EURUSD

Fundamental Perspective

EURUSD extended its struggles, capping a dismal fourth quarter as the pair dropped nearly 8% since reaching yearly highs above 1.1200 in late September. The Euro has posted gains in only one week during this period, weighed down by a resurgent US Dollar.

The Greenback has gained momentum amid escalating geopolitical tensions, including the Russia-Ukraine conflict and the revival of the “Trump trade.” This resurgence propelled the US Dollar Index (DXY) above 108.00, its highest level since November 2022. Domestically, Germany and the broader Eurozone face a challenging economic landscape, with subdued business activity, political uncertainty, and a stagnating outlook dampening confidence in the Euro.

On 7 November, the Federal Reserve reduced its benchmark interest rate by 25 basis points, bringing the target range to 4.75%- 5.00%. While this move aligns with efforts to bring inflation closer to 2%, Fed Chair Jerome Powell emphasized caution, signaling no immediate plans for further cuts. Markets expect 75 basis points of easing from the Fed over the next year, compared to 150 basis points projected for the European Central Bank.

The divergence in monetary policy, combined with potential US tariffs on European goods under a Trump administration, suggests sustained pressure on the Euro as the Dollar continues to dominate the currency markets.

Technical Perspective

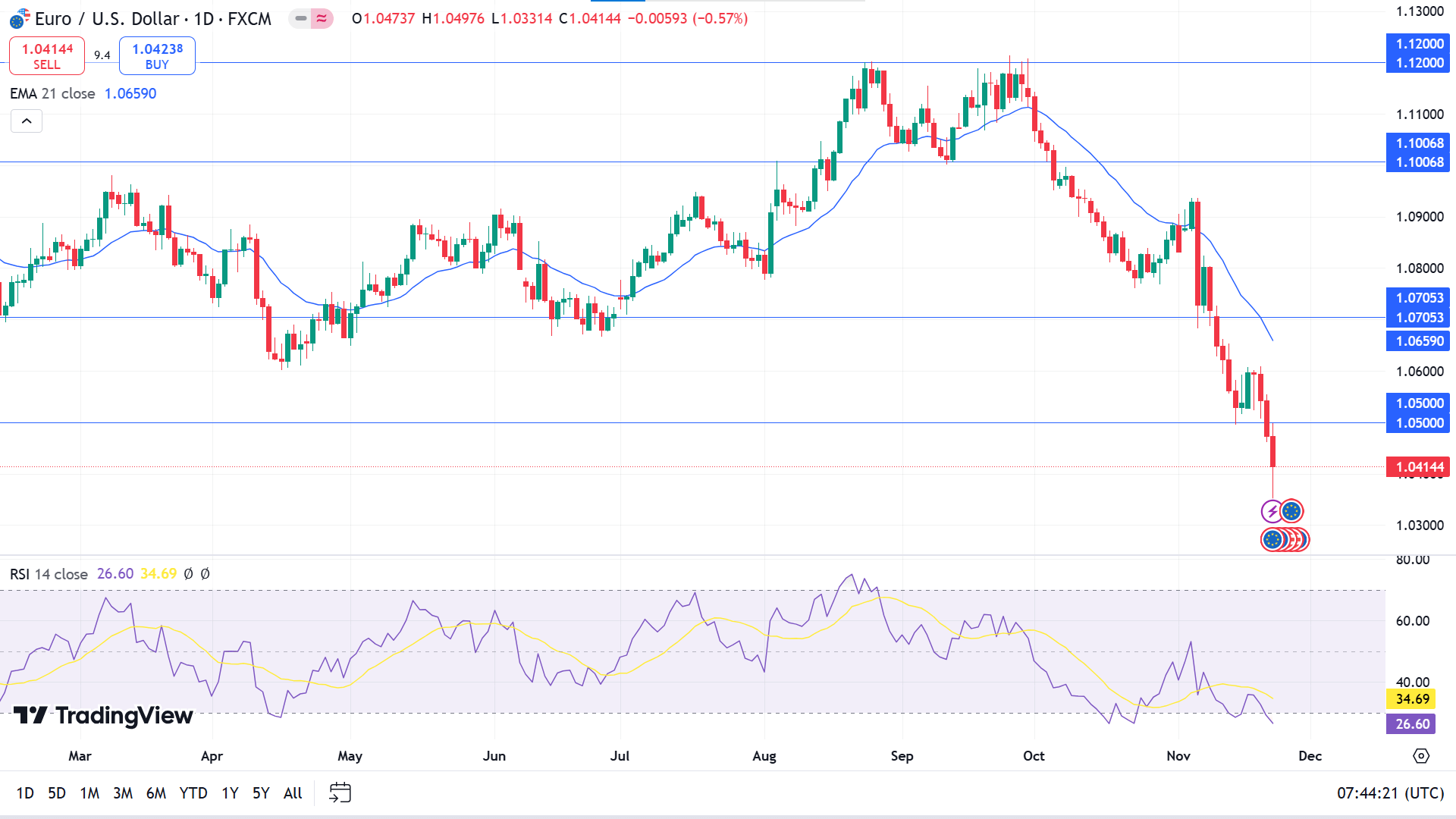

The weekly chart shows that the asset's bearish trend remains intact. A series of red candles shows the price breaking below the yearly low. No recent signs of bullish pressure keep sellers optimistic about the asset.

The price has been floating below the EMA 21 line since October this year, when the RSI dynamic line reached below the lower line of the indicator window overbought line. Combined, these readings indicate extreme bearish pressure and confirm the current downtrend.

Based on the EURUSD weekly outlook, expert traders may sell positions closer to the 1.0500 level, which may drive the price toward the next possible supply zone near 1.0235. However, the price needs to remain below the historically adequate 1.0500 level to dive further downside.

Meanwhile, the bearish signal will be invalid if the price bounces back and remains above the 1.0500 level, which can attract buyers toward the nearest demand zone near 1.0705.