EURUSD

Fundamental Perspective

The EURUSD pair approached the 1.1200 mark again last week but settled at 1.1160, holding moderate gains. The pair have struggled to surpass this level since mid-August, and they are awaiting the Federal Reserve's (Fed) policy announcement. The Fed introduced a 50-basis-point rate cut, leading to a brief drop in the USD. Chair Jerome Powell emphasized that future decisions will depend on economic data and be made on a meeting-by-meeting basis. Projections suggest an additional 50 bps cut this year, followed by 100 bps in 2025 and another 50 bps in 2026, targeting a terminal rate of 2.9%.

Although concerns about economic growth persist, the Fed's actions helped calm recession fears. Treasury yields eased, with the 2-year yield falling below the 10-year, signaling growing optimism for a potential recovery. Meanwhile, European data, mainly from Germany, continued to disappoint, with worsening economic sentiment and assessments of the current situation. In contrast, US Retail Sales rose by 0.1% in August, exceeding expectations. Investors now focus on upcoming economic data, particularly US inflation figures, as they speculate on the Fed's next move. Financial markets expect a 25 bps rate cut, though further disinflation could spark talks of a 50 bps reduction.

Technical Perspective

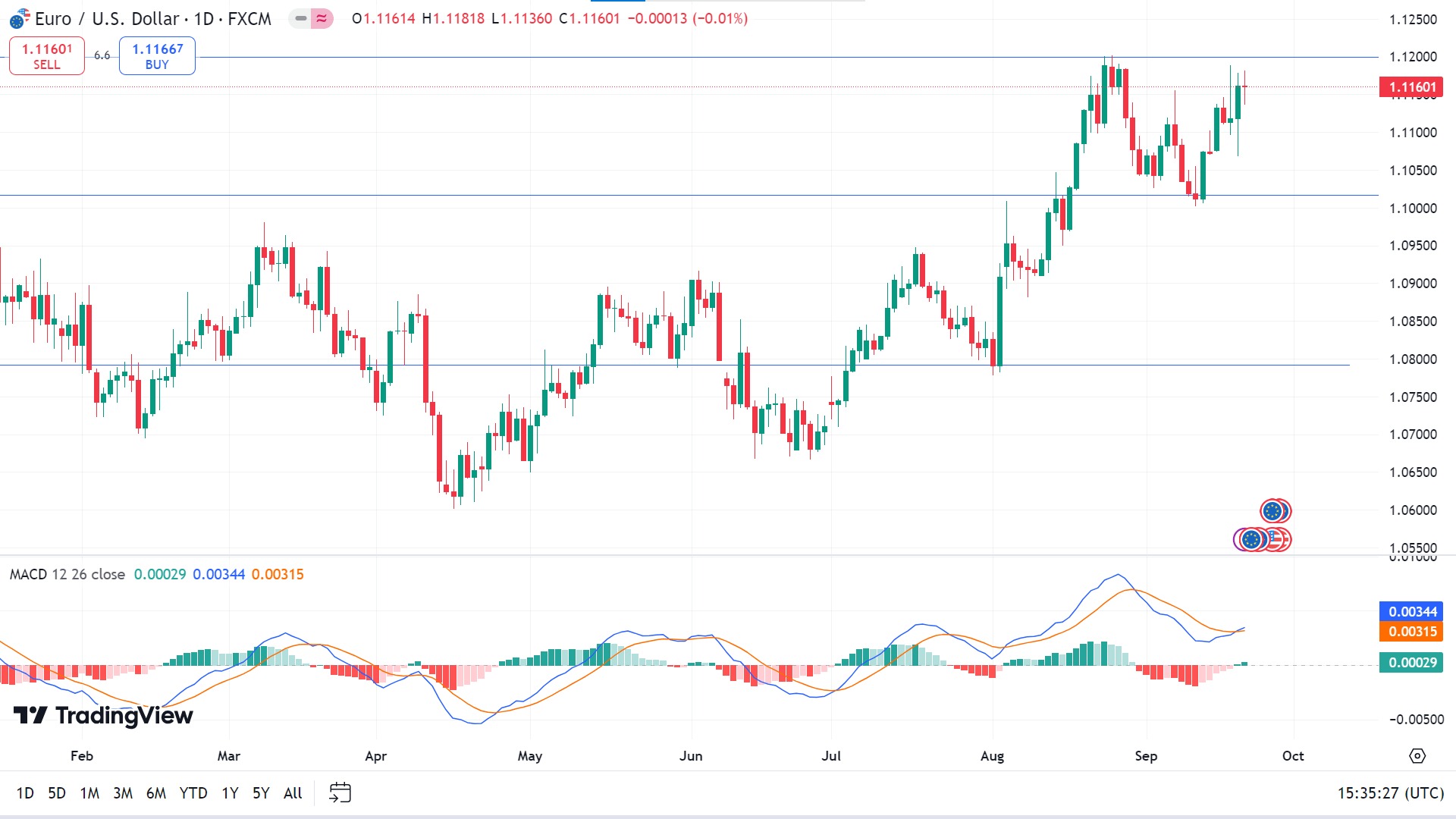

The last weekly candle finished solid green after a red hammer candle, reflecting that bulls are currently controlling the asset price, which leaves buyers optimistic for next week.

The bullish continuation is aiming higher, as the current price hovers above the 1.1000 crucial support level. Also, the MACD indicator window reveals that the price is currently in an uptrend on the daily chart. The dynamic signal line creates a fresh, bullish crossover, and green histogram bars appear. The price may head toward reaching the nearest resistance near 1.1270, followed by the next resistance near 1.1432.

Meanwhile, any pause in the current uptrend may guide the price to decline at the primary support level near 1.1015. If the MACD window indication turns bearish again, the EURUSD pair can drop to the next support level near 1.0855.