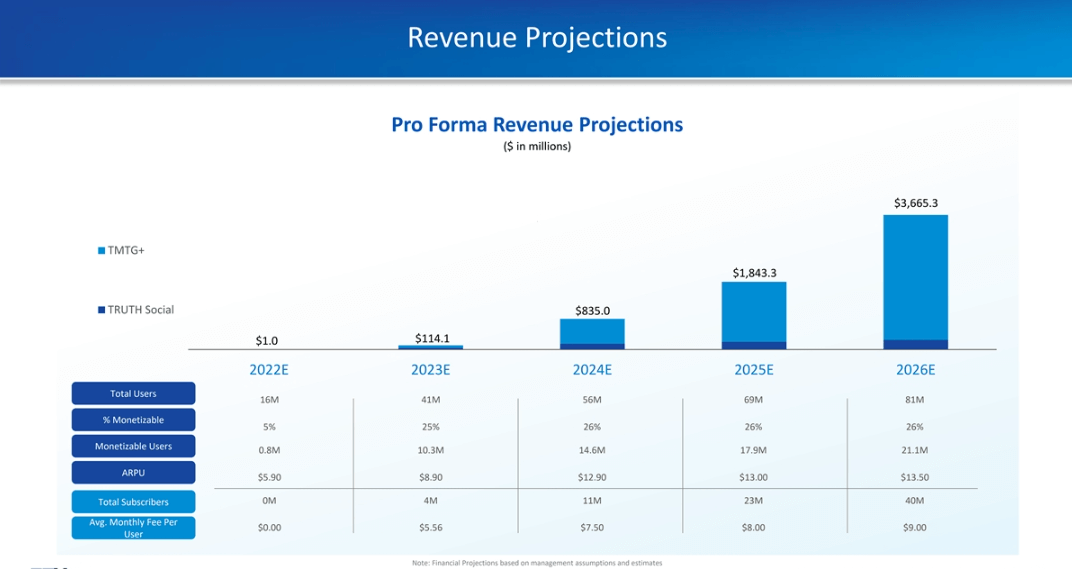

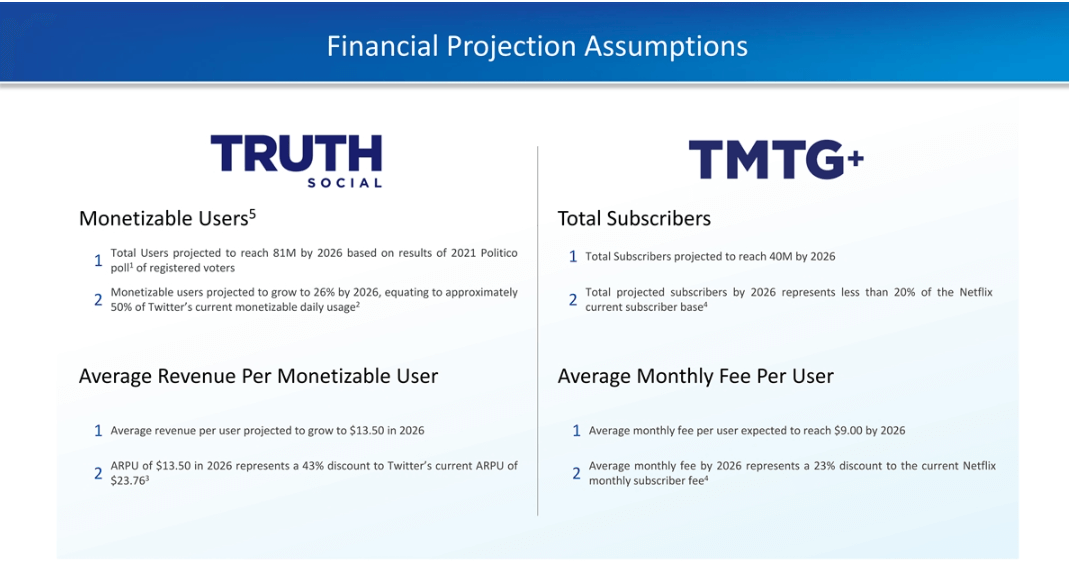

Trump Media & Technology Group (NASDAQ: DJT) holds significant growth potential in its recently launched TV streaming service, Truth+. This service, integrated with the Truth Social platform, targets a niche market focused on uncancellable, conservative content, and family-friendly programming. As the streaming industry continues to expand, TMTG's ability to tap into this demand positions the company for substantial growth. The introduction of advanced features, such as interactive TV guides, network DVR, and video-on-demand, will likely attract a broad audience, increasing user engagement and driving revenue. Furthermore, the company's custom-built content delivery network (CDN) enhances its control over streaming quality, reducing dependency on Big Tech and aligning with its brand identity of promoting free speech.

Source: SEC.gov

B. Expansions and Strategic Initiatives:

TMTG's strategic initiatives include potential mergers and acquisitions (M&A) to broaden its content offerings and technological capabilities. By acquiring complementary businesses, the company can accelerate its market penetration and diversify its revenue streams. Additionally, TMTG's investment in research and development (R&D) is focused on refining its streaming technology and expanding the Truth+ platform. This R&D investment underpins the rollout of new features and enhancements, which are crucial for retaining and growing its user base. Partnerships and collaborations with content creators and technology providers are also on the horizon, offering opportunities to enrich the content library and enhance the platform's technological robustness. These expansions and strategic initiatives position TMTG to capitalize on the growing demand for alternative media platforms, driving long-term growth in 2024 and beyond.

Source: SEC.gov

III. DJT Stock Forecast 2024

A. Truth Social Stock Price Prediction: Technical Analysis

The stock forecast for Trump Media & Technology (NASDAQ: DJT) by the end of 2024 reflects a complex technical landscape. Currently trading at $21.42, TMTG stock's trendline and baseline, based on modified exponential moving averages, are significantly higher at $36.55 and $36.80, respectively, suggesting downward pressure on the DJT stock.

Source: tradingview.com

The average DJT stock price target of $55 by the end of 2024 is derived from the momentum of change-in-polarity over mid- to short-term trends, particularly around Fibonacci retracement/extension levels. This target is optimistic, assuming the stock can maintain or gain upward momentum. The optimistic DJT price target, reaching $87, hinges on a strong upward swing, while the pessimistic target of $12.55 anticipates a downward trajectory if negative momentum persists.

Source: tradingview.com

The Relative Strength Index (RSI) at 34.80, below the regular bullish level of 38, indicates weak momentum with no signs of divergence, further confirmed by a downward trend in the RSI line. The MACD also signals bearish momentum, with a negative histogram of -3.11 and increasing trend strength, reinforcing the potential for downward pressure.

Conversely, the Price Volume Trend (PVT) line at 5.53 billion shows bullish momentum, contrasting with the bearish stock volume momentum indicated by a negative volume delta. These conflicting signals suggest that DJT stock price could experience significant volatility, with resistance at $29 and core support at $12 being key levels to watch.

Source: tradingview.com

Source: tradingview.com