- Nvidia's Q3 2024 revenue reached $30 billion, up 122% YoY, with data centers contributing 87.7% of the total.

- Data Center segment growth was driven by Nvidia's Hopper GPUs and generated $26.3 billion, up 154% YoY.

- Nvidia's automotive and healthcare segments are emerging growth areas, with YoY increases of 37% and strong potential in AI applications.

- Nvidia's strategic expansions in AI through partnerships and R&D investments highlight confidence, supported by a $50 billion share repurchase.

- Nvidia stock shows mixed technical signals, with a current price of $125 and an optimistic year-end target of $193.

I. Nvidia Q3 2024 Performance Analysis

A. Key Segments Performance

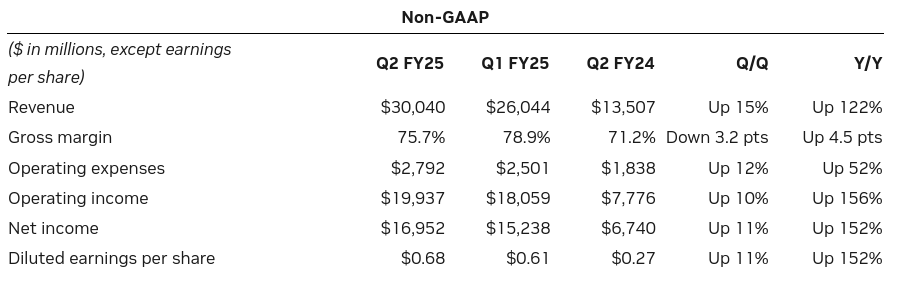

Financial Highlights:

Nvidia reported a record Q3 2024 revenue of $30 billion, marking a 15% increase from Q2 and a staggering 122% YoY growth. The Data Center segment was the primary driver, contributing $26.3 billion, up 154% YoY. Net income surged by 160% YoY to $8.25 billion, translating to GAAP EPS of $0.67 (up 168% YoY). Non-GAAP EPS reached $0.68, up 152% YoY. Operating income rose by 120% YoY to $12 billion, with GAAP gross margins at 75.1%. Nvidia's operating expenses increased by 12% sequentially to $4.3 billion, driven by higher compensation-related costs. The balance sheet remains robust, with $25.7 billion in cash and equivalents, while cash flow from operations hit $14.5 billion.

Source: nvidianews.nvidia.com

Operational Performance:

Data Center performance was exceptional, driven by strong demand for Nvidia's Hopper and Blackwell architectures, with Data Center revenue accounting for 87.7% of total revenue. Gaming revenue grew 16% YoY to $2.9 billion, fueled by RTX GPU sales and increased demand for AI-powered gaming experiences. Nvidia introduced several new products, including the Blackwell GPU, Spectrum-X Ethernet platform, and advancements in AI and generative AI technologies, solidifying its market leadership. Nvidia's market share in the Data Center segment increased to over 80%, driven by accelerated adoption of AI solutions across industries.

