- Palantir (PLTR) showed a 27.2% increase in quarterly earnings to $678.10 million in Q3.

- Palantir's machine learning and artificial intelligence capabilities have the potential to boost growth as businesses prioritize integrating AI significantly.

- Palantir Stock (PLTR) is trading within a bullish trend, where the ongoing buying pressure might extend above the 50.00 level by the end of 2024.

- Over 50% of Palantir's revenue comes from the government, signaling that changes in government policy and politics could affect its revenue.

I. Palantir Q3 2024 Performance Analysis

A. Key Segments Performance

In the latest quarter, Palantir reported quarterly revenue of $678.10 million, a 27.2% increase from the same quarter in the previous year. Moreover, the quarter saw an analyst beat on billing estimates and remarkable guidance for the next quarter.

Earnings per share came at $0.09, beating the analyst's estimate of $0.08, representing an 11.81% growth.

The average EPS growth for the last 6 quarters was 11.58%, whereas the latest report was above the average growth.

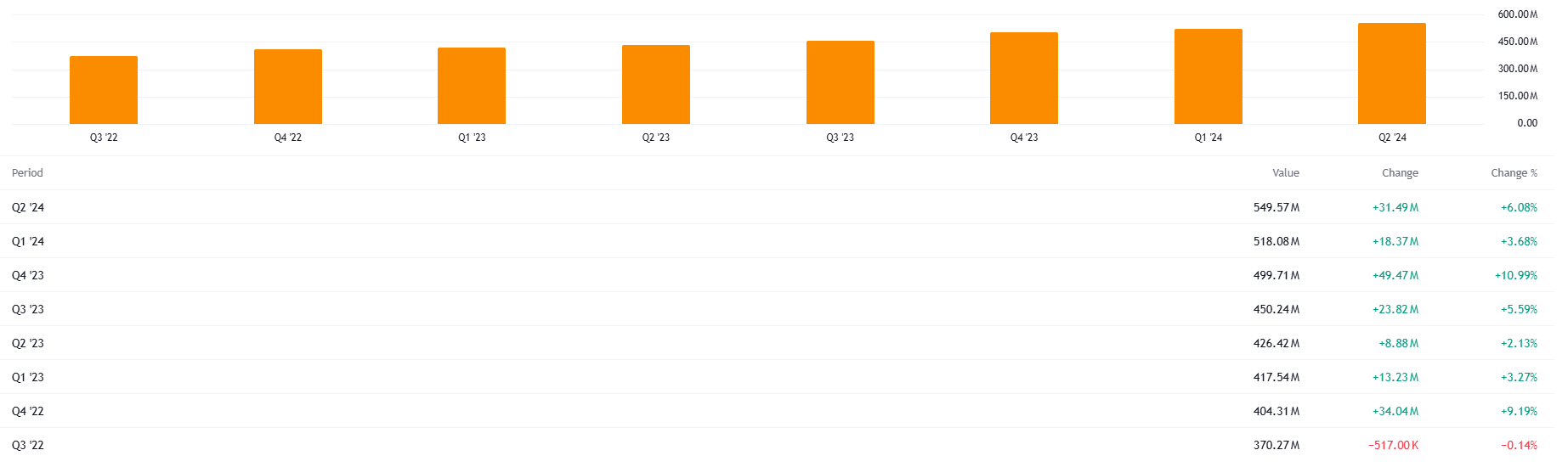

The average GP Margin for the last 6 quarters was 24.21%, whereas the latest quarter showed a 31.49% increase in the EPS, which is above the average growth.

As per the latest report, Palantir reported a 20% year-over-year increase in revenue, reaching $500 million in Revenue in a single quarter.

In the revenue segment, the top contribution came from the Foundry section, which represents 60% of the total sales. Apart from this, there was significant growth in the commercial sector, resulting in 40 new customers and 300 total.

In the industry, Palantir holds the 10% market share of the data analysis business, indicating a moderate position against key competitors like Alteryx, IBM, Tableau, Splunk Inc., and Amazon Web Services (AWS).

B. PLTR Stock Price Performance

Palantir Technologies (PLTR) is a leading company that builds and deploys software platforms on operating systems. The company has commercial and government segments, which signals stable earnings momentum. Its current market capitalization is $92.74 billion, and it has over 3K employees worldwide.

Looking at the stock price, the 3rd quarter showed a decent recovery, taking the price higher from $25.12 to $37.15 line.

PLTR experienced a time of volatility during Q3, peaking at $38.25 and falling to $21.33, but it eventually trended upward.

Over the quarter, the stock rose roughly 47.88%, demonstrating powerful investor confidence driven by encouraging prospective growth and revenue reports.

In contrast to stock market indices, PLTR performed better than the S&P 500, which witnessed gains of about 43.22% over the same time period. This superior performance highlights investor confidence regarding Palantir's growth plans and market position.

In comparison to the main market indices, PLTR had a strong third quarter of 2024, with notable stock price growth and a positive outlook.

II. PLTR Stock Forecast: Outlook & Growth Opportunities

A. Segments with growth potential

Analysts anticipate a year-over-year increase in the company's highest range in the upcoming quarter, fueled by robust business from new and existing clients, bolstering the Government and Commercial sections.

Under the revenue segment, Palantir's Foundry structure is becoming increasingly popular in the business community, especially in sectors like logistics, healthcare, and finance. Palantir is in a strong position to increase its market share as companies look for insights based on data to improve operations and make choices.

On the other hand, Palantir has strong growth prospects due to the ongoing need for its services in the defense and intelligence fields. Given the increasing expenditures in defense and national security technology, the company's solid ties with government organizations may result in more contract extensions and new initiatives. More than 50% of the company's revenue comes from the government segment, which signals a stable business. In 2023, the revenue from the commercial segment came to $1.00 billion, while the government segment provided $1.22 billion in revenue.

Palantir's machine learning and artificial intelligence capabilities have the potential to boost growth as businesses prioritize integrating AI significantly. Thanks to their capacity to offer sophisticated data analysis and integration solutions, they have an advantage over rivals in the tech sector.

Entering foreign markets, especially those in Europe and Asia, offers great room for growth. Palantir's product line and distribution network can also be expanded through strategic alliances with tech behemoths and business titans. Partnerships in cybersecurity and cloud computing can further strengthen its competitive edge.

B. Expansions and strategic initiatives

Palantir's AI Platform will be integrated with L3Harris' software-defined and sensor structures. The company recently announced an alliance with L3Harris Technologies Inc. LHX to improve target recognition and contextual awareness by expanding AI-driven security technology capabilities and supporting U.S. Army programs.