I. Recent AMAT Stock Performance

AMAT Received DOJ Subpoena

Applied Materials recently disclosed that the U.S. Department of Justice issued a subpoena requesting information about its grant applications under the U.S. Chips and Science Act. The company's application for federal funding was ultimately denied.

This denial marks a significant setback for Applied Materials, which had planned to build a $4 billion research facility in Sunnyvale, California.

The company has been under increased scrutiny, particularly regarding its product shipments to China. Earlier this year, Applied Materials also received inquiries from the Securities and Exchange Commission and the U.S. Attorney's Office for the District of Massachusetts, further highlighting its regulatory challenges.

AMAT Share Exchange Update

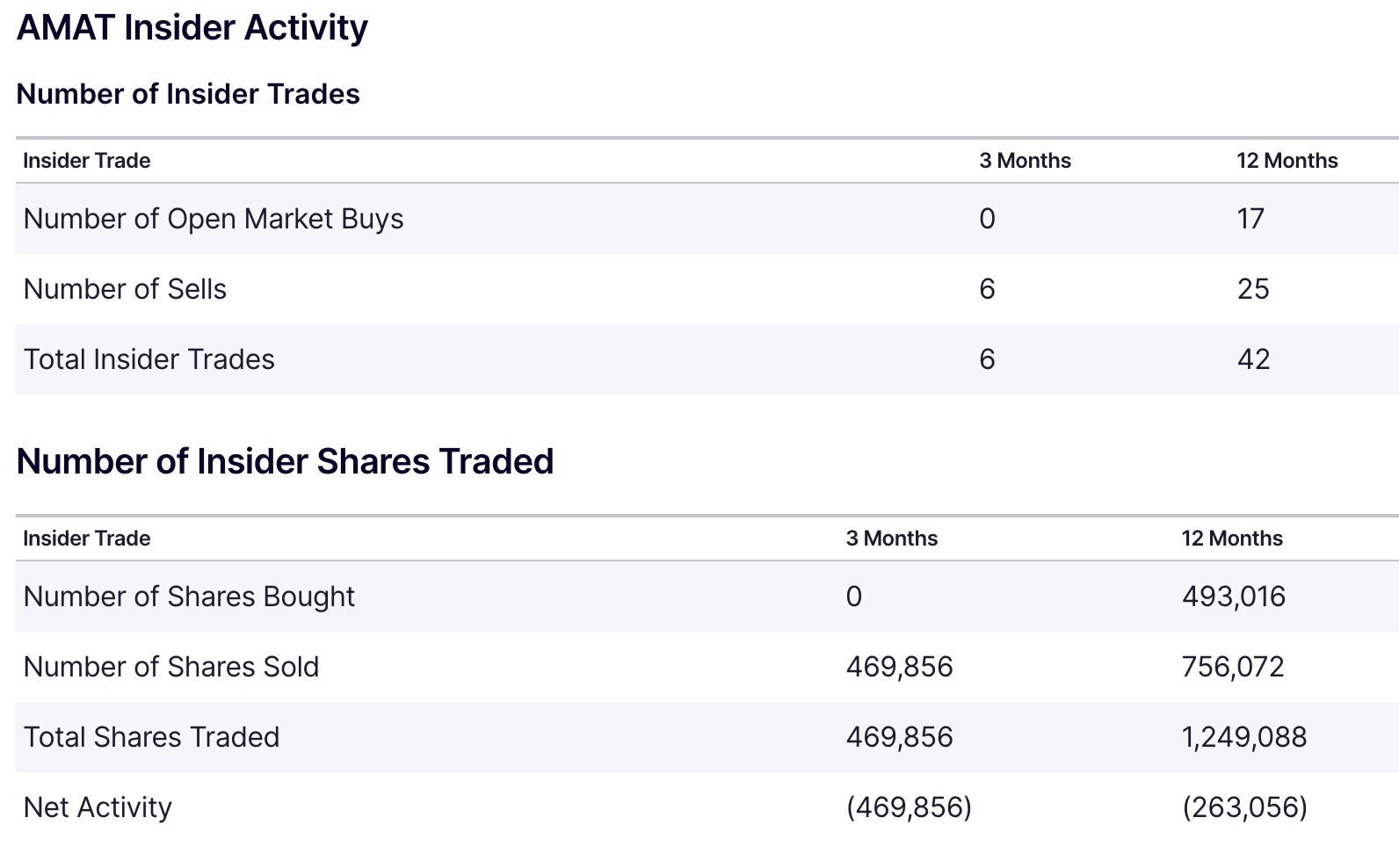

According to a recent SEC filing, Bailard Inc. trimmed its holdings in Applied Materials, Inc. (NASDAQ: AMAT), reducing its position by 6.6% during the second quarter. The institutional investor sold 1,869 shares, leaving it with 26,262 shares of the semiconductor equipment manufacturer, valued at approximately $6.2 million.

This adjustment in Bailard's portfolio mirrors similar moves by other institutional investors. For instance, Redmont Wealth Advisors LLC and Atlantic Edge Private Wealth Management LLC initiated new positions in Applied Materials, valued at $26,000 and $27,000, respectively.

Mark Sheptoff Financial Planning LLC acquired a stake worth $35,000 in the first quarter. These strategic shifts reflect a broader trend of investors recalibrating their exposure to Applied Materials amid a complex semiconductor industry landscape.

AMAT Lawsuit Threat

Bronstein, Gewirtz & Grossman, LLC has launched an investigation on behalf of investors who purchased securities of Applied Materials, Inc. (NASDAQ: AMAT). This inquiry follows reports that the U.S. Justice Department is conducting a criminal investigation into Applied Materials, alleging that the company violated export restrictions involving China's leading chipmaker, SMIC.

