EURUSD

Fundamental Perspective

The EURUSD pair closed just below 1.1100, remaining stable for the week despite early losses that saw the pair hit a low of 1.1001. The US Dollar initially gained strength due to market risk aversion but later reversed as the European Central Bank (ECB) and US inflation data influenced sentiment.

The ECB reduced its deposit rate by 25 basis points to 3.5% while cutting other key rates by 60 basis points, reflecting slow economic growth in the Eurozone. ECB President Christine Lagarde acknowledged these economic headwinds and indicated that restrictive monetary policy would remain in place as long as needed to control inflation. The ECB reaffirmed that future decisions would be made on a meeting-by-meeting basis and would rely on incoming data.

In the US, inflation data fell to beat expectations. The Consumer Price Index (CPI) and Producer Price Index (PPI) figures both missed forecasts, reducing hopes for a larger 50-basis-point rate cut by the Federal Reserve. Instead, markets now expect a 25-basis-point reduction, with the Fed's updated economic projections likely to shape future policy.

Upcoming monetary decisions from the Bank of England and Bank of Japan, as well as critical economic data from the US and Eurozone, may further influence market sentiment.

Technical Perspective

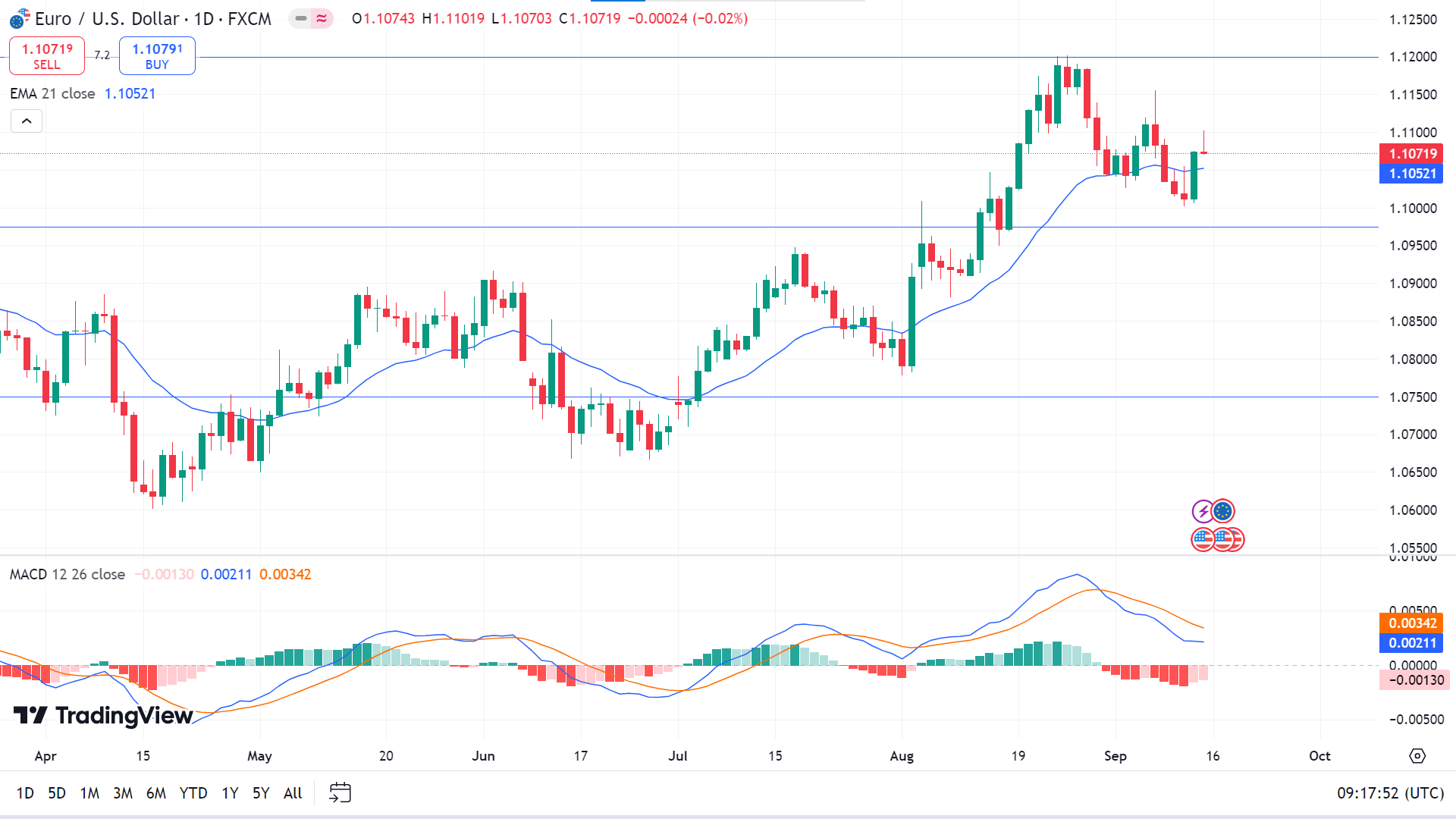

The last weekly candle closed as a doji with a small red body and longer lower wick after a green inverted hammer candle. This suggests that EURUSD might still have bullish pressure for next week.

On the daily chart, the price is above the EMA 21 line, reflecting recent bullish pressure, while the MACD indicator window reading suggests otherwise. The red histogram bars on the MACD window are fading, indicating a weaker selling pressure. Following the major trend, the price has a higher possibility of hitting the nearest resistance near 1.1200, followed by the next resistance near 1.1432.

Meanwhile, if the bearish pressure on the MACD indicator window continues and the price declines below the EMA 21 line, it can reach the primary support near 1.0975, followed by the next support near 1.0745.