EURUSD

Fundamental Perspective

The EURUSD pair hit a nearly four-month low of 1.0760 before rebounding above 1.0800. Initially, the US dollar gained as investors sought safety, though renewed interest in high-yield assets emerged later on, fueled by upbeat US economic data.

Political risks and geopolitical strains pressured market sentiment. Israel's continued military actions in Gaza and Lebanon persisted despite US-led ceasefire efforts by Secretary of State Antony Blinken. Meanwhile, the tight US presidential race between Vice President Kamala Harris and former President Donald Trump has raised concerns about potential shifts in Federal Reserve policies should Trump win, which could disrupt inflation control efforts.

Eurozone data reflected a challenging economic landscape. The German Composite PMI showed slight improvement but remained in contraction, with weakening private-sector output and employment. Similarly, Eurozone PMI data signaled persistent economic pressure.

ECB officials have hinted at further rate cuts in response to weak growth, while US indicators showed resilience, with lower-than-expected jobless claims and a stronger PMI. Upcoming key data releases, including GDP and inflation measures, could drive significant EUR/USD movement as investors weigh the economic outlook for both regions.

Technical Perspective

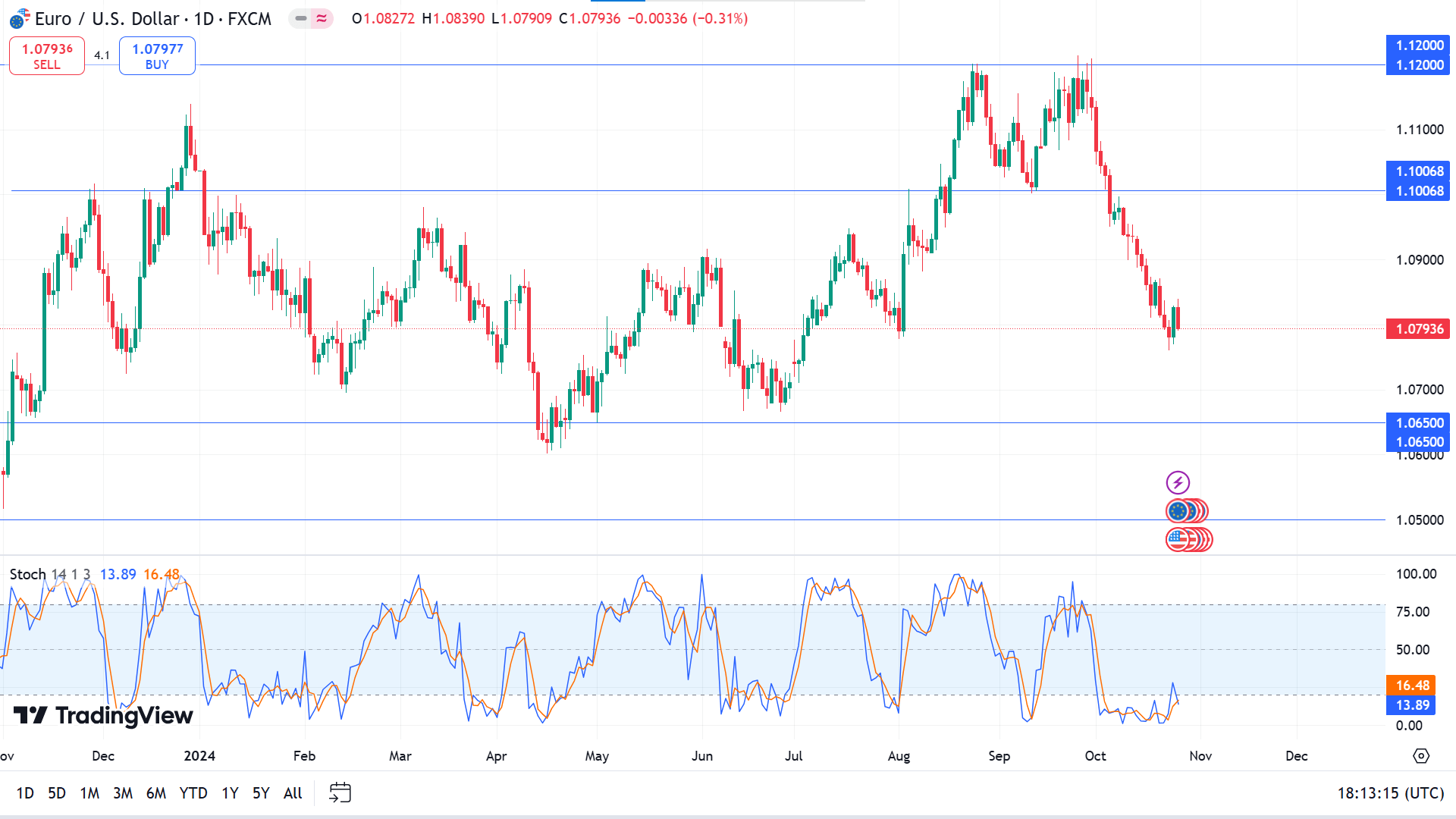

The weekly chart creates a valid double-top pattern, confirming a reversal from the resistance and indicating possibilities for a downtrend continuation.

On the daily chart, the price remains in a downtrend as the Stochastic dynamic lines float below the lower line on the indicator window, reflecting oversold conditions and creating a fresh bearish crossover. If the bearish pressure sustains, the price might hit the primary support near 1.0650, followed by the next possible support near 1.0500.

Meanwhile, if the dynamic signal lines of the Stochastic indicator window start edging upside, the price can bounce back to the neckline near 1.1006, and a breakout may trigger toward the next resistance near 1.1200.