EURUSD

Fundamental Perspective

The EUR/USD pair started weak in October, declining to 1.0958, driven by robust US employment data that boosted the US dollar. This positive data reduced market expectations for aggressive Federal Reserve rate cuts while escalating Middle East tensions pushed investors toward safe-haven assets, further supporting the Greenback. Oil prices spiked amid concerns over potential supply disruptions, creating pressure on global stock markets.

US employment data exceeded forecasts, with September's Nonfarm Payrolls showing 254K new jobs and unemployment dropping to 4.1%. Other key indicators, including the ADP private jobs report and an improved ISM Services PMI, pointed to a resilient US economy. As a result, market bets on a 50 bps Fed rate cut fell sharply, with most anticipating a more minor 25 bps reduction.

In the Eurozone, inflation pressures eased, with Germany's HICP falling and the broader EU index dipping to 1.8% annually. However, weak economic growth indicators, including a marginal rise in the EU Composite PMI to 49.6, kept the Euro downward.

Attention will be on key US releases, including September's CPI and FOMC meeting minutes, while the Eurozone calendar will highlight retail sales data and the ECB's meeting accounts. However, no major policy shifts are anticipated.

Technical Perspective

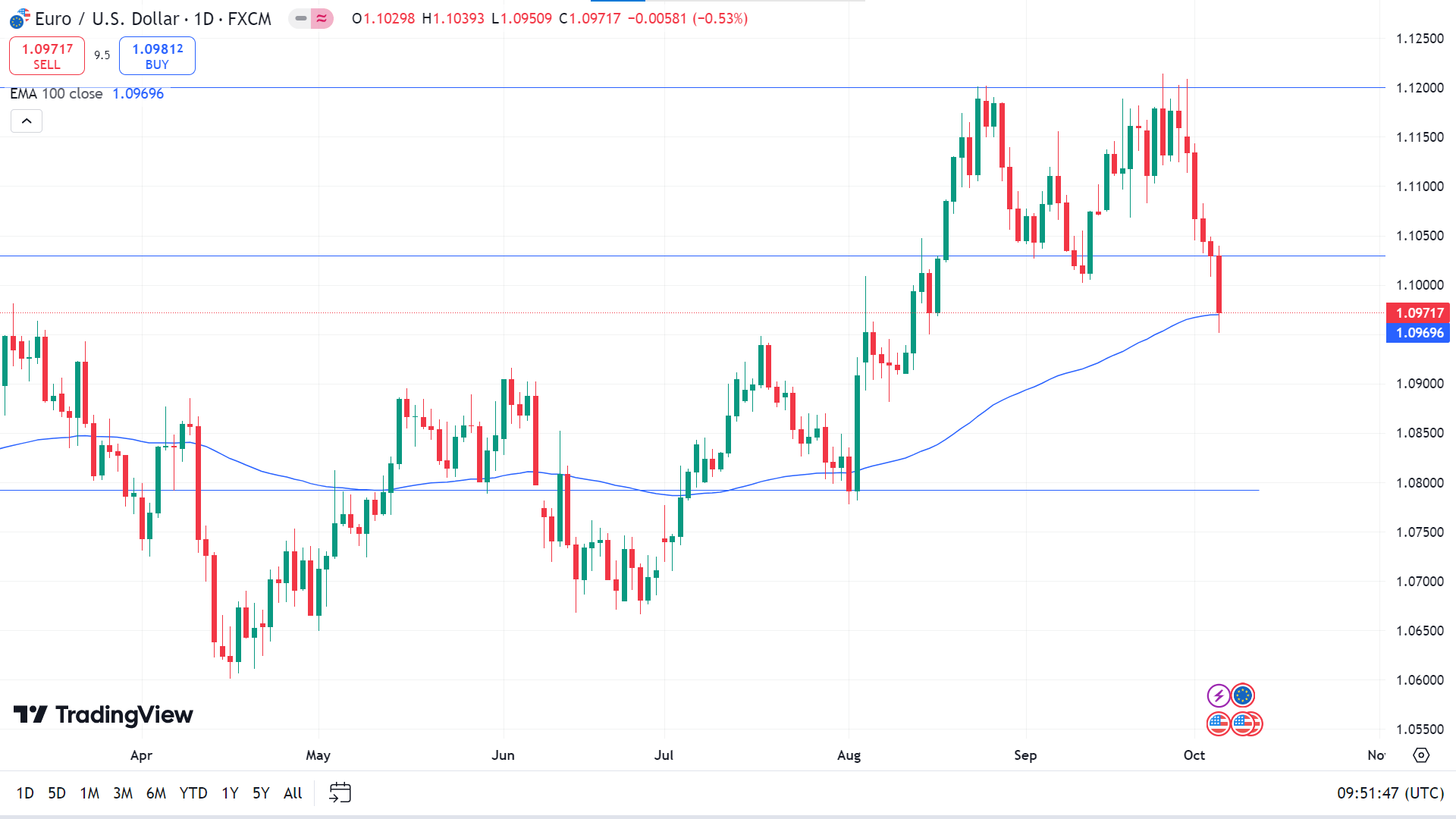

The weekly candle finished with a long red candle, erasing the previous six weeks' gains leaves sellers optimistic for this week.

Due to recent bearish pressure, the price declined back to the EMA 100 line on the daily chart. If the dynamic support sustains the price, it can head to the possible neckline of a double top pattern to the 1.1030 level before further decline, and an acceptable breakout of that level can trigger the price to regain the next possible resistance of 1.1197.

Meanwhile, if the price continues declining below the EMA 100 line, it can reach the nearest support of 1.0894, followed by the next support near 1.0792.