The revelation of this probe led to significant declines in Applied Materials' stock price in November 2023 and February 2024.

Expert Insights on AMAT Stock Forecast for 2024, 2025, 2030 and Beyond

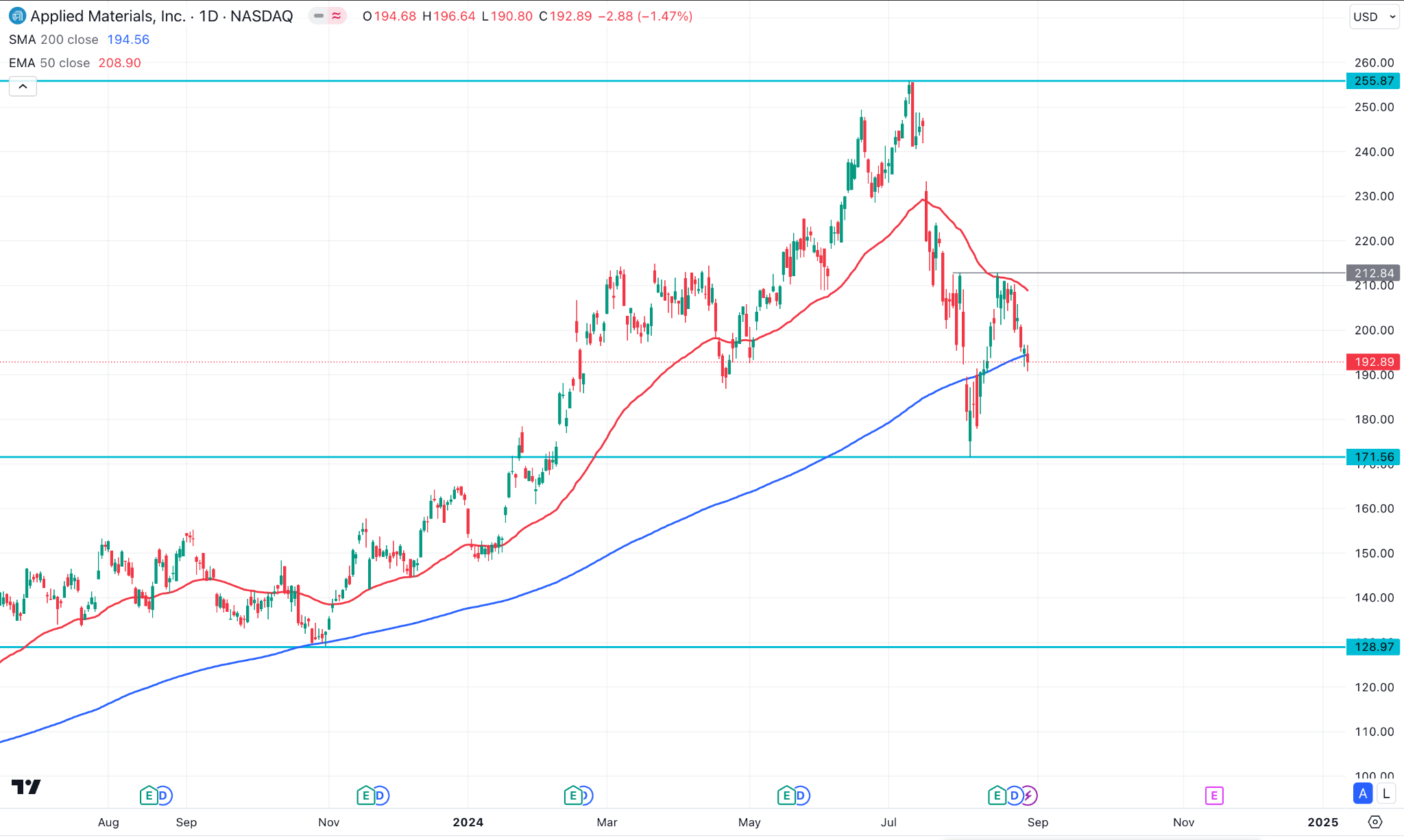

The AMAT stock price reached a high near 167.06 at the beginning of 2022 and started declining. It then made a low near 71.12 by October 2022. Since then, the price has been on an uptrend until July 2025, hitting the ATH of 255.89 and starting to decline.

As of writing, the price of the AMAT stock is floating at 196.23 after bouncing back from the low of 171.61. Before checking further details, let's see what experts anticipate about AMAT stock price by the end of 2024, 2025, 2030, and Beyond.

|

Providers |

2024 |

2025 |

2030 and beyond |

|

StockScan |

$274.90 |

$381.66 |

$553.03 |

|

Markettalks |

$282.00 |

$337.50 |

$647.50 |

|

Coincodex |

$215.56 |

$258.17 |

$1,019.63 |

II. AMAT Stock Forecast 2024

The AMAT stock price is trading within a minor bearish pressure, which may soon regain the previous resistance of 231.90 and gradually create a new ATH near 280.00 by the end of 2024.

In the daily chart of AMAT, the broader market direction remains bullish, where the most recent price struggles to aim higher at the double-top pattern.

The price floats between the EMA 50 and SMA 200 lines, reflecting a mixed signal. The EMA 50 lines act as dynamic resistance, while the SMA 200 line acts as a dynamic support level. The price above the SMA 200 line indicates the price is still in a bullish trend for the longer term, and when it is below the EMA 50 line, it reflects short-term bearish pressure. So, the price exceeds the EMA 50 line, indicating significant bullish pressure on the asset price. In that case, it may reach the nearest resistance near 231.90, followed by the next possible ATH, as many experts predict by the end of the current year.

Meanwhile, the price reaches below the SMA 200 line. In that case, it will declare sellers' domination, and the price may retrace toward the previous support of nearly 171.60 before bouncing back to the resistance levels.