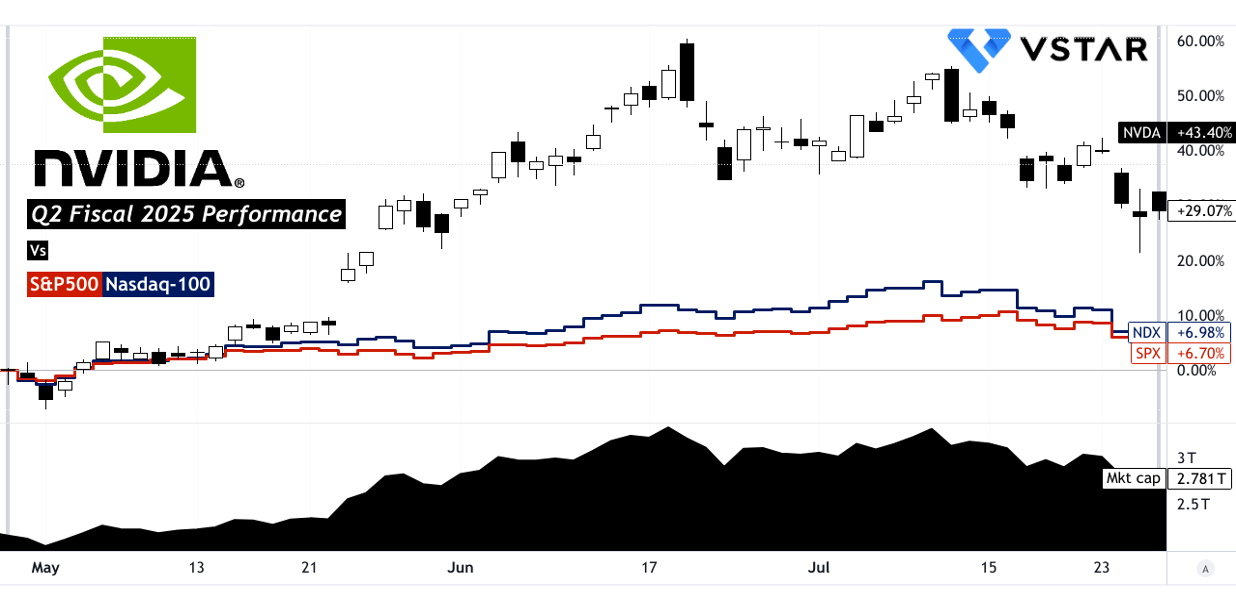

B. NVDA Stock Price Performance

NVIDIA's (NVDA) stock price surged 29% during the quarter, with the price rising from $87.60 to $113.06. The stock hit a high of $140.76 and a low of $81.25. In comparison, the S&P 500 and NASDAQ returned 6.7% and 7%, respectively. This stark outperformance underscores NVIDIA's market strength, contributing to its market capitalization reaching $2.78 trillion. The 29% price return significantly exceeded broader market indices, highlighting investor confidence in NVIDIA's growth potential amid favorable conditions in the semiconductor sector.

Source: tradingview.com

II. NVDA Stock Prediction: Outlook & Growth Opportunities

A. Segments with Growth Potential

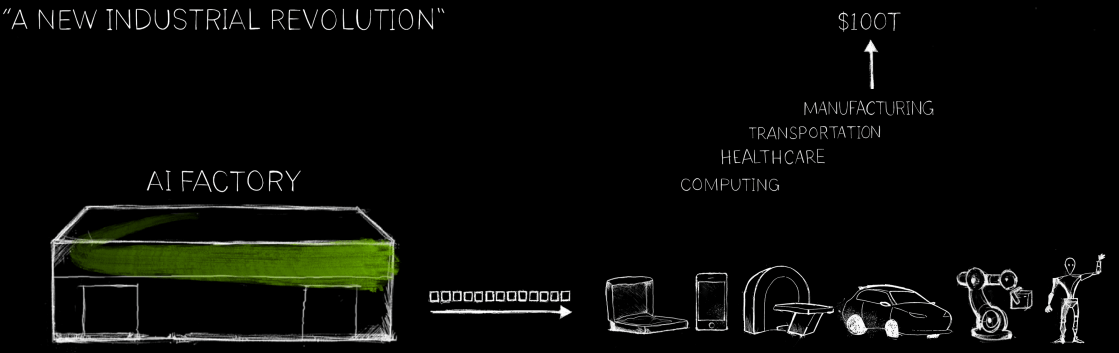

NVIDIA's data center segment is a primary driver of growth, achieving $26.3 billion in revenue in Q2 FY 2025, representing a 16% sequential increase and a staggering 154% year-on-year growth. This surge is largely due to the strong demand for NVIDIA Hopper GPUs and networking platforms. The compute and networking revenues within this segment grew by over 2.5 times and 2 times, respectively, compared to last year. Generative AI workloads, model training, and inference are key contributors, with inference alone driving more than 40% of data center revenue over the past four quarters. Additionally, NVIDIA's automotive segment shows promise, with a 37% year-on-year increase in Q2 FY 2025, driven by the adoption of self-driving platforms and AI cockpit solutions. Healthcare is also emerging as a growth area, particularly in AI-driven medical imaging and drug discovery, with expectations to evolve into a multi-billion dollar business.

Source: gartner.com

B. Expansions and Strategic Initiatives

Source: NVIDIA_Annual_Stockholder_Meeting_2024

NVIDIA is strategically positioned to capitalize on AI's expansion through targeted mergers and acquisitions, R&D investments, and partnerships. The recent launch of the NVIDIA AI Foundry service, in collaboration with Meta's Llama 3.1, exemplifies NVIDIA's focus on generative AI for enterprises. NVIDIA's partnerships with companies like Accenture and SAP to integrate AI into business applications underscore its commitment to expanding AI capabilities across industries. In R&D, NVIDIA's continuous investments are evident in the development of the Blackwell platform, expected to generate billions in revenue starting Q4 FY 2025. The $50 billion share repurchase authorization indicates strong confidence in future growth, bolstered by significant expansions in AI, automotive, and data center technologies.