EURUSD

Fundamental Perspective

The EURUSD pair climbed back above 1.1150 level, recovering the bulk of its intraday losses as the US Dollar weakened after the release of the August Personal Consumption Expenditures (PCE) Price Index. The report showed that inflation gradually aligns with the Federal Reserve's 2% target. Annual PCE inflation increased by 2.2%, slightly below the 2.3% forecast and down from July's 2.5%. Core inflation, which excludes food and energy, rose as expected to 2.7% year-on-year.

The US Dollar Index (DXY) slipped to 100.40, edging closer to its crucial support level of 100.20. This weakening Dollar has boosted the EURUSD pair as investors anticipate further rate cuts from the Federal Reserve. Markets are increasingly confident of a second rate cut in November but remain divided between a 25- and 50-basis-point reduction.

Looking ahead, attention will shift to Fed Chair Jerome Powell's speech on Monday, along with a series of labor market reports and the ISM Purchasing Managers' Index (PMI), which could provide more clarity on the Fed's policy direction and the Dollar's outlook.

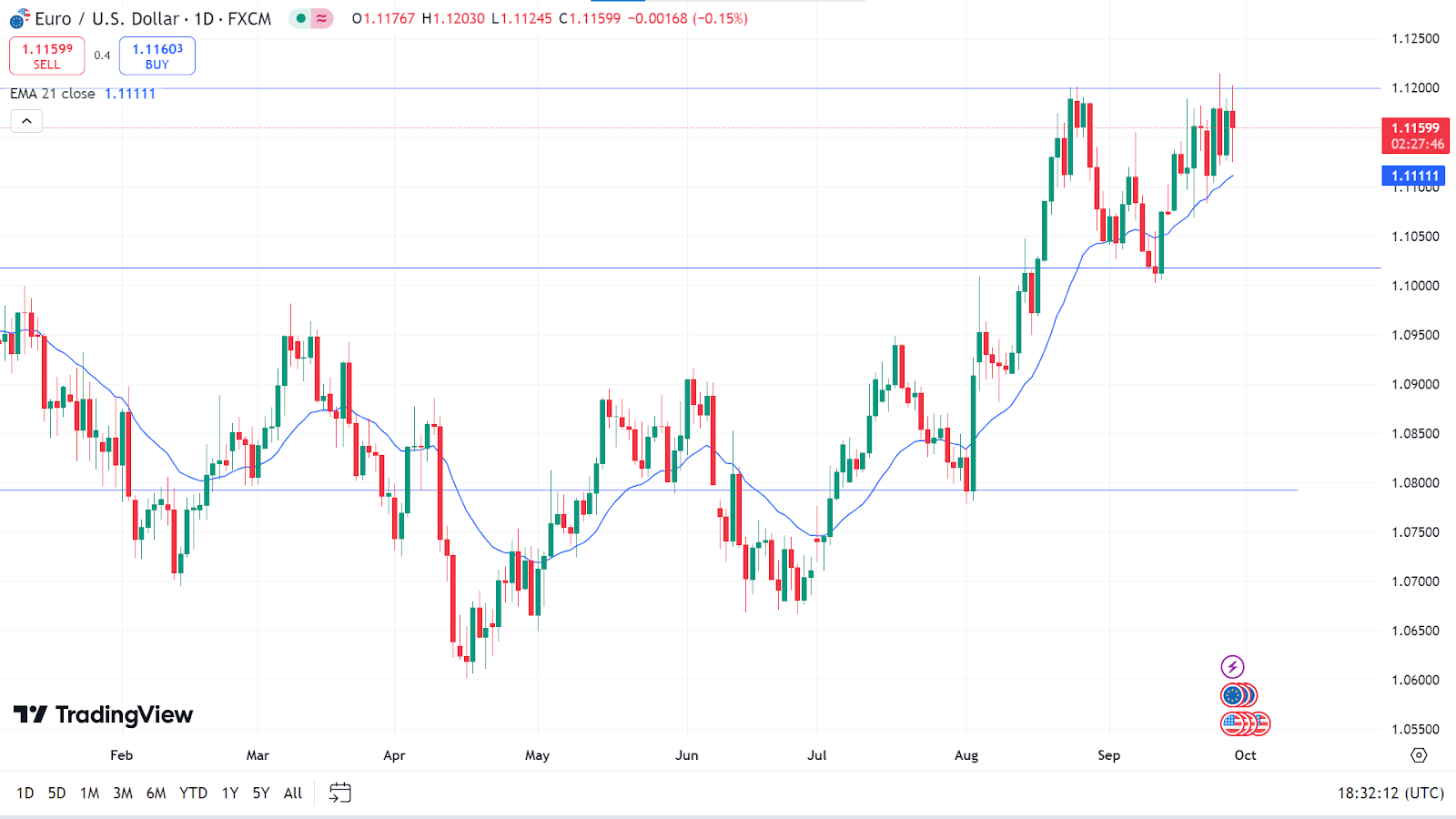

Technical Perspective

The last weekly candle doji, with a small green body after a solid green candle, reflects a pause in the current bullish trend, leaving buyers optimistic for the next week.

The price is floating above the EMA 21 line, signaling the recent bullish pressure on the asset price. The price may head toward the nearest resistance, 1.1270, followed by the next resistance near 1.1432.

In the meantime, any pause occurs in the current uptrend, and if the price declines below the EMA 21 line, it can reach the primary support near 1.1017, followed by the next support near 1.0